- The eBay Canada Community

- Archive Category

- Shippo Central

- Using SHIPPO and Canadian TAX Credits implications...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-11-2017 05:59 PM

Well recently we started using Shippo for our Canadian shipments and after of week or so our accountant noticed something odd about the invoice we were suplied by Shippo for the labels we purchased.

Namely, the Shippo invoice show only the Date, Carrier, Tracking Number and Amount and TOTAL. There is no amount showing what Tax amount we paid for each label not to mention there is no GST number on the invoice.

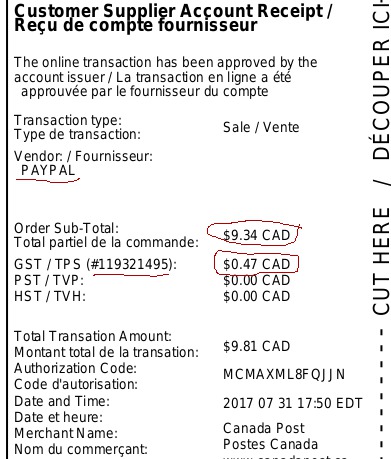

Second, the PayPal shows that we maid a payment to SHIPPO CANADA and the transaction page printout only shows that we paid SHIPPO CANADA a lump sum amount of $XX.XX and the SALES TAX section of the report shows $0.00.

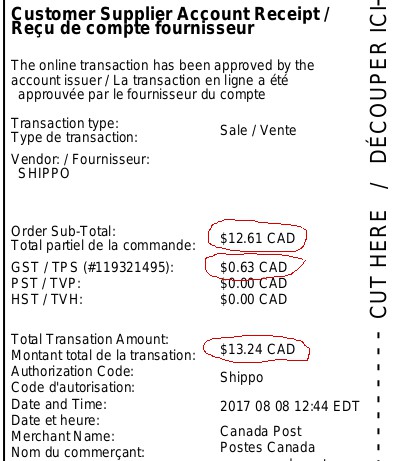

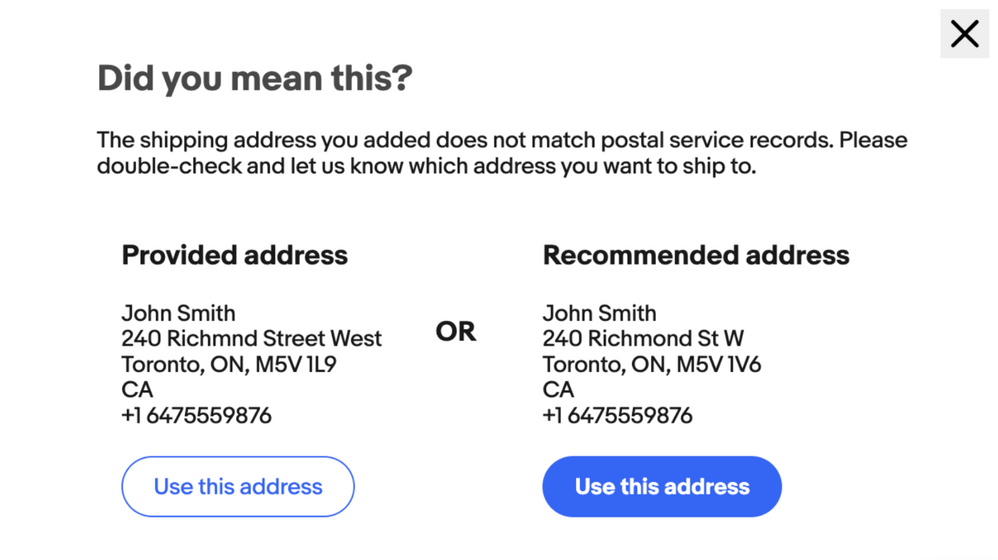

Third, when we printout the CanadaPOST Shipping label through the SHIPPO site we get a PDF label from CanadaPOST that does show all the costs along with the TAX that was charged but here is the problem...that receipt is issued under SHIPPO and not our company name ...on the CanadaPOST Shippiing Label Receipt it clearly shows "Supplier Account Receipt" is SHIPPO.

We spoke to CanadaPOST they comfirmed that the account the label is being printed from belongs to SHIPPO and any tax amount shown on the label would be under SHIPPO's name not ours.

According to Revenue Canada this is a PROBLEM since we have no paperwork to backup our ITC credit claim for the taxes we paid and therefore we cannot prove to them that we paid the tax portion therefore we cannot claim it as a ITC credit.

We are stopping all purchase through the SHIPPO site until they address this major problem.

Oh by the way, eBay was no help at all - total waste ot time talking to them.

Regards

Tim @ FTL

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-11-2017 07:54 PM - edited 08-11-2017 07:55 PM

Shippo/ebay is supposed to be acting as an agent on your behalf (not as a reseller of the label) and all costs and taxes are supposed to be passed through to you.

If your information is "correct" then you can only use the tax amount as an ITC when you buy directly from Canada Post. Forget PayPal or Shippo or any of the other "supplier accounts" that Canada Post has been adding this year.

Shippo label:

PayPal label:

-..-

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-14-2017 12:29 PM

Time to deal directly with CanadaPOST and not use SHIPPO or PAYPAL anymore or simply forgo the making a claim for shipping costs.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-14-2017 05:27 PM

Well today I go confirmation from CanadaPOST that the shipping label we purchase either through PayPal or Shippo are under their respective companies names rather than under the name of the actual purchaser therefore the receipt would not be valid for CRA reporting purposes.

So basically we are paying the GST tax but cannot legally claim is since neither PayPal nor Shippo provide a proper receipt.

In fact, PayPal has confirmed that they are NOT registered for GST collection and DO NOT submit any funds to CRA.

Scary news for anyone using these two companies to buy shipping labels and thinking they can claim the GST TAX they paid they paid.

BEWARE ...the taxman commeth

TIM @ FTL

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-14-2017 08:32 PM

Another example that Shippo in Canada is a mess.

Do they not have any business lawyers to check their workflows for tax compliance?

Shippo must have hired the people that rolled out Target in Canada. They have about the same understanding and arrogance of the Canadian market.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-15-2017 05:22 AM

I find it difficult to believe that the CRA would not accept the taxes paid as ITC credits. When purchasing a PP label my payment is shown as going to CP, not to PP so it would be similar to paying with a credit card. Canada Post is charging the gst not PayPal, so PP has no need for a gst number. Sellers have been claiming ITC for PP labels for years and I've never heard of anyone having a problem.

The way that I understand it Shippo is acting as our agent and submitting money to CP for the labels on our behalf. When we buy labels from either site that label is credited to our small business account on the CP site so there is an obvious paper trail that we purchased the label.

It isn't necessary for your name on an invoice when claiming an ITC unless the amount is $150+. Dennis shows the CRA rule in the following thread. But even if the amount was over that, as our agent Shippos name would be enough.

http://community.ebay.ca/t5/Shippo-Central/Shippo-HST-breakdown/m-p/381189#M508

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-16-2017 01:56 PM

Wrong wrong wrong....call the CRA GST rulings department and see for yourself -- we have provided both the CanadaPOST Receipt and also the Shippo Invoice and also the PayPal Shipping invoice and all of thsese are NOT acceptable to Canada Revenue.

If you need their numbers then I can post them for each department.

Also, CanadaPOST is looking into this and we spoke with one for their billing analyst who also notice the problem with the label receipt that is being generated and included with the shipping label.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-18-2017 05:20 PM

So you are saying that if I go to Staples to buy some office supplies and pay with cash, I cannot use the cash register receipt for an itc because it does not have my name on the receipt?

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 05:56 PM

The issue isn't not having "your" name on the receipt - the issue is that someone else's name is.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-23-2017 05:45 PM

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-23-2017 05:46 PM

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-23-2017 05:49 PM

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-24-2017 01:13 AM

No need to be rude.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-26-2017 10:12 AM

Noted...

As for the recent Webinar....both Shippo and eBay did not respond back to our questions about the GST other than to say that they are WORKING ON IT ...no timeframes mentioned.

So for the time being better to deal direct with CP and get a proper receipt then to use Shippo or Paypal.

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-26-2017 12:11 PM

Just for curiosity... how did you do it in the past before the change to Shippo? Because PayPal never gave receipt to our name... so how were you able to claim ITC credit for your PayPal labels?

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-28-2017 07:13 PM

We use CP not not PP for our labels - also there is other bulk shippers based in Canada that you can use to buy CanadaPOST labels through at a discount (based on your volume).

Using SHIPPO and Canadian TAX Credits implications - MUST READ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2017 08:45 AM

Quick solution. Do not use Shippo..