- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: New York State Sales Tax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-04-2019 06:12 PM

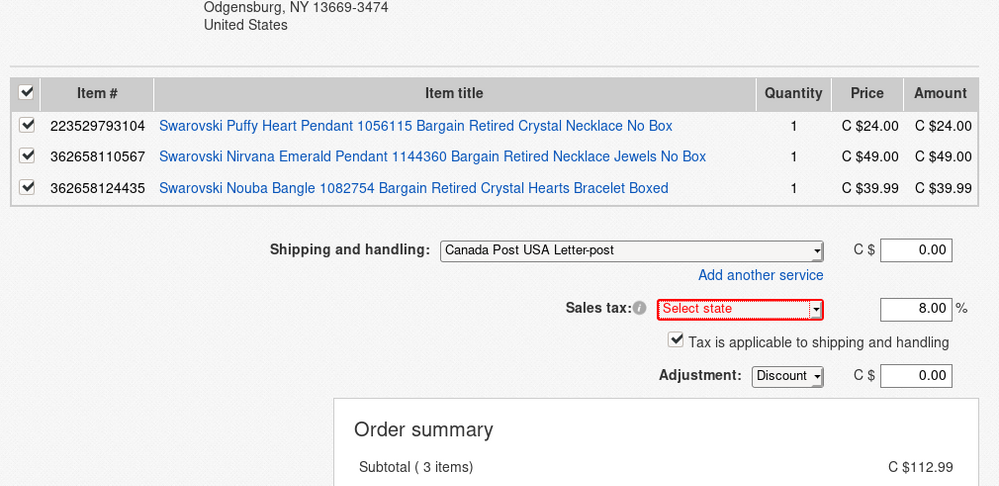

I have been noticing this month that more states have passed laws that require eBay to collect and remit taxes to certain states, it appears New York is now one of them. Why can they not roll this out in a more seamless manner. I do not believe that 8% is the correct rate. Why is it defaulting to that? How are we supposed to know what to put in the fields? If eBay is required to collect the tax why are we responsible for figuring out the correct rate for them? Just want to send out a combined invoice. Anyone know how to proceed?

Solved! Go to Solution.

Accepted Solutions

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 11:45 AM

I've only seen one of these so far and even though it seemed like I had the ability to set the amount the percent was actually already locked in.

Do you have the ability to alter the amount?

If so, why not just set it at 0%?

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 11:45 AM

I've only seen one of these so far and even though it seemed like I had the ability to set the amount the percent was actually already locked in.

Do you have the ability to alter the amount?

If so, why not just set it at 0%?

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 01:11 PM

Hi @bassox333 - for states where we collect sales tax on behalf of buyers, the rate is determined by us based on their address. The combined invoice will allow you to enter a percentage, but it will not override the total amount of tax collected from the buyer - at this point that field is 'cosmetic' for you: it won't display to the buyer. We're in the process of reworking the invoice feature altogether, but until that time that field will still be present.

You don't need to do anything else! Sorry for the stress.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 01:12 PM

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 01:13 PM

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 03:06 PM

@tyler@ebay @bassox333

Hello Tyler,

With the rework of invoices is this being communicated to Shippo, Paypal etc so the customs invoice can match the eBay Packing Slip? Any discrepancies can cause delays during the customs process. The other question is there ANY plan to completely remove Phone Numbers from a transaction? For customs/courier shipments, that CAN be required info for higher value shipments. Using sellers home phone number or made up one can cause problems. Most important why a phone number is correct. Having this information display correctly would also be a way for customs to confirm any taxes have already been paid and customers do not get double billed.

-Lotz

PS. Standard requirements for any international shipments is supposed to be Shipping Label(Bill of Lading), Customs Invoice AND the packing slip.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 03:12 PM

Hi @lotzofuniquegoodies -

The packing slip on .com is being reworked. Currently the information that you mention is still available via the process mentioned here.

As to what the new .com packing slip will contain, I couldn't tell you. However, I know that they work closely with shipping partners to make sure that the product aligns with their requirements.

There is no plan that I am aware of to remove customer specific information from a packing slip or invoice. Thanks!

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 09:58 PM

There is a packing slip available on Paypal.

Does it have the information your customer needs?

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 12:59 AM

I use Shippo for all my label making except in the rare circumstance where a service is not available I use CP. I haven't used PayPal in several years. I include all the required information mainly to keep Customs happy and prevent any delays. The packing slip is so a customer can receive into their system if required. If in a case you were sending something to a business they should be able to clearly view if any additional charges were applied, like taxes at the correct rates. Currently, with Shippo, the phone number, if it's there does populate to the Shippo label but it still needs to be accurate or if customs has questions they will have limited ways to contact a customer. That's why I was concerned there might be a chance of it being removed down the road by eBay.

-Lotz

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 07:06 PM

@lotzofuniquegoodies wrote:@tyler@ebay @bassox333

Hello Tyler,

With the rework of invoices is this being communicated to Shippo, Paypal etc so the customs invoice can match the eBay Packing Slip? Any discrepancies can cause delays during the customs process. The other question is there ANY plan to completely remove Phone Numbers from a transaction? For customs/courier shipments, that CAN be required info for higher value shipments. Using sellers home phone number or made up one can cause problems. Most important why a phone number is correct. Having this information display correctly would also be a way for customs to confirm any taxes have already been paid and customers do not get double billed.

-Lotz

PS. Standard requirements for any international shipments is supposed to be Shipping Label(Bill of Lading), Customs Invoice AND the packing slip.

US Customs DO NOT and will not get involved in collecting State Sales Tax.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 07:49 PM

From a business's perspective, those amounts(Any Taxes/Shipping) should display correctly on any packslip/invoices. Those values may be required if they are purchasing for either resale or processing a customers repair. From a customs perspective, those amounts could be factored in for an items declared value.

-Lotz

What Information Should Be on a Commercial Invoice?

If you want your commercial invoice to take the place of a Canada Customs Invoice, it must have the following information:

- Your full name, address, and country

- Your customer’s full name, address, and country

- Details about the goods being shipped

- Net weight – the weight of the goods without packaging

- Gross weight – the weight of goods after packaging

- Unit price in the currency of payment (also called settlement)

- Delivery and payment terms

- Date the goods went into transit

- Purchase order number and other reference numbers

- Importer’s licence information if relevant

- Freight charges

- Any shipping insurance details

You may also want to include an invoice number, the date your document was issued, quantities, the total price, and discounts. Additional shipping details such as the port of entry, shipping date, and the mode of transport being used (road, rail, ocean freight, plane, etc.) are also helpful.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 08:08 PM

You don't need all of that for LVS (Low Value Shipments) which are the overwhelming share of eBay transactions. For a US bound shipment sent by Post you don't need most of that unless the value exceeds US$2500.

If you are using UPS/FedEx then the customs documents are extracted from the info you enter to create the manifest.

One thing that is absolutely clear (at least for shipments to the USA) no sales tax info is needed AT ALL. If the buyer needs the info they can find it on their order details page.

Also note that eBay buyers who are tax exempt are able to file an exemption form with eBay and avoid being taxed at all.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 08:16 PM - edited 06-06-2019 08:22 PM

Just like the OPs example I was presented with one of these invoices too, only difference being it was for a Washington state customer. The bit I just do not understand is why are we required to "select state" ? Why. Is that field not already populated by the ebay system? What would have been the consequences had I chosen say Wyoming instead of the state the product was actually being shipped to which was Washington?

tyler@ebay These invoices confuse me.

Edited to add that this select state sort of invoice only occurs when sending a combined invoice.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 03:51 PM

Thanks for letting me know you saw this as well @kawartha-ephemera!

The combined invoice does not alter the percentage of tax charged in states where eBay is required to collect and remit on behalf of the buyer - it is more of an appendix-style feature at the moment. It doesn't really do anything and it wouldn't be missed if it were removed. 😉

In your example if you were to change it to a state that was not one of the mandatory collection states and stated a percentage it would charge the buyer that amount. I am troubled by the fact that it required you to select a state instead of just skipping that field and I've gotten this reported. My hope is that we see this field just removed, or an option to 'apply tax table' for those sellers that collect tax in states we do not do so yet.

Thanks!

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 04:17 PM

Hello Tyler,

You mentioned combined invoices. Would it update accordingly for a revised manual invoice for the taxes based on the state? To confirm for the USA, taxes only apply to final price and not on shipping?

-Lotz

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 04:25 PM

@lotzofuniquegoodies wrote:

Hello Tyler,

You mentioned combined invoices. Would it update accordingly for a revised manual invoice for the taxes based on the state? To confirm for the USA, taxes only apply to final price and not on shipping?

-Lotz

Hi @lotzofuniquegoodies - sorry, not sure I'm following (Friday afternoon slump!).

If you mean for states where eBay does not collect tax for buyers, you should be able to set the state and tax percentage of your choice.

For states where we do charge and collect tax we do that independent of the invoice you send. If the state requires tax to be charged on item price and shipping we would apply that when the buyer goes through checkout. Similarly, if they don't require it be collected we wouldn't. Thanks!

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 04:34 PM

Hello Tyler,

For my situation, I send out revised invoices for customers when they purchase multiple units of the same item. The calculator is not always accurate in those cases as we've discussed in the past. In over 10 years of selling, I have yet to require combined shipping for 2 different items. I could send out refunds each time but would be easier to just send a correct accurate invoice. And not all customers use ADD to CART. (This is for the states where taxes are applicable only)

-Lotz

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 04:39 PM

Hi @lotzofuniquegoodies - thanks for the clarification!

Whether your buyers put items in the cart or wait for your invoice, they'll go through checkout eventually, and we would apply the required tax on the stated amounts at that point in time. 🙂

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-24-2021 05:06 PM

But why the heck am I being charged FVF on an American state's sales taxes? I have NOTHING to do with that money. You're ripping off...er, sorry...charging CANADIANS fees on taxes that YOU are collecting for ANOTHER COUNTRY. Why do I get dinged for that? Ding the state you're collecting the taxes for. You guys just keep raising and raising and raising the fees either by outright increasing the percentage you charge or by applying them to more and more things involved with the sale. Brian Burke (whom I do not trust in ANY way whatsoever to tell sellers the truth) said most sellers would experience a decrease in fees once, against my will, I was forced to switch to EMP. My fees have MORE THAN DOUBLED, and part of that has to do with the fact that I'm getting screwed by fees on taxes your picking up for another country.

Re: New York State Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-25-2021 12:17 AM

Hi everyone,

Due to the age of this thread, it has been closed to further replies. Please feel free to start a new thread if you wish to continue to discuss this topic.

Thank you for understanding.

Help us keep the community friendly and fun for everyone, check out the Guidelines