- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Buyer Central

- Ebay's New Canadian Sales Tax is a scam

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 04:05 PM

The only people who should be charging tax on used goods in Canada are businesses. If people are selling their used goods, they are not required to charge tax. The only exception is automobiles. A private sale of an automobile requires tax before you can register that vehicle, but that tax is paid directly to the government by the buyer.

Generally the sale of what is referred to as personal use property is not subject to GST/HST. Personal use property is an item that people own and use for their own personal use. If you sell a used personal use item then the transactions is generally not subject to GST/HST. There are, however, important exceptions to this rule. One relates to the “small supplier” threshold. If the sales of personal use property in a given year exceed $30,000 then you are required to be a GST/HST registrant and you are required to charge and remit GST/HST. The second relates to commercial property. The personal use exemption does not apply to the sale of used commercial property, which is generally always subject to GST/HST.

https://www.northernpolicy.ca/article/tax-implications-of-the-secondhand-economy-4065.asp

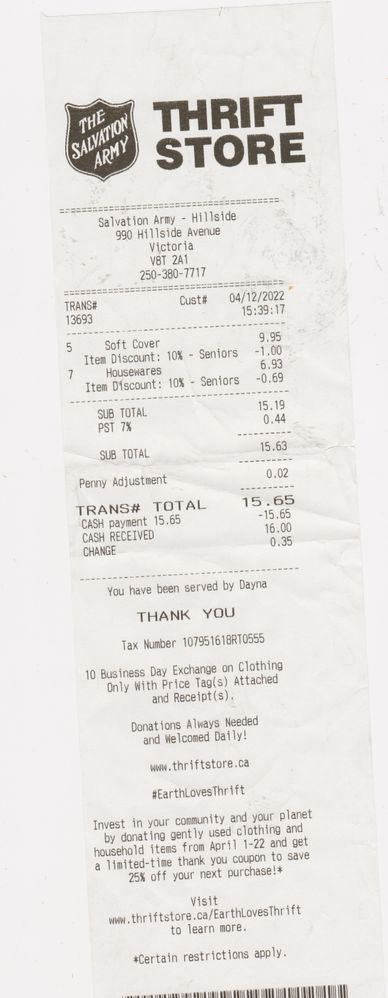

Thrift stores, Pawn shops, all of these places are businesses, and must charge tax. They have a GST number these taxes are paid under. If an Ebay seller is doing it as a business, they must be collecting taxes.

Ebay collecting taxes on behalf of the average joe who sells one or two things a year, is extremely shady. There's no business number it's being associated with. What Ebay is doing, is they're collecting taxes, and since there's no business associated with it, they're going to apply those taxes to their own tax debt. Which is as shady as it can get.

I don't buy from Ebay that often, but I was shocked when I went to buy a graphics card from a private seller, and there was tax being charged. Then I noticed their "new policy".

Ebay is dead in Canada.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 04:49 PM

If you already did not know

This TAX collection system was planned by your elected Canadian Government, not eBay!

It was in the 2021 Canadian Budget, you did read it right, as a voter you should always read what is going through the system in the pork rind, CBC and most mainstream media only tells you the "things" the GOV wants to be publicized...

Also, it applies to all "online marketplaces" Amazon, Etsy, and all others.

Any marketplace "Facilitator" that makes over $30,000.00CDN in sales has no choice other than to charge and collect the tax, this is not an eBay thing, it's a Government thing, put in place by the people you elected and put into office...

If you have an issue you can contact your local MP.

BTW - This is actually a worldwide thing, The UK, USA, Australia, and a whole slew of others already have a similar tax or shortly will.

And, yes it applies to USED GOODS sold through a "marketplace facilitator"

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 05:00 PM

Amazon, Etsy and all others facilitate business sales. The correct analogy is Kijiji or another online classified that facilitates private sales. Last I checked no online classified is collecting sales tax on personal use items.

So again, this tax is being collected by Ebay, and submitted to the government under their own GST number, and being used to pay their own tax debt.

Ebay is only required to collect sales tax on behalf of entities doing this as a business. Such as Newegg, or other professional resellers.

Thanks though, Chief.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 05:36 PM

You are incorrect ALL online purchases except "Bullion" is subject to TAX collection, for every BUYER who purchases online in CANADA, which will soon include so-called "personnel" sales...

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 06:36 PM - edited 07-07-2022 06:40 PM

I'm not incorrect. You can stomp your feet all you want. If I buy something off Kijiji, pay through Kijiji, and have them ship me the item... I'm not required to pay tax.

Why is that? Oh why would that be? Oh right, personal used goods are non-taxable if sold between two entities that are not businesses.

Which is exactly what happens on ebay when some guy in Ontario sells me his used video card.

The ONLY WAY this would be taxable with your examples of Etsy and Amazon, would be if that person does this as his business.

OR Ebay itself BUYS the item from that person then SELLS it to me.

Anything else is NOT TAXABLE.

A person in Ontario is not going to have a business number. Therefore the taxes EBAY collects, gets attributed to EBAYS business number, and when those funds are given to the government, they're paying down EBAYS tax debt.

The new law was meant to force drop-shippers that sell on Amazon or Ebay as a BUSINESS to pay taxes, because they weren't.

EBAY has taken it on themselves to apply this to every seller on the website, not just professional sellers, hoping people don't catch on to the fact it's a scam.

It's a scam, regardless how you try to spin it.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 07:51 PM

Are you a peer-to-peer seller? Here’s what you need to know

April 30, 2021

Ottawa, Ontario

Canada Revenue Agency

What is a peer-to-peer sale?

A peer-to-peer (P2P) sale is the selling of goods or services from one person or party directly to another. You may be involved in P2P selling if you are connecting with buyers through online platforms like websites, online marketplaces or mobile applications (such as Etsy, eBay, Amazon or Kijiji).

Income tax implications

As a resident of Canada, you have to report your income from all sources inside and outside of the country, including P2P transactions, on your tax return. If you paid tax on foreign income, you could be eligible for a tax credit.

It is important to maintain proper financial records of all your sales and expenses. This applies to the sales you make to buyers in Canada and other countries. Keep records of all your purchases to claim eligible expenses on your return.

GST/HST implications

You may have a reasonable expectation of profit from your online activities, and your total taxable supply may be valued at more than $30,000 over four calendar quarters. If so, you will need to register for, collect and pay to the Canada Revenue Agency the goods and services tax / harmonized sales tax (GST/HST) for taxable supplies of goods and services that you made inside and outside Canada. You can get more details on GST/HST registration requirements at: Find out if you must register for a GST/HST account.

How to correct your tax affairs

If you did not report your income from P2P selling, you may have to pay tax, penalties and interest on that income. You can avoid or reduce penalties and interest by voluntarily correcting your tax affairs. To correct your tax affairs (including corrections to GST/HST returns) and to report income that you did not report in previous years, you may:

- Ask for a change to your income tax and benefit return

- Adjust a GST/HST return

- Apply for a correction through the Voluntary Disclosures Program

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 07:53 PM - edited 07-07-2022 07:56 PM

My Brother in Law is actually a CRA investigator so I can assure you even Kijiji is in the sights of the CRA, as are all the other platforms.

Did you read about Peer to Peer

You and John Doe conduct a transaction on Kijiji, that's Peer to Peer and INCOME to declare.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 08:00 PM - edited 07-07-2022 08:07 PM

If you are listing and selling used goods on a selling site(marketplace facilitator) you are considered as "doing business" from that site and those sales are subject to taxation according to LAW.

and just because such sites as Kijiji, Facebook Marketplace & the like are not currently having to collect taxes, that does not mean that at some point in the near future, that these sites won't be required to set up a proper financial payment/taxation system...enjoy the "freedom" there while you can!

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 09:16 PM

Nothing you posted had anything to do with selling USED GOODS from one private individual to another private individual. What you posted had to do WITH BUSINESS transactions, and has to do with YOU DECLARING YOUR INCOME.

If you're providing a lawn care service as a BUSINESS you need to declare that income. If you sell someone an old TV, that is not INCOME.

I highly doubt your brother in law is a CRA investigator. As you've repeatedly shown here, you have no clue what you're talking about. You can't even post things relevant to the topic.

The CRA does not consider yard sales, private sales on marketplace, any of that INCOME. It's not taxed. No law requires it to be taxed.

EBAY purposely overreached. Instead of collecting tax on BEHALF OF BUSINESSES, they just blanketed it across ALL SELLERS on the site, and are collecting the benefits.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 09:18 PM - edited 07-07-2022 09:29 PM

... if collecting taxes were according to LAW.

... Kijiji, Facebook Marketplace and the like not doing it, would be a violation of said law wouldn't it?

Should also add that Kijiji is owned by Ebay, and they aren't charging taxes there.

It's almost like it's not actually a law or something.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 09:54 PM

I think there is a big difference with selling on Kijiji and/or Marketplace - it is almost like the olds days of having an ad in the classifieds of newspapers (which no one but my parents and a handful of people read anymore!). In those cases the sellers are dealing directly with the buyer, often from home with cash (at least when I've used them) and yes, there is no tax in those situations just like a garage sale (at least for now).

But you can't compare that to eBay, it's nowhere near the same thing. Here we have access to buy and sell worldwide (or almost anyways), it's totally different. eBay is the business, we are using their services to get our stuff out there (or to find treasures if we are buyers!) with a massive online market. I've sold stuff here to people around the world, can't do that with Kijiji! (Plus we don't have to worry about the no-shows!)

Don't get me wrong, no one likes to pay more taxes than they have to...but sometimes we just have to!

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 10:38 PM - edited 07-07-2022 10:40 PM

well I tell you what...when you become owner of eBay, you can do things your way...

in the meantime, this is eBay's site, and eBay is handling this taxation process as has been set out and YOU do have a choice: accept, adapt, adjust and carry on! .....OR move on!!

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 10:59 PM

... I like your response is "well I can't disprove anything you said, so you need to accept it"

I am moving on. I won't buy a used item from a private seller on Ebay. I'm positive a lot of people won't anymore either.

Which means your business is about to get harder. So you can accept, adapt, adjust and carry on! .....OR move on!!

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 11:03 PM

There is no difference between a private individual selling a used item to another private individual, regardless of the medium, in terms of tax laws. That's the point. Ebay is scamming out more revenue.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 11:12 PM

@twdi_22 wrote:Amazon, Etsy and all others facilitate business sales. The correct analogy is Kijiji or another online classified that facilitates private sales. Last I checked no online classified is collecting sales tax on personal use items.

So again, this tax is being collected by Ebay, and submitted to the government under their own GST number, and being used to pay their own tax debt.

Ebay is only required to collect sales tax on behalf of entities doing this as a business. Such as Newegg, or other professional resellers.

Kijii, Craigslist and their ilk are classified ad sites. The ad is posted there, but the site itself has nothing to do with the transaction. Buyer and seller connect off the site and pay off the site.

It's different with sites such as eBay and Etsy. The transaction is conducted and concluded on those websites; payment is made through the website.

It doesn't matter if the seller considers it a business transaction or a personal transaction, it's the medium in which the sale is being conducted that is affected by this new law, not the nature or intent of the seller. An intermediary service such as eBay is (so far) treated differently by CRA than a classifed ad site as CRA considers it a "digitial distribution platform".

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/digital-ec...

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-08-2022 12:53 AM

If people are selling their used goods, they are not required to charge tax.

You are wrong.

This does vary from province to province.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-08-2022 10:22 AM - edited 07-08-2022 10:23 AM

oh and BTW, folks like you have been sayin' "eBay is dead" for at least the past 12+ years, yet eBay is still alive and I suspect will be for some time...USA buyers have not disappeared (USA states' internet taxes) nor have buyers from the countries with VAT, and nor will all these multitudes of Canadian buyers that you think will magically disappear....however what you do is your choice so BYE BYE!

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-08-2022 10:23 AM

Peer to Peer means YOU & John Doe doing a deal...and KIJIJI is included as per the CRA

Are you a peer-to-peer seller? Here’s what you need to know

April 30, 2021

Ottawa, Ontario

Canada Revenue Agency

What is a peer-to-peer sale?

A peer-to-peer (P2P) sale is the selling of goods or services from one person or party directly to another. You may be involved in P2P selling if you are connecting with buyers through online platforms like websites, online marketplaces or mobile applications (such as Etsy, eBay, Amazon or Kijiji).

Income tax implications

As a resident of Canada, you have to report your income from all sources inside and outside of the country, including P2P transactions, on your tax return. If you paid tax on foreign income, you could be eligible for a tax credit.

It is important to maintain proper financial records of all your sales and expenses. This applies to the sales you make to buyers in Canada and other countries. Keep records of all your purchases to claim eligible expenses on your return.

The above is from the CRA website, and YOU ARE INCORRECT...

...The "Fog" of rage is strong with this one.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-08-2022 10:23 AM

My Brother in Law is actually a CRA investigator so I can assure you even Kijiji is in the sights of the CRA, as are all the other platforms.

Did you read about Peer to Peer

You and John Doe conduct a transaction on Kijiji, that's Peer to Peer and INCOME to declare.

Ebay's New Canadian Sales Tax is a scam

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-08-2022 10:27 AM

You are so wrong it's almost funny, did you actually read the CRA information and links...