- The eBay Canada Community

- Discussion Boards

- Community News and Information

- Monthly Chat Session

- September 22 2021 Weekly Session

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

September 22 2021 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-21-2021 12:16 PM

Hi everyone -

Opening the thread up for your questions! We'll begin working on answers tomorrow afternoon. 🙂

Tyler

September 22 2021 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2021 11:11 AM

Hello Tyler,

September 22 2021 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2021 03:04 PM

@lotzofuniquegoodies wrote:

Hello Tyler,

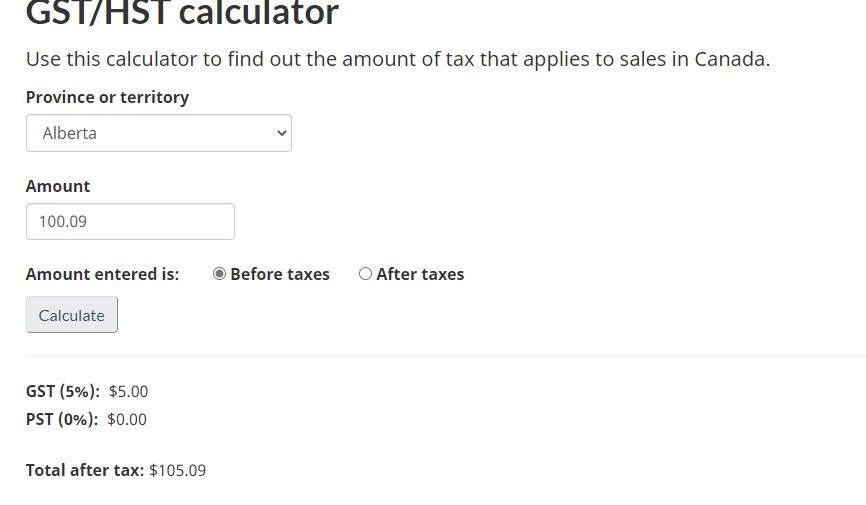

Could the system please be updated so that promotion fees are included as part of the original FVF's vs a separate transaction?Also as standard practice, TAX in Canada is added to the Sub Total and then rounded up or down accordingly. NOT to each line and rounded up. Over the course of a year the method eBay is using will compound, esxpecially with eBay's multi-line system. When tax is charged, it should be applied correctly.Example: 5 % Tax in Alberta100.00 + 5.00 = 105.00100.09 + 5.0045 = 105.09 (not 105.10).100.10 + 5.01 = 105.105 (105.11)Calculator AttachedIn reviewing the eBay help pages I still do not see clarification for items that in many jouristictions are tax exempt.Has this ever been officially addressed?-Lotzofuniquegoodies

Hi @lotzofuniquegoodies - I will get your requested suggestions filed with the product team!

When it comes to tax exemption by category, there is not currently anything in place that eBay Canada oversees or mandates. The closest applicable page I could find is this one.

In the event that eBay Canada begins to charge taxes similar to the way it is done on .com I would expect there to be a formal process for a buyer to notify us of any personal exemptions related to business, as well as category-specific tax exemptions in place.

If you find instances of sellers charging taxes in a category you know should not have tax charged please consider reporting them to CS so they can review and take appropriate action.

Thanks!

September 22 2021 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2021 03:04 PM

Thanks for joining the chat this week! It's closed but will be back next Tuesday!