- The eBay Canada Community

- News & Updates

- Canadian Sales Tax

- Taxes paid on shipping labels

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-28-2023 12:20 PM

I sold an item and bought a Canada Post shipping label through eBay directly.

I was charged for the shipping label but I cannot find an itemized list showing how much tax I paid for that label.

Where would I see the tax information for the shipping label that is purchased via eBay?

Based on "https://community.ebay.ca/t5/Seller-Central/FAQ-s-for-Canada-Post-Expedited-Lite-for-Collectibles/m-... ... "Tax is calculated based on applicable GST/HST tax rates of the destination province or territory. For example, a shipment with a destination address in Alberta is subject to a 5% GST; and a shipment with a destination address in Ontario is subject to a 13% HST."

For example, when buying a shipping label from Canada post, I see label 5$, fuel surcharge 2$, insurance 1$, tax 2.50$. That way I can put in my accounting 8$ shipping charge and 2.50$ tax... but when using the eBay buy shipping, I only see the TOTAL.

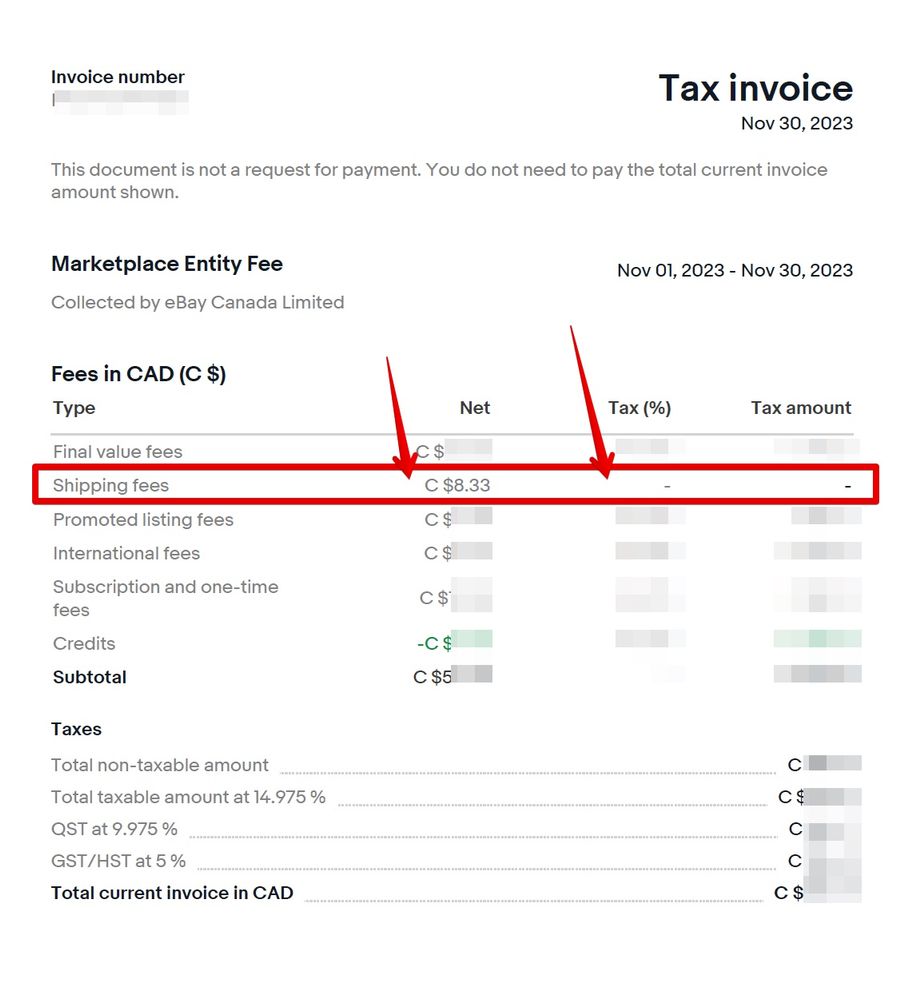

Would the tax information show up on the monthly tax statement or since eBay handles the taxes, 8.33 is the actual charge before eBay paid the taxes and I can just ignore the tax?

****

ORDER DETAIL PAGE:

When I go in the order detail, I see the TOTAL amount paid for the label but no link to explain what the fees are:

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-28-2023 12:52 PM

@andrei_nicolae wrote:I sold an item and bought a Canada Post shipping label through eBay directly.

I was charged for the shipping label but I cannot find an itemized list showing how much tax I paid for that label.

Where would I see the tax information for the shipping label that is purchased via eBay?

Based on "https://community.ebay.ca/t5/Seller-Central/FAQ-s-for-Canada-Post-Expedited-Lite-for-Collectibles/m-... ... "Tax is calculated based on applicable GST/HST tax rates of the destination province or territory. For example, a shipment with a destination address in Alberta is subject to a 5% GST; and a shipment with a destination address in Ontario is subject to a 13% HST."

For example, when buying a shipping label from Canada post, I see label 5$, fuel surcharge 2$, insurance 1$, tax 2.50$. That way I can put in my accounting 8$ shipping charge and 2.50$ tax... but when using the eBay buy shipping, I only see the TOTAL.

This package is shipped from QC to ON and this means that it should have a 13% HST tax charge. As a business, if I paid taxes on the shipping, I can ask for those taxes back so rather than 8.33, my actual accounting charge is 7.37$ (shipping fee) + 0.96$ tax (HST 13%).On the other hand, if 8.33 is the NET amount and eBay then pays the taxes and then claims them back on their end, then my only accounting fee is 8.33 for shipping.

Would the tax information show up on the monthly tax statement or since eBay handles the taxes, 8.33 is the actual charge before eBay paid the taxes and I can just ignore the tax?

****

ORDER DETAIL PAGE:

When I go in the order detail, I see the TOTAL amount paid for the label but no link to explain what the fees are:

"Shipping label-C $8.33"****REPORT: ALL TRANSACTIONSWhen I go to "payments->all transactions", I see a line for the shipping label with the amount 8.33 and I can click on "view" which opens a page that shows me 8.33 again.Transaction amount:Total cost-C$8.33****CSV TRANSACTION REPORT DOWNLOADSo I try another route, which is to download the transaction report as a CSV and in there, there is only 1 line showing a net charge of 8.33 for the shipping label.****

Do we have any follow up on this issue? Critical information for high volume sellers that were collecting tax in the past. Along with anyone who were planning to submit to Rev Canada in the future.

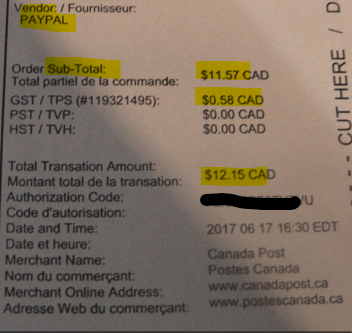

Sample attached below from PayPal days. If a label were purchased directly from CP the breakdown of charges for Canada would show tax and fuel along with any discount with a final total. For USA/Intl the charges would show fuel/discount & total. No taxes apply to international postage. Note: When you check the CP calculator it shows that info. Signed in to CP SSB account it includes any applicable discount.

Also do you have any updates on this months Q & A? Several of the questions I submitted were on behalf of other sellers that were unsure where to turn for that info.

-Lotzofuniquegoodies

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-28-2023 02:25 PM - edited 11-28-2023 02:29 PM

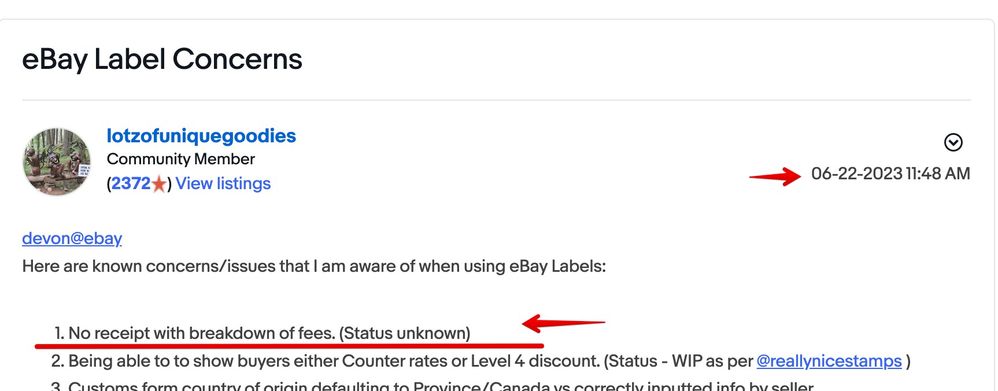

I saw your list of broken things when it comes to eBay labels but no real fix after so I was hoping that at least #1 was fixed... seeing how simple of a fix that should be.

I contacted eBay support to ask them for an itemized tax invoice for the shipping label purchased but the person did not seem to understand what I was talking about. I explained that in Canada, we pay for the tax of the destination province we ship to and I only saw the TOTAL. She then explained the amount of taxes that ebay charged to the customer and that eBay would take the taxes from there to pay for the shipping label as the customer already paid... which doesn't make sense.

She did say that eBay only "forwards" the fee from Canada Post so essentially, they have access to the breakdown somewhere but decided to only post the "total". A clear answer for such a small question, that needs no human reasoning, shouldn't be this hard to get.

She also said to contact Canada Post and dispute the charge as eBay was only an intermediary so I can understand that she didn't understand at all that the only information I needed, was a way to prove to the government if I have an audit, that here: I paid this for shipping, this for tax and here is the tax id # of eBay who collected these taxes from me.

Essentially, I need all the data that you showed on your printscreen that was given when buy shipping was paid via PayPal.

...

(I edited the post to add the image in the post rather than as an attachment and to correct syntax and grammatical errors in the text.)

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2023 05:15 PM

Ok so, I figured it out.

The amount charged by eBay is NET of all taxes.

After getting the monthly tax invoice, I checked if there is any mention of taxes charged on shipping and there are none...

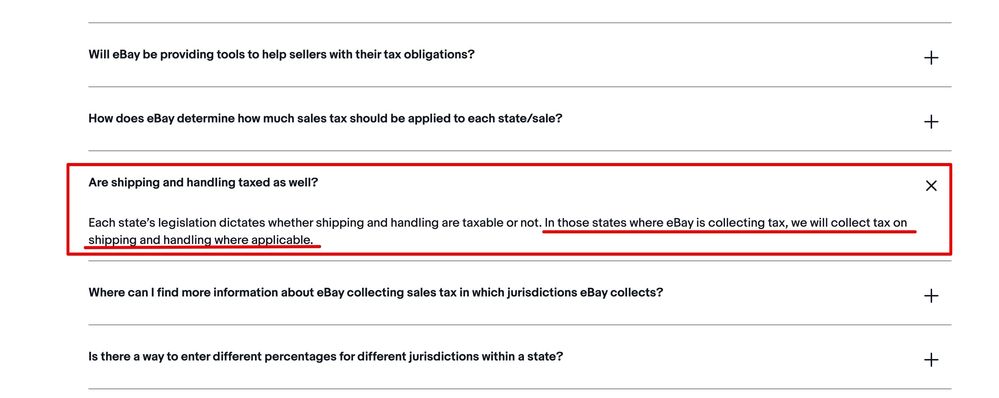

Then I found here (https://www.ebay.ca/sellercentre/payments-and-fees/tax-information) that eBay deals with all taxes in the "states" that decide if shipping is taxable.

I guess this is a translation of the USA information since in Canada, we do not have "states", we have "provinces". Furthermore, since shipping is taxed in Canada and eBay handles taxes in Canada, then eBay also handles the taxes for the shipping label.

So, we will probably never get an itemized invoice for the shipping label, but at least I know what I can provide to the tax authority if I ever get audited.

https://www.ebay.ca/sellercentre/payments-and-fees/tax-information:

Hope this helps someone! 🙂

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2023 06:26 PM - edited 12-05-2023 06:28 PM

I don't think you're entirely correct, or perhaps I'm misunderstanding your post a little. eBay is collecting sales tax on the full transaction, which includes shipping and handling. We fill out the tax form and get it countersigned by eBay giving them the authority to collect it and remit it on our behalf. My understanding is that we don't have to worry about this part at all and can basically forget it even exists.

What you see on the tax invoice are the taxes we pay eBay as part of the service they provide us (final value fees, store fees, etc) and these we can claim. Taxes on what we ACTUALLY PAY ON SHIPPING is part of that service, either directly or indirectly depending on how their agreements work.

The reason we don't have the tax breakdown on shipping is because eBay never separated it out. They get an all-in quote, including taxes and fuel surcharges, from Canada Post and that's what they show and charge us. The cost we pay for shipping includes any taxes that are applicable. We ARE supposed to have that broken out in the tax invoices as well. eBay has stated that they're working on it and (hope) to have it available by the end of the year, but ... we'll see. Apparently their systems aren't designed to handle that and it's non-trivial for them to implement it. In the mean time, you should be able to calculate what tax you paid for each label yourself based on the destination province (preferably automatically in a spreadsheet).

Of course, you should assume that everything I said is wrong and talk to a professional or do your own research. This is my understanding of it though 🙂

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-18-2023 01:13 PM

Again, that seems to make sense too... I don't understand how something so basic can be so unclear. Do mods from eBay actually respond to messages sometimes?

You raise a good point. It is possible that eBay makes it look like "net" but in reality, its just a lump sum that they put in a category called "net".

My accountant told me that if I do not provide Tax numbers for an expense but I decide to ask for a tax reimbursement, if ever the gov decided to verify, then the refund i would have asked for the shipping label's tax will be rejected. The last time the gov did an audit, they requested random invoices and for the ones that did not include the tax numbers, I was asked to either request one or to provide one that had them or else they wouldn't accept it.

Thus, following this logic, if eBay doesn't specify that they charged "me" taxes on the shipping label, then it becomes a "net of taxes" expense for me and I have their monthly tax invoice to prove what they charged me.

When I look at the transaction:

Item subtotal C $11.99

Shipping C $14.95

GST/HST* C $3.50

Refund -C $3.67

Order total** C $26.77

eBay collected from buyer GST/HST -C $3.50

So my assumption is that eBay charges 3.50 tax on 14.95 to my customer, then I buy a label for 8.33 + (5% tax 0.42$) and the 0.42$ taxes are deducted from the 3.50 that they already charged the customers and the remaining 3.08$ tax, they remit to the gov.

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-18-2023 01:30 PM

@andrei_nicolae wrote:Again, that seems to make sense too... I don't understand how something so basic can be so unclear. Do mods from eBay actually respond to messages sometimes?

You raise a good point. It is possible that eBay makes it look like "net" but in reality, its just a lump sum that they put in a category called "net".

My accountant told me that if I do not provide Tax numbers for an expense but I decide to ask for a tax reimbursement, if ever the gov decided to verify, then the refund i would have asked for the shipping label's tax will be rejected. The last time the gov did an audit, they requested random invoices and for the ones that did not include the tax numbers, I was asked to either request one or to provide one that had them or else they wouldn't accept it.

Thus, following this logic, if eBay doesn't specify that they charged "me" taxes on the shipping label, then it becomes a "net of taxes" expense for me and I have their monthly tax invoice to prove what they charged me.

When I look at the transaction:

Item subtotal C $11.99

Shipping C $14.95

GST/HST* C $3.50

Refund -C $3.67

Order total** C $26.77

eBay collected from buyer GST/HST -C $3.50

So my assumption is that eBay charges 3.50 tax on 14.95 to my customer, then I buy a label for 8.33 + (5% tax 0.42$) and the 0.42$ taxes are deducted from the 3.50 that they already charged the customers and the remaining 3.08$ tax, they remit to the gov.

What I would like to be able to rationalize/make sense of is when you give a buyer a refund...example 10.00 does the buyer get any associated tax paid on that amount similar to any fees? In theory there should be there is no way to tell if that is actually happening. Just like a purchase is documented so should any refunds/credits. Hey...Just throwing it out there. And even more important if the amount is large.

-Lotz

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-18-2023 01:44 PM

If you are asking if buyer gets tax that they've paid when they get a refund, the answer is yes. I haven't done a refund in a while do can't look back but I'm sure that it showed the breakdown of what a buyers received back.

But this isn't related to the breakout of taxes that we pay to Canada Post when we pay for shipping?

Taxes paid on shipping labels

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-18-2023 05:59 PM

@andrei_nicolae wrote:So my assumption is that eBay charges 3.50 tax on 14.95 to my customer, then I buy a label for 8.33 + (5% tax 0.42$) and the 0.42$ taxes are deducted from the 3.50 that they already charged the customers and the remaining 3.08$ tax, they remit to the gov.

No, we definitely appear to be charged tax. You can see this for yourself if you use the eBay shipping calculator. Get the level 4 chart from Canada Post, add the fuel surcharge and then taxes and compare it to the quote from the shipping calculator. They'll match.

As for the tax numbers, your accountant should certainly have a better idea than I do (you should definitely ask them about that directly), but my understanding is that you don't "need" proper tax invoices to claim the tax for lower value purchase amounts which most labels probably fall into. It's certainly not ideal for us to be missing them though and it adds a bunch of annoying work that's easy to make mistakes on to do the calculations.