- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Payments

- Fees/Payments for selling a vehicle

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 06:55 AM

I haven't sold on ebay for a while and i'm confused about fees and payments for selling a motorcycle. the listing tool only allows me to accept money order, cash, or check. these don't seem very buyer friendly(i would have used paypal previously). i see a $49 listing fee which is fine but i get the feeling there's a final value of like 10% which seems like a lot.

can anyone clarify?

Solved! Go to Solution.

Accepted Solutions

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 11:24 AM - edited 05-07-2022 11:44 AM

10% is wishful thinking...

https://www.ebay.ca/help/selling/fees-credits-invoices/motors-fees?id=4127

https://www.ebay.ca/help/selling/fees-credits-invoices/selling-fees?id=4822

You should also check recent updates:

https://pages.ebay.ca/seller-centre/news/seller-updates/timeline.html

But wait, there's more...

"

Dear eBay Canada Seller, |

Pursuant to the guidelines announced in Canada’s 2021 Federal Budget and recent provincial sales tax amendments, eBay Canada Limited (“eBay”) will be required to collect Canadian sales taxes (GST/HST/QST/PST) on applicable sales to Canada-based buyers. |

Effective July 1, 2022, for all sales of tangible goods sold within Canada, eBay will be collecting the Canadian sales taxes (GST/HST/QST/ PST) from Canada-based buyers on behalf of Canada-based sellers (irrespective of registration status) and remitting the tax to the appropriate tax authorities. |

For sellers not registered to collect tax with the CRA and provinces, there is no action necessary. You will begin to see sales taxes charged and collected by eBay on buyer purchases beginning in July. eBay collected taxes will also be displayed in your seller reporting as of that date. |

For GST/HST and/or QST registered sellers, eBay will be appointed as a billing agent for collection and remittance of Canadian sales taxes where the sales tax laws do not automatically require it. As such, eBay will require completion of billing agent authorization forms. A separate communication for GST/HST and QST-registered sellers will be forthcoming. |

"

There's always more.

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 11:24 AM - edited 05-07-2022 11:44 AM

10% is wishful thinking...

https://www.ebay.ca/help/selling/fees-credits-invoices/motors-fees?id=4127

https://www.ebay.ca/help/selling/fees-credits-invoices/selling-fees?id=4822

You should also check recent updates:

https://pages.ebay.ca/seller-centre/news/seller-updates/timeline.html

But wait, there's more...

"

Dear eBay Canada Seller, |

Pursuant to the guidelines announced in Canada’s 2021 Federal Budget and recent provincial sales tax amendments, eBay Canada Limited (“eBay”) will be required to collect Canadian sales taxes (GST/HST/QST/PST) on applicable sales to Canada-based buyers. |

Effective July 1, 2022, for all sales of tangible goods sold within Canada, eBay will be collecting the Canadian sales taxes (GST/HST/QST/ PST) from Canada-based buyers on behalf of Canada-based sellers (irrespective of registration status) and remitting the tax to the appropriate tax authorities. |

For sellers not registered to collect tax with the CRA and provinces, there is no action necessary. You will begin to see sales taxes charged and collected by eBay on buyer purchases beginning in July. eBay collected taxes will also be displayed in your seller reporting as of that date. |

For GST/HST and/or QST registered sellers, eBay will be appointed as a billing agent for collection and remittance of Canadian sales taxes where the sales tax laws do not automatically require it. As such, eBay will require completion of billing agent authorization forms. A separate communication for GST/HST and QST-registered sellers will be forthcoming. |

"

There's always more.

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 11:49 AM

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 12:14 PM

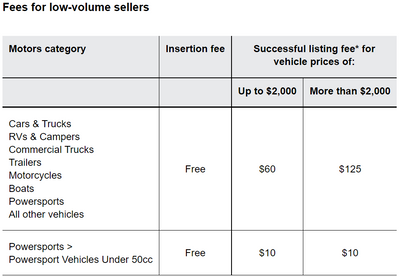

Thanks very much for the links. This does not seem too bad:

That would be $125 on a $3500 sale price. I must be doing something wrong though because i'm seeing a $49 listing fee. I note the tax issue but there's nothing I can do about that.

I may start over and make sure i'm in eBay motors. Maybe the issue of what payment is allowed will be clearer there.

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 12:24 PM

Which category are you using?

Motors vehicles listings are those within the Cars & Trucks, Motorcycles, Powersports, Boats, and Other Vehicles & Trailers categories.

Low volume sellers (maximum of 6 listings per year) of vehicles should have a free listing (plus optional extras) with a flat fee if successful ($10 or $60 or $125).

https://www.ebay.ca/help/selling/fees-credits-invoices/motors-fees?id=4127

-;-

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 03:37 PM

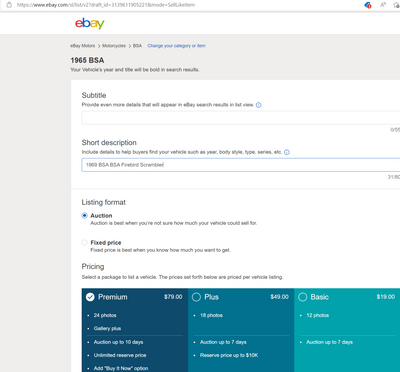

I'm still doing something wrong because i get the same insertion fees. I got here by clicking on a 1965 BSA and then "have one to sell? Sell Now"

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 03:38 PM - edited 05-07-2022 03:38 PM

It seems to be a totally different pricing set up if you list on .com in eBay motors.

https://www.ebay.com/help/selling/fees-credits-invoices/fees-selling-vehicles-ebay-motors?id=4127&st...

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 05:05 PM

I am guessing it's something to do with US vs canada. I'm about to give up and list on facebook marketplace.

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-08-2022 01:35 AM

That would be my 1st choice to sell or purchase a vehicle.

Good luck.

Fees/Payments for selling a vehicle

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-08-2022 01:48 PM