- The eBay Canada Community

- Archive Category

- Archive 1

- New compulsory "Import Fees" from USA to Canada

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-10-2013 06:45 PM

Member since 2010 (632 100% feedback). I have been experiencing the new compulsory "import fees" policy on items from USA. Surprising! I am disappointed with this policy. It is a negative one on many levels notwithstanding for USA and eBay revenues, as many like myself will now be sure to be motivated to resource items outside of USA, and outside of eBay.

Also disappointing is a story I was told that USPS recently (January 28, 2013) redefined Canada from being an 'intermediary' to an 'international' country, and therefore shipping fees from the USA to Canada have risen 80%!

Must be people in rooms in the USA racking their brains on how to support the USA economy versus just printing money.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 09:41 AM

Is it possible that the GSP charge showing has something to do with sales taxes for the current high bidder?

The HST/PST/GST ranges from 5% to 15% depending on province. Some US states also have sales taxes.

My thought is based on the dotCOM numbers being substantially lower than the dotCA for the same items.

It does have a certain logic, although it would be quite useless to the bidder, who wants to know what she will pay, not what the current high bidder would pay.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 01:19 PM

You know what........there's one way to get aroud the GSP........MOVE ON, DON'T PURCHASE FROM THEM! Unless you are "desperate" to have the item (which I totally don't understand) read the mega posts about charges, etc. There are many US sellers who are not enrolled in this program. After reading posts about this day after day - why would I purchase from them? Educate yourself about it and if you do decide to purchase, accept the charges without moaning about it. Do I agree with it -absolutely not, but why the heck would I pay ridiculous charges which I can't afford.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 02:27 PM

there are no import duty/brokerage etc if the value of the item is under $20. shipping to the US? it's $200. so if you want to try, ask the seller if they can keep the order under $20 when they ship. they dont have to charge for them either.... it's called an "edit" button.

my bigger issue is the actual freight cost that Ebay allots to said items. i've contacted dozens of sellers recently about how they get the shipping price to be exactly $15.14 or $14.22 or whatever... i sell my items and ship for $5 to Canada and $8 to the US.

just edit your listing. do a little work and help the buyer out. it's not hard. on that note, most of them have replied saying, "oh ebay set that - not me - i can ship it to you for $____ instead).

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 03:08 PM

I really don't understand why sellers are charging that "import duty" when the item is used, if I go to the Salvation Army in the US and buy a bunch of clothes and come back to Canada show the border people my receipt and where it was bought, they won't charge you any duty since the itmes are used so why are Ebay sellers charging this duty when their item is used? I am not buying iff they are charging of course, it is a loss for so many American sellers since we Canadians are not buying anymore from them.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-16-2013 05:19 PM

@bcrafty4fabrics wrote:I really don't understand why sellers are charging that "import duty" when the item is used, if I go to the Salvation Army in the US and buy a bunch of clothes and come back to Canada show the border people my receipt and where it was bought, they won't charge you any duty since the itmes are used so why are Ebay sellers charging this duty when their item is used? I am not buying iff they are charging of course, it is a loss for so many American sellers since we Canadians are not buying anymore from them.

The sellers aren't charging it, and those charges are largely taxes (GST/PST/HST/QST) and processing fees, not duty. The Import Charges are collected by the Global Shipping Program who remits the tax portion to the feds.

Remember that there's a personal exemption from taxes/duties for residents of Canada visiting the United States, which may be why Canada Border Services hasn't charged you taxes on the clothing you've purchased from Sally Anns there.

http://www.cbsa-asfc.gc.ca/travel-voyage/ifcrc-rpcrc-eng.html#a4

Here's a link to information on how personal imports by post are assessed taxes and duties:

http://www.cbsa-asfc.gc.ca/import/postal-postale/duty-droits-eng.html

Keep in mind that just because CBSA doesn't necessarily assess all postal items for taxes and duties doesn't mean that those items are exempt from taxation.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-17-2013 04:32 AM - edited 09-17-2013 04:35 AM

pjcdn2005 wrote:You've listed a few of those examples on the .ca and .com boards. I found some of them and gave the links and info to one of the ebay reps who said they will look into it. But then they still haven't fixed the difference in the shipping amount on the search page compared to the price on the actual listing. (for gsp listings under $20).

I checked about 20 of the 40+ item price variations noticed between .ca and .com in different categories and didn't notice any corrections.

New items have been listed with the same variations, so maybe that is the way it's supposed to be.

Too bad if the buyer gets a surprise and higher charges, though.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-17-2013 12:45 PM

@chimera148 wrote:

pjcdn2005 wrote:You've listed a few of those examples on the .ca and .com boards. I found some of them and gave the links and info to one of the ebay reps who said they will look into it. But then they still haven't fixed the difference in the shipping amount on the search page compared to the price on the actual listing. (for gsp listings under $20).

I checked about 20 of the 40+ item price variations noticed between .ca and .com in different categories and didn't notice any corrections.

New items have been listed with the same variations, so maybe that is the way it's supposed to be.

Too bad if the buyer gets a surprise and higher charges, though.

Ebay is often slow at fixing things.. I doubt that it is supposed to be that way but I don't understand why it hasn't been fixed. They still haven't fixed the problem with the search showing one shipping price for GSP and a higher shipping price on the actual listing.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2013 12:49 PM

The import charges defined by eBay are scandalous. It is stunning that they apply such charges even for the smallest amounts. For example a software delivered online and priced at $30 has $7. 45 of Import charges, which are supposed to be GST, duty, clearing fee etc. What is stunning is that Import charges are indiscriminate. For example, they apply to goods that are customs exempt under NONFAT free trade agreement.

My hunch is this is something eBay, Canada Revenue agency and Canada Post cooked up. Else, eBay on its own would not dare charge this because their definition of it is explicit. Import charges include duty, taxes and clearance fee. If CRA and Canada Post are not in this scheme, then eBay is committing a big fraud. But I doubt they are.

So it is worth while finding out who is in this scheme, or if eBay is mandated to collect those charges for CRA and Canada Post.

I tell you I have been paying my fees to CRA and Canada Post for years for any duty and clearance fees. I had no problem. But my guess is they found it inefficient to collect small amounts this way. So, they may have authorized eBay to collect for them. But the fees look outrageously high, which leads me to believe eBay is adding their service fee. This is a company with stagnant profits who is craving to find ways and means to jack up their profits. So, it looks like a win win situation for the three, especially for eBay,

They get to dip in the pockets of the little guys one more time.

It is scandalous.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2013 01:10 PM

@honest-sagitar wrote:

The import charges defined by eBay are scandalous. It is stunning that they apply such charges even for the smallest amounts. For example a software delivered online and priced at $30 has $7. 45 of Import charges, which are supposed to be GST, duty, clearing fee etc. What is stunning is that Import charges are indiscriminate. For example, they apply to goods that are customs exempt under NONFAT free trade agreement.

How can software delivered online be listed through the Global Shipping Program? That makes no sense.

Can you give an example of a listing where duties have been charged a GSP item where duties shouldn't be charged? My understanding is that the bulk of GSP import charges are taxes (GST, HST, PST, QST) and those aren't eliminated through any sort of trade agreements.

@honest-sagitar wrote:My hunch is this is something eBay, Canada Revenue agency and Canada Post cooked up. Else, eBay on its own would not dare charge this because their definition of it is explicit. Import charges include duty, taxes and clearance fee. If CRA and Canada Post are not in this scheme, then eBay is committing a big fraud. But I doubt they are.

So it is worth while finding out who is in this scheme, or if eBay is mandated to collect those charges for CRA and Canada Post.

I tell you I have been paying my fees to CRA and Canada Post for years for any duty and clearance fees. I had no problem. But my guess is they found it inefficient to collect small amounts this way. So, they may have authorized eBay to collect for them. But the fees look outrageously high, which leads me to believe eBay is adding their service fee. This is a company with stagnant profits who is craving to find ways and means to jack up their profits. So, it looks like a win win situation for the three, especially for eBay,

They get to dip in the pockets of the little guys one more time.

It is scandalous.

My take on it is pretty simple: eBay.com domestic sales have reached a saturation point, and many American sellers still don't ship internationally under their own steam. eBay either approached Pitney Bowes or Pitney Bowes approached eBay with a solution that would theoretically make international shipping less intimidating for those non-international shippers. Perhaps someone in that mix figured that most international buyers would be savvy enough to simply avoid sellers who didn't use the GSP to its best advantage.

Since Canada isn't the only destination served by the GSP, I don't think Canada Post, Canada Border Services, or the Canada Revenue Agency had much--if any--input into its implimentation. Besides, similar services already exist, including one called Borderfree which until this spring was owned by--Surprise!--Canada Post (and thus, the citizens of Canada).

All commercial carriers are required to remit taxes due on imports. What the GSP (or Pitney Bowes' agents, if you prefer) is doing is nothing new. For example, if you do some digging on these discussion boards, you'll find a few where buyers have been shaken by the much higher fees levied by carriers such as UPS for ground shipments from the U.S.

I do find it interesting that you find the GSP fees to be high, though. I looked up four GSP items earlier this week valued between US$35 and US$125 and had my settings set up to calculate shipping to an Ontario postal code which would have meant that at least 13% HST would be owing on the items. In all four cases after deducting the HST from the import fees I found that what was leftover for Pitney Bowes was less than the C$9.95 processing charge on a taxed item sent through the mail.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-21-2013 06:11 PM

For example a software delivered online and priced at $30 has $7. 45 of Import charges, which are supposed to be GST, duty, clearing fee etc.

The highest rate for HST is 15% which is $4.50. In Ontario it is 13% which would be $3.90 on a $30 imported purchase. Then Pitney Bowes add their service fee of $4.95 (minimum) making $7.80. No duty is involved.

But if the software was delivered electronically there was no parcel to be handled. And no sales taxes to pay. Are you even more confused than I am?

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2013 04:28 PM

if I go to the Salvation Army in the US and buy a bunch of clothes and come back to Canada show the border people my receipt and where it was bought, they won't charge you any duty since the itmes are used

Errr, no.

For some reason, Canadians can bring up to $200 worth of product into Canada in their luggage, when they have visited the US for a time. (I haven't been to the US in years and am not sure how long that time is. A day maybe?) without paying duty.

Nor are we charged Canadian tax on the goods.

But if we are importing by mail or courier, the limit is $20. ($60 if Auntie Flo sends you an ugly sweater for your Christmas present.) both duty and tax are applicable. The carrier, whether Canada Post or a private courier like Pitney Bowes or UPS, is entitled to charge a fee for processing your purchase in addition to the actual transport fee.

New or used does not come into it.

If you managed to spend $201 at the Sally Ann, you would be charged duty on the clothing.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2013 07:10 PM

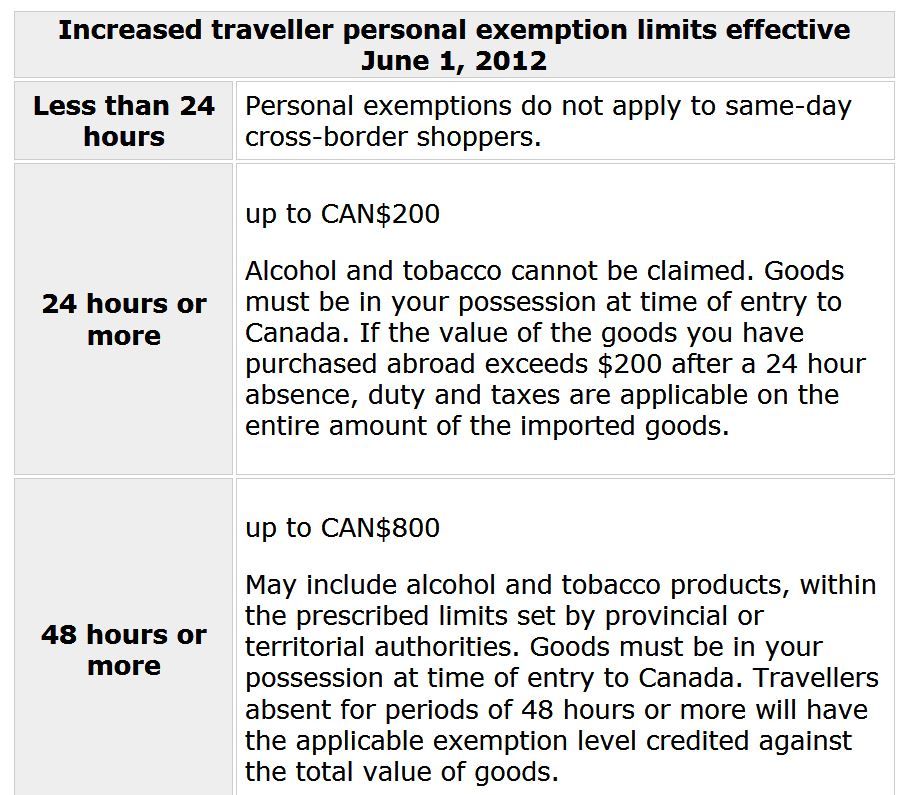

The tax and duty personal exemptions limit, on most items, were increased last year to $CAD200. for travellers in the US longer than 24 hours, and to $CAD800. for longer than 48 hours.

http://www.cbsa-asfc.gc.ca/travel-voyage/ifcrc-rpcrc-eng.html#a4

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2013 08:22 PM

I still wonder if the US side ever collects taxes on items.

Their limit is $225 but as far as I know they never collect on items shipped from person to person in the mail.

Has anyone ever heard otherwise?

As far as I can tell my American buyers aren't even aware they have a limit.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-22-2013 10:01 PM

@i*m-still-here wrote:I still wonder if the US side ever collects taxes on items.

Their limit is $225 but as far as I know they never collect on items shipped from person to person in the mail.

Has anyone ever heard otherwise?

As far as I can tell my American buyers aren't even aware they have a limit.

Do you remember the hue and cry a few years ago when there was talk about what was perceived as an "internet tax" on purchases made by U.S. buyers?

This, in fact, was actually nothing new. 40+ U.S. states charge "use tax" on purchases of tangible goods made from out of state. This is usually the same as state sales tax, although there can be allowances made if another state's tax was charged on the purchase instead. As far as I know, no states have a "use tax free limit".

The issue as things currently stand is that there's no legal way to collect use tax except for the honour system. In some (if not many) states, buyers have to make declarations of out of state purchases on their income tax forms and pay the use tax owing with their income tax. The flap about the "internet tax" is that there were rumblings about changing the way in which use tax is collected.

It's generally agreed that most Americans are completely unaware of use tax and this is the main reason it goes unpaid.

If you're interested in further reading on this subject, here's a link to a webpage from the Florida Department of Revenue explaining how use tax works in that state. You can find similar pages for other states.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-23-2013 12:04 AM - last edited on 09-23-2013 12:14 AM by lizzier-ca

Sounds like yet another eBay money grab scam. What a bad joke eBay is becoming more and more!!! Pure thievery !!!! Sounds like a good way to force stay away from all but home soil items!! eBay must have bought a ton of Pitney Bowes stock at deflated prices or cut a new royalty deal??/

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-23-2013 12:28 AM

@e-collectem wrote:Sounds like yet another eBay money grab scam.

Who's grabbing what money with the Global Shipping Program? Why is it a "scam"?

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2013 01:07 PM

It is a simply a money grabbing scam by eBay.

I have bought a lot of items from the US (on eBay and not) - some high ticketed items and not once had I ever had to pay duty on any item. GST yes (and even then not always, more so not).

The only time I had to pay any kind of outrageous import fee (brokerage) was when UPS was involved and as such I try to avoid them at all costs as a shipping company (plus other reasons). There are no brokerage fees if one uses USPS/Canada Post, yet eBay seems to feel that they need to be charging the Canadian consumers this fee, even when the items is shipped via USPS/Canada Post. Even if you have the item shipped FedEx the brokerage fee is usually a lot less as well (far less than UPS).

I seriously doubt that this will change, just another way for eBay to make more money.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2013 02:12 PM

@tpcf wrote:It is a simply a money grabbing scam by eBay.

I have bought a lot of items from the US (on eBay and not) - some high ticketed items and not once had I ever had to pay duty on any item. GST yes (and even then not always, more so not).

The only time I had to pay any kind of outrageous import fee (brokerage) was when UPS was involved and as such I try to avoid them at all costs as a shipping company (plus other reasons). There are no brokerage fees if one uses USPS/Canada Post, yet eBay seems to feel that they need to be charging the Canadian consumers this fee, even when the items is shipped via USPS/Canada Post. Even if you have the item shipped FedEx the brokerage fee is usually a lot less as well (far less than UPS).

I seriously doubt that this will change, just another way for eBay to make more money.

I don't get the connection between the "money grabbing" and eBay.

Right now, I'm looking at a listing for a Williams Cyclone Pinball Machine Cabinet Stencil Set that ships through the GSP. The seller is asking US$124.99 for it. Import charges to Ontario--where 13% HST is charged--are US$20.63. US$16.25 of those import charges are HST. This leaves US$4.38 for the GSP administrators to divvy up.

On the other hand, items sent through the mail that are assessed taxes/duties due are subject to a processing charge of C$9.95, a higher charge than what the GSP is charging in my example. (Your claim that items sent through the mail aren't subject to brokerage charges is accurate to a point, but they're still subject to charges on top of taxes/duties due.)

If you're still following this thread, perhaps you could do the number-crunching on a GSP item to show me how you figure there's "money grabbing" going on here.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2013 03:31 PM - edited 09-30-2013 03:34 PM

marnotom! wrote:

I don't get the connection between the "money grabbing" and eBay.

Right now, I'm looking at a listing for a Williams Cyclone Pinball Machine Cabinet Stencil Set that ships through the GSP. The seller is asking US$124.99 for it. Import charges to Ontario--where 13% HST is charged--are US$20.63. US$16.25 of those import charges are HST. This leaves US$4.38 for the GSP administrators to divvy up.

On the other hand, items sent through the mail that are assessed taxes/duties due are subject to a processing charge of C$9.95, a higher charge than what the GSP is charging in my example. (Your claim that items sent through the mail aren't subject to brokerage charges is accurate to a point, but they're still subject to charges on top of taxes/duties due.)

If you're still following this thread, perhaps you could do the number-crunching on a GSP item to show me how you figure there's "money grabbing" going on here.

First you didn’t say how much shipping was in your example.

Ok, let us take this example: http://www.ebay.com/itm/F14-Tomcat-NOS-Pinball-Playfield-/231061695774?pt=LH_DefaultDomain_0&hash=it...

eBay has listed import charges at: $155.82. Now, I have bought playfields before from the US and the most I have paid for shipping has been US$70 (actually just under yes and it was insured, cheapest I paid was ~$50 - not sure why that 1 was so cheap).

In this auction we have $155.82 PLUS the $21.34 for shipping = US$177.16.

$177.16 - $70 is $106.16 (unless my math is off) - so where does this money go? Now even if you add in the GST (which is all I would have to pay here in AB) that would only add ~$37 to the total, eBay is still way ahead by ~$70. For some reason I have yet to pay GST on any playfield I have received - maybe things are different in Ontario where they make you pay for everything since you have an up front provincial sales tax?

Like I said, I have only been charged for GST for less than 3% of all the purchases I have ever made (on eBay and other places, not to mention from many other countries), so why would I voluntary want to pay for every single one of them now? If I am charged tax, I am still further ahead is all I am saying without eBay pocketing $70 in this case.

Or, how about another example? I recently bought some Robotron stencils from Game Stencils - total cost to me was: ~$115, no GST, no duty, no "import fee". Unfortunately there no eBay comparison, but just using your example for import fees, why would I want to pay an extra $20 (assuming it is similar price structure)?

BTW: Cyclone stencil kit: $124.99 + $32.85 shipping (http://twistedpins.neoreef.com/) – not sure how the total cost compares since you never included shipping costs in your post, just the import fees so can't say if you are further ahead even if you have to pay HST.

New compulsory "Import Fees" from USA to Canada

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2013 05:00 PM - edited 09-30-2013 05:00 PM

I didn't mention shipping fees in my previous post because you didn't mention them, either. All you seemed to be referring to were the Import Charges which are GST/PST/HST/QST and duties (if applicable) plus the GSP processing charges.

The example you provided shows a shipping charge of US$21.34. You can tell me better than I can if that's reasonable or not.

The example you provided also shows Import Charges of US$66.06 to Alberta, at least for me. If you change the destination postal code, the import charges should reflect the taxes charged in the destination province, although for some reason for me in B.C. I get what appears to be just GST charged when we actually have PST as well.

The import charges are based on the Buy it Now price, so 5% of US$1100 is US$55, which makes the GSP's "money-grab" US$11.06.

Personal imports sent by mail are always subject to tax charges (and duty if the item is made outside of a free-trade zone country) if the declared value of the item is more than C$20. A C$9.95 charge is added on top of the taxes, etc. due. The big however is that if they're sent by mail, they go through Canada Border Services, and they don't assess and tax every single item that they receive, just like the cops don't always ticket me for speeding in a school zone. With the GSP, you're never going to see a taxable item go tax-free. Am I making sense here, or am I talking Chinese?