- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Buyer Central

- Sales tax added at check out but not disclosed in ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 07:21 PM - edited 06-05-2019 07:21 PM

If a seller does not indicate in their listing that they charge sales tax, does the buyer have to go through with the purchase, when sales taxes show up in the check-out page?

I would think that the fact that a seller is going to charge sales tax, should be clearly indicated in the listing description or in the payment details.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 08:50 PM - edited 06-05-2019 09:10 PM

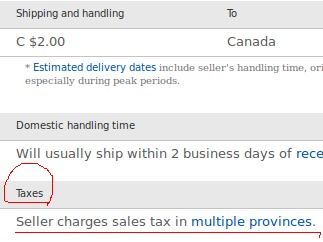

Sales tax (if it applies) shows in the Shipping and handling tab section.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 09:52 PM

A seller would have to be registered to charge and remit Canadian sales taxes.

Usually this means they have a physical presence in your province.

For example, if you bought from The Bay's website which has (I think) a warehouse in Montreal, and you were in Winnipeg, The Bay would charge you Manitoba sales taxes because they have stores there.

But if you bought from Gary in Alberta, who has only the car parts for sale from his junkyard, he would not be charging you any provincial sales taxes because he has no Manitoba presence.

Are you talking about the new US "internet sales taxes" which are currently rolling out in 14 states and soon in 21 states?

EBay is collecting those taxes, not sellers. The sellers have nothing to do with it. It isn't part of your income. Your buyer should be referred to his state government for clarification.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 01:26 AM

"Sales tax may apply when shipping to: IA*, MN*, WA*.

* Tax applies to subtotal + S&H for these provinces only"

As you can see, It does not mention the province of Ontario or any other province in Canada. The seller was located in my province.

The seller cancelled the transaction at my request, due to the fact that the charging of taxes was not defined in their listing.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 02:38 AM - edited 06-06-2019 02:49 AM

@cbeezer wrote:

This is the only mention of taxes in the Shipping and handling section.

"Sales tax may apply when shipping to: IA*, MN*, WA*.

* Tax applies to subtotal + S&H for these provinces only"

As you can see, It does not mention the province of Ontario or any other province in Canada. The seller was located in my province.

The seller cancelled the transaction at my request, due to the fact that the charging of taxes was not defined in their listing.

Since those are USA states and not Canadian provinces it sounds like the Seller is listing on ebay.COM and does not have Canadian tax tables properly set up. Either that, or they are unregistered and are charging a fake sales tax.

If tax tables are properly set up you should see:

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 01:54 PM

it sounds like the Seller is listing on ebay.COM and does not have Canadian tax tables properly set up. Either that, or they are unregistered and are charging a fake sales tax.

Which would be a good reason to Contact the Seller through the link on the right top of the original listing and ask.

The thing about "provinces" for US states is worrisome. If it were "states" and actually referred to Canadian provinces, I'd be less worried.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 07:35 PM

Hello,

I am very confused by all of this.

I am a Canadian seller. I sell on ebay.com. I do not charge GST and PST because my low sales volume does not require it.

A buyer in New Jersey just purchase an item from me and there is a message saying that ebay collected sales tax from them. I have no control over this.

It appears that sales tax is being charged to buyers based on their state no matter who sell to them.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2019 07:59 PM

@backpacktreasures wrote:A buyer in New Jersey just purchase an item from me and there is a message saying that ebay collected sales tax from them. I have no control over this.

It appears that sales tax is being charged to buyers based on their state no matter who sell to them.

eBay now collects sales tax for some USA states. It is automatic based on destination and applies to all sales. The Seller is not involved with the tax collection process.

The USA list:

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121#section4

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-22-2019 11:16 PM

I wonder why some sellers can "collect sales tax" when they don't have a GST/HST number listed on their profile...

I generally try to avoid sellers who charge sales tax (15%!!!) but I did, and I checked, the eBay transaction only gives a subtotal and the Paypal transaction doesn't show a GST/HST number... I wonder if that's legal. I think you HAVE to have a GST/HST number in order to legally charge sales tax to your customers.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2019 07:34 AM

I am guessing that there is a large % of ebay sellers in Canada listing on .ca who collect taxes and just keep it as there is no mechanism to police the practice.

Sales tax added at check out but not disclosed in listing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-27-2019 07:35 AM

I am guessing that there is a large % of ebay sellers in Canada listing on .ca who collect taxes and just keep it as there is no mechanism to police the practice.