- The eBay Canada Community

- Archive Category

- Seller Listing Tools

- State Sales Taxes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 05:24 PM

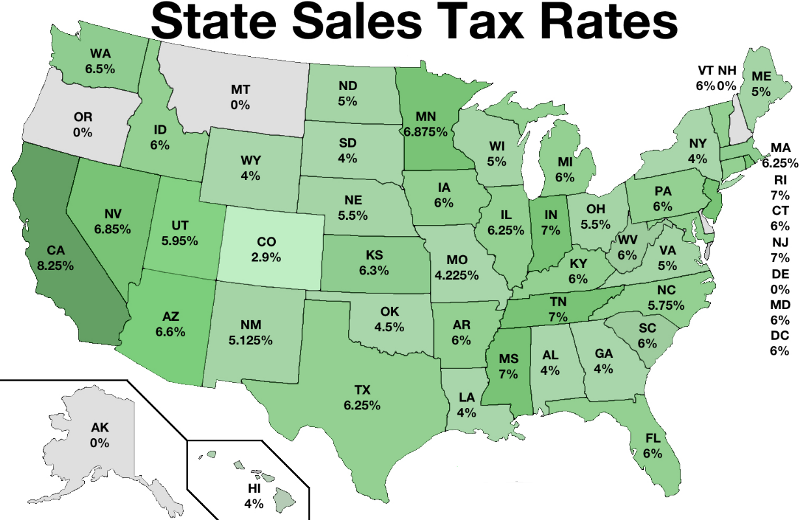

Does anyone know of a place IN eBay that clarifies the sales tax percentage that are being charged by State by eBay? The link below only confirms for a few random states.

https://www.ebay.ca/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

Handy for issuing refunds where applicable. One should not need to go to taxjar or individual state websites to confirm or have to do the math.

-Lotz

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 07:59 PM - edited 03-11-2020 08:00 PM

Why do you need to know the tax rate when doing a refund?

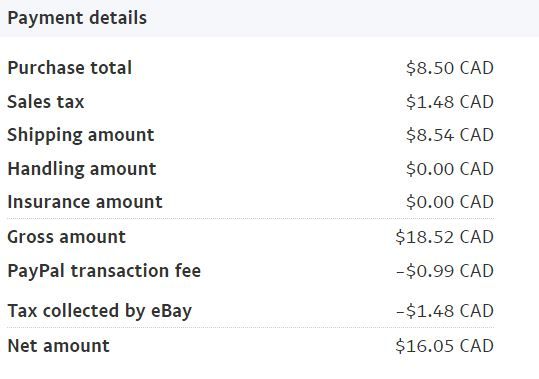

If the sale money was through paypal the sales tax details are there for a sale through ebay.

-..-

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 08:57 PM - edited 03-11-2020 08:59 PM

"If the sale money was through paypal the sales tax details are there for a sale through ebay".

Where exactly do you see the tax percentage on the PayPal transaction details?

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 09:21 PM

@silverpinups wrote:"If the sale money was through paypal the sales tax details are there for a sale through ebay".

Where exactly do you see the tax percentage on the PayPal transaction details?

Tax amount is shown, cost of item is shown, cost of shipping is shown.

All that is required is simple arithmetic to figure out what the percentage is -- it is not rocket science.

-..-

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 10:04 PM

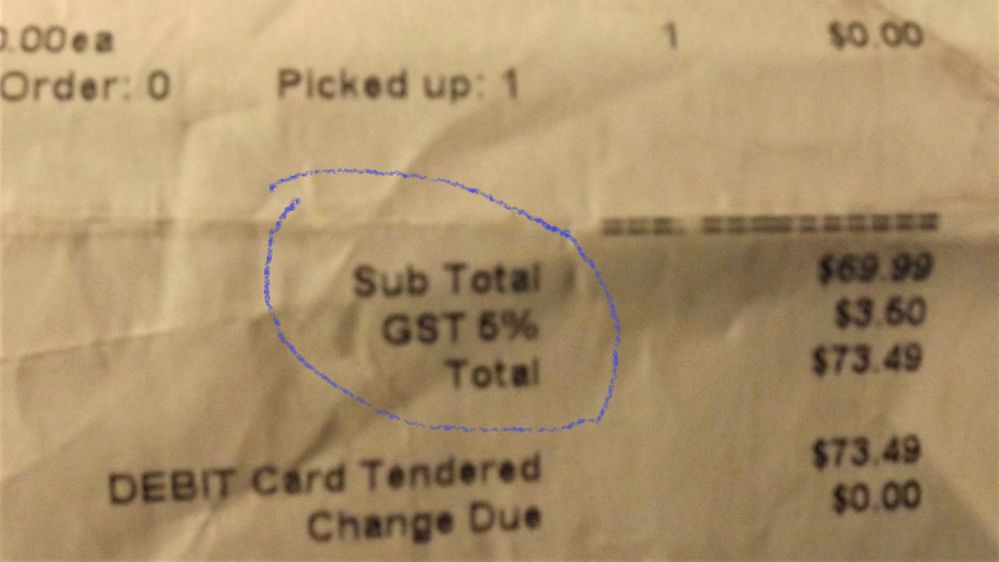

I'm not really sure what's wrong with suggesting eBay to show their math? Each State Tax rate varies. Some states charge tax on Sale + Shipping. Some just on the sale. There are items that are as per state regulations should be exempt. Others at reduced rates. How else will sellers and buyers KNOW they are being billed accurately. Note. Receipts are for Alberta so no PST. 🙂 Apologies to the the provinces with PST/HST.

https://blog.taxjar.com/sales-tax-and-shipping/

-Lotz

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-11-2020 11:55 PM

Some states have different tax rates for different municipalities so TaxJar is not going to be accurate unless it gives you that info as well. I don’t see why a seller needs to know the percentage or what real math would be involved in refunding as the amount is already stated.

I dont know if buyers see a percentage or not.

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:18 AM

Handy for issuing refunds where applicable.

NO!

The seller did not collect the taxes, did not receive the taxes, and doesn't refund the taxes.

Seeing the taxes on the PP invoice (and paying a 3.4% fee to PP for the privilege of having them flit by, grrrrr) does not mean the seller has to refund money she never had.

It's never* applicable to the US Internet Sales Tax.

The Canadian seller does need to know the Canadian sales tax rates if she is registered to collect and remit these. But she has that information elsewhere in any case.

*Oh, okay, there may be a very few sellers on the Canada Board who are registered to collect sales taxes in some states, perhaps because they dropship and their suppliers have warehouses in those states.

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:22 AM - edited 03-12-2020 12:24 AM

Are you in Alberta?

Because here in BC, we are charged PST and GST separately , and some products, such as children's shoes, do not have any PST although GST is applicable.

In ON, as I recall, books were not subject to PST, but were taxable under GST and, again as I remember it, when the HST was introduced, suddenly books were being taxed.

How else will sellers and buyers KNOW they are being billed accurately.

The seller isn't being billed, so she doesn't have to know.

And I realize that contradicts my constant whining about the 3.4% PP fee on the Internet Sales Taxes that eBay, not the Seller, collects.

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:27 AM - edited 03-12-2020 12:33 AM

I just read the weekly chat so have a better idea of what ‘math’ you were referring to. I hadn’t thought about how doing a refund in PayPal had to include tax and that we would get credited back the amount refunded.

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:32 AM

If you read today’s weekly chat you will see Tyler’s explanation of the refund process if the refund is being done through PP. We actually would have to take the taxes amount into account.

note - PP fees for US transactions is 3.7%, not 3.4

PP fees to other countries is 3.9%

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 01:27 AM

https://pages.ebay.com/seller-center/service-and-payments/tax-information.html

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 03:13 AM

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 03:38 AM

"eBay sales tax collection.

Based on applicable tax laws, eBay will calculate, collect, and remit sales tax on behalf of sellers for items shipped to customers in the following states:"

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:22 PM - edited 03-12-2020 12:26 PM

I just did a refund of 12.00 for shipping overcharge to a customer and PayPal automatically calculates the tax for you when you enter the refund amount.

See below....

$94.72 USD

State Sales Taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-12-2020 12:39 PM

I refunded a buyer the other day & the tax was also refunded back automatically.