- The eBay Canada Community

- Archive Category

- Archive 1

- Customs forms Item Description

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 09:31 AM

Usually I am pretty specific when describing an item on customs forms an write exactly what is in the package: LP Record Album, DVD, Paperback book, Hardcover book...

I've been wondering though if perhaps I should be a bit more vague and for records and DVDs put something like Recorded Media and for Books Printed Media

Would that be acceptable?

The reason I ask, is that I did have 1 item go missing, and of course it was a higher priced audiophile record album. I'm wondering if having the description so obvious and the value right there on the package is such a good idea.

I understand the need to declare for customs, I'm just wondering how specific I have to be and if I can be as vague as the description in the HS code.

What do the rest of you do with regards to item descriptions on customs forms?

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 10:02 AM - edited 12-11-2016 10:03 AM

books / dvds / metal tokens(*) / cds / recorded music / ...

an accurate HS code is the only essential...

(*) metal tokens instead of silver coins ...

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 11:41 AM

The proper HS Code of course.

Most of my items can be summarized by either DIECAST TOY VEHICLE or PLASTIC TOY FIGURINE.

I don't call things 'Action Figures' on Customs declarations because none are battery operated and I don't want to invite the question what actions those figures might perform.

But with international shipments which have value written right on them for all the world to see, I don't send those without tracking, ever. That just says, 'Steal Me' to anyone of four dozen people who might handle it along the route to their destination.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 12:06 PM

@around_again_records wrote:

I've been wondering though if perhaps I should be a bit more vague and for records and DVDs put something like Recorded Media and for Books Printed Media

Would that be acceptable?

A generic description is just fine, in fact preferable, for the reasons you mentioned. As long as it isn't an outright misrepresentation, and you have the proper HS code, you can be as vague as necessary. For example, if I ship a vintage evening gown, I'll call it a "used dress" -- helps to make the parcel less attractive to prying eyes, which in some countries might even include the local mail delivery person.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 12:22 PM

In this case, I would think 'media' is too vague a term and invite more questions than 'used book' or 'used LP record'.

Know what I mean? Like don't describe it as 'Rare, Vintage First-Edition Book' on your Customs Declaration but instead just say 'Used Book'. A used book doesn't sound all that interesting to me. It could be a torn, food-encrusted kids' book, like the last two I received from ebay's biggest online competition. Eyeroll.

Basically, describe the item to be an uninteresting as possible while still remaining truthful. And, of course, us the correct HS Code.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 05:57 PM

Most of the media I purchase online comes from outside of Canada and, virtually all of the time, the seller just lists "used CD" or "used DVD". Any time I've had to fill out a customs form for media (which is pretty much all I've ever sold) I do the same thing: "used ______".

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 08:37 PM

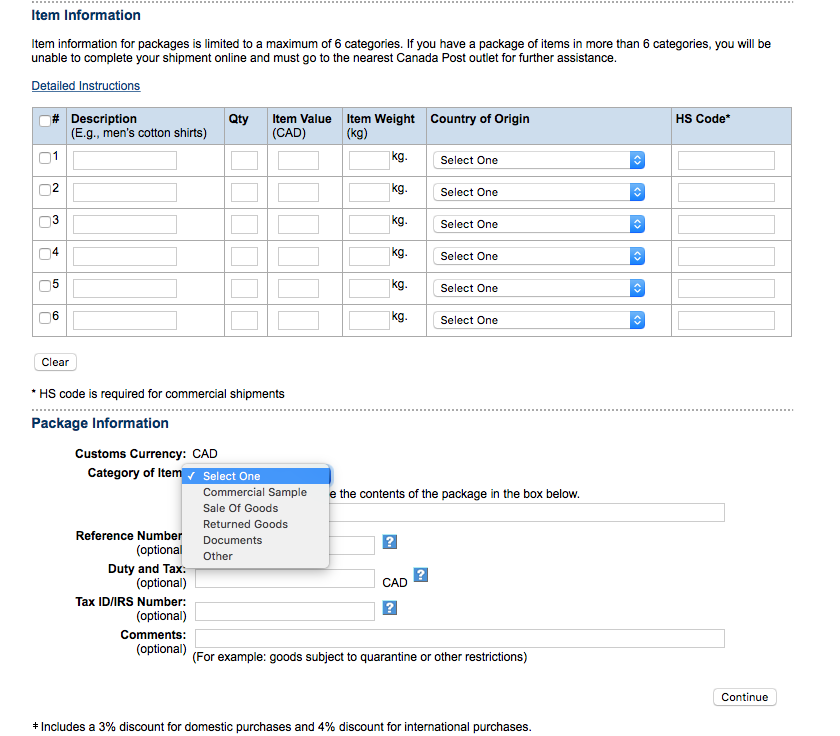

I realize this doesn't specifically relate to the original question but it does relate to customs forms. When printing a label through paypal I have always chosen "Other" as Canada post told me this was the best choice. Recently I've noticed a new option "Sale of Goods" in the choices offered. I'm just wondering what other sellers select when printing their labels? Any helpful feedback would be appreciated. Thanks! ![]()

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 08:44 PM

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 09:22 PM

Hand write all of mine. "video game, "movie" , "hat". Have never used an HS code. Occasionally remember I meant to put a customs form on...after I already dropped the pile into the mail box. Has never made any difference. Always a low value

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-11-2016 11:13 PM

It's Sunday night and I'm a bored (and easily entertained) millennial, so I looked up some information on HS codes and found a fun list of "Tariff Classifications" on the CBSA website.

http://www.cbsa-asfc.gc.ca/publications/dm-md/d10-eng.html

They have a whole document on the classification of pizza kits. My favourite line:

"The pizza base (dough) is considered to provide the whole with its essential character."

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 02:52 AM - edited 12-12-2016 02:55 AM

LOL pizza kits.

When I ship Light Packet / Small Packet I never bothered with HS code. The only time I bother with HS code is when I'm shipping Tracked / Expedited Parcel and printing the label on Paypal. Most of mine just say "used books", no invoice attached whatsoever, only a simple "thanks for buying from me" note and a small paper craft as gift.

@mjwl2006 wrote:

I don't call things 'Action Figures' on Customs declarations because none are battery operated and I don't want to invite the question what actions those figures might perform.

OMG, that's too funny ![]()

![]()

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 05:39 AM

There is no HS code for skateboard wheels so we call them roller skate wheels which are really the same thing anyways.

We describe items as vague as possible like "used cassette tape" instead of it's title or "used software" instead of the pc game title. If the item is tracked and insured then there is no need to be vague.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 06:02 AM

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 06:17 AM

Where do you see that...at the top off the customs page? I don't see that as an option, I stil have to type in merchandise next to 'others'.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 11:21 AM

No no, it's right a the bottom of the form, the drop-down menu changed to include Sale of Goods and Merchandise Returns in the fall. At least it did with paypal shipping.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 11:32 AM - edited 12-12-2016 11:35 AM

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 03:36 PM

Interesting. I had to go to the classic view to see that. I normally use the newer view and it has package information at the top and has a choice of commercial sample, documents or other with an area to type. You would think the newer view would have more options.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-12-2016 03:42 PM

Takes me back to my days at Agriculture Canada

They have a whole document on the classification of pizza kits.

There was a huge arguement over these from the Dairy Farmers who pointed out that the product was a way of smuggling cheap hormone heavy American cheese into Canada.

The Canadian quota system keeps the price of cheese relatively high ($13 a kilo or more) but also means that not only are growth hormones forbidden on dairy farms in Canada, but it is actually a waste of money for dairy farmers to use them to make a cow produce more milk, since any overproduction must be destroyed.

If you are eating and drinking Canadian dairy products you can be relatively certain that you are not ingesting unknown quantities of estrogen and other hormones.

BTW. The kits are more likely to be used by the small local pizzeria than the big chains, who not only have their own recipes, but also have lower costs due to large scale buying.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2016 12:07 AM

That is very interesting. Really, I'd never have guessed this. Pizza kits and hormone-laden imported cheese.

I suppose it goes to show that all the things I find so odd for being subject to extra scrutiny came to that for good reason.

Customs forms Item Description

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-14-2016 11:36 AM

@mjwl2006 wrote:That is very interesting. Really, I'd never have guessed this. Pizza kits and hormone-laden imported cheese.

I suppose it goes to show that all the things I find so odd for being subject to extra scrutiny came to that for good reason.

Oh yes, customs restrictions can serve an essential purpose. Sometimes it's been a matter of just one Canadian department or committee (or indeed one individual MP) who has protected the entire nation through making what seems to be an insignificant bureaucratic distinction like this. It's not an isolated example either. Otherwise, kids in Canada would be ingesting all sorts of hormones in dairy products, as U.S. children continue to do to this day. And as most of us know by now, over-exposure to estrogens in particular has been associated with various cancers.

Back in the 1980's when I lived in Abbotsford, B.C., we often used to drive across the line to buy our dairy products in Blaine, Washington (State). They were unbelievably cheap in comparison to Canadian prices and I was happy to save money on our food budget. That is, until I did some research on the U.S. food industry. But that's another topic entirely...