- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Buyer Central

- Canadian buying from USA, charged state tax??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2021 07:34 PM

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-10-2021 01:04 AM - edited 02-10-2021 01:07 AM

Is the seller apparently a mom'n'pop operation or a "real business"?

Just as in Canada, businesses can only charge state/provincial taxes when they are registered to collect tax in the Buyer's state/province/country.

Start with a polite note to your seller, reminding them that they should not be collected taxes in this way and that you will be paying Canadian duty and taxes on delivery to Canada Post (along with a $9.95 service charge).

Politely.

And if they argue, ask for a cancellation.

they ship with reg usps and not global shipping.

For the record with Global Shipping if your purchase is over $150 you would be paying duty ( and if over $40 Canadian sales taxes) at the time of purchase along with a~$5 service charge.

Same import fees, just paid at a different point.

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-10-2021 08:26 AM

they're a big business, not small seller. i've never paid sales tax with them before and i buy a lot from this seller. could it be an error?

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-10-2021 12:46 PM

Have you asked them?

If they are a very big seller, they may have a physical presence in your province and be registered to collect Canadian taxes.

But, generally, if the seller doesn't have a physical presence in a state/province, he does not collect taxes there.

For one thing, imagine the confusion for the bookkeeper of a small business (less than 10 employees) in working out what tax to charge buyers in 50 states, 10 provinces, and half a dozen assorted Territories.

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-10-2021 03:48 PM

You shouldn't be paying US state tax if your item is being delivered to Canada.

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-14-2023 11:14 PM

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-14-2023 11:35 PM

@morequalityitems wrote:

I’m a Canadian business that purchased an item from a private seller in the US in order to resell it in Canada. The item was sold to me and both the GST and PST were added to the payment. I contacted the US private seller that confirmed they are not registered to collect Canadian tax and they do not have tax numbers to give me in order for me to reclaim these taxes from the respective government entities. The seller deposit understand either why eBay charged me Canadian taxes on the transaction. I contacted eBay Buyer Services and was told that I must contact the government for an exemption certificate?? I explained that I was not exempt of paying the taxes but that I needed the tax numbers from either the seller or from eBay in order to reclaim the taxes. They are unable to assist further. Canadian law confirms that tax numbers must be listed on the sellers invoice. These are nowhere to be found. This is ridiculous. What should I do?

Re: Your USA purchase discussion question

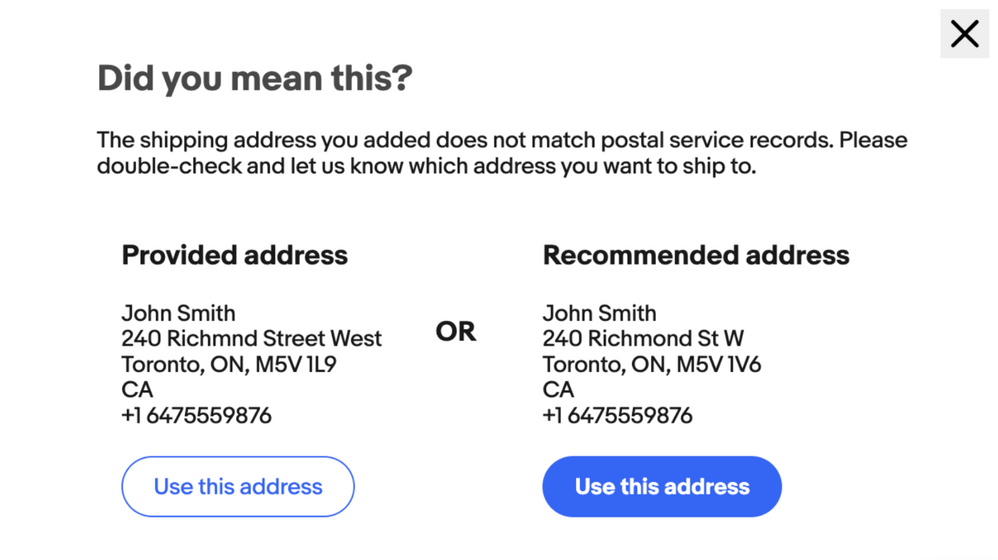

Not positive this will work but if you go to your ebay purchase screen and click on the purchase in question...See part way down page on left side... View Tax Invoice. Hopefully the info you are looking for is there. Screenshot below.

-Lotz

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-14-2023 11:57 PM - edited 07-14-2023 11:57 PM

@morequalityitems wrote:

I’m a Canadian business that purchased an item from a private seller in the US in order to resell it in Canada. The item was sold to me and both the GST and PST were added to the payment. I contacted the US private seller that confirmed they are not registered to collect Canadian tax and they do not have tax numbers to give me in order for me to reclaim these taxes from the respective government entities. The seller deposit understand either why eBay charged me Canadian taxes on the transaction. I contacted eBay Buyer Services and was told that I must contact the government for an exemption certificate?? I explained that I was not exempt of paying the taxes but that I needed the tax numbers from either the seller or from eBay in order to reclaim the taxes. They are unable to assist further. Canadian law confirms that tax numbers must be listed on the sellers invoice. These are nowhere to be found. This is ridiculous. What should I do?

What shipping method was stated in the listing? The only shipping method that I can think of that might lead to you being charged GST and PST at checkout would be the new-ish and uninspiringly named "eBay International Shipping" service. Originally, buyers were supposed to be responsible for paying taxes and duties owing on their purchases upon receipt, but the hype on this service suggested that they might move to taxes and duties being charged at Checkout. I think eIS is experimenting with this new process on some listings now.

The eIS terms and conditions for buyers state in section 6(c) that the service is intended for non-commercial use and goods purchased where the eIS is involved are intended for personal use, so you might not be able to recover the amount you paid in taxes on that basis. Was there anything on the listing page or at Checkout that suggested that the amounts charged in taxes were, in fact, "estimates"?

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-15-2023 11:58 AM

Thanks but no such luck...

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-15-2023 12:08 PM

It was indeed eBay International Shipping on the listing. I've used this method before but never paid Canadian taxes in US funds on a transaction with a private US seller.

No, there was no reference to tax estimates at check-out. Both the GST and PST were simply added to the invoice just before the payment page.

As a business located in Quebec and being that I'm registered to both the Federal (GST) and provincial (PST) governments to collect and remit taxes, I think that on this particular transaction (US private seller to Canadian business buyer with Canadian taxes), I'll simply refer to the eBay GST and PST tax ID numbers when treating the taxes that I paid on the transaction. The issue is, eBay billed me these taxes in US dollars. Not quite sure what the Canadian government deems as an acceptable conversion of funds from US dollar to Canadian dollar...

Thanks for the insight and let me know if you have any other suggestions.

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-15-2023 02:10 PM

Originally, buyers were supposed to be responsible for paying taxes and duties owing on their purchases upon receipt, but the hype on this service suggested that they might move to taxes and duties being charged at Checkout. I think eIS is experimenting with this new process on some listings now.

This is, in my opinion, an improvement.

Not only does it simplify the transaction in much the same way "free" shipping does, by having the customer pay once for their purchase, but it gets around the "customs delay" scam where the buyer claims non-delivery for a foreign purchase, gets refunded, then claims the package at customs paying only import fees.

Not quite sure what the Canadian government deems as an acceptable conversion of funds from US dollar to Canadian dollar...

FWIW, when I did travel claims for government officials we used the xe.com rate for the travel period.

Basically as long as you are not too greedy, it should be fine.

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-15-2023 03:35 PM

@reallynicestamps wrote:Originally, buyers were supposed to be responsible for paying taxes and duties owing on their purchases upon receipt, but the hype on this service suggested that they might move to taxes and duties being charged at Checkout. I think eIS is experimenting with this new process on some listings now.

This is, in my opinion, an improvement.

Not only does it simplify the transaction in much the same way "free" shipping does, by having the customer pay once for their purchase, but it gets around the "customs delay" scam where the buyer claims non-delivery for a foreign purchase, gets refunded, then claims the package at customs paying only import fees.

Not quite sure what the Canadian government deems as an acceptable conversion of funds from US dollar to Canadian dollar...

FWIW, when I did travel claims for government officials we used the xe.com rate for the travel period.

Basically as long as you are not too greedy, it should be fine.

Do you know if there in cases of INAD's if they refund at the rate of the original sale or the date of the refund? Reason I ask several years ago I had a seller unable to ship to me because of certain GSP requirements. There was a major lag time in the seller discovering this. The amount refunded was much lower than the amount paid. Noticed after the fact. It was approx 10.00 CAD. Buyers should not be penalized in these situations. Do we know if there is anything in the fine print to confirm 1 way or another how this is handled?

-Lotz

As a side, in my situation the refund was processed by the seller. It could be different when it is handled by EIS via eBay Inc???

Canadian buying from USA, charged state tax??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-15-2023 11:35 PM

@lotzofuniquegoodies wrote:

Do you know if there in cases of INAD's if they refund at the rate of the original sale or the date of the refund? Reason I ask several years ago I had a seller unable to ship to me because of certain GSP requirements. There was a major lag time in the seller discovering this. The amount refunded was much lower than the amount paid. Noticed after the fact. It was approx 10.00 CAD. Buyers should not be penalized in these situations. Do we know if there is anything in the fine print to confirm 1 way or another how this is handled?

As a side, in my situation the refund was processed by the seller. It could be different when it is handled by EIS via eBay Inc???

Mind if I cut in?

I think this would be more of an Adyen versus PayPal issue than an eIS versus GSP issue, and even then, things might get more complicated if the buyer used PayPal to fund their payment.

I had PayPal do the conversion on my one and only eIS-forwarded purchase to date, so what shows up on my credit card statement is an amount in Canadian dollars only. I don't know how Adyen or PayPal would deal with the reverse-conversion in the event of a refund.

However, if I had let my credit card issuer do the conversion, I don't think Adyen or PayPal would "know" what I ended up paying in Canadian dollars, so I'd be at the mercy of the currency buy-sell rate spread and exchange rate of the moment.

Hope I'm making at least a smidgen of sense here.