- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2023 05:30 PM

It's frustrating- I buy and sell a lot of coins from the US and globally. I understand the logic of eBay collecting GST/HST- because the government is losing money. The issue is they don't understand Canadian tax/duty laws. There is no tax/duty on silver/gold coins, with some exceptions. Now - what happens is you call them- after you pay for the item- or even before you pay, they encourage you to pay- and you will be refunded the taxes. They say the 'tax department' is swamped, so that it may take a day or two. I've been waiting for almost THREE months, and not a dime has been refunded. I call them- and I get the run-around- again- and am told that the issue would be marked 'high priority' and thanks for the call- then nothing.

I can't be the only one this happens to. It's particularly sad for those who are just getting into coin collecting and don't know they are overcharged- and those who want me to do something. All I can do is refer them to eBay for the run-around.

So eBay- question- what are you doing with all the extra revenue you are receiving- that isn't going to Revenue Canada?

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2023 05:43 PM

devon@ebay Another complaint about this.

@brle_5065 Write to your MP.

Member's Name

House of Commons

Ottawa ON

K1A 0A6

You don't even need to stamp the envelope, just mark it OHMS (On His Majesty's Service).

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2023 06:53 PM

To be exempt from GST/HST precious metals in the form of coins must be at least 99.5% purity for Gold or Platinum and 99.9% purity for Silver.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2023 10:31 PM

"There is no tax/duty on silver/gold coins, with some exceptions"

You kinda got it backwards...

As recped said, "To be exempt from GST/HST precious metals in the form of coins must be at least 99.5% purity for Gold or Platinum and 99.9% purity for Silver".

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2023 10:42 PM

Yes, I stand corrected- the 99.+% rule applies. I don't care about the taxes on stuff I sell or buy that taxes should be applied to.

The other issue is the service fees- If you are charged, let's say 10% service fee- fine, but eBay collects the tax on the item- and charges you 10% of the tax that they collected and adds it to your fee- example:

Item sells for $100.

Tax: 12%

Total amount from person who buys item: $112.

Service fee: $11.20

Does that make sense?

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2023 12:01 AM

Not exactly.

EBay charges its fees on the entire payment your customer makes.

That payment is made up of the selling price, your shipping charge*, and any taxes the buyer pays**.

The fee is not on the tax, it is on the payment.

* Although you may charge the exact counter price for shipping to your customer, you are often getting a discount on that when you purchase a shipping label with your SfSB card/eBay labels/ Shippo labels etc.

**As does Paypal, merchant credit card accounts etc.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2023 03:36 AM

The coins with that purity should be exempt but ebay does charge buyers tax on them even if they are in the bullion category.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2023 03:49 PM

Apropos of nothing, am I imagining things or do the users who post on the subject of taxes being applied to bullion sales tend to favour using ALL CAPS when composing the topic title? 🤪

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2023 05:29 PM - edited 03-02-2023 05:30 PM

@pjcdn2005 wrote:The coins with that purity should be exempt but ebay does charge buyers tax on them even if they are in the bullion category.

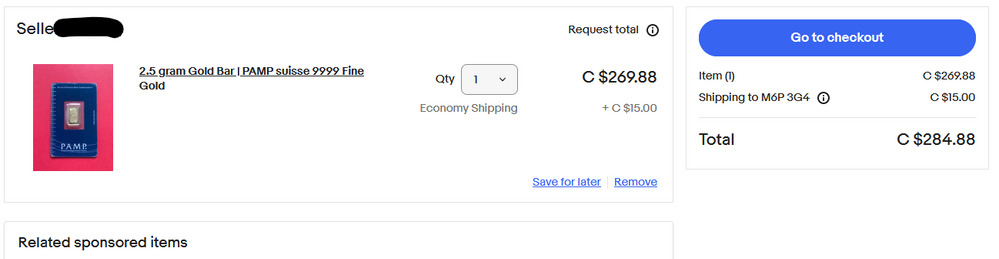

I just tested this by adding a .999 gold item listed in the Bullion Category from a Canadian seller..........

No tax was charged!

Cart......

Checkout.....

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 09:42 AM

I remember a year or so ago suggesting that it might be possible to purchase on the US site to get around this, but while the preview screen showed no GST/HST charges, they popped up in Checkout. Good to see that the fix on .ca extends to Checkout.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 03:21 PM

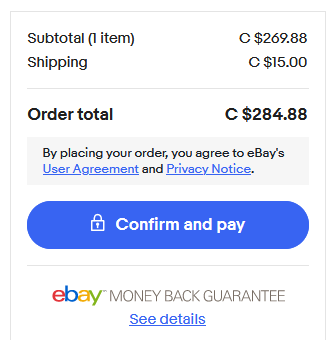

Your screenshot surprised me as I had doublechecked whether tax was being added before I posted. This one that I added to my cart did charge tax. It was also listed under bullion and is .9999 gold.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 03:27 PM

There must be something different in the listings in the non taxed ones versus the taxed ones. I haven't narrowed it down but someone else might be able to figure it out.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 05:55 PM

I checked a few different listings and I think that in order for ebay to NOT tax bullion, the fineness .9999 or .9995 needs to be in the title. It doesn't seem to matter if it is in item specifics.

It also needs to be listed only in the bullion category. If it is listed in bullion and another category, it shows up as taxable.

It's possible that I've come to the wrong conclusion but just based on looking at it today, that's how it seems to work.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 06:00 PM - edited 03-03-2023 06:01 PM

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 07:04 PM

That shouldn't be a factor.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 07:32 PM - edited 03-03-2023 07:36 PM

@pjcdn2005 wrote:That shouldn't be a factor.

What are you referring to? The type of bullion, the incorrect categorization, or the device used for the "purchase"? 😋

The sub-sub-subcategory for your purchase is, I assume, "bars" while the others was "coins." It may be that some sort of fix has been engineered based on "coins" but it hasn't made it to "bars" yet.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 10:34 PM

I was referring to your comment that "Maybe it depends whether it’s a coin or a bar?"

The screenshots that recped and I posted were both of bars. One had tax, one didn't so that alone tells me that it is not a bar/ coin issue.

I checked a number of listing from Canadian sellers that were listed in the bullion category, some coins, some bars. When I put them in my cart some added tax and some didn't. They all qualified for the .9999 fine silver or gold category. The only difference that I could see was that the ones with .9999 in the title and that were listed only in the bullion category never added tax. If the item specifics had .99999 but the title didn't, there was tax. If the title had.9999 but the item was on bullion and another category there would be tax.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-03-2023 11:45 PM

@pjcdn2005 wrote:

The screenshots that recped and I posted were both of bars. One had tax, one didn't so that alone tells me that it is not a bar/ coin issue.

Whoops. How in Hades did I miss that? I plead using my phone when viewing the post. 😇

@pjcdn2005 wrote:

I checked a number of listing from Canadian sellers that were listed in the bullion category, some coins, some bars. When I put them in my cart some added tax and some didn't. They all qualified for the .9999 fine silver or gold category. The only difference that I could see was that the ones with .9999 in the title and that were listed only in the bullion category never added tax. If the item specifics had .99999 but the title didn't, there was tax. If the title had.9999 but the item was on bullion and another category there would be tax.

I've checked other listings for the same coin I looked at, and it does appear to be 9999 pure according to the listings where Item Specifics has (have?) been used. The only instances where I can see tax being charged is when the seller didn't categorize the coin as "bullion".

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2023 08:31 AM

Another to try is listing your silver or gold coins in the World/Commemorative section,

not the Canada/Commemorative section. The fineness doesn't need to be in the title but needs to be in the item specifics along with composition listed as silver or gold.

EBAY CHARGING TAX ON NON-TAXABLE ITEMS -CANADA-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2023 08:59 AM

Edit to my above post. Only applies to pure silver coins, not gold.