- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- User to User Help

- Re: Alberta Based Seller Charges PST?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 02:48 AM

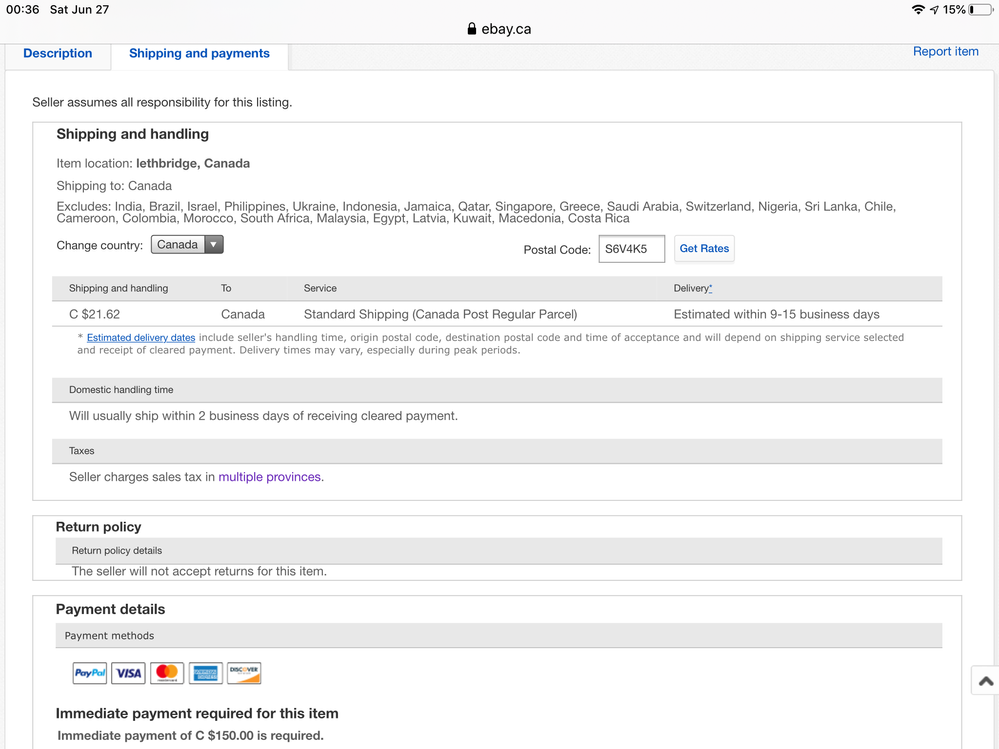

So, I just won an item from a seller based in Alberta (I am in Saskatchewan),

and being a former Albertan, I'm aware that AB charges only GST on sales.

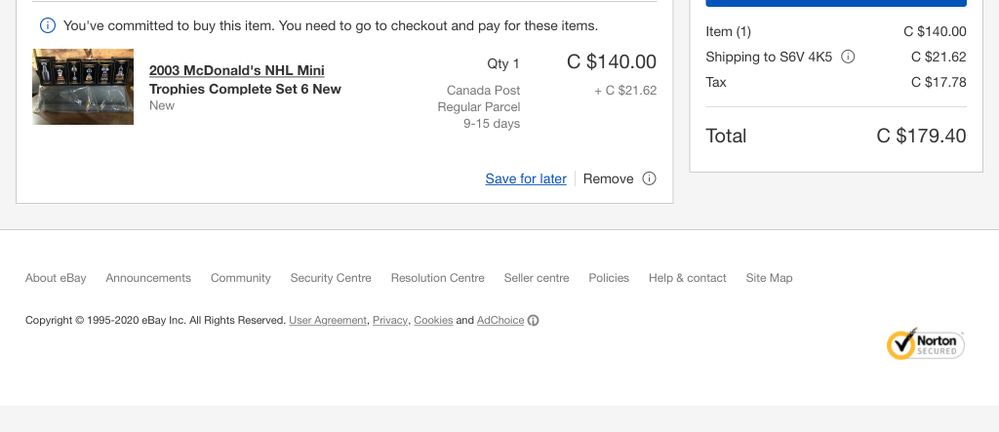

The final item price (CND) was $140.00 + $21.62 (shipping) + $17.78 (tax) = $179.40. By my math, GST (5%) on $161.62 is $8.08, not $17.78. Clearly, I was charged another 6% (presumably for SK PST).

I've purchased new items from other provinces before (ON, QC, BC), and have paid the 5% GST, which I fully expected, but was never charged with paying the respective provinces' PST rate.

When I looked under the Taxes section (under Shipping and Payments heading), the section that reads 'seller charges sales tax in multiple provinces' was blank. Has something changed recently?

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 03:16 AM - edited 06-27-2020 03:26 AM

If the Seller is legit then they have registered to collect sales tax for the province of Saskatchewan. They should have a SK tax number to prove it.

Sales tax (if charged) is based on the destination, not on where it is coming from.

Provincial sales tax (BC, SK, MB, QC) is only to be charged by Sellers who have registered for those provinces.

-..-

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 04:54 AM

For Manitoba, PST Is charged only if the total sales to buyers that live in Manitoba is over $10,000 each year.

Each PST province should be checked ... BC, SK, QC... You already have the Manitoba information.

-----------------------

I sell books... Books are exempt from PST or the provincial component of HST.....

The tax on books is GST = HST = 5 %

For postage the charge is GST for GST provinces, HST for HST provinces.... No PST for PST Provinces.

---------------------------

If this seller is charging PST and is not registered to charge PST, in a province such as Saskatchewan, then the PST becomes income...

This seller should be reported to the Saskatchewan tax people

-----

When I sold items other than books..... the only tax for buyers in provinces other than Manitoba was GST or HST

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 04:59 AM

Saskatchewan PST....

From this page....

PST is a six per cent sales tax that applies to taxable goods and services consumed or used in Saskatchewan. It applies to goods and services purchased in the province as well as goods and services imported for consumption or use in Saskatchewan. New and used goods are subject to tax.

When you purchase or rent taxable goods or services from a supplier who is licensed to collect PST, you pay PST to the supplier. When you purchase or rent taxable goods or services from a supplier who did not collect the tax, such as an unlicensed supplier located outside Saskatchewan, you must self-assess and pay the PST directly to the Revenue Division.

Learn something new every day!

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 10:37 AM

Yes, learn something new everyday, absolutely! Thank you both for the replies. I didn't know PST was charged based upon the destination of the buyers' province. I guess that's the cost of doing business sometimes.

Cheers

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 12:56 PM

More appropriate.... That is the cost of buying on-line....

However, few people know of this situation..

All we have to do is look at what happened with respect to Internet state tax in the US.....

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 01:13 PM

Are all these sellers charging taxes doing it legitly and 100% correctly? Who knows? That also goes for US/Canadian transactions where there are items being charged taxes where they should be exempt. It's easy to add a blanket tax across the board. It still needs to be done properly within the applicable laws. This is why it would be most helpful if eBay clearly showed the tax percentage that was applied on a transaction in Seller's hub and on packing slips/invoices.

-Lotz

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 03:09 PM

That is why the suggestion that the seller's SK sales tax number be added to the invoice.

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 03:12 PM

I've seen that clearly stated with some sellers. Probably for most buyers they receive an invoice and just pay it without questioning it's accuracy.

-Lotz

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 03:25 PM

Unless the seller has a presence in SK and are registered to pay PST there,they should only be charging for gst. I can’t see that listing but there is a chance that the seller has set up the tax chart incorrectly. Are they a new seller? Or are they a large seller who might have stores in various provinces?

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2020 04:59 PM

Re: Alberta Based Seller Charges PST?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-28-2020 03:32 PM

Hello

I am a registered business with the government and as such am obligated to collect GST/HST from my Canadian buyers. Since I pay out more GST/HST than I would collect from my buyers I don't bother collecting it but I do have to keep track of the sales in each province and each tax percentage, calculate it at the end of the year and submit a document showing how much I would have collected from my Canadian buyers.