- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- U.S. customers are responsible for duty but are ta...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 02:19 PM

There used to be a place on payment policies to explain that customers were responsible for import duties and taxes. That field is no longer there - not sure if it is because I now have MP and payment policies were changed by eBay.

I want to have that information on my listings - unfortunately I now have to enter it individually on each page instead of being able to edit it through the policy.

Question, though, what is the best way to word it? Used to be "customer is responsible for any duties and taxes" but taxes are paid now aren't they?

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 04:16 PM

I have chosen to keep it simple: "Customer is responsible for import duties and fees."

And the disapperance of the Seller's Payment Instructions off of my listings seems to be tied to Managed Payments (at least that is what a seller in the U.S. seems to think - from a discussion on .com in August of last year). The Instructions show on my listings until any revision is made - even if nothing gets changed - and then it just gets deleted. I am glad I noticed it.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 04:33 PM

eBay already includes a notice about duty/taxes on every listings (you won't see it unless you change your ship to location to something other than Canada).

As far as Duty on shipments to the US, the official duty free limit is US$800 but the reality is that shipments sent via the postal service are rarely assessed Duty unless the value exceeds US$2500 (a formal customs entry is required at that level).

So unless you are shipping an item worth more than US$800 (over CA$1000) there will never be any Duty payable.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 05:06 PM

Thanks recped! When do they see that? Is it prior to purchase?

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 06:03 PM

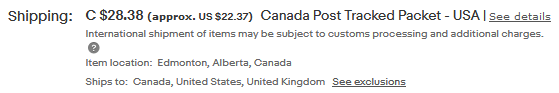

It shows right under the shipping information......

It might also show up in checkout but I'm not 100% sure of that.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 06:25 PM - edited 03-07-2021 06:43 PM

Thank you, appreciated.

I get a different message - both the same whether signed in to .ca or .com

I don't know how to post an image like you did.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-07-2021 06:59 PM - edited 03-07-2021 07:18 PM

This is the msg I see (with some cutting and pasting to make it fit)!

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2021 01:52 AM

I kept that boilerplate and have it as part of all my Descriptions:

Import duties, taxes and charges are not included in the item price or shipping charges. These charges are the buyer's responsibility. Please check with your country's customs office to determine what these additional costs will be prior to bidding/buying.

It may be elsewhere but Buyers Don't Read. So suspenders and belt it is.

As recped says, our US customers have a duty-free allowance of $800 so the question does not often come up.

But there is the newish "Internet Sales Tax" which is really the state sales taxes that eBay (and other online venues) are required to collect from most Americans.

EBay puts that on the invoice and unless the buyer pays it, the payment does not clear.

We do not handle it in any way.

It's been long enough that most US buyers are now used to it, if they do any online buying at all.

Both PP and Managed Payments do however collect their fees on the customer's ENTIRE payment, so if you make a $100 sale to a state that has a 5% state sales tax, the customer will be paying $105.00 and you will be paying 30c+ 3.7% of $105 =$4.19 for payment processing.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2021 03:25 AM

Your screenshot is from a different spot than the one that recped posted. The mention of custom taxes etc is right next to the shipping amount near the top...just under the 'buy now' and 'add to cart' icons.

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2021 11:26 AM

pjcdn Thanks! How on earth did I miss seeing that on my listing page when that is the information I was looking for? Good grief.

femmefan Thank you for the boilerplate and also the info on taxes and fees. My initial question was about U.S. customers but I also sell to the UK and sometimes Australia so that all helps. Loved the comment about suspenders and belt!

I am so appreciative of all of the help I get here!

U.S. customers are responsible for duty but are taxes paid already? How to word it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-08-2021 03:32 PM

@hallscrystal wrote:My initial question was about U.S. customers but I also sell to the UK and sometimes Australia so that all helps.

Well for the UK and Australia eBay is now collecting VAT, for Australia they collect on orders under AU$1000 and there is no import duty on those either. For the UK eBay collect VAT on shipment below £135 and those are also duty exempt.

Bottom line, except for higher value shipments buyers in those countries will be prepaying import charges so the notice is basically irrelevant.

Of course there is the real issue of who ac tually reads these notices? Most buyers already know and the ones that don't most likely never see/read the notice or see it but it doesn't register.

I can say one thing for sure, most of the people who complain about import taxes are well aware of them but they just like to complain. Much like the recent uproar over US Sate Sales Tax, still plenty of buyers and sellers who think that is something illegal.

On a similar vein, buried in the US Covid bill is a requirement for the 1099 threshold to be reduced to $1000, the US boards are going to be filled with outraged sellers "I am not a business" or "I am just selling stuff" or "my stuff is all used" etc. etc. Bottom line there are probably millions of sellers who think that somehow they are exempt from reporting income and paying taxes on eBay sales. For years people have been saying that eBay is trying to get rid of "small sellers", eBay never was or at least never directly tried but the thinning of the herd is going to happen as the tax evaders realize it's time to pay up or disappear.

Some are saying they are moving the facebook Marketplace, they are going to be dissappointed because facebook will be following the same path with reporting sales to the IRS. Craigslist is going to be the only "tax-free" way to sell in the near future.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.