- The eBay Canada Community

- Archive Category

- Archive 1

- Can anyone explain the sales tax for canada starti...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-24-2017 09:23 PM

Hi all-- Im really confused about the sales tax that ebay.ca is going to be starting as of July 1-- How does this work? I called them today, but was left totally confused about there answers--if anyone has looked into this, can u please explain how this is going to work, I am in Canada--thank you

Solved! Go to Solution.

Accepted Solutions

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-25-2017 09:28 AM

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2017 02:57 AM

It's not a 'sales tax' in the sense that users are confused about. They're thinking it's a RETAIL sales tax when, in reality, it's a tax on the service eBay has sold us as a venue. That's the differentiation I am trying to make for the folks who are already confused about it.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-24-2017 10:25 PM

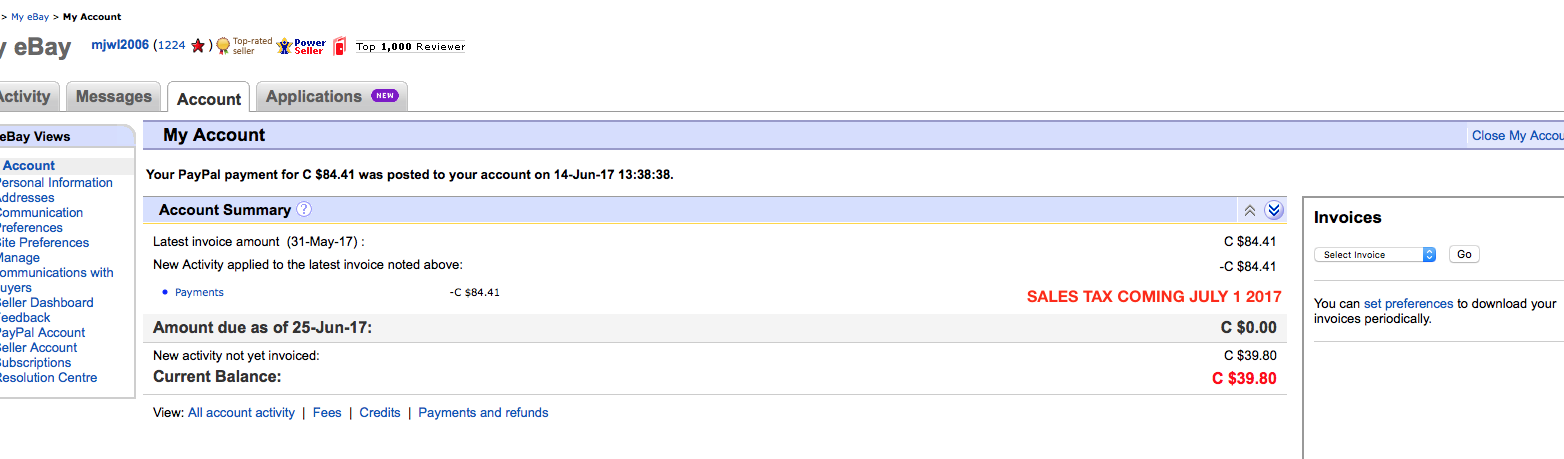

It means only that we as sellers will see our Monthly fees due to ebay increase. Like, our selling fees will now be subject to Canadian tax.

- Hi

- if you say no tax to buyers. Then how come when i recently bought am item im charged tax. $8 game becomes 96 cents tax

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-24-2017 10:38 PM

@blueriviera95 wrote:Im really confused about the sales tax that ebay.ca is going to be starting as of July 1

It just means tax is added to the fees that eBay charges you.

That is the only change. It does not have anything to do with the items you sell.

eBay will start including tax on your monthly bill as a seller. All automatic.

-..-

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-25-2017 03:23 AM

It's not on the items you sell.

It's not on your payments.

It's "only" on your fees -- so 5% GST on the 10% (or less) of each payment you pay to eBay .

If you sell $1000 worth of goods with $100 in shipping charges, you would pay eBay about $110 in FVF.

And in addition you will now be paying $5.50 in GST.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-25-2017 09:28 AM

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-21-2017 10:49 PM

Another stacking of fees, I bet. What happen it was a used item sold by a private owner? This Tax makes little sense.. All it is just nipping and more nipping at the sellers feet, especially canucks.. I do not see, legally, that Ebay can tax the fees. That should be decided by the seller who has a business and uses Ebay as virtual store, and be given ability to add GST fee, or whatever to the final price before payment.

Whatever.. another way to choke the fun of Ebraying..

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-21-2017 11:06 PM

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2017 08:45 AM

I sell used items. Is that going to have added tax. Mine is not a business.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2017 09:36 AM

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2017 09:58 AM

Just to make this abundantly clear.....

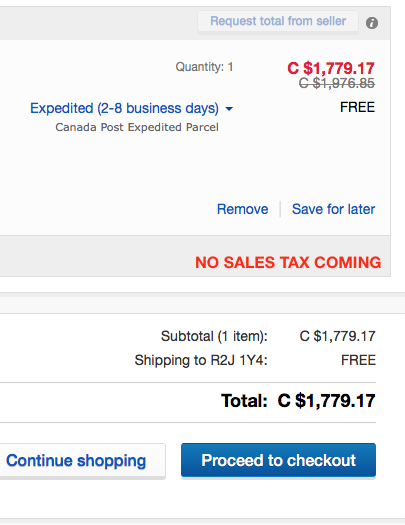

Starting July 1, 2017 ebay WILL NOT be charging sales tax on the purchases that buyers make.

But ebay WILL BE charging sales tax on the monthly seller fees that sellers pay to ebay in order to sell here.

(Specific to the screen capture above: before anyone goes getting all snarky about the monthly fees you see, my store subscription renews annually on June 1 and we were away for a week this month. If you sell here as a serious user, you'll already know what that means and I don't have to explain more.)

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2017 02:46 AM

Its still a sales tax...except its ebay doing the selling. They're selling you, the service of selling online via their website, to a potential global market of consumers. Rightly you should have been paying sales taxes on all your listings / subscription fees for years now.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2017 02:51 AM

THEY'RE NOT TAXING THE ITEM BEING SOLD TO THE BUYER, THEY'RE TAXING THE FEES THEY CHARGE YOU TO USE THEIR PLATFORM.

You're monthly subscription for seller accounts or individual listing fees are all subject to sales tax.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2017 02:57 AM

It's not a 'sales tax' in the sense that users are confused about. They're thinking it's a RETAIL sales tax when, in reality, it's a tax on the service eBay has sold us as a venue. That's the differentiation I am trying to make for the folks who are already confused about it.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2017 09:01 PM

yes it is a sales tax.. alberta 5%, bc, what ever they get dings with.. its still a tax.. a tax is a tax..

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2017 09:14 PM

Again, I'm going to stress it's not a sales tax in the retail sense, like the kind anyone shopping on ebay might actually care about.

It's only a service tax on the fees that sellers pay monthly to ebay. It's totally not a big deal to me as a small-time seller, and the big-time sellers are already registered to collect and remit tax so they're prepared for this kind of thing. I'd be way more worried to see retail sales tax applied to the stuff buyers purchase here. That's not what is happening right now.

The tax shift coming July 1 affects only sellers, not buyers.

I'm not worried about it. An extra $15 monthly on my seller's fees is not alone going to run me out of business.

Most of the users coming to ebay Canada Community right now to ask questions about it are assuming it's a retail sales tax they are now forced to collect on the goods they sell and that is simply not the case. That's the important part.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2017 03:21 PM

It is also the end of ALL sellers flying under the CRA radar and not disclosing sales. Feebay will not only be handing over your taxes on those fees, but they will be handing over ALL of your personal information as well! The CRA will know who is paying those fees and if they declared anything from ebay previously. Declaring income was once the responsibility of the individual, not anymore.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2017 03:23 PM

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2017 06:33 PM - edited 07-09-2017 06:34 PM

It is according to an eBay manager that I spoke to. If you have something more informative and helpful than your terse response, please enlighten me.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2017 07:20 PM

eBay is collecting tax on seller monthly fees. Not retail tax on items sold to buyers. Ebay wouldn't declare which sellers submit to them the 23,789,678 individual GST payments on monthly seller fees they received.

Regardless, profit is up to the individual seller to declare on personal income taxes. Canada Revenue Agency last demanded tax records from eBay Canada on its sellers in 2009. Via court ruling. And that was only from sellers who made more than $20,000 per year in sales, if memory serves.

Any seller NOT already declaring profit on eBay sales when filing income taxes to CRA is asking for trouble. But that has little to nothing to do with the GST being collected on monthly fees.

Ask at eBay Canada Weekly Board Hour on Wednesday if you're skeptical. As knowledgeable employees of eBay Canada, they are in a better position than me to provide more detail, and in a far more knowledgeable position than anyone working at a call Centre in The Phillipines who will simply agree with anything the caller says to end the call.

Can anyone explain the sales tax for canada starting july 1-- i'm really confused on this, thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2017 08:25 PM - edited 07-09-2017 08:27 PM

I called eBay and spoke to an agent who didn't sound too sure or informed on the matter, so I pressed him to let me speak to a manager. That manager specifically told me that eBay was submitting to the CRA, the eBay seller's info along with the tax collected on the sales fees. Yes, I understand it depends on who you speak to, and you can get wildly different answers to same question posed to them, and all with equal assurance that their answer is the correct one. The agent didn't sound like they were from overseas though, and hopefully you are correct and that agent was indeed trying to end the call.