- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- A Canadian question why pay tax after confirm purc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 02:37 PM

Here we go, its REALLY hurt our sellers in having this kind of eBayer in our community.

A Canadian blast about sales tax at the end of checkout and yet confirmed transaction and paid for it, claimed it should have been informed before commit to buy. Seller takes the blame with a NEGATIVE feedback.

eBay system allows seller to setup tax rates and is clearly stated in all listings, it is buyer's choice to pick seller and check with details including final payment amount before submit purchase order.

eBay should step up their punishment to this kind of behavior within the community, we, the seller work so hard to please buyers and yet a few of these bad apples ruin our credit rating due to this ridicules reason.

Regards,

Samson

Solved! Go to Solution.

Accepted Solutions

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-20-2018 12:58 AM

You put my thoughts into words exactly as I feel regarding ebay sales taxes.

Not a problem.....IF it is actually stated somewhere in a seller's listings ahead of time.

A potential cause for concern if not.

For Auction Items (Not Cart Items) , a buyer will not know until they have committed to purchasing by winning the auction/auctions.

Why give your sellers a chance to have a negative feeling about their new purchase, especially after they've won your auction.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 02:45 PM

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 03:06 PM

Definitely report that feedback to eBay and ask for removal.

I looked at one of your listings and suggest that you should have the fact that you are a registered business and charge GST/HST as applicable in your Description.

I know. Buyers Don't Read ™.

But at least try to warn them.

You could make the fact that you are a Real Life Professional Business a benefit. "Established 1923 in beautiful downtown Scarborough."

While you are doing that could I suggest removing these statements from the Description.

Payment should be made within 3 days of your purchase.

Not necessary or really even enforceable.

Non-paying bidders will be reported to eBay for further actions.

Too negative. Just drop it.

We ONLY ship to Canada via First Class Lettermail without tracking

Just asking for false Claims.

(Small fee for expedited shipping with tracking).

You have this choice in your Shipping section and it emphasizes how easy it would be to file a false Claim.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 04:55 PM

You are registered and have a gst number?

You are in Ontario so you should not be collecting PST in other provinces unless you are actually registered to charge PST in each province. If you live in a pst province and you are gst registered, you do have to collect for gst and pst. Otherwise, you should only be collect hst and gst.

The following link goes to the Revenue Canada and site and gives the correct percentage that you should be charging.

http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rts-eng.html#rt

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 05:08 PM

cnetseller - "...and is clearly stated in all listings"

I took a look at some of your listings and did NOT see any mention of sales tax applicable for shipment within Canada.

Not all viewers read every word in the description but a line indicating "GST/HST (as applicable) will be charged to Canadian buyers" would help.

Many sellers, registered with GST/HST sell online and absorb whatever tax is chargeable to Canadian buyers. Why? To remain competitive with a large number of sellers not registered to charge tax.

I sold on eBay for eighteen years prior to my retirement, was registered with GST/HST, and always absorbed the tax when shipping to a Canadian. It is a very small price to pay to remain competitive.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 05:56 PM

I'm on your side if your listing(s) state that applicable sales taxes apply.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 06:04 PM

Oh, I don't know. I don't think any buyer has the right to get all uppity about paying a sales tax. Yes, many sellers on ebay are too small to warrant collecting it but it shouldn't be an expectation that all ebay is tax-free. If a buyer uses Add to Cart, the sales tax is there to be seen. Maybe it makes sense to add a word of caution to an Auction item description. But I still don't think anyone buying on ebay has a right to complaining about having to pay a sales tax to a seller. Taxes are part of living in Canada.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 06:08 PM

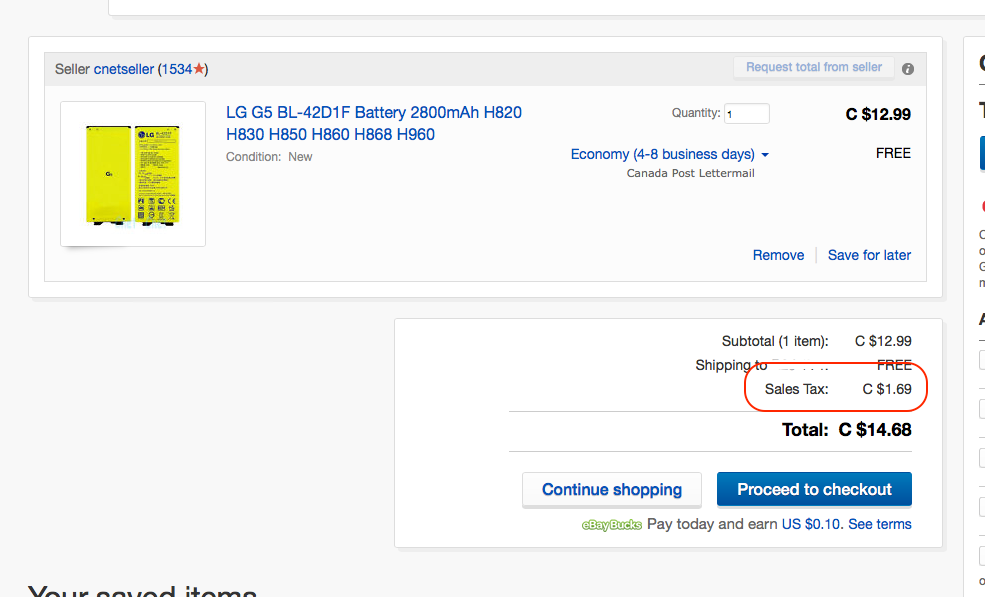

Adding insult to injury, this buyer is complaining about having to pay sales tax on an item valued at $12.99. Thirteen dollars. It's not like this was a surprise addition to an invoice on an item valued at $496.78 where the tax might be an extra $75.

It was taxes on $12.99. It added between 65 cents and $2 to their overall cost. Big whoop.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 06:13 PM

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 06:14 PM

Like I said earlier, in the thread, call and get the Negative removed. Also, your response. It doesn't make you look any better to state they claimed not to have received it.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 06:51 PM

Yes, I am a registered Canadian seller with business number to report annually, all chargeable taxes are according to buyer's province at different rate provided by CRA.

Buyer purchased the item, all calculations were listed at checkout and continue to confirm the transaction with payment and yet the complain didn't come after 2 weeks when buyer checked PayPal account being so called "overcharge".

The choice of buying from whichever seller is entirely on buyer and we did nothing wrong to earn this NEGATIVE feedback plus a total lost in this transaction.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 07:44 PM

Taxes are being calculated according to different provinces.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 07:49 PM

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 10:15 PM

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 10:23 PM

That is also a very valid method of dealing with the buyers who think they're entitled to live their best ebay life tax-free. Good advice.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2018 10:25 PM

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-24-2018 01:46 AM - edited 02-24-2018 01:47 AM

@cnetseller wrote, Yes we are a registered seller with business number.

Taxes are being calculated according to different provinces.

I agree that buyers shouldn’t be complaining about paying the correct taxes as they are aware of what they are when they check out.But depending on where your buyer is located, they may have been charged the wrong percentage as you are overcharging tax for at least 5 provinces. As mentioned earlier, buyers in pst provinces should only be charged gst. You can only charge pst if you have a physical presence in those provinces. In my first post there is a link to the CRA site with the correct percentages.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-24-2018 02:36 AM

@pjcdn2005wrote:... You can only charge pst if you have a physical presence in those provinces.

That's confusing optional with required to collect.

You can only charge PST if you are registered to collect PST for that province. Physical presence is only used to determine if you must collect PST -- the provinces are not going to turn down someone volunteering to collect tax for them. Although, most sellers would wonder why someone would volunteer to give away a competitive advantage.

...

The sales tax rates do keep changing...

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-24-2018 11:45 AM

"Oh, I don't know. I don't think any buyer has the right to get all uppity about paying a sales tax. Yes, many sellers on ebay are too small to warrant collecting it but it shouldn't be an expectation that all ebay is tax-free."

I respectfully disagree. I look at the total cost when making purchases and expect those that charge tax to indicate that in the body of the listing. I don't expect eBay to be tax free. I do expect to know if taxes are additional to the listing price and shipping.

I would not have left a negative but I have in the past requested a cancel on a purchase because the extra 13% made the item more expensive than the same item from a seller charging a few dollars more for the item without tax.

I have never used the cart so knowing it indicates tax is good but many buyers will not know this.

And many buyers do read descriptions. The problems caused by buyers who do not stand out but the problems never incurred because the potential buyer did read simply go unnoticed.

A Canadian question why pay tax after confirm purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-24-2018 12:01 PM

Knowing about the cart is good but I just realized that won't work for auctions. Sending the seller a question to ask will not work either as I only ever check on auctions ending soonest and I purchase the bulk of my items in auctions.

So if you charge tax no problem ... if you indicate it in the listing body.