- The eBay Canada Community

- Discussion Boards

- eBay Café

- Canada Town Square

- Re: prepaid duty

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-14-2013 08:23 PM

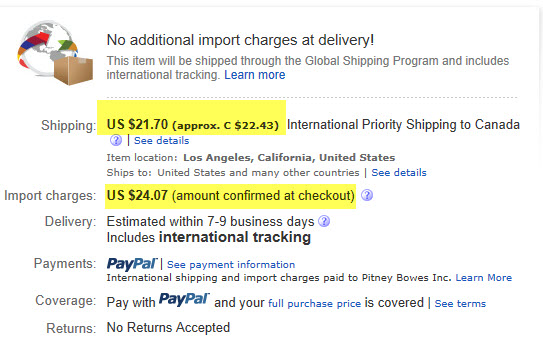

Does anyone else have a problem with the fact that the service charge incurred when a seller collects the duty upfront is not indicated in the listing?

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-14-2013 10:18 PM

It is indicated in the listings that I have seen.

_____________________________________

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 12:34 PM

There's a much longer thread about this elsewhere here. I've just had to tell someone I used to buy from - who is now opted in to the Global Shipping Program but refuses to believe the evidence even when I sent her a screen shot - that I won't be purchasing from her ever again.

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-17-2013 08:09 PM

I have a problem with them collecting duty for items shipped to Canada in the first place. We have a free trade agreement with the US and we don't pay any duty on anything coming from the US to Canada. As far as I'm conserrned this is a direct violation of that agreement. I don't buy from anybody who charges custom fees.

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-17-2013 08:40 PM

You are not paying DUTY,

You are paying taxes which is a different thing and has nothing

to do with NAFTA.

Anything with a value of over $20.00 Canadian that is imported is subject

to taxes , although a lot of it slips by customs.

If sent by mail and gets checked by customs then there is an additional

$9.95 handling fee.

If sent by courier then you pay the taxes and a higher handling fee.

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2013 06:59 PM

The problem we have is with the "service" that collects an exorbitant "tax" and clearly states that if the tax exceedes what Canada Customs would collect the buyer will not be refunded the differance. Let the Canadian govt do or not do its job. I would hope American vendors would be less enthusiastic to act as tax collectors for a foreign govt. Let Cdn buyers and the Canadian govt worry about Cdn taxes.

Re: prepaid duty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-09-2013 10:59 PM

@juno.ca wrote:The problem we have is with the "service" that collects an exorbitant "tax" and clearly states that if the tax exceedes what Canada Customs would collect the buyer will not be refunded the differance. Let the Canadian govt do or not do its job. I would hope American vendors would be less enthusiastic to act as tax collectors for a foreign govt. Let Cdn buyers and the Canadian govt worry about Cdn taxes.

Calculate the tax payable on a GSP item. Subtract that amount from the Import Charges listed. Keep in mind that items not manufactured in a NAFTA country may be subject to duty as well as taxes. Is the amount left over really obscene, in your view? Then don't buy the item and then you won't have to worry about overpaying taxes.