- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Buyer Central

- Why am I being charged by GLOBAL mail and import t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 11:45 AM

Today I purchased a collectors item from England and received an invoice with an Import tax the purchase was for $40.74 and the tax was $12.85 .

I was unaware that Canada Taxed used Items ? Does E bay monitor their Global mail.. it is not the most efficient way to mail and I would assume that Bay is responsible to ensure that the taxes are correct and that the respective governments receive the total taxes..

I was told by the seller that they did not have anything to do with the tax and if I did not pay the tax that the article would not be delivered with out the tax being paid..

I have been a good customer and seller over the years and have never questioned being bill for services I have received From E bay..

I will continue selling because Canada does not tax a private seller of used personal posessions...

I will not purchase anything on E Bay where the seller uses E bays Global mailing!!!!!

Solved! Go to Solution.

Accepted Solutions

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 04:04 PM

While most used goods are not dutiable, they are taxable.

Most of what you paid is likely sales taxes which can be up to 15% of the declared value.

In addition, Pitney Bowes which runs the program for eBay, charges ~$5 as a customs brokerage /service fee.

The Global Shipping Program is a Seller Protection option and offers no added value to buyers.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 06:44 PM

Used or new is irrelevant to the de minimus which is $20 CAD by mail.

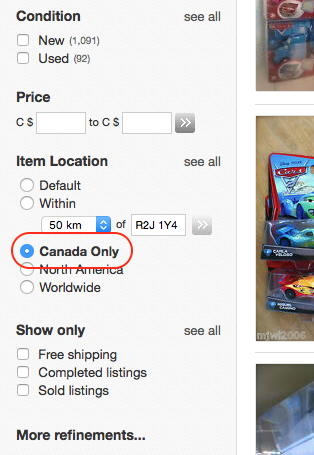

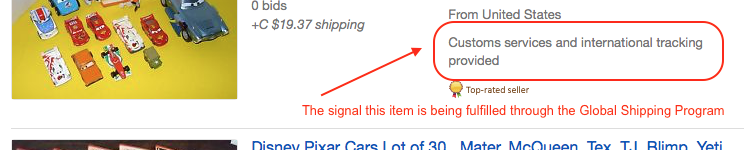

It's easy to avoid sellers who use Global Shipping Program. Either select your search results to show Canada Only, or set the search view to List and avoid anyone who says International Priority Shipping in the listing capture.

Canada Only:

List View of Search Results showing Global Shipping Program identifier:

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 11:59 AM

You purchased an item from a Seller that uses the Global Shipping Program (GSP).

The GSP is a Seller protection program where the Seller's only responsibility is to ship the item to a central shipping hub. The item is then processed for customs fees and taxes (if applicable) and shipped to you with a tracking number.

All items coming into Canada valued at 20.00 or more are subject to customs fees and taxes.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 04:04 PM

While most used goods are not dutiable, they are taxable.

Most of what you paid is likely sales taxes which can be up to 15% of the declared value.

In addition, Pitney Bowes which runs the program for eBay, charges ~$5 as a customs brokerage /service fee.

The Global Shipping Program is a Seller Protection option and offers no added value to buyers.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 06:44 PM

Used or new is irrelevant to the de minimus which is $20 CAD by mail.

It's easy to avoid sellers who use Global Shipping Program. Either select your search results to show Canada Only, or set the search view to List and avoid anyone who says International Priority Shipping in the listing capture.

Canada Only:

List View of Search Results showing Global Shipping Program identifier:

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 09:34 PM

This is the worst program ever invented and a complete rip off.. First of all the shipping costs are inflated (double in some cases). Secondly, as a general rule CBSC won't look at a package declared in the $50 range or lower and many times higher so in fact you're unnecessarily paying HST and a brokerage fee on products under those values. .

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-21-2017 09:45 PM

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-22-2017 12:31 AM - edited 08-22-2017 12:32 AM

@tch_ca wrote:... the shipping costs are inflated (double in some cases). Secondly, as a general rule CBSC won't look at a package declared in the $50 range or lower and many times higher so in fact you're unnecessarily paying HST and a brokerage fee on products under those values. .

Shipping costs are not that inflated for tracked and insured parcels. The program is aimed at American sellers who prefer safe (and who are rewarded for tracked).

The actual limit on the law books is $20, that many higher value shipments via the post office slip through unaccessed is just a buyer's bonus.

The GSP does not make sense for low value shipments between the USA and Canada (direct is more often in the buyers favour). But GSP does make sense for American sellers dealing with the rest of the world where tracked shipping is much more expensive.

You DO NOT need to buy from sellers in the USA and UK that use GSP.

-..-

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-22-2017 03:05 PM - edited 08-22-2017 03:07 PM

@ypdc_dennis wrote:

@tch_ca wrote:... the shipping costs are inflated (double in some cases). Secondly, as a general rule CBSC won't look at a package declared in the $50 range or lower and many times higher so in fact you're unnecessarily paying HST and a brokerage fee on products under those values. .

Shipping costs are not that inflated for tracked and insured parcels. The program is aimed at American sellers who prefer safe (and who are rewarded for tracked).

The actual limit on the law books is $20, that many higher value shipments via the post office slip through unaccessed is just a buyer's bonus.

The GSP does not make sense for low value shipments between the USA and Canada (direct is more often in the buyers favour). But GSP does make sense for American sellers dealing with the rest of the world where tracked shipping is much more expensive.

You DO NOT need to buy from sellers in the USA and UK that use GSP.

-..-

I thought books had no exemption.

http://www.cbsa-asfc.gc.ca/import/courier/menu-eng.html

Items that do not qualify for the CAN$20 exemption include the following:

- tobacco;

- books;

- periodicals;

- magazines;

- alcoholic beverages; and

- goods ordered through a Canadian post office box or a Canadian intermediary.

Edit: The last line about using a post office box is interesting. No exemption if you use a PO Box?

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-22-2017 05:12 PM

Whether goods are new or used has no bearing on their dutiable status unless accompanied by paperwork which identifies goods as antique (more than 100 years old or more than 50 years old) by including their date of production in the description of goods.

See this:

http://www.cbsa-asfc.gc.ca/publications/dm-md/d13/d13-10-1-eng.html

and this:

https://blog.pcb.ca/2013/02/importing-antiques-into-canada-duty-free/3634

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-22-2017 07:19 PM

Edit: The last line about using a post office box is interesting. No exemption if you use a PO Box?

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-22-2017 07:27 PM

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-23-2017 04:50 PM

You have to show ID to rent a PO box so they do know who it belongs to but I have no idea what that sentence is all about.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-23-2017 04:54 PM

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-24-2017 09:28 PM

@tch_ca wrote:

This is the worst program ever invented and a complete rip off.. First of all the shipping costs are inflated (double in some cases). Secondly, as a general rule CBSC won't look at a package declared in the $50 range or lower and many times higher so in fact you're unnecessarily paying HST and a brokerage fee on products under those values. .

The program is actually a glorified forwarding service and it can work reasonably well when it's employed by sellers who know what they're doing. As pointed out by Dennis, the pricing is competitive with trackable parcel post and couriers. It's not designed as a substitute for oversized letter mail (First Class International / Small Packet).

The reason why it costs what it does is because you're paying the seller's charge for shipping the item to the forwarding centre in Kentucky as well as the Program's shipping charge. What the Program charges for shipping is supposed to be based on information the seller provides on the item's shipping weight, but quite often sellers don't do that for smaller items because they're using flat-rate shipping, so the Program has to calculate an estimate based on a category average.

The point about CBSA and taxes/duty has already been covered. Suffice it to say, just because CBSA doesn't always charge you taxes and duty on a postal import doesn't mean that they shouldn't. I may break the speed limit without getting caught, but that doesn't mean that what I did isn't a traffic offence.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2017 11:01 AM

That was taxed! was in Britain! and taxes from people outside of Britain do not pay British Taxes of in Britain if taxed while in Britain there is a form that they can give you and you will be refunded the taxes so if it is going outside of Britain why does global tax?

If Canada Revenue wanted to tax it would TAX in Canada..

I think Global is something that E bay should take a hard look at and maybe even shy away from ...It is a great way for the American tax people rake in taxes ..Does Global inform Ebay how much the Collected and provide Global with proof they payed the government those taxes...?

If I were buying new I would expect to be taxed

I will not purchase from anyone who uses Global and that means less purchase and less profit for the Sellers and E bay...

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2017 11:17 AM

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2017 12:41 PM

Or, more accurately, Pitney Bowes pays the GST/HST/PST/QST and duties owing on an item forwarded through the GSP on your behalf. The "import charges" are how you pay Pitney Bowes back, and then some. It's explained in the GSP terms and conditions you scanned through and agreed to before committing to purchase.

You either haven't been paying these taxes and duties on items you've purchased from overseas and had delivered by mail because they've been of extremely low value, or else Canada Border Services hasn't stopped them for assessment of taxes and duties owed.

Why am I being charged by GLOBAL mail and import tax when i make a purchase in another country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2017 04:11 PM - edited 08-29-2017 04:13 PM

@miss-cee wrote:That was taxed! was in Britain! and taxes from people outside of Britain do not pay British Taxes of in Britain if taxed while in Britain there is a form that they can give you and you will be refunded the taxes so if it is going outside of Britain why does global tax?

If Canada Revenue wanted to tax it would TAX in Canada..

I think Global is something that E bay should take a hard look at and maybe even shy away from ...It is a great way for the American tax people rake in taxes ..Does Global inform Ebay how much the Collected and provide Global with proof they payed the government those taxes...?

If I were buying new I would expect to be taxed

I will not purchase from anyone who uses Global and that means less purchase and less profit for the Sellers and E bay...

I just got 2 parcels from Europe that did not use the GSP for all used items.

I paid 200€ for shipping and then a little over $75 for import fees and GST when they got here.

It is what it is and if you want stuff from overseas, you pay for it. Incidentally, the 2 boxes were around 25 KG each