- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Customs duty / International return

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 10:30 AM

I recently sold a higher ticket item in the computers category from my .CA store to a buyer in the USA. Sale price was 1100CAD + 65CAD shipping.

About a week after the buyer had received the item they contacted me saying they were invoiced by FedEx for customs duties, about 26USD. They messaged me requesting/demanding the funds to cover this, saying that shipping should be DDP (delivery duties paid). Thee even mentioned they had contacted ebay already and "confirmed" that it was the sellers responsibility to pay the duty.

That seems like a lie to me, as everything I can find in ebay's policies, and the information on the listing (auto inserted by ebay) states any duties etc are the buyers responsibility.

I had a 14 day return policy for international sales, which has since expired, they received the item on April 3.

I really feel like they are trying to pull a fast one one me here, they are an experienced ebayer with thousands of feedbacks.

My concern is they will try to return the item despite the 14 day window being closed. I have read conflicting info about this, that the 14 days only applies to certain categories, and that even after that window they can return if not as described etc. The shipping costs would be pretty painful to eat.

Curious if you all think it would be better to just bite the bullet on the 26usd or if I'm protected here at all.

Thanks in advance

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 10:58 AM

In my own case, I look at these things as a time, energy, $ perspective instead of a principles one.

$26 against a potential problem of $1165 is 2%. If they made some sort of other comment about condition etc and wanted a $26 refund I'd send it automatically, as long as they were polite I wouldn't even block them.

The potential time, energy to fight it against the possible $$$ at stake if it escalates in my eyes is a simple refund and possibly block them scenario.

Others will certainly disagree but in my "spend as little time and $$$ on fixing things" kinda world I'd treat it like a somewhat inexpensive cookie jar scenario and move on. (despite how very annoying it is).

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 01:00 PM

Contact eBay's for business page on Facebook or Twitter. Provide them with the delivery date from the tracking. Ask them to confirm what the last possible date is for the buyer to open a return.

Additionally, ask them by eBay's policy whether it is the buyer or seller who is responsible for paying duties.

If the return window is closed, and they say it's the buyer's responsibility, you have no more liability. Your only liability is a negative feedback, which you can then have removed because the buyer would be leaving you feedback based on something out of your control and not included in the transaction.

The best way to have a negative feedback removed is through this link: https://www.ebay.ca/help/selling/selling/seller-levels-performance-standards/appeal-defect?id=4871#s... - scroll to the bottom, and click 'e-mail us'. You have to be clear that you're not looking for info on the feedback removal policy, otherwise they will just copy and paste to you info about asking the seller to revise the feedback. You have to be clear that their feedback violates eBay's policy because of X, explain the duty disagreement, copy and paste in the eBay CSR who told you it was up to the customer to pay it, you're done.

With that said, that's only from the one-dimensional perspective of protecting your account. If you're a full time seller, you may want to consider refunding it as a 1 time courtesy. It really depends on context. The amount of back and fourth you will take with customer service, and then having to possibly message eBay more than once to confirm policy and have negative feedback removed, it might be better for everybody just to eat the $26 on a $1000+ transaction. The customer is happy, you save some time. In online selling, not everything always goes according to plan. Which isn't to say you're at fault.

With that said, the only way I would say you are at fault is if you advertised a shipping service like USPS, and used Fedex or UPS instead without consulting the buyer. As a Canadian, I specifically avoid US listings that use UPS, because they charge a very high brokerage fee. While I believe it's common sense that the buyer is responsible for import charges (unless otherwise stated), I would be annoyed if a seller shipped with UPS instead of Canada Post (via UPS), and I was hit with a brokerage charge. I wouldn't be annoyed if I was hit with a duty or brokerage fee in any other situation. The way I see it, that's always been the buyer's responsibility with international purchases.

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 01:00 PM

That said, @ricarmic makes a good case on the “price of being right.” Perhaps you can offer to pay half the FedEx charge? Just out of curiosity, would sending the item DDP cost more than what the buyer paid in shipping and customs-related charges?

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 01:12 PM

@ilikehockeyjerseys wrote:;Contact eBay's for business page on Facebook or Twitter. Provide them with the delivery date ;return.

;ditionally, ask them by eBay's policy whether it is the buyer or seller who is responsible for pay duties.

If the return window is closed, and they s

ay it's the b

uyer's responsibility, you have no more liability. Your only liability is a negative feedback, which you can then have removed because the buyer would be leaving you feedback based on something out of your control and not included in the transaction.

The best way to have a negative feedback removed is through this link: https://www.ebay.ca/help/selling/selling/seller-levels-performance-standards/appeal-defect?id=4871#s... - scroll to the bottom, and click 'e-mail us'. You have to be clear that you're not looking for info on the feedback removal policy, otherwise they will just copy and paste to you info about asking the seller to revise the feedback. You have to be clear that their feedback violates eBay's policy because of X, explain the duty disagreement, copy and paste in the eBay CSR who told you it was up to the customer to pay it, you're done.

With that said, that's only from the one-dimensional perspective of protecting your account. If you're a full time seller, you may want to consider refunding it as a 1 time courtesy. It really depends on context. The amount of back and fourth you will take with customer service, and then having to possibly message eBay more than once to confirm policy and have negative feedback removed, it might be better for everybody just to eat the $26 on a $1000+ transaction. The customer is happy, you save some time. In online selling, not everything always goes according to plan. Which isn't to say you're at fault.

With that said, the only way I would say you are at fault is if you advertised a shipping service like USPS, and used Fedex or UPS instead without consulting the buyer. As a Canadian, I specifically avoid US listings that use UPS, because they charge a very high brokerage fee. While I believe it's common sense that the buyer is responsible for import charges (unless otherwise stated), I would be annoyed if a seller shipped with UPS instead of Canada Post (via UPS), and I was hit with a brokerage charge. I wouldn't be annoyed if I was hit with a duty or brokerage fee in any other situation. The way I see it, that's always been the buyer's ;responsibility with international purchases.

Prior to all the VAT/Tax collection by eBay it was noted on the front page that any taxes were the resposibility of the buyer. That same info has not shown up on the check rates page for years.

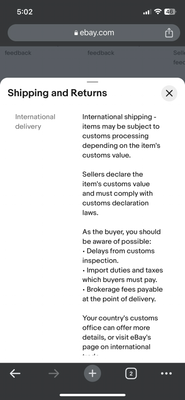

The new message is as follows for international shipping. (Canada to World (which wouldn't include USA)

Please allow additional time if international delivery is subject to customs processing.

Taxes:Taxes may be applicable at checkout. (No mention of customs processing fees which would be applicable for anything over 800 USD.)

As for the OP they note Standard International Shipping. Because eBay STILL doesn't have a working calculator any sellers using non CP shipping options has their hands tied. Flat rate is a guess at best. You do not always win using that choice.

-Lotz

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 02:12 PM

The point is mainly just to get it in writing from a CSR so they have it in their back pocket if they need to have a negative feedback removed. If there is somewhere on eBay's policy page where it is clearly spelled out, quoting that would be fine as well. It would still probably get removed without either, but it would be easier with policy to point to.

A negative feedback isn't really the end of the world anyways, but it's nice to be able to get rid of them if they aren't for a valid reason. If the return window is closed, that's the only real liability to consider at this point.

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 02:47 PM

Th $26 is not duty, it's a customs processing charge from FedEx (applicable to all US bound shipments except when using Express/Overnight service.

https://www.fedex.com/en-us/shipping/international/brokerage.html#fedex-broker

The buyer has the computer, FedEx send the bill after the fact and if it's not paid by the buyer FedEx will simply bill it back to you. If YOU don't pay FedEx two thing happen, 1) if unpaid they may block you from using FedEx again, and 2) eventually if unpaid by you they will turn it over to collections.

Normally when using FedEx you should have those charges billed back to the shipper instead of the recipient as it's really part of the shipping cost.

My advice, pay the buyer the $26 because the alternatives could be VERY costly to YOU.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 03:38 PM

In the short run , pay it.

In the long run, add this to all your listings,

Import duties, taxes and charges are not included in the item price or shipping charges. These charges are the buyer's responsibility. Please check with your country's customs office to determine what these additional costs will be prior to bidding/buying.

EBay supplied that boilerplate several years ago for those of us selling internationally.

Americans have an $800 duty free allowance , so it is very likely that your customer never had to deal with this before.

And FedEx is notorious for billing, including their substantial "customs brokerage fees", weeks after delivery.

So again in the long run, don't ship by FedEx.

UPS and Canada Post/USPS don't pull that stunt on unsuspecting customers.

Customs duty / International return

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2023 08:04 PM - edited 04-19-2023 08:11 PM

@femmefan1946 wrote:

EBay supplied that boilerplate several years ago for those of us selling internationally.

eBay now supplies that information itself, and it goes into a fair bit of detail on the mobile site.