- The eBay Canada Community

- Archive Category

- Archive 1

- Re: Canadian sellers to be charged GST/HST/QST on ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-09-2017 02:15 PM - edited 05-09-2017 02:17 PM

As part of the Summer 2017 update, eBay has announced the following. You will see all updates in the email they are sending.

Today, eBay announced changes that will impact Canadian residents and businesses who use eBay.

To better reflect how we manage and operate our platform in Canada, on July 1st, 2017 we will be changing the contracting party for Canadian residents and businesses from eBay International AG to eBay Canada Limited, a Canadian corporation.

As a result, eBay users residing in Canada will begin contracting with eBay Canada Limited. This change will impact these users' User Agreement, User Privacy Notice, Billing Agreement, and other agreements with eBay.

The new contracting entity, eBay Canada Limited, is subject to Canadian tax law. As a result, sales tax (GST/HST/QST) will be charged on eBay fees starting July 1st, 2017. The applicable sales tax rate will vary by province, which we will determined based on your registered eBay address. You should confirm that your registered address is correct. The current applicable tax rates are:

| Province | Rate |

| Alberta (AB): | 5.00% |

| British Columbia (BC): | 5.00% |

| Manitoba (MB): | 5.00% |

| New Brunswick (NB): | 15.00% |

| Newfoundland and Labrador (NL): | 15.00% |

| Northwest Territories (NT): | 5.00% |

| Nova Scotia (NS): | 15.00% |

| Nunavut (NU): | 5.00% |

| Ontario (ON): | 13.00% |

| Prince Edward Island (PE): | 15.00% |

| Quebec (QC): | 14.75% |

| Saskatchewan (SK): | 5.00% |

| Yukon (YT): | 5.00% |

While the addition of GST/HST/QST on fees is new, eBay's prices will not change as a results of this legal entity change. Furthermore, you should see no interruption in your service as a result of this change, and you will not need to make any updates to your listings.

If you are a business user, we recommend that you consult with your tax advisor to understand your eligibility and the process for claiming an input tax credit on tax paid for services provided to your business.

- « Previous

- Next »

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-26-2017 09:40 AM

Thanks for the info, it does seem logic. I did not go through the math myself and believed that it came up higher, but you are right, considering that I would still have paid taxes in CAD$, it does come up to about the same thing.

Thanks for taking the time to reply back, case closed! 🙂

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2018 11:35 AM

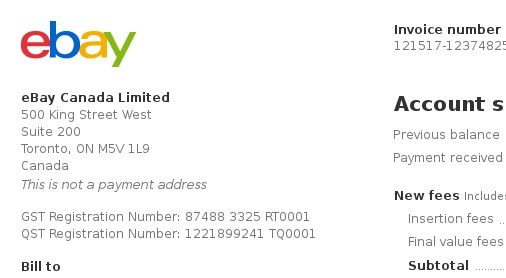

So where and what is the HST tax number ?

This needs to be provided on a invoice

it is the law

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2018 11:57 AM

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2018 10:21 AM

Yes eBay is charging 10% of the shipping cost in US dollars and that is considered a Fee on which they charge 15%, again in US dollars. I know the difference but when I ship to the USA from Canada there is no 15% tax I need to pay. I just did the math on a sale of a $15.50US item and the eBay fees are 16.7% and that's not figuring in what PayPal charges. It's my choice to stay on eBay after 18 yrs or leave which I'm gradually working on. SAD!

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2018 10:28 AM

Seller fees are seller fees. You're being charged a Final Value Fee on Shipping regardless of the destination of the package. And ebay is charging you GST on your seller fees. We're not talking about no-tax on postage labels charged by Canada Post to the USA here, I think you may be confusing two similar but different areas with one another.

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2018 11:26 AM

rroader94 - "... It's my choice to stay on eBay..."

That is correct. Would you quit eBay for $0.15?

On July 1st 2017, rules were changed requiring eBay to collect and remit GST or HST on the fees it charges Canadian sellers.

On a US$10.00 shipping charge, the eBay fee is 10% or $1.00 and the HST in New Brunswick is $0.15. If you lived in Alberta for example, the extra charge would be 5% only ($0.05).

Fees are also lower if you have an eBay store. That would also result in lower taxes. But that is another discussion.

Fees and taxes are a reality of all businesses. Eventually we all learn to live with them.

Good Luck.

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2018 05:47 PM

Thanks for the input. I know the difference between tax on eBay fees and tax on mailing cost which are collected for Revenue Canada. Fees and taxes are part of the cost of doing business and dislike eBay's fee of 10% on shipping costs as much as you like, it's not going away. In hindsight that has been my sore spot but I should not have mixed taxes with fees. I guess seeing 15% on top of the 10% on "cost of mailing" aroused my frustration from back when.

Have a great weekend.

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2018 05:55 PM

rroader94 "...10% on "cost of mailing" aroused my frustration from back when."

I get it. Most sellers are unhappy with the fee being charged on the shipping charge. I do not work for eBay nor do I wish to defend their policy.

Try to look at it from a different perspective. eBay is based in the USA where the majority of listings offer "free shipping" (domestically - by far the largest market). As such, those sellers are paying FVF on the shipping charge (included in the selling price).

By having a policy where all sellers pay their FVF on the transaction amount (selling price + shipping charge) it levels the playing field and makes it fair for all.

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-13-2019 06:52 AM

Re: Canadian sellers to be charged GST/HST/QST on all fees effective July 1 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-13-2019 09:54 AM

ZOMBIE thread.

- « Previous

- Next »

- « Previous

- Next »