- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- eBay will start collecting taxes on our behalf eff...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 08:42 AM

Hey guys!

Am I understanding this correctly?

Stating on July 1st, I no longer be receiveing taxes from my Canadian clients? (similar to my US sales?)

Have you guys filled the form they sent us?

Did you print it, fill it, scan it and sent it to the e-mail address they provided (CanadaGST/PST@ebay.com)?

Thanks!

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 12:29 PM - edited 06-01-2022 12:30 PM

Yes you are understanding it correctly, it has been discussed a lot, below are a couple links.

I would like very much to get the form, I've traditionally covered the taxes for my customers so the automagic process to send me the paperwork didn't tag me, probably because I don't have any tax tables filled out, so now I've got to figure out how to get included.

Anyway here are the discussion links:

In this category:

As a separate category:

https://community.ebay.ca/t5/Canadian-Sales-Tax/bd-p/CA_sales_tax

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 02:45 PM

This is the email I recieved yesterday

|

|

|

This is the link to the form

https://ir.ebaystatic.com/cr/v/c1/ca/pdf/Billing_Agent_Election_-_GST_HST_&_QST.pdf

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 04:45 PM - edited 06-01-2022 04:47 PM

Thank you VERY much for attaching this!!

I've printed it off, I see a couple things that confuse me that I want to clarify (if you know!). I'm worried whether the forms they sent out are customized, I doubt they are but just incase!

I believe in section one, after the GST/HST account number the other 3 parts NEQ, Identification number and File sections are all for QC folks? Hopefully so, I don't know of any identification numbers for myself.

3.1 has GST/HST and QST ticked off, from what I see you're also an ON seller like me so it looks like the "GST/HST and QST" option is ticked off for everyone?

This is an observation about something in the "fine print" that worried me when this was announced and I mentioned in other threads where sometimes I see the VATs being applied and sometimes not. In the obligations section where it says the principal(me) and agent(ebay) are solidarily liable for a few things, in the list this one worries me: "reporting and remitting the net tax, as well as any amount that the agent might neglect to remit and that is reasonably attributable to a supply covered by the election". My worry is that this would tell me that I have to keep an eye out for when eBay for some reason doesn't collect the tax. Although if this happens, I can't collect it after the fact. I do note that it doesn't say that the agent might neglect to "collect", but only "remit". Perhaps it is simply saying that if for some reason eBay doesn't remit what they've collected I have to. I think I'll put this question in the main tax thread as well.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 05:15 PM

Yeah i was also confues by 3.1 and that was automaticlly selected with no way to change it. I am in Ontario and only registered for GST/HST. I assume its a form sent to everyone thats the same but not sure?

I havent filled the form out and sent back yet lol

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-01-2022 06:22 PM

I'm in the same boat as you ricarmic. I'm wondering if we'll have to contact CRA directly and explain our situation to them and see if there are forms we fill in, or do we register NOW with ebay to begin collecting the gst and CRA will be in touch with us. If you find out anything further, would you mind posting and I'll do the same.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-02-2022 08:50 AM

Hi @jcd931 I'm a bit confused by your note. I've been registered to collect GST/HST and have been doing so "forever". What I've been doing on most of my platforms is covering (ie paying) the taxes for my customers, a "taxes in" scenario, so the taxes are still being identified and paid to the government (this is perhaps more common in the stamp world than others). So for clarity a $100 sale to an Ontario customer leaves me with $88.50 and $11.50 goes off to the government as taxes because I sold it taxes in.

So the only thing changing with respect to my relationship with CRA is that because of the new tax collecting direction eBay needs to be set up as a billing agent for the taxes they collect for eBay sales I make. Theoretically from CRAs perspective this new form is one "I'm" asking the CRA to accept, along with eBay, despite the fact I don't really have a choice.

I've mentioned this elsewhere in other threads but when this is in place, to my mind for CRA reporting, ebay sales will be treated like zero rated sales to international locations, everything else like ITCs will be as they are today. This might be wrong but that's my current thinking.

The problem my "taxes in" scenario caused is that I've been overlooked by the eBay set up process because I don't have any tax tables set up, which probably makes the automagic process think I'm a non-business and not required to collect taxes.

I'm hopeful that I can simply fill out the form and submit it and that will wake up the process as though I wasn't overlooked. At least thats my optimistic side's view. Time will tell.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-02-2022 09:56 AM

Just for clarity, if a seller is not registered for GST and sales are under $30k, you do not fill in any forms. The form is for those registered for GST.

Basically the gov't is creating 2 classes of small businesses here (under $30k) sales, those that do not sell online still do not have to charge GST/HST, but those selling online will have it charged "on their behalf" in a blatant discriminatory tax grab. Of course, eBay is happy to comply as they will now charge FVF on the tax they collect "on your behalf".

For sellers with under $30k is sales, if you register you can now claim input tax credits to get a refund of GST/HST you paid on inventory and direct business expenses. You need to look at what that potential amount would be and decide if it is worth the hassle of government forms and being in the GST/HST reporting system. It is not for me, but you need to run your own numbers and decide.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-03-2022 01:17 PM

those selling online will have it charged "on their behalf" in a blatant discriminatory tax grab. Of course, eBay is happy to comply as they will now charge FVF on the tax they collect "on your behalf".

"This new tax requirement is legislated by the Canadian government. eBay will remit all taxes collected to the appropriate taxing authorities as legally required."

and this is not just for eBay, this encompasses other online selling sites as well.

The reality is: this Canadian taxation process is NO different than the "internet taxation" as legislated by 45 states in the USA.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 12:14 AM

@mrdutch1001 wrote:those selling online will have it charged "on their behalf" in a blatant discriminatory tax grab. Of course, eBay is happy to comply as they will now charge FVF on the tax they collect "on your behalf".

and this is not just for eBay, this encompasses other online selling sites as well.

The reality is: this Canadian taxation process is NO different than the "internet taxation" as legislated by 45 states in the USA.

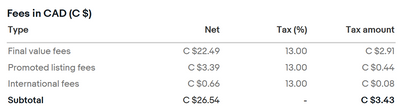

So if I sell something for $100, a buyer in Ontario will be paying $113, Ebay sends me something like $85 after their deductions. Now what I wonder is, on Ebay's ~$15 fee, are they going to charge HST on this _again_ for the service they provided me? Because that's what they're doing on the invoice: https://www.ebay.ca/sh/fin/report/invoices

Or is eBay going to automatically claim some kind of input credit on that and charge HST once on their FVF?

Maybe eBay can pull an a i r b n b and have the buyer pay the FVF directly to eBay?

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 11:52 AM

eBay fees are on the TOTAL transaction = FVFs are on the TOTAL including any applicable taxes paid by the buyer = no different than what is now in place for transactions to the USA in which FVFs are paid on the TOTAL transaction, including any applicable taxes paid by the buyer.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 02:05 PM - edited 06-04-2022 02:19 PM

@mrdutch1001 wrote:eBay fees are on the TOTAL transaction = FVFs are on the TOTAL including any applicable taxes paid by the buyer = no different than what is now in place for transactions to the USA in which FVFs are paid on the TOTAL transaction, including any applicable taxes paid by the buyer.

Right, but will I continue to pay HST on eBay's fees when eBay starts charging HST on the TOTAL transaction?

see here from my invoice:

And if my sales were mostly ex-Canada, could the HST collection from some Canadian sales completely make up for the 13% HST that eBay is charging me on all of their fees?

Usually the game with HST is if you're registered, you can claim an input credits with what you paid vs collected. If you're unregistered, you pay HST when you buy supplies but don't collect it from buyers. Are we in a doomed third state where non-registrants are both paying it *and* collecting it?

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 02:32 PM - edited 06-04-2022 02:33 PM

I am no expert in the field of taxation, nor do I have any experience with any Canadian taxation collection process...

I am but a fellow seller who sells a few hundred $ of items/per year on eBay and all that I know for any kind of certainty is that buyers are paying the applicable taxes, sellers pay their fees on the TOTAL transaction.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 02:34 PM - edited 06-04-2022 02:38 PM

There seems to be a lot of confusion about the HST/GST we pay eBay and the HST/GST customers pay.

Nothing changes with respect to the GST/HST we pay ebay against our fees after July 1st. Those collecting still have the credits (ITCs) as they do today. (so Yes to your first question)

After July 1st buyers will pay the GST/HST to/through eBay instead of to those of us registed today. For those registered, it means book keeping changes to us, for those unregistered, nothing is different from today.

ITCs will still be ITCs for those who are registered.

Presumably the "future" state will be the same for GST/HST registered folks as if we sold everything to US/International folks, ie we collected 0$ in GST/HST from customers but we still have the ITCs from what we purchased and used for the business.

Today if GST/HST registered folks had all Zero rated sales to the US for example, one would be getting a refund of 100% of the ITCs.

Theroretically in the future state it would be the same because GST/HST registered folks got no HST/GST in our own accounts from eBay sales, but we still spent GST/HST on the inputs so to speak.

The big question will be how GST/HST registered folks report sales made through a billing agent to the CRA. My current guess is that it will look the same as today's zero rated sales, but time will tell on that. I see nothing on today's CRA HST forms that advise/explain how billing agent sales are to be recorded.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2022 02:59 PM

@electronicsextraordinaire wrote:Are we in a doomed third state where non-registrants are both paying it *and* collecting it?

No, because you're not collecting the tax(es), eBay is.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-08-2022 12:24 PM

Thanks for posting this. I had the email it turns out but hadn't read it properly.... I wish senders would make it more obvious that action may be required, I can't fully read every email I get from a company that sends me several a day....

Would have been helpful for eBay to make the PDF fillable and automatically submittable. They've created a lot of extra work for us and them.

Ian

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-08-2022 02:01 PM

@ricarmic wrote:

After July 1st buyers will pay the GST/HST to/through eBay instead of to those of us registed today. For those registered, it means book keeping changes to us, for those unregistered, nothing is different from today.

ITCs will still be ITCs for those who are registered.

Maybe this is simply an issue with the current GST/HST forms, but as a registrant, how do you reclaim your ITCs without also reporting your total Canadian sales and tax collected/due?

Presumably the "future" state will be the same for GST/HST registered folks as if we sold everything to US/International folks, ie we collected 0$ in GST/HST from customers but we still have the ITCs from what we purchased and used for the business.

Today if GST/HST registered folks had all Zero rated sales to the US for example, one would be getting a refund of 100% of the ITCs.

Theroretically in the future state it would be the same because GST/HST registered folks got no HST/GST in our own accounts from eBay sales, but we still spent GST/HST on the inputs so to speak.

But these are not 'zero-rated' sales - national and provincial taxes must be collected and forwarded - we will simply no longer be the reconciliation point. So how do we report without inviting a CRA auditor phone call?

The big question will be how GST/HST registered folks report sales made through a billing agent to the CRA. My current guess is that it will look the same as today's zero rated sales, but time will tell on that. I see nothing on today's CRA HST forms that advise/explain how billing agent sales are to be recorded.

Moreover, what happens if there is an INR or SNAD dispute, and we need to refund? The buyer will be expecting their entire purchase refunded including a reversal of all taxes paid...even though the latter never touches our accounts.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-08-2022 03:10 PM

@ichopshop wrote:

Would have been helpful for eBay to make the PDF fillable and automatically submittable. They've created a lot of extra work for us and them.

The "fill and sign" function on Adobe Acrobat Reader DC works on the document for me. From there it should be just a straightforward process of attaching it to an email.

By the way, it's not an eBay form but a Revenue Canada/Revenue Quebec form.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-08-2022 03:16 PM

My understanding, but keep in mind I might be wrong...

Today if one of us sells ONLY to USA folks, then when we fill out our GST forms, all of our sales are ZERO rated, so you show all your sales as you would today, no GST collected because they were all zero rated and the ITCs would turn out to be 100% refunded. I don't know for sure how it is going to go onto the forms, I suspect it will be like zero rated items. I have occasion to have to call the GST folks someday soon, I'm going to ask them about this when I catch up to them and hopefully get some direction that way.

Theoretically the billing agent authorization puts something in place that allows us to show the sales and relative $0 GST/HST collected.

The INRs and SNADs will be the exact same as happens with the USA folks today regarding the IST (Internet Sales Tax) they have that ebay collects. eBay refunds the taxes because they're the one who collected them. The process for this has been in place for US and international purchases for some time.

eBay will start collecting taxes on our behalf effective July 1st?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-08-2022 03:33 PM

Confirming what @ricarmic posted.

Prior to the last few years when Canadian sales picked up for me I was always getting refunds on my quarterly filings.

I have another GST account that has been getting hundreds or thousands of ITC refunds per quarter going back to almost the beginning of GST in 1991.

I've also had audits during that time, the auditor did ask, I replied with "99% of sales are exports" which ended that discussion and moved on to other matters. Could they have questioned my statement, perhaps but that would just mean I would provide a huge list of foreign customers and if neccessary the shipping information to back it all up.

Going forward if you are subject to an audit you would only need to pull out your "Billing Agreement" with eBay and say "eBay collects and remits on my behalf". It's not like this is going to be an unusual situation, every GST registrant that sells via a platform like eBay, Etsy, Amazon, Walmart etc. will be doing the same thing.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.