- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH M...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 12:36 PM - edited 11-30-2019 12:37 PM

Does anyone know what the US and Canadian laws would be on this? Can eBay legally deposit and withdraw the tax, that eBay is required to collect, through MY PayPal account? I am really bothered by this. We do not have a nexus in the US and are not registered to collect taxes from anyone. I would like this to be spelled out very clearly.

Can anyone help on this?

Thanks.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 12:56 PM - edited 11-30-2019 12:58 PM

eBay thinks this legal.

American rules apply since PayPal is USA based.

The sales taxes are all outside Canada so Canadian tax law does not apply.

-..-

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 02:25 PM

if you look at your sales total , you will see ebay is also adding the sales tax into our sales totals..

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 02:49 PM

Just checked my November numbers in Seller's hub and everything appears to be jiving. Sale + Shipping = Monthly total with no tax included. Will it happen "suddenly mysteriously" that tax is included? Sadly anything is possible. Has anyone noticed if taxes applied in Paypal is based on the sale including shipping for US shipments? Also, seeing this is not going to change no matter how much we gripe I still believe because the tax rates are different per state, the percentage should be clearly shown in PayPal. Like they said in school...."Show your math". This needs to be completely transparent especially for anyone requiring this info for tax purposes.

-Lotz

PS. Shipping charged STILL should not be considered part of a sale. It only is in eBay's eyes for FVF fees. Sorry. Major pet peeve!!! 95% of my shipping is created in Shippo as with most other sellers along with Paypal.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 02:57 PM

this is a screen shot from my sales graph on sellers hub!!

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 03:16 PM

Not positive on the terms "legal or illegal". More likely either a loophole, creative bypass, technicality or even a subterfuge method to dump a fee that someone who will remain nameless no longer wanted to pay on defenceless sellers to boost their bottomline.

From the Desk of:

Kick 'em When They're Down Inc ![]()

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 03:22 PM

I see that now. Is it possible that it is based on sellers on dot ca that include tax (PST,HST,GST) on their invoice. I do not include, so personally I am not seeing that factored into my total. That would be a whole other major can of worms.

-Lotz

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 03:29 PM

i am not registered to collect sales tax, so that can't be the case.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 03:47 PM

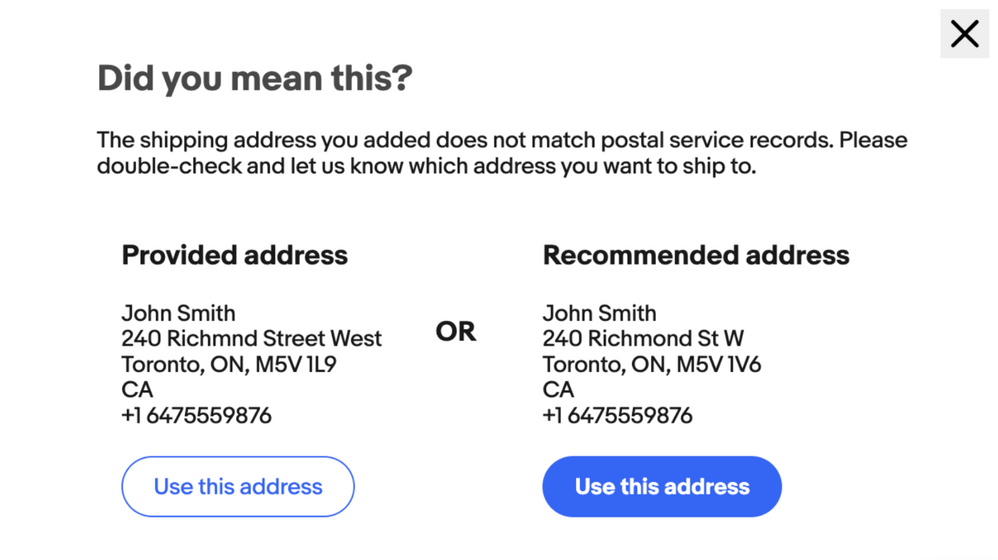

Neither am I. It could be something placed generically on all Seller Hub pages. Maybe something for Tyler next week. Similar to below which as per eBay CS explanation is only a US concept.

Check ones invoice it magically gets all lumped together and not noted with the asterisk per transaction as per their Seller's Hub page.

-Lotz

PS. I was able to confirm total because it's easy to check when sales have slowed to a crawl. My abacus barely got warm during the calculation.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-30-2019 10:14 PM

@esclyons wrote:if you look at your sales total , you will see ebay is also adding the sales tax into our sales totals..

@esclyons wrote:if you look at your sales total , you will see ebay is also adding the sales tax into our sales totals..

Yes they are including sales tax in our sales totals, this includes the new IST being collected by ebay (via our Paypal acc) on behalf of State treasuries.

To confirm I compared the daily sales total provided on the Sales chart with the Orders paid on that day. IST is definitely included in the sales totals ebay tracks and compares to prior periods.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 12:28 AM

Sometime after Nov 8, 2019 and before Nov 20, 2019 it went from Item total + Shipping to Item Total + Shipping + State tax in sellers Hub. I thought taxes were never supposed to appear on the eBay side? Only in PayPal.

-Lotz

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 12:23 PM

I don't recall what was supposed to be or not supposed to be, but the sales tax definitely is showing up on eBay sales. For myself the few sales I get on eBay is not a huge concern but this whole tax thing and the way it is being dealt with and processed is very concerning.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 03:11 PM

@mrdutch1001 @gwrocen @kawartha-ephemera

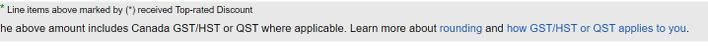

It "may" have been a system update incorrectly applied for a short time period. I had a sale overnight and it does not show the tax. Will the transactions it was applied to get fixed? Anyone's guess. It still should never show up as Seller Gross Profits with US State tax included. Personally, I would say monitor closely. Note: Subtotal & Shipping did not copy. Text is missing for Dec 1 transaction.

-Lotz

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 03:15 PM

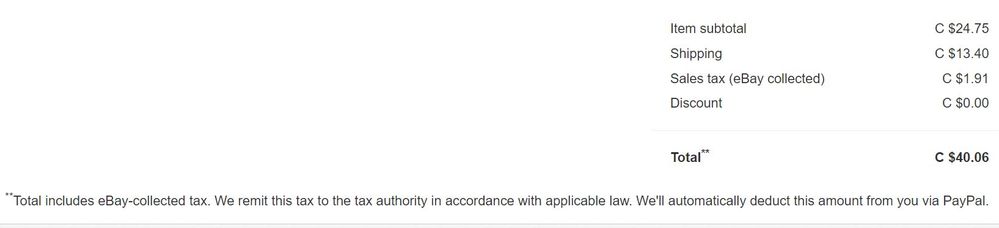

The part that annoys me is we are now paying paypal fees on the US sales tax collected by ebay!!!!!

Look at your paypal account for any item purchased by an US buyer in a US state for which ebay must now collect sales tax.

The tax is deposited into your paypal account as part of the total payment (item, shipping and tax). The tax is then instantly sent to ebay (ie it never really hits your account, it just looks like it does - ie you never have control or access to these funds - they are phantom funds)

However before these phantom tax dollars appear from your account, paypal takes its percentage!

Now that I think it illegal.

Imagine if Paypal had a policy of putting $1000 into your account with every item purchase, then instantly removing the $1000 (ie using your account as a momentary accounting location entry for the money), and they charged you 3-4% of the $1000 every time.

That would be the same as stealing $30-40 from your account every time someone made a purchase.

This is apparently what paypal is doing with the US tax payments.

These payments are collected by Ebay, and have nothing to do with Canadains. However ebay has passed the fees to Canadians by having the tax funds entered as an in and out accounting entry in your paypal account.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 04:07 PM - edited 12-01-2019 04:09 PM

I don't get that many sales from eBay anymore and I no longer list any high value items here, so the extra pennies in PayPal fees is not overly concerning to me...just don't feel this is the way this USA based internet tax should be handled. For those sellers of high value items, this is not good at all. This is all wrong in the way this USA internet tax is being processed.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 04:19 PM

@lotzofuniquegoodies wrote:@mrdutch1001 @gwrocen @kawartha-ephemera

It "may" have been a system update incorrectly applied for a short time period. I had a sale overnight and it does not show the tax. Will the transactions it was applied to get fixed? Anyone's guess. It still should never show up as Seller Gross Profits with US State tax included. Personally, I would say monitor closely. Note: Subtotal & Shipping did not copy. Text is missing for Dec 1 transaction.

Nov 26

Dec 1

-Lotz

Note that I discovered that some resellers do not get charged tax, so it is possible the untaxed person was a reseller. (This kind of stuff must have been a nightmare for the ebay developers to implement!!!!)

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 04:42 PM

Thanks for the plausible explanation. I confirmed with buyer and they are not tax exempt. Was a definite possibility based on sellers id. In the meantime I've checked on the transaction in PayPal and also no tax charged. So a rational explanation is not visible to my eyes.

-Lotz

PS. If I received $1.00 Cdn every time a feature in eBay did not work as I expected it should I would be rich.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-01-2019 07:52 PM

@lotzofuniquegoodies wrote:@mrdutch1001 @gwrocen @kawartha-ephemera

It "may" have been a system update incorrectly applied for a short time period. I had a sale overnight and it does not show the tax. Will the transactions it was applied to get fixed? Anyone's guess. It still should never show up as Seller Gross Profits with US State tax included. Personally, I would say monitor closely. Note: Subtotal & Shipping did not copy. Text is missing for Dec 1 transaction.

Nov 26

Dec 1

-Lotz

Which state is the buyer in?

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-02-2019 01:16 AM

Ooopsie. My error. The most recent transaction was Florida. A fortunate non-tax state as of yet. This is why I suggested back at the beginning of October for transparency if tax is getting charged show it where it needs to be shown including the actual percent being charged. Rates can vary and some items are considered exempt.

It appears eBay's posted list needs updating.

https://www.avalara.com/us/en/learn/guides/state-by-state-guide-economic-nexus-laws.html

States currently without an internet sales tax as follows.

-Alaska

-Florida

-Missouri

-Montana

-New Hampshire

-Oregon

-PR??

-Lotz

PS. AS A BTW:

South Dakota v. Wayfair – What it Means for Sales Tax Compliance

- Prior to the South Dakota v. Wayfair ruling (June 2018), states were only able to tax businesses based on “physical presence” and a few other laws.

- As of June 2018, the Supreme Court ruling allows states to tax out-of-state retailers based on an “economic” threshold of total revenue and/or number of separate transactions.

- For example, you will owe taxes in South Dakota if your annual sales in South Dakota exceed $100K OR your total number of annual transactions in South Dakota exceed 200.

- Laws based on these economic thresholds are referred to as “economic nexus laws”. Although not all states have them yet, many are moving quickly to take advantage.

- Things got complicated, and many businesses and accountants are struggling to navigate the mess.

IS IT LEGAL FOR eBay TO DIVERT TAX MONEY THROUGH MY PayPal ACCOUNT?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-02-2019 02:08 AM

And that still does not explain why this Sales Tax funnelling through our Paypal account is now showing up included within Total Sales in Sellers Hub? It's not revenue to eBay sellers.

-Lotz