- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Minor annoyance: HS Code section of CPC returning ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

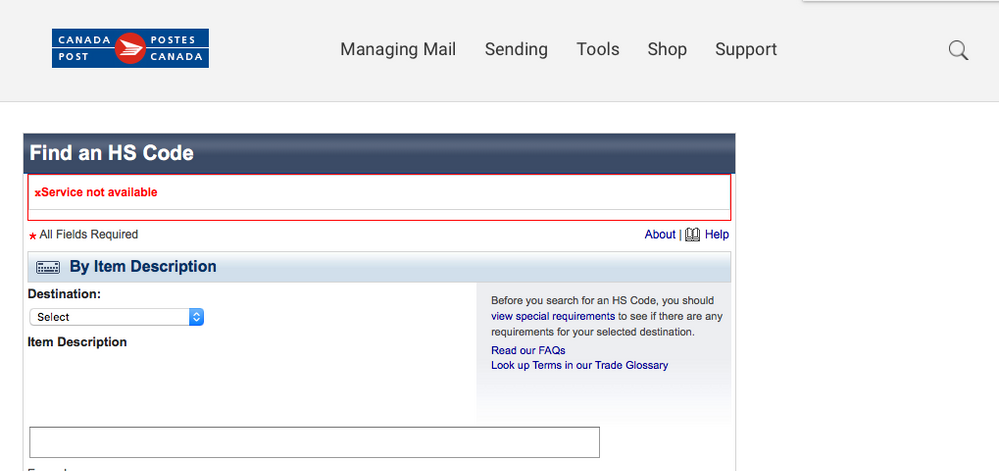

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-23-2018 10:47 AM

I don't know when it began or how long it will last but the HS Code section of the Canada Post website is down. My workaround was to look at another outbound label recently purchased and copy-and-paste the code I required from there. The label itself printed just fine so it's not a site-wide problem, just that section of the Customs code look-up.

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-25-2018 03:39 PM

If you still require backup sites for looking for HS codes you can use either of these 2.

-CM

XXXX.XX is acceptable

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-25-2018 06:01 PM

I actually printed a label today and the HS code was not accepted the first time.

So I redid the label and it was fine.

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-25-2018 07:54 PM

That's a bit odd, today it worked fine for me.

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 03:04 AM

With PayPal I never have to use HS code at any time.

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 07:07 AM

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 07:10 AM - edited 09-26-2018 07:11 AM

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 07:25 AM

Hope you don't mind but a minor clarification as follows:

The Harmonized Commodity Description and Coding System, HS Code for short, is a common standard worldwide for describing the type of commodity that is shipped. Every commodity that enters or crosses most international borders has to be declared to customs using this code. Thus, the code helps to standardize and identify cargo in the same manner whether it is in Singapore, Mali or Rotterdam.

How is the HS Code Used?

The system is used by many economies around the world as a basis for their customs tariffs and for the collection of international trade statistics. Over 98 % of the merchandise in international trade is classified in terms of the HS.

As of this article, the HS code has 99 Chapters covering 21 Sections. To understand what the code means, we can take 1704.90.10.00 as an example:

- 17 relates to Chapter 17 of Section IV – Prepared foodstuffs; beverages, spirits, and vinegar; tobacco and manufactured tobacco substitutes

- 04 relates to sugar confectionery (including white chocolate), not containing cocoa

- 90 relates to confections or sweetmeats ready for consumption:

- 10.00 relates to candied nuts

So in essence 1704.90.10.00 = candied nuts.

This code is used by various international organizations, governments for the purposes of taxes, trade policies, monitoring, the setting of freight and transport tariffs, gathering of transport and trade statistics and economic research and analysis among other uses. It does not matter what mode of transportation you are using.

Using the correct HS code and the right interpretation is of utmost importance for an importer as usage of incorrect code may be considered by customs as non-compliance, misleading or misdeclaration – all of which comes with its associated penalties.

-CM

From:

https://freighthub.com/en/blog/harmonized-commodity-description-and-coding-system/

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 02:58 PM

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 03:00 PM

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 03:30 PM

With the volume that CPost and USPS handle on a daily basis, they are just looking for an honest effort regarding the correct HS code (In da ballpark range). If a seller is not including a copy of the invoice with the mailing label(Paypal) or Mailing Label and Customs Invoice with SHIPPO or EST Online and the value listed does not appear accurate, Customs can over-ride the value. You list the value for iPhone as 10.00 warning bells will go off. Follow the stated rules and less chance for customs delays. What I have been advised in the past directly from US customs/customs brokers is Ignorance is not a valid excuse for not following the rules.

Sidenote: I have a buyer in the US that purchases items from me to be shipped to alternate locations which he provides in advance of his purchase. I have been asked to not include an invoice/packing slip with the shipment or invoice with customs documents when the ship to address is in the USA. I have clarified this is a requirement of US Customs that this is included, which he now understands and the reasons. One possible solution is a sticker on the customs docs - To be removed prior to final delivery. Documents attached for customs purposes only. No guarantees.

-CM

PS. One of the main reasons, that packages coming from USA to Canada are delayed is your average(Not all) US seller can't be bothered filling out customs paperwork properly and why they hand it off for someone else to do. It's really not that difficult!! All the help guides are there to walk you through the process.

Minor annoyance: HS Code section of CPC returning only error messages

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-26-2018 03:33 PM