- The eBay Canada Community

- News & Updates

- Canadian Sales Tax

- Re: What this looks like for a buyer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-01-2022 04:44 PM

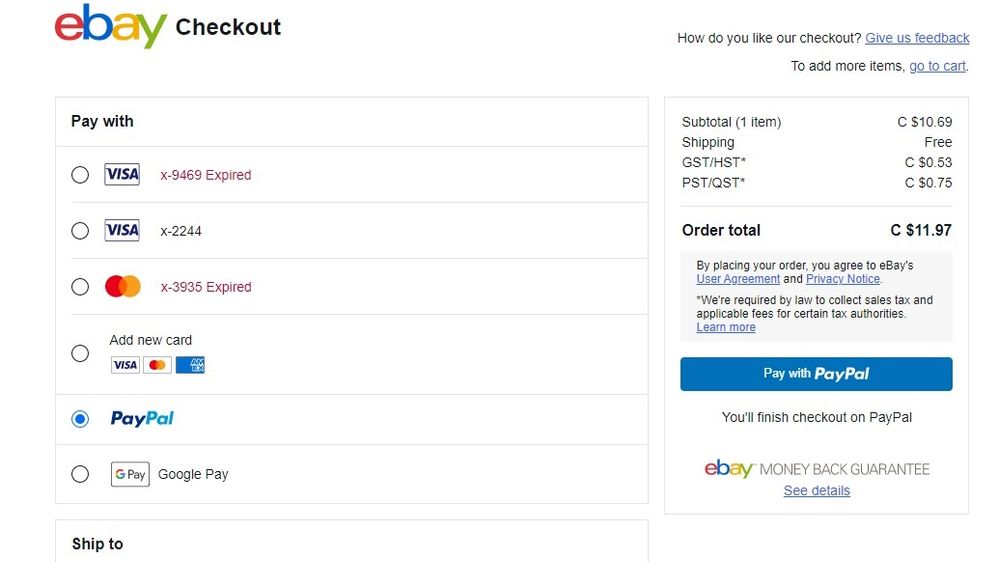

Just made my first Canadian purchase on eBay with the new system in place.

Checkout:

There's a note below the total that states that eBay is "required" to collect sales tax, blah blah blah. There's also a learn more link that takes the buyer to this page:

https://www.ebay.ca/help/buying/paying-items/paying-tax-ebay-purchases?id=4771

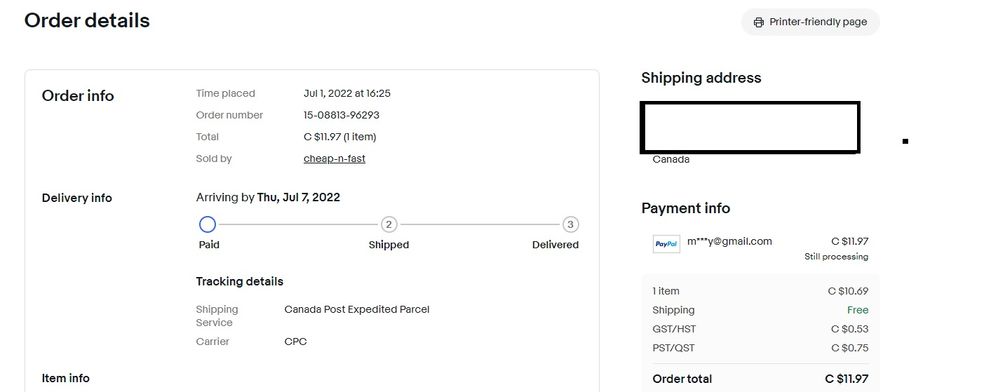

The order details page has pretty much the same information. There's no GST number displayed, however. I don't know if this seller is registered to collect and charge GST/HST, but I would assume that if they are their number would show up below the total.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-01-2022 05:49 PM - edited 07-01-2022 05:50 PM

@marnotom! THX for posting this!

I suspect the opposite of you, I don't think there will be a GST number provided ever, because they should have theirs or ours if we've provided one to them (I'm not sure how one does that as a note aside from having provided it on the BAA form) if it was going to happen.

I'm not sure how come that's ok, my recollection from a long time ago was that the GST number had to be on the receipt somewhere, but that may have been relaxed in the modern era with these billing agent authorization situations.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-01-2022 06:15 PM

Yeah. It's supposed to be included if the total is $30+, although I see no reason eBay shouldn't be including it on all receipts. I mean, it's all done automatically anyway.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-01-2022 09:05 PM

Should'nt the GST number be on invoices?

Perhaps you could send a reminder to the form design team?

Some of our buyers will be resellers and need the number.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 03:27 PM

@marnotom! wrote:Just made my first Canadian purchase on eBay with the new system in place.

Checkout:

There's a note below the total that states that eBay is "required" to collect sales tax, blah blah blah. There's also a learn more link that takes the buyer to this page:

https://www.ebay.ca/help/buying/paying-items/paying-tax-ebay-purchases?id=4771

The order details page has pretty much the same information. There's no GST number displayed, however. I don't know if this seller is registered to collect and charge GST/HST, but I would assume that if they are their number would show up below the total.

Thanks for sharing. Interesting to see it display with actual breakdown of 2 taxes. (Not sure of your province of residence.) With this new system in place for an Alberta residents, would it show just the 5% if it was being purchased from for example Ontario or would it show 2 taxes? Seeing as tax according to eBay is destination applicable. It's either destination or location...Pretty sure it can't be both!!

Happy like to throw things up in air and see what sticks day!! Still shaking my head at based on item/based on transaction rationalization.

-Lotz

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 03:39 PM

@lotzofuniquegoodies wrote:Thanks for sharing. Interesting to see it display with actual breakdown of 2 taxes. (Not sure of your province of residence.) With this new system in place for an Alberta residents, would it show just the 5% if it was being purchased from for example Ontario or would it show 2 taxes? Seeing as tax according to eBay is destination applicable. It's either destination or location...Pretty sure it can't be both!!

I'm in British Columbia, the province that had the HST briefly before it went down in flames in a referendum. I suspect that for Alberta and for any item that wouldn't be subject to PST (e.g. books), the PST field would still be on the invoice but there would simply be an amount of "$0.00" showing.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 10:31 PM

Thanks for sharing. Interesting to see it display with actual breakdown of 2 taxes. (Not sure of your province of residence.) With this new system in place for an Alberta residents, would it show just the 5% if it was being purchased from for example Ontario or would it show 2 taxes? Seeing as tax according to eBay is destination applicable. It's either destination or location...Pretty sure it can't be both!!

It's just 5% (no PST in Alberta). On the printable packing slip and order receipt, it has one line followed by the total:

GST/HST (eBay collected)

A province with PST/QST/RST would presumably have two lines. While it doesn't show eBay's tax number, at least it DOES clearly state that eBay has collected the tax. That might not help someone who buys our item who has a business, but it should at least be sufficient for our accounting purposes (I think).

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 10:35 PM

@marnotom! wrote:

@lotzofuniquegoodies wrote:Thanks for sharing. Interesting to see it display with actual breakdown of 2 taxes. (Not sure of your province of residence.) With this new system in place for an Alberta residents, would it show just the 5% if it was being purchased from for example Ontario or would it show 2 taxes? Seeing as tax according to eBay is destination applicable. It's either destination or location...Pretty sure it can't be both!!

I'm in British Columbia, the province that had the HST briefly before it went down in flames in a referendum. I suspect that for Alberta and for any item that wouldn't be subject to PST (e.g. books), the PST field would still be on the invoice but there would simply be an amount of "$0.00" showing.

Except nothing qualifies as exempt of tax because it is applied to the transaction...Not the item as per eBay!! Even books and food.

-Lotz

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 10:56 PM - edited 07-02-2022 11:06 PM

I just put a book in my cart and only the applicable 5% GST charge showed for it, although the description of it was simply "tax". Might be different for those living in an HST province.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 11:25 PM

@marnotom! wrote:

I just put a book in my cart and only the applicable 5% GST charge showed for it. Might be different for those living in an HST province.

What muddies the water here big time is according to the various provinces items and tax collection when it comes to GST/PST/HST and any other ST items can be potentially exempt of tax. Similar to the USA in the different states. Items can be either ZERO rated or taxed lower. When an explanation is requested from eBay staff they have always avoided answering or its answered in doublespeak.

Now with Internet Tax its the transaction + accessorials vs the item that are in question.

Remember the bruhaha when MP was announced and currency/bullion was going to be a problem? They figured out a way to make it not a problem. Possibly because with a basic search they realized there were 1.3 M listings on dot com and forget the quantity on dot ca. That would have been too much revenue down the tube without finding a way to make those items accessible/permitted.

And what happened to the 30,000.00 thresh hold?

-Lotz

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2022 11:32 PM

@marnotom! wrote:I just put a book in my cart and only the applicable 5% GST charge showed for it, although the description of it was simply "tax". Might be different for those living in an HST province.

I tried a book at Indigo without including my address and it automatically included 5 % GST. Not sure if what is stated below will change because of it being transaction based.

-Lotz

From Indigo:

All taxes are calculated based on your shipping destination. Books shipped to a Canadian address are subject to GST (Goods and Services Tax) but not PST (Provincial Sales Tax). In provinces with a Harmonized Sales Tax (HST) only the GST portion is applied, with the exception of Newfoundland, which does charge full HST for books.

PST, GST and HST are added to other items as applicable, as well as to gift wrap and shipping charges.

All orders shipped outside of Canada are NOT subject to Canadian taxes. Duties or taxes (as determined by Customs) may apply, which the recipient is responsible for paying on receipt.

GST/PST exemptions

Scan a copy of the card(s) with GST/PST exemption number(s), and provide us with your name and order number for exemptions. Email the information to service@indigo.ca and we will either adjust your order before shipping, or process a refund for the tax amount.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2022 02:36 AM - edited 07-03-2022 02:38 AM

@lotzofuniquegoodies wrote:What muddies the water here big time is according to the various provinces items and tax collection when it comes to GST/PST/HST and any other ST items can be potentially exempt of tax. Similar to the USA in the different states. Items can be either ZERO rated or taxed lower. When an explanation is requested from eBay staff they have always avoided answering or its answered in doublespeak.

@lotzofuniquegoodies wrote:Now with Internet Tax its the transaction + accessorials vs the item that are in question.

I can't remember where I posted this, but it's my hypothesis that eBay is saying that the transaction is being taxed rather than the item because it doesn't possess the item being purchased as it's an intermediary service. So the tax is on the transaction, i.e. the work eBay does to facilitate the purchase of the item in question. It's likely that once the dust settles and eBay gets the bugs out of the system, a transaction tax will look pretty much the same as a goods tax.

@lotzofuniquegoodies wrote:And what happened to the 30,000.00 thresh hold?

What about it? Sellers below that threshold remain below that threshold; it's up to them whether they want to register to collect GST/HST. It's the venue that's charging and collecting the tax, not the seller. The threshold is irrelevant if the seller is availing themselves of the services of an online platform such as eBay.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2022 04:16 PM

For what it's worth, I just put a child's shirt in my cart and there's no British Columbia PST being levied on the transaction, and that would be the case if the shirt were purchased in British Columbia from a brick and mortar retailer.

----------------

Does that not prove that they are taxing the item, not the transaction?

If it was simply a transaction tax as suggested, then there would have been pst on that item as well.

eBay does not always give correct and/or complete information and I don't believe that there 'transaction tax' answer was accurate. They also say in reply to questions in the US that it is a transaction tax but they also have taxed and non taxed items so it is a tax based on the buyer's location and on the item....not simply a tax on the transaction. Perhaps they have their reasons for calling it that but when posters reply that a non taxable item such as bullion is being taxed I don't think that it is because it is a 'transaction' tax. I think that is a software/programming problem.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2022 04:53 PM

@pjcdn2005 wrote:For what it's worth, I just put a child's shirt in my cart and there's no British Columbia PST being levied on the transaction, and that would be the case if the shirt were purchased in British Columbia from a brick and mortar retailer.

----------------

Does that not prove that they are taxing the item, not the transaction?

If it was simply a transaction tax as suggested, then there would have been pst on that item as well.

eBay does not always give correct and/or complete information and I don't believe that there 'transaction tax' answer was accurate. They also say in reply to questions in the US that it is a transaction tax but they also have taxed and non taxed items so it is a tax based on the buyer's location and on the item....not simply a tax on the transaction. Perhaps they have their reasons for calling it that but when posters reply that a non taxable item such as bullion is being taxed I don't think that it is because it is a 'transaction' tax. I think that is a software/programming problem.

Well stated. It's similar to when tax is being charged based on final destination with anything purchased mail or by courier. As an Albertan if I go to Ontario I pay both taxes where applicable. If someone comes to Alberta from Ontario and purchases something the pay GST only. How bout some sort of consistency. Truthful explanations/clarification and eBay...No comment!!!

-Lotz

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2022 05:58 PM - edited 07-03-2022 06:09 PM

It’s not proof that it’s tax on the item because the tax is based on the category under which the item was listed, not the item itself.

The limitations or inappropriate use of eBay's category system are the main reasons we see taxes applied incorrectly on the site.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2022 04:30 PM

@lotzofuniquegoodies wrote:

@pjcdn2005 wrote:For what it's worth, I just put a child's shirt in my cart and there's no British Columbia PST being levied on the transaction, and that would be the case if the shirt were purchased in British Columbia from a brick and mortar retailer.

----------------

Does that not prove that they are taxing the item, not the transaction?

If it was simply a transaction tax as suggested, then there would have been pst on that item as well.

eBay does not always give correct and/or complete information and I don't believe that there 'transaction tax' answer was accurate. They also say in reply to questions in the US that it is a transaction tax but they also have taxed and non taxed items so it is a tax based on the buyer's location and on the item....not simply a tax on the transaction. Perhaps they have their reasons for calling it that but when posters reply that a non taxable item such as bullion is being taxed I don't think that it is because it is a 'transaction' tax. I think that is a software/programming problem.

Well stated. It's similar to when tax is being charged based on final destination with anything purchased mail or by courier. As an Albertan if I go to Ontario I pay both taxes where applicable. If someone comes to Alberta from Ontario and purchases something the pay GST only. How bout some sort of consistency. Truthful explanations/clarification and eBay...No comment!!!

-Lotz

Perhaps I am misunderstanding your point as I'm not sure what you want clarified in that regard. Online shopping has always worked like that whether its on eBay or a large retailer. The receiver pays the applicable tax in their province. Thank goodness that it does! Whenever I buy something online, it's to my benefit that I pay Alberta tax whether the item is being shipped from BC or the Maritimes.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2022 04:48 PM

@marnotom! wrote:It’s not proof that it’s tax on the item because the tax is based on the category under which the item was listed, not the item itself.

We're going round in circles here lol. The tax is based on the category because that particular category if for items that are not taxable. So...it is a tax on the item, not a transaction tax.

The limitations or inappropriate use of eBay's category system are the main reasons we see taxes applied incorrectly on the site.

I don't disagree with that in some cases. But I do believe that eBay has it wrong in the case of bullion. I put an item listed under bullion in my cart and it showed that I would be charged GST. I've bought the same type of item from Canada Mint and they do not charge GST. They do have the ability to base the tax on the subcategory. For example, if I put childrens pants in my cart and use a BC address, I'm just charged GST. When I add a wallet, which is also under the clothing and accessories main category, I am charged GST and PST.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2022 04:55 PM

My point was to the following.

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-06-2022 08:25 PM

See this thread for the answer as to the business number on the receipts..

Re: What this looks like for a buyer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-21-2022 04:01 PM

@reallynicestamps wrote:

Should'nt the GST number be on invoices?

Perhaps you could send a reminder to the form design team?

Some of our buyers will be resellers and need the number.

Hi @reallynicestamps! The tax team said:

We don't need the GST number on the invoices. The numbers for eBay Canada Ltd. are online in the User Agreement in the Fees and Taxes section: eBay.ca User Agreement | eBay. Technically they don’t have to be in an invoice if they’re in other supporting documentation, such as a contract. (They're also included in the Billing Agent Authorization). For DDG sold by international sellers, the numbers are not available. As long as you provide them upon request, that’s all that is required by law.