- The eBay Canada Community

- Archive Category

- Archive 1

- Re: Excuse me while I rant...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 02:09 AM

Sent together in 1 box but at least the shipping was still $80 so I'll forgive that.

But I had to pay another $90 duty fees. I couldn't believe it was so much until I got home and looked closer at the box and say they put $600US each for the value!

How does it make sense that postal services can say you can't claim less value but then it's fine for someone to mark down significantly more.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 07:07 AM

Contact the number on the bill you got for duty or go to one of their offices if there is one nearby

take a copy of the original ebay auction or BIN with the actual price you paid

they will readjust it accordingly

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 09:51 AM

I don't think they have offices either 😕

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 09:53 AM

It just sucks things like this can even happen. Or that the seller would even do that

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 11:00 AM

@prarie_nerd wrote:

They don't give out bills. They give a card saying what's owing that they keep when you pick up.

I don't think they have offices either 😕

As the importer you have the right to have the Canada Customs assessment information (valuation, duty, taxes and COD charge). Was there no documentation stuck to the outside of the shipping box?

You deal with Canada Customs by phone or mail when disputing an assessment.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 11:33 AM

The dispute process is explained here:

http://www.cbsa-asfc.gc.ca/import/postal-postale/dispute-contestation-eng.html#_s2

My wife recently went through this process when she purchased items from an online retailer who declared her items at their "regular" price and not their sale price. In your case, end of auction notices or eBay invoices should be satisfactory documentation for CBSA.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 01:56 PM

I would also take the time to contact the seller to let him/her know that doing this causes significant problems for the buyer. Don't demand anything and don't threaten to leave negative feedback! Just let the seller know that the declared value should be the price the buyer paid for the item only (not item + shipping). The seller needs to be made aware that the customs form is not an insurance form: if the package is lost, not only is the customs form lost along with it, but the seller will have to back up the claimed value with some sort of documentation anyway, such as the listing page.

The seller needs to know that what he/she did is definitely not a good idea!

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 03:29 PM

prarie_nerd wrote:

Bought 2 items from a seller in November. Almost $200 US each + $40 US shipping.

had to pay another $90 duty fees. I couldn't believe it was so much until I got home and looked closer at the box and say they put $600US each for the value!

How does it make sense that postal services can say you can't claim less value but then it's fine for someone to mark down significantly more.

It is not fine to mark the value as more. Obviously buyers want values lowered so they pay less import charges, but up or down, it's still illegal.

What I don't understand is that you seem so annoyed but then you say it is not worth it to get back all the money you paid. I wish I were that rich. Ranting about it here might let off a little steam but it won't put one cent back in your pocket. Just picture all that money laid out on the table in front of you, and to get it all you have to do is push a little paper. Up to you.

You have been told how to get it back, so why not try?

Whenever you buy no matter how you pay you always get a receipt sent to your email address. That is what you need to prove what you actually paid so find it and print it off.

I also agree with 00nevermind00 that you should let the seller know about it. Be VERY NICE, because they might not know that what they did was illegal. It is a federal offense. I don't think a seller ever does that to hurt a buyer, just to let them know what a great deal the buyer is getting or maybe they think if it says $600 on the label and the parcel is lost they will get that amount back. They won't. They, like you, need the original receipt showing what was paid.

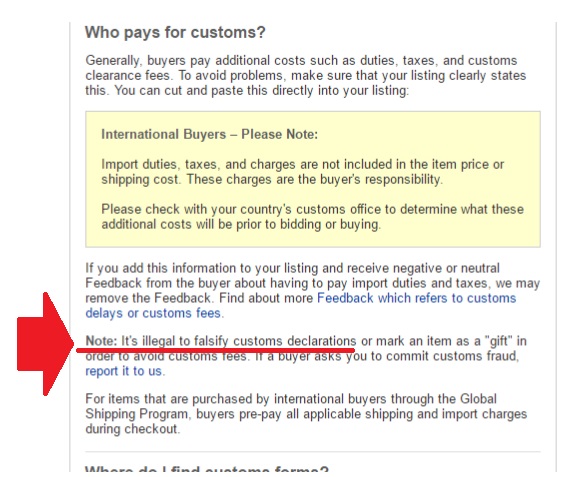

You can show your seller this link where it says falsifying a customs form is illegal:

http://pages.ebay.com/help/pay/international-shipping-rules.html

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 04:58 PM

Many American sellers that I encountered back in the days when the .com board had an International Trading Discussion Board tended to bristle at suggestions of them doing anything illegal, whether it's intentional or not. I don't know if this is indicative of the American national character or just the types of sellers that eBay attracts.

I'm more inclined to go with 00nevermind00's approach of just letting the seller know that stating values above the transaction value of the sale can cause problems as we don't have the luxury of a high tax and duty-free limit.

Besides, the eBay warning is a bit vague. What's meant by "falsifying"? We're accustomed to the transaction value of a sale being used as the declared value, but it hasn't always been this way. In fact, CBSA doesn't always follow this guideline either. In the early days of eBay my wife purchased an antique pocket watch for me. The CBSA agent who inspected the package disagreed with the declared value (which was the transaction value) and charged taxes based on the higher market value for the watch instead. (Where that agent got that information from is beyond me.) Fortunately, she was able to make a successful reassessment claim for that.

Speaking of CBSA agents, one thing I forgot to mention in my earlier post about my wife's dealings with CBSA is that not only did the online retailer declare her items at their regular price rather than their sale price, but the CBSA agent who dealt with her parcel also made a hash out of calculating the taxes and duty owing on it, so I would also suggest that prarie_nerd check the calculations on the assessment form, assuming that there is one on the package. (Can't see why there wouldn't be.)

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 07:07 PM

@marnotom! wrote:Besides, the eBay warning is a bit vague. What's meant by "falsifying"?

The eBay warning is not vague, not to anyone with a reasonable understanding of English. Sellers are not to mark items as gifts, not to lower the values, to lie about what is in the parcel, and boy do they ever freak out when a buyer asks them to do any of those. They are all over it about how "that would be illegal". And it would be.

Anyone here can do whatever they want when on the receiving end of an overvalued item. By all means, do nothing. If it were me and my $90 overcharge, this is more than a little 'problem'. What that seller did IS illegal, and if someone did something illegal and it cost me all that money, I would consider that more than a mere inconvenience.

It is not a matter of asking a seller to do buyers a 'favor' by filling out the forms correctly. It's a requirement of federal law. The seller committed an offense and obviously does not care about buyer inconvenience. The seller might not know it is the law. If it were me, I would tell the seller that.

In my opinion the seller needs to know about the law so that they don't do this same thing to someone else. Europeans would not be happy about paying the VAT on a fictional $600 USD either.

The transaction value of a sale (selling price) IS the declared value, no matter what did or did not happen to your wife. Your wife's experiences are not the world.

http://www.cbsa-asfc.gc.ca/import/valuation-valeur/menu-eng.html

Do whatever you want when it happens to you. Or should I say your wife.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 10:37 PM - edited 12-24-2016 10:41 PM

they might not know that what they did was illegal. It is a federal offense.

The position in law is that any offence is comitted by the buyer, not the seller. The declaration on the customs form is completed by the seller acting as agent for the buyer, the import declaration is always deemed to be made by the importer.

There is a pretty good reason for this. It would be quite impractical to proceed against the seller for a Canadian offence, so the penalty is directed to the person they can get their hands on,, not the out of jurisdiction seller. In addition I really do not think that any offence can be deemed to exist if the declaration is inflated. The mens rea in the under valuing of an import is the intention to pay less tax, or none. Paying more tax hardly contains the 'evil mind' needed to commot any offence at all.

The ebay statement is vague because it has to be. If it stated that the illegality, if any, is down to the buyer, not the seller it would help to reduce the cries of 'it's illegal' and be a more accurate statement. Ebay is not a reliable source of legal advice.

There is also justification in law and precedent for declaring the cost value of the goods as the value, since this is the amount the seller would lose if the item vanished. They could not be said to have lost the profit because the payment, until delivery to the buyer,, is still the property of the buyer, even if the seller is holding it.

On a pragmaic note, this is about as serious a crime as 'stealing by finding', something that anyone does who picks up a dollar coin in the street and does not report the find and deliver up the coin to a local police station. No one really cares. Customs people are entitled to re-assess any package value to what they deem the value to be, in the very rare occasions when this happens, paying the tax is the only 'sanction' used. It is just not worth the effort as Canada has very sensibly found out, by simply ignoring low value parcles for taxation purposes.

The first time I had to send an international package, many years ago, I took a look at the customs form and thought "What a daft idea, placing the description and value on the ouside where any casual thief would be saved the effort of opening the package and guessing the value".

So that and the next ten thousand or so packages went out with a very generic description avoiding any value keywords like 'gold' or 'silver' and with a value of $20 or $30, regardless of contents. Never, ever in years of ebay selling was any problem encountered by the buyer. My international loss rate was about 1 in 500 items.

Never in about 16 years of following ebay international trade related boards has anyone been able to find a case of a US seller being penalised for putting whatever value they fancied on a customs form on a small package or parcel.

The shift to preprinted postage labels, rather than hand completed customs forms has made this topic much rarer than it used to be, and probably much increased the problems of sellers shipping internationally, but that's another matter.

I always found the protestations by posters that they would never lie or do anything illegal hilarious.

As Emerson said, "The louder he proclaimed his honor the faster we counted the spoons"

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-24-2016 11:12 PM

But how is the value of an item "altered"? USPS doesn't' even define what to use as a value on a customs form!

https://about.usps.com/forms/ps2976.pdf

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-25-2016 09:30 PM

marnotom! wrote:

afantiques wrote:

marnotom! wrote:

afantiques wrote:

marnotom! wrote:

afantiques wrote:

Wow. You two are really something, aren't you.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-26-2016 02:59 PM

The shift to preprinted postage labels, rather than hand completed customs forms has made this topic much rarer than it used to be, and probably much increased the problems of sellers shipping internationally, but that's another matter.

But the descriptions can be altered quite easily.

I occasionally have sold books into countries where the title may cause my customer problems (sociology, politics, gay literature, theology) and change those titles to Used Book.

You can also shorten the description or lengthen it if you want.

Re: Excuse me while I rant...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-27-2016 01:06 AM

But the descriptions can be altered quite easily.

Of course, if you have your wits about you and think about it. As can the value. But people tend to just take what they are given. Once upon a time you tended to be pretty smart to do computery things. I think the invention of the selfie stick proves this is no longer the case.