- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Sales tax for US buyers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 12:35 AM

I got an email that outlined the internet sales tax. I sell on .ca and .com. Does anyone have a clue how they are going to make us collect sales tax on our US sales or will ebay do it all like they do for Australia?

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 12:40 AM

Jeez, what a nightmare. I'm outta here.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 01:23 AM - edited 09-20-2018 01:24 AM

@musicyouneed wrote:I got an email that outlined the internet sales tax. I sell on .ca and .com. Does anyone have a clue how they are going to make us collect sales tax on our US sales or will ebay do it all like they do for Australia?

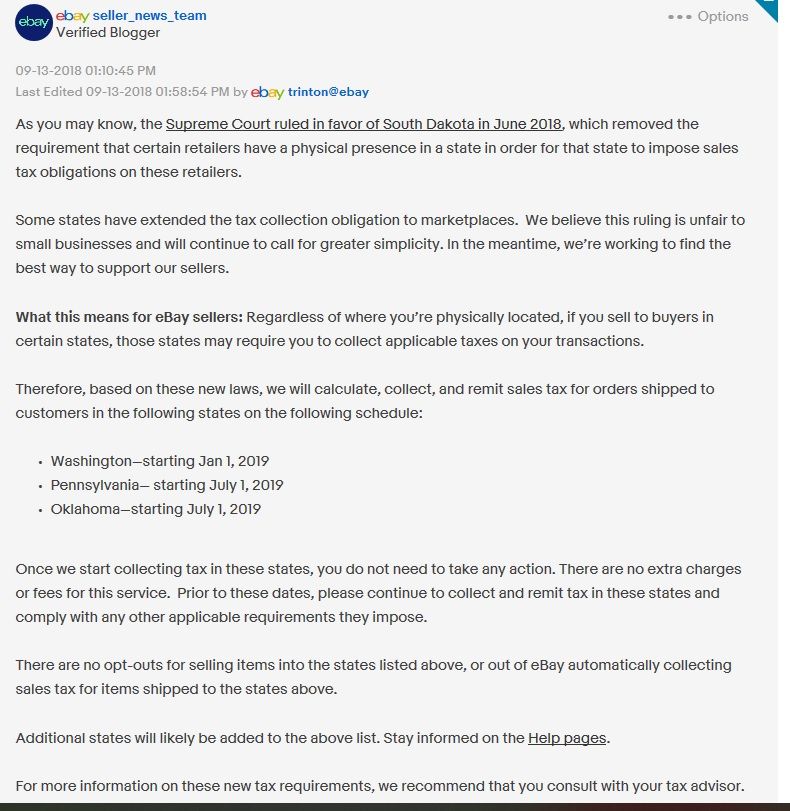

Marketplaces will collect and remit. Free of charge service, for now at least. Curious to see how it will be implemented given the presence of non-resident sellers on .com.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 02:23 AM

I hope it is like ebay does for Australia now. Sales to Australia have almost stopped, used to have a couple a month and now one every month or two.

Now for returns that will a be a nightmare for the buyer and ebay to give tax refunds. I get a headache even thinking about it.

I think sales tax is going to really put a damper on online sales especially ebay sellers. By the time a buyer pays for the item, pays the high shipping costs and then tax on top of that. Cheaper to buy it new at Walmart.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 02:39 AM

I went on .com and this is the thread.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 03:04 AM

@musicyouneed wrote:

I think sales tax is going to really put a damper on online sales especially ebay sellers. By the time a buyer pays for the item, pays the high shipping costs and then tax on top of that. Cheaper to buy it new at Walmart.

Depending on the category and typical size of retailers in a given category I think you'll definitely see some share shifting away from marketplaces to online retailers in locales where there are tax advantages for a given retailer - customer pairing. A retailer selling on a marketplace may result in taxes for the buyer, whereas taking that sale off marketplaces may mean no taxes for buyers or relying on them to self report. To give some context, when HST came into effect it had a direct effect on some regional based retailer/etailers, but overall the etail revenues remained largely the same. If you were buying from retailer A instead of B only because it meant you saved provincial taxes, then you reverted to what was the preferred e/retailer. It should help cut down on some of the more pointless ecommerce transactions where a market only exists because of tax avoidance and sloth-like laziness on the part of the consumer. With the way things are shaping up, ebay isn't going to get it both ways, imitating amazon while trying to play the tax avoidance game because nexus, locale, etc.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 03:35 AM

Heyyyy Jebediah....Trade you a barely used set of Sony Headphones for fixing your Oxen Cart? Yes, I know you won't need headphones for 200 years. Do we have a deal? Sure, save the tax!! Oye vey!! ![]()

-CM <~~~Misses the olden days!!

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 05:21 AM - edited 09-20-2018 05:26 AM

@musicyouneed wrote:I got an email that outlined the internet sales tax. I sell on .ca and .com. Does anyone have a clue how they are going to make us collect sales tax on our US sales or will ebay do it all like they do for Australia?

The article you attached says that eBay will start doing the tax collection next year.

Only sellers that already collect taxes for those States on the list will need to make changes.

...

Everyone else will just keep on selling as usual (Australian style).

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 07:32 AM

Yep, right in paragraph four: ".... we will calculate, collect and remit...."

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 01:41 PM

Unless the seller is registered to REMIT any taxes collected, she should not try to collect taxes.

For export, the standard is that the importer is responsible to know what can and cannot be imported and to pay the assessed duty and sales taxes.

There can be an third party handling this for the importer.

If the transaction is done through eBay, the shipper usually handles this for the importer and charges the importer on delivery.

The third party (Canada Post, UPS, Global Shipping Program, etc.) charges the importer a service fee, under various names, for doing this.

So.

In my opinion, eBay seller shouldn't have any more work to do on exports than we do now, although that would include putting the HScode on labels and marking the origin of the item.

It will, and already has, have an impact on sales at least for a while after the implementation of the various taxes.

In the long run, Australian sales will probably recover pretty fast. They are already paying the 10% GST on domestic transactions and their economy is small enough that they have to import.

The US is different.

They hate taxes with a passion. So much so that they will cut off their noses to spite their face, and then go after their lungs.

But it's not just we exporters whose products will be taxed. It's all online sellers.

And Americans adore mail order. It's part of their culture that is so engrained that they don't even notice it.

I'm wondering what Amazon will do about these taxes.

Because that's one huge player in mail order and their work to reduce fear and anger about the new taxes will be all-important.

Remember that AZ may have some 3rd party sellers, but mostly they sell their own goods, while eBay sellers are individual and not competing with the venue.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 03:04 PM - edited 09-20-2018 03:08 PM

@femmefan1946 wrote:

... But it's not just we exporters whose products will be taxed. It's all online sellers.And Americans adore mail order. It's part of their culture that is so engrained that they don't even notice it.

I'm wondering what Amazon will do about these taxes.

Remember that AZ may have some 3rd party sellers, but mostly they sell their own goods, while eBay sellers are individual and not competing with the venue.

AZ has a lot of third party sellers (53% of sales volume for the last quarter were 3rd party sellers). They gave up and switched to collecting sales tax for all States (but not for cities) on their own stuff a year or so ago.

For third party sellers they will be collecting sales tax for States that have passed legislation.

Currently that's: Washington, Oklahoma, Pennsylvania

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. The marketplace facilitator will calculate, collect, and remit tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation is enacted.

...

The people that really have to be worried about all this are the parcel reshippers/amalgamators to countries outside the USA -- those based in high sales tax states could really feel the pinch.

-..-

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-20-2018 04:13 PM

Currently that's: Washington, Oklahoma, Pennsylvania

@ypdc_dennis wrote:

They gave up and switched to collecting sales tax for all States (but not for cities) on their own stuff a year or so ago. For third party sellers they will be collecting sales tax for States that have passed legislation.

Yep, Amazon is a big winner in all of this and is very much pro tax. For them compliance is a cinch as they already have the infrastructure and size of staff to make compliance something easy to implement. When the legal dust settles on the process for third party sales they are in a position to be selling accounting services using existing infrastructure, so another win. On top of that they are basically spreading out everywhere physically, so logistically they have a huge leg up over competitors who may no longer be able to play the tax free card. Realistically this mess needs to be simplified with a national tax otherwise it'll just end up being a cash cow for marketplaces that have the accounting staff and expertise on board to actually implement this.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 11:38 AM

Wasn't sure if it was worth starting a new discussion on this topic or not.

Does anyone know if a US buyer checking calculated shipping will see the applicable state taxes if they are "fortunate" to live in one of the states that now collects the internet sales taxes? Or would it suddenly show up automagically when they went to pay?

As for the previously noted announcement regarding those taxes, I never received a copy at any time. Curious to know how visible this information in eBay is to your average Canadian seller or US buyer.

-Lotz

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 12:37 PM - edited 01-13-2019 12:40 PM

One of the more recent threads: https://community.ebay.ca/t5/Buyer-Central/Sales-Tax/m-p/416268

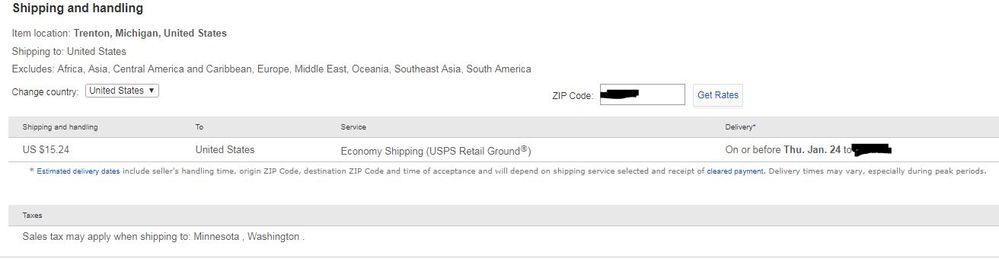

Shipping cost page:

If you select Australia as a shipping destination it will say GST may be collected.

If you select United States no mention of taxes is made, even if a zip code in an eBay collected State is picked.

...

If you go to the Checkout page via the Shopping Cart it will show the tax before the buyer pays.

I tested with a fake Washington State shipping address.

...

This will cause problems with American auction buyers who do not expect a sales tax or with American BIN buyers who use a quick pay method that skips using the shopping cart.

-..-

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 12:48 PM

Thanks for the clarification ypdc_dennis. That's a start that this info displays for Australian buyers. Maybe something to throw in Tyler@ebay direction to see if this is going to be updated in the future for dot ca/com? Curious to know it would display on dot com for a US buyer to a US buyer. Definitely, something that needs to be upfront to buyers and sellers so everyone is on the same page.

-Lotz

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 04:07 PM

We can holler tyler@ebay about all this.

Yoohoo! Tyler!

One concern is that Americans are a very low information bunch. And the more rural or lower income the population, the lower the information.

Sometimes I come here just to luxuriate in the proper grammar and decent spelling.

If we sell to any of those states, it might be a good idea to include a Message with the invoice that any sales taxes are being collected for their home state and are not seen by the seller.

Or would that draw too much attention?

But since ALL online purchases from those states will be taxed, after a few months it should all blow over.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 04:26 PM

It's one of those situations where you are darned if you do and darned if you don't. Pretty sure we, as Canadian sellers or sellers in general, don't need any more surprises to our buyers when they get the bill and go what the heck is that? Just another thing we have no control over. If for example, it were to show up as a message for US buyers shopping with US sellers but not USA from Canada it could put us at another unfair disadvantage. Like what are those crazy Canucks up to? The way I look at it if random(sometimes yes, sometimes no) charges like these are going to get implemented it should be transparent across the board.

-Lotz

PS. If one were to luxuriate in the forest would anyone hear? Hmmm

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:53 PM - edited 01-13-2019 05:59 PM

@lotzofuniquegoodies wrote:... Curious to know it would display on dot com for a US

buyerseller to a US buyer.

From my tests eBay is basing the sales tax on the ship to address -- not on where the seller (or buyer) is located.

...

This will effect those buyers who send gifts to a taxed State or those using a forwarder/mailbox in a taxed State.

...

These changes will be ongoing in 2019 as more States get added to the collection list.

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121#section4

eBay will need to add a generic "sales tax may be collected for <list of states>" when the United States is selected as a destination. Just like they do for Australia. @happy_pigeon

-..-

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 09:59 PM - edited 01-13-2019 10:00 PM

@lotzofuniquegoodies wrote:

PS. If one were to luxuriate in the forest would anyone hear? Hmmm

Hey CM- Only the Real Loud Sighs.

Sales tax for US buyers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 02:23 PM

@reallynicestamps wrote:

We can holler tyler@ebay about all this.

Yoohoo! Tyler!

One concern is that Americans are a very low information bunch. And the more rural or lower income the population, the lower the information.

Sometimes I come here just to luxuriate in the proper grammar and decent spelling.

If we sell to any of those states, it might be a good idea to include a Message with the invoice that any sales taxes are being collected for their home state and are not seen by the seller.

Or would that draw too much attention?

But since ALL online purchases from those states will be taxed, after a few months it should all blow over.

Hi @reallynicestamps - if a seller has their sales tax table filled out it will show in the 'Shipping and Handling' tab on .com. If it's seller input the percentages will be listed after the states.

For eBay-collected sales tax, it will just list the state. On @ypdc_dennis' advice I double checked a few listings, from large sellers to small sellers as well as Fixed Price and Auction style. All the items I looked at did stated that sales tax may apply for Washington and Minnesota (the two states we're currently collecting for). Screenshot attached!

If anyone finds examples that aren't displaying that information will you send me a private message with the item number or link so I can take a look?