- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- GST/HST/PST and INCOME TAX for eBay Sellers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2014 09:49 AM

If you sell your own used personal items on eBay (and elsewhere) this thread is not for you. Sales of used personal items are generally not taxable.

Here is a quick summary of taxation rules in Canada as they apply to sellers who purchase goods for resale. It does not really matter if you sell online or through a brick and mortar store or both. Since you are in fact running a business (buying and reselling for the purpose of making a profit) your activities are subject to taxation.

Unless you have strong bookkeeping skills and knowledge of taxation laws, I strongly recommend you hire a competent accountant familiar with your personal circumstances – preferably one with experience in mail order business - to assist you in setting up your books properly and arrange registration with the tax authorities if required.

GST/HST/PST

If your annual worldwide business revenues (including shipping charges) exceed Cdn$30,000, you must, by law, register with GST/HST. For the purpose of registration, it does not matter if most of your sales are shipped outside Canada.

Start learning about it here: http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/menu-eng.html

After you have read the information in that link, please read again. It is important to understand the concept and its applications.

Once registered with GST/HST, you must remit the tax (GST or HST) based on the province of residence of the buyer, regardless of where you are located in Canada. For example, if you ship to a buyer in Ontario, you will have to remit 13% HST of the transaction value. If your buyer is located in Alberta or Manitoba (for example), you need to remit 5% GST since Alberta and Manitoba are not HST provinces.

Whether you actually charge the GST/HST or absorb it is up to you. Many GST/HST registered online sellers absorb the tax to remain competitive with the majority of sellers who are not GST/HST registered. In any case, the tax must be remitted. To be candid, that is all the government cares about: getting the tax from you. They do not care if you collect it or not!

If you decide to charge GST/HST to your Canadian eBay buyers, in fairness, I strongly suggest you clearly state that fact in your listings. Most Canadian buyers expect their purchases from Canadian sellers on eBay to be tax free and some will even post negative feedback when charged tax unexpectedly.

While you are obligated to remit GST/HST payable, you also get the benefit of receiving Input Tax Credits (ITCs) on the tax you have paid at time of purchasing your inventory or when paying for the many services and expenses related to your business. ITCs are credited to you regardless where the goods are eventually shipped.

NO GST/HST should be charged or needs to be remitted for goods exported from Canada.

As far as PST is concerned, provinces that are not HST provinces have different rules and you should consult the tax authorities of your province (BC, SK, MB, QC) to understand your liabilities and responsibilities.

INCOME TAX

That is pretty simple. All Canadians are required to report their net business income (profit) and add it to other income (employment, pension, investment, etc…) to eventually arrive to taxable income.

There is no minimum, no exception, no exemption. All net profit must be reported starting from the first dollar.

To calculate your net profit, add up your revenues (sales, handling and shipping charges) for worldwide proceeds and deduct your cost of goods sold and business related expenses.

All amounts must be calculated in Canadian dollars. If you purchase and resell in a foreign currency (US$ or others) you need to convert those amounts to Canadian dollars prior to presentation on your Profit and Loss Statement.

If you are GST/HST registered, the tax charged or paid should not be included in your numbers, if you are not GST/HST registered, then the tax paid should be included in your purchases and expenses.

Only the net profit is added to your other income on your tax return (line 135).

For the benefit of online sellers, I prepared this sample Profit and Loss Statement a few years ago, Feel free to use it and/or modify it to your specific needs:

http://www.pierrelebel.com/lists/P&L-sample.htm

CRA provides similar forms for your convenience:

http://www.cra-arc.gc.ca/E/pbg/tf/t2125/README.html

If you have any questions on the subject, please post them here, on this thread.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-24-2016 06:29 AM

"and I'm sure will result in a decrease in sales.......US sales are down despite the advantage they have with their high dollar"

There is no tax (GST/HST) charged on shipments to any country outside Canada. So GST/HST does not affect your USA sales.

" impossible to compete on postage with items shipped within the US....."

It is not impossible as many sellers succeed. However it is challenging when you sell easily available items of relatively low value (under $50) requiring high shipping. You are competing with many sellers who - because of their high volume - effectively have much lower shipping rates than yours.

A simple reality in 2016 for Canadians is that not everything is meant to be sold online.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 12:38 PM - edited 04-20-2016 12:41 PM

Hi,

What about European sellers that sell to Canada? Their checkout process does not seem to apply any canadian taxes. Will the taxes be collected on reception or is it at the discretion of the buyer? If it is not mandatory, it creates a very unfair competition between european sellers and canadian sellers, since legit canadian sellers will charge taxes in their check out process (and advertise it too).

Thanks.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 01:29 PM

Hi Bits!

A point of clarification, I believe you are in Ontario. You have to recover the GST from all provinces, but only have to recover the provincial portion from the HST provinces.

I say this because in your example you use Manitoba, Manitoba isn't an HST province so you only have to charge the 5% to them*. Same is true for everyone except the HST provinces: ON,NB, NF (8% more, 13% total) NS (10% more 15% total), PEI (9% 14% total).

*if you sell a large percentage of your sales to a given non-HST province you might have to recover for that province. Normally this won't be a problem for you, but you'll have to check the guide to see what the rules are as to when a given non-HST province qualifies these days.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 01:51 PM

Sellers outside of Canada cannot collect taxes on behalf of Canadian governments. When a parcel arrives in Canada, if its value is under $20.00 Cdn, it is exempt from duty and taxes. If over $20.00, CBSA may require taxes and duty (if applicable) to be collected. If Canada Post delivers the parcel, they charge $9.95 for doing the job of collecting any monies owed. CBSA often does not assess parcels. Courier services, because they do their own customs clearance, must assess all items worth over $20.00, and they charge a fee for doing this - it is much higher than that charge by Canada Post.

"Legit" Canadian sellers do not all collect taxes. Only sellers whose worldwide sales (including shipping charges) are $30,000.00 and over. There are many many small online sellers who don't have that level of annual sales.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 02:01 PM

"What about European sellers that sell to Canada?"

In most countries in the wold (including Europe) the onus of paying consumption taxes is on the buyer, not the seller.

When a Canadian seller ships to a buyer in Europe, the seller does not pay taxes, the buyer is responsible for taxes levied in his country at time of Customs clearance.

The same applies in reverse.

When Canadians import by mail, they have to pay taxes (GST/HST) and duty (if applicable) . Please take a look at thew Canadian government webpage on the subject:

http://www.cbsa-asfc.gc.ca/import/postal-postale/duty-droits-eng.html

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 09:20 PM

In fact, what I wonder is if the buyer is "obliged" to pay the taxes or can he decide to ignore it at his own risk? If the item is worth 400$ cad, will the post office force the buyer to pay the taxes? What if the item is shipped directly at the door?

Also, if the item is shipped to Canada from europe via DHL, what are their brokerage fees? The info is pretty hard go find...

Regards.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 09:28 PM

Just a clarification, I was talking about an item that is NEW, so not expected to be shipped as a gift.

Thx.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 09:32 PM

I forgot to ask: as canadian only ebay sellers, will ebay automaticalky charge the taxes for orders to canadian destinations?

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 10:14 PM

"I wonder is if the buyer is "obliged" to pay the taxes or can he decide to ignore it at his own risk? If the item is worth 400$ cad, will the post office force the buyer to pay the taxes? What if the item is shipped directly at the door?"

If sent by mail, the item will be picked up at the post office and will not be released to the buyer until the taxes, duty (if applicable) and service charge are paid.

If coming by DHL, FedEx, UPS or other couriers, the delivery person will collect the taxes, duty (if applicable) and service charge at the door.

Either way the Canadian buyer will receive the item after payment.

It does not matter if the item is new or used. The taxes are the same and the rate depends on the province of the buyer.

When you buy a used car (for example) you pay GST/HST as you would when buying a new car.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 10:18 PM

"as canadian only ebay sellers, will ebay automaticalky charge the taxes for orders to canadian destinations?"

eBay does not charge taxes. eBay is only a venue where sellers list and sell their products.

Some sellers are GST/HST registered while others are not.

If the Canadian seller is GST/HST registered, there are two possibilities:

1) the seller will add the tax GST or HST on the invoice sent by eBay to the buyer

2) the seller will absorb the tax and not charge it to the buyer

The decision to charge or not charge GST/HST is made by the registered seller.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2016 11:21 PM

Hi Pierre, I have always wondered where do I report losses of inventory. I have been selling for the past 14 years on ebay, amazon, bonanza, craigs list, flea markets and yard sales, anything to make a buck. I keep track of all my sales and purchases.

Over the years I have purchased things that I just cannot sell for whatever reason, broken, out of style, damaged, no one wants it and so on. I keep track of what I throw out and what I have donated to thrift stores. At one time all these items were part of my inventory and now are no longer. For instance I purchased a lot of clothes and sold them at good prices on ebay until 2008 when the ebay market changed. The clothes became dated very quickly and now if a consignment store won't take them, I try to sell them at a yard sale and failing that I donate them to the Salvation Army. I donate or throw out hundreds of dollars of items each year.

Now when I go to fill it the tax forms I list my inventory from the previous years and my sales from all venues for the current year and then list my current inventory. When it asks for cost of goods sold. The actual goods sold, I made a profit but putting the current inventory less the donations or discards, is that where they get reported?

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-21-2016 08:14 AM

Great question!

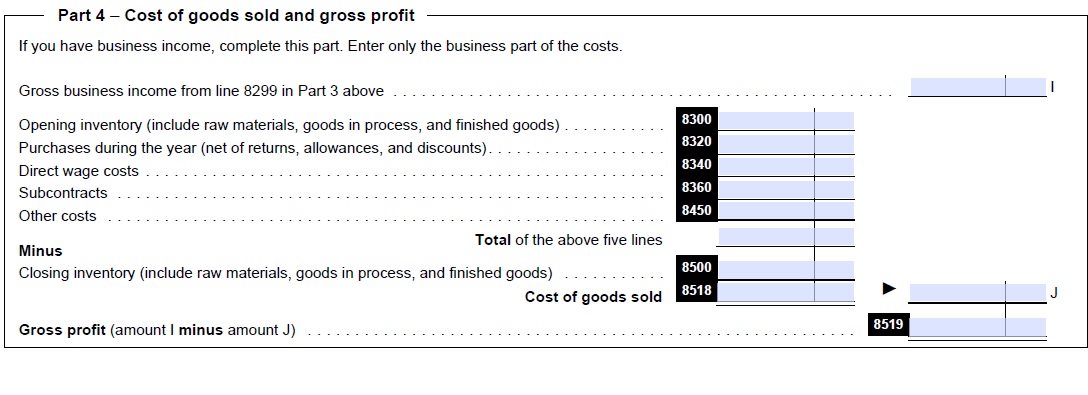

Since most eBay sellers are not involved in manufacturing but simply in purchasing goods for resale, i would like to simplify the calculation as follows:

a) Opening inventory (last year's closing inventory): $_____________

b) Plus purchases during the year: $________________________

c) Equals: Goods available for sale: (a+b): $___________________

d) Minus: Closing inventory: $______________________________

e) Equals Cost of goods sold (c-d) $ ________________________ (sales minus cost of goods sold will give gross profit)

The products that were stolen, given away, broken during the year are automatically included in the calculation since their value is NOT included in the closing inventory. As such no adjustment is required.

For example, if your opening inventory was $10,000 and you purchased $27,000 during the year, your inventory available for sale would be $37,000. Now if your inventory at year end is $11,000, your cost of goods sold would be $26,000. Now there was $500 inventory broken or given away during the year. Where is it? It is already included in the $11,000 inventory at year end. If nothing had been broken or given away the inventory would have been $11,500 ($500 more) which would ultimately have resulted in $500 more gross profit.

If these donated or broken products had not been donated or broken, the value of your closing inventory would have increased by the value of those products. Since their value is not included in closing inventory, it is deducted by default.

Many years ago I prepared a sample "Profit & Loss Statement" sellers can use to prepare their books and attach to their tax return, Feel free to use it or modify it to your needs.

http://pierrelebel.com/lists/P&L-sample.htm

Good Luck

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-25-2016 10:52 AM

I have a question ,

a company in Quebec recycling used items ( given to them ) wants me to sell antiques and collectibles on commission for them .

How would this work ?

They dont buy or pay for anything everything is used.

Thanks Holger

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-25-2016 02:37 PM

Wrong question.

Their costs are their business.

You would be taking the items on consignment and would be paid percentage of the selling price. Most companies that take consignments have a flat rate to cover the costs of photographing, describing, transcription, listing and storing consigned goods.

Your costs are covered by that flat rate.

Then both you and the consignor make money when it sells, splitting the selling price between you.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 06:17 PM

For example. My expenses were 8k and my sales were 10k. To make things easier can I just pay the taxes on that full 10k?

Sorry I am new to all of this. Thanks for the write up.

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 07:20 PM

Let us say the tax rate is 25 % ......

Would you be happier paying taxes on $10,000 or on $2,000?

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 08:11 PM

Depends what the tax rate is. What is it in Canada?

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 08:36 PM

After all deductions have been made.... for personal income tax, the tax rate is about 25 %.

So... if this income is above basic deductions

If you report sales of $10,000 you will pay $2500

If you report $2,000 after deduction of expenses you will pay $500

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 08:37 PM

It is not the tax rate that is important.

It is how much you report..... and then how much tax you pay...

GST/HST/PST and INCOME TAX for eBay Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-29-2017 08:49 PM