- The eBay Canada Community

- Archive Category

- Archive 1

- If the seller is not enlisted in the "Global Shipp...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

as a buyer what is the tax regulations from country to country

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-28-2014 06:03 PM

I live in Canada; please help me with how can I pay my taxes on the items I have bought on ebay,and what is exactly free-trade?thanks

If the seller is not enlisted in the "Global Shipping Pro...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-28-2014 06:47 PM

If the seller is not enlisted in the "Global Shipping Program" you will pay duties and taxes to the delivery person at the time of delivery or when you collect the item from the Post Office or UPS store etc etc....

Only items valued at more than $20 Canadian are subject to import duties and if the vast majority of items shipped via the Post Office get through without charges even if they were eligible for charges.

If the seller is enlisted in the "Global Shipping Program" you will pay duties and taxes at the time you pay for your purchase.

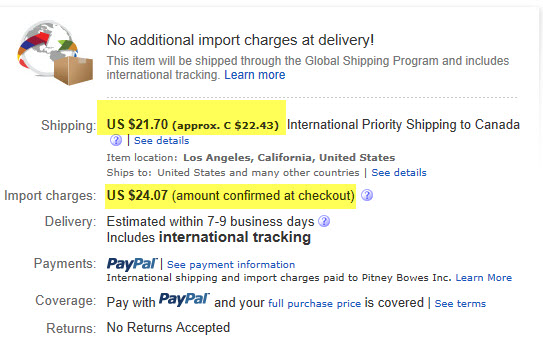

If the seller uses the Global Shipping Program that information is displayed near the top of the listing as shown in the screen capture below.

If the seller is not enlisted in the "Global Shipping Pro...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-28-2014 06:53 PM

Free Trade is an agreement between Canada - Mexico & The United States that makes imports between those countries of most goods manufactured in those countries duty free.

Goods are still subject to PST - GST - HST however depending upon where you reside and not all goods are covered by the Free Trade Agreement.

Basically don't even think about it someone else gets to work out the details either Pitney Bowes or Revenue Canada

https://en.wikipedia.org/wiki/North_American_Free_Trade_Agreement