- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Selling on ebay.com and Canadian sales tax collect...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2020 04:25 AM

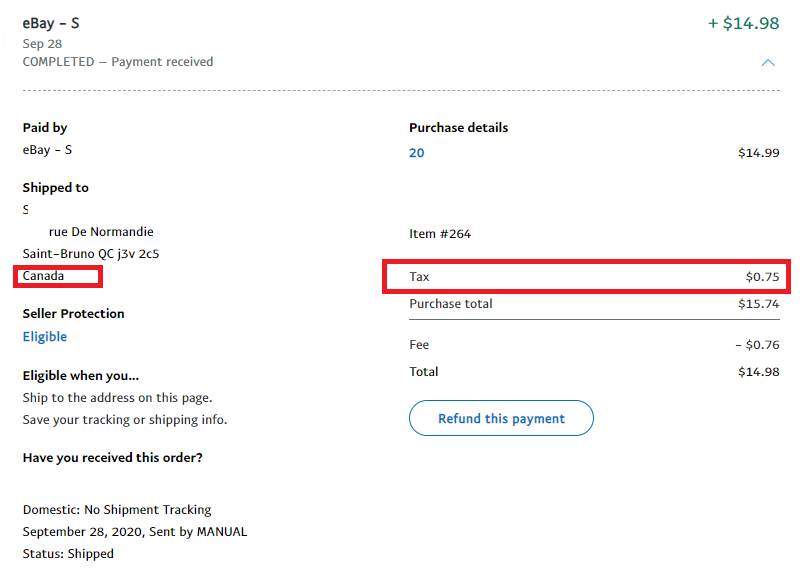

Anyone know when ebay.ca started collecting Canadian Sales tax on items listed on eBay.COM, but purchased through ebay.CA? It seems to be sometime in 2020, as I only noticed it in the past 3 months (example below). I don't think eBay.ca checkouts collected Canadian sales tax for you in 2019 if your items where listed on .com. If someone know that date this began it would be greatly appreciated.

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2020 01:15 PM

The only time Canadian tax is charged by eBay on either site is if the seller has set up their listings to charge tax. I don’t see any .com listings on this ID so this must be on another ID but you should check your settings.

As an FYI. If you are registered to collect gst your listings should be set up on on both .com and .ca to charge Canadians tax unless you are absorbing the tax. The site you list on isn’t what determines whether tax is collected, it is based on the ‘ship to’ location.

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-30-2020 02:08 PM

If you are not registered to remit Canadian sales taxes do NOT enable their collection.

Revenue gets upset about that.

Generally you do not have to register until your gross is $30,000 annually.

Check your listings (use Revise to see what eBay is working with) to be sure you are not collecting taxes without being able to remit them to the appropriate governments.

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2020 05:10 PM

Also a seller must supply his HST registration number to a buyer when the buyer pays tax. The number should appeasr on your invoice.

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-05-2020 04:36 AM - edited 10-05-2020 04:36 AM

My question is ABOUT eBay's change and NOT regarding the specifics of sales tax regulations. I am registered and have a HST/GST number so that is not the issue.

Selling on ebay.com and Canadian sales tax collection start date

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-05-2020 12:45 PM - edited 10-05-2020 12:47 PM

I'm not aware of any change. If you are registered to collect tax from Canadians it should be collected regardless of which site the item was listed on and it has been possible to set it up to do that for as long as I can remember. But it has always been the seller that sets it up..not ebay.

When you set up your taxes on .ca that is carried over to .com if you check off 'add applicable sales tax' in customize. I suppose that it is possible that ebay now checks off that option for you on .com if you already have taxes set up on .ca and it is checked off there but I haven't heard anything about them doing that.