- The eBay Canada Community

- Discussion Boards

- Community News and Information

- Monthly Chat Session

- Re: November 13 2019 Weekly Session

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-12-2019 12:23 PM

Howdy everyone -

Feel free to leave your questions below and I'll be by tomorrow (Wednesday) to work on getting you answers.

Thanks!

Tyler

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-12-2019 09:31 PM

Hello Tyler,

I have a question regarding FVF credits when a buyer has been refunded or a transaction has been cancelled.

I recently had an INR case in which I fully refunded the buyer. I was originally charged a FVF of $2.08 on the item and $1.01 on the shipping. The FVF credits I received were $1.87 and $1.01. I was short changed by $0.21 on this transaction.

On two cancelled transactions the FVF originally charged was $0.16 on each, but the FVF credit received was only $0.15 on each. I was shortchanged by $0.01 on each transaction.

While I realize that the differences are small, over the course of time these small amounts add up. Given the large number of sellers on E-Bay, this would be a significant amount.

Why are FVF credits not being correctly refunded?

Kind regards, Monika.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:40 AM

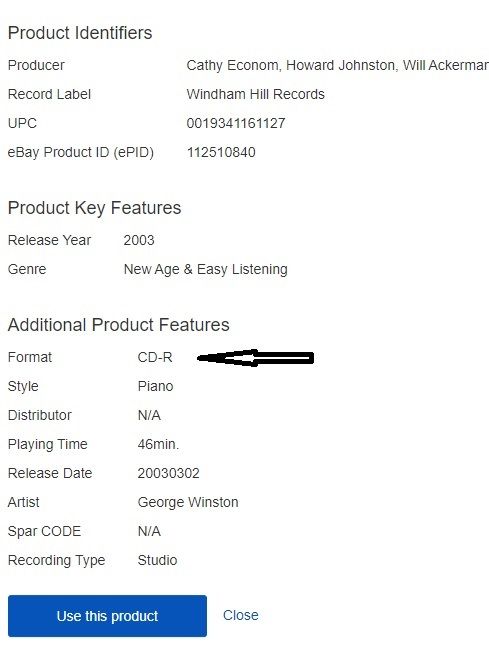

When listing CD's for sale the item specifics always show format as CD-R which is CD-R (Compact Disc-Recordable). They are not CD-R's and I hesitate to use item specifics indicating they are a copy of an original. Any idea why they use that term as it is incorrect.

https://techterms.com/definition/cdr

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 11:56 AM - edited 11-13-2019 12:13 PM

Here is a copy of a reply posted in another thread by another poster

re the Sales Tax/PayPal charging Canadian sellers fees process.............................

@dhslk wrote:

Here are a few excerpts from a Canadian tax law website from July 2019 discussing the collection of US sales tax by Canadians (US Sale Tax Guide for Canadians):

"Economic nexus will be based strictly on the volume of sales and/or unit count you sell into the state. There is no ambiguity in the application of the law. From the states’ perspectives, once you cross that threshold, you are obligated to register and comply."

(...in other words, if you sell over a certain $ value or a certain units value in a specific US tax jurisdiction, then collecting sales tax for that jurisdiction is required. In my case, I sell miniscule amounts to any one jurisdiction and DO NOT have an economic nexus anywhere in the US; therefore, US sales taxes should NEVER be in my account---it is EBAY that has the nexus, not me, and ebay is the registered tax collector, not me).

"Am I in trouble if I start collecting sales taxes without a registration?

It is illegal to collect sales tax from customers if you haven’t obtained a sales tax permit/registration number from the state. Please make sure that you register first before you start collecting."

(In other words, EBAY may be causing me to engage in ILLEGAL activity; by putting the tax money into my possession for even a nanosecond, they are opening me, and ALL Canadian small sellers , up to HUGE legal problems for illegal tax collection). PLEASE someone out there who is a lawyer, take this on!!)

The method that ebay was using earlier in the year worked, and was legal. The sales tax was collected and remitted by ebay, as it should legally be.

I am going to alert my MP to this.

My question is............................

What is eBay going to do about fixing this illegal situation

that has been created for all Canadian sellers?

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 12:43 PM

At the very least, provide us with proof (as in refer us to or post the legislation etc.) that this newly implemented tax collection method is LEGAL so that we don't have to get ulcers over it. At this point, I can't find anything to show that it is legal, but have found several sources that seem to show that it is ILLEGAL for me to have the taxes put into my account.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:04 PM - edited 11-13-2019 01:06 PM

A state tax was recently included in a sale to a buyer in New York state.

The total in the Paypal record included ..................

The item price +

Shipping cost +

State tax

= a total for these three numbers

It appeared that Paypal charged their fee on this total of these three numbers

and only after this fee was calculated did eBay collect the State Tax.

As a Canadian seller I am registered to collect GST/HST. the Paypal fee is calculated on a total paid by a buyer, and that total includes GST/HST.

I am not registered to collect the State Tax...... then ...Why is this number showing on my Paypal record?

The amount for State tax should be removed before it shows on my record on Paypal.

It is eBay that collects the State Tax for Canadian sellers.... The business that collects the State Tax should be the business that pays the Paypal fee calculated on the State Tax....

Sellers on eBay, those that are not registered to collect a specific State Tax... should not be charged a fee on this State Tax by Paypal.

---------------------

As a seller on eBay Canada, State taxes will show on an invoice, because a buyer must pay the tax. It is eBay that places that number on the invoice.

The state Tax will show on an invoice.... because the buyer must pay the tax that eBay will collect

However, this State Tax should not show up on my record on Paypal.

If a seller is not registered to collect a specific State Tax, then that tax should not appear on the Transaction record on Paypal.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:31 PM

Hello Tyler,

Should Canadian buyers be receiving offers from US sellers that DO NOT make available shipping to Canada? Possibly that setting was not considered when the program was designed? Have noted some of those sellers with settings that won't even let you message them to even make a request.

-Lotz

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:44 PM

@cgphile wrote:

Hello Tyler,

I have a question regarding FVF credits when a buyer has been refunded or a transaction has been cancelled.

I recently had an INR case in which I fully refunded the buyer. I was originally charged a FVF of $2.08 on the item and $1.01 on the shipping. The FVF credits I received were $1.87 and $1.01. I was short changed by $0.21 on this transaction.

On two cancelled transactions the FVF originally charged was $0.16 on each, but the FVF credit received was only $0.15 on each. I was shortchanged by $0.01 on each transaction.

While I realize that the differences are small, over the course of time these small amounts add up. Given the large number of sellers on E-Bay, this would be a significant amount.

Why are FVF credits not being correctly refunded?

Kind regards, Monika.

Hi Monika!

Based on what you've shared I would wager that your account is Top Rated and you received a Final Value Fee discount of 10% on the purchase price. Because you were charged less on that fee, you received less on the refund. It's also why the shipping Final Value Fee was refunded in full (because Top Rated discounts apply only to the purchase price).

Thanks!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:45 PM

@musicyouneed wrote:

When listing CD's for sale the item specifics always show format as CD-R which is CD-R (Compact Disc-Recordable). They are not CD-R's and I hesitate to use item specifics indicating they are a copy of an original. Any idea why they use that term as it is incorrect.

https://techterms.com/definition/cdr

Hi @musicyouneed - I see what you mean. I would definitely recommend bringing that up with the catalog/Item Specifics team, as it seems like there's a better term they can be using. You can reach them direct at sdsupport@eBay.com.

Including an example screenshot or two will be helpful, as well as what the more effective terminology is, will help them out immensely. Thanks!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:48 PM

From Amazon help pages:

"

A Marketplace Facilitator is defined as a marketplace that contracts with third party sellers to promote their sale of physical property, digital goods, and services through the marketplace. As a result, Amazon is deemed to be a marketplace facilitator for third-party sales facilitated through www.amazon.com.

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. As the marketplace facilitator, Amazon will now be responsible to calculate, collect, remit, and refund state sales tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation is enacted. In certain states, local taxes are not included within Marketplace Facilitator Legislation; Amazon is not responsible for those taxes."

What EBAY is doing is ILLEGAL and, by corollary, is making us do ILLEGAL tax collection and remittance!!!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:50 PM

...it is the MARKETPLACE (ebay, Amazon, etc.) that is responsible for collection and remittance!!!!!!!!!! NOT the third party seller!!!!!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:04 PM

I agree the set up of this USA sales tax on eBay is all wrong!

Personally I don't care that the USA sales tax is being charged.. I am a casual seller and don't sell much anymore on eBay...BUT what I do care about is how that sales tax is handled...

there is no way that tax should be going to my PayPal account. That tax should not be handed off for PayPal to handle through seller's accounts. That is wrong!.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:10 PM

...and ILLEGAL.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:21 PM

Putting the sales tax on the customer's invoice and having her pay everything at once is Good Customer Service to the buyer.

KISS

But I agree that it is Bad Customer Service for eBay to make the seller (who is eBay's customer) pay the Paypal fee for the tax.

The simplest way to deal with this would be for eBay to make a refund of the PP fees, perhaps on our monthly invoice.

Naturally this will involve some fancy programming. But the amounts in aggregate are not small.

This is not a Paypal problem, but should have been considered before programming the passthrough of the tax.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:24 PM

@gwrocen wrote:

Here is a copy of a reply posted in another thread by another poster

re the Sales Tax/PayPal charging Canadian sellers fees process.............................

@dhslk wrote:

Here are a few excerpts from a Canadian tax law website from July 2019 discussing the collection of US sales tax by Canadians (US Sale Tax Guide for Canadians):

"Economic nexus will be based strictly on the volume of sales and/or unit count you sell into the state. There is no ambiguity in the application of the law. From the states’ perspectives, once you cross that threshold, you are obligated to register and comply."

(...in other words, if you sell over a certain $ value or a certain units value in a specific US tax jurisdiction, then collecting sales tax for that jurisdiction is required. In my case, I sell miniscule amounts to any one jurisdiction and DO NOT have an economic nexus anywhere in the US; therefore, US sales taxes should NEVER be in my account---it is EBAY that has the nexus, not me, and ebay is the registered tax collector, not me).

"Am I in trouble if I start collecting sales taxes without a registration?

It is illegal to collect sales tax from customers if you haven’t obtained a sales tax permit/registration number from the state. Please make sure that you register first before you start collecting."

(In other words, EBAY may be causing me to engage in ILLEGAL activity; by putting the tax money into my possession for even a nanosecond, they are opening me, and ALL Canadian small sellers , up to HUGE legal problems for illegal tax collection). PLEASE someone out there who is a lawyer, take this on!!)

The method that ebay was using earlier in the year worked, and was legal. The sales tax was collected and remitted by ebay, as it should legally be.

I am going to alert my MP to this.

My question is............................

What is eBay going to do about fixing this illegal situation

that has been created for all Canadian sellers?

Hi @gwrocen & @dhslk - I'm not able to discuss legalities as I'm not a lawyer.

I can refer you to the User Agreement and the Tax Policy page , but I don't have anything further to provide you as far as resources go. Thanks!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:27 PM

@cumos55 wrote:

A state tax was recently included in a sale to a buyer in New York state.

The total in the Paypal record included ..................

The item price +

Shipping cost +

State tax

= a total for these three numbers

It appeared that Paypal charged their fee on this total of these three numbers

and only after this fee was calculated did eBay collect the State Tax.

As a Canadian seller I am registered to collect GST/HST. the Paypal fee is calculated on a total paid by a buyer, and that total includes GST/HST.

I am not registered to collect the State Tax...... then ...Why is this number showing on my Paypal record?

The amount for State tax should be removed before it shows on my record on Paypal.

It is eBay that collects the State Tax for Canadian sellers.... The business that collects the State Tax should be the business that pays the Paypal fee calculated on the State Tax....

Sellers on eBay, those that are not registered to collect a specific State Tax... should not be charged a fee on this State Tax by Paypal.

---------------------

As a seller on eBay Canada, State taxes will show on an invoice, because a buyer must pay the tax. It is eBay that places that number on the invoice.

The state Tax will show on an invoice.... because the buyer must pay the tax that eBay will collect

However, this State Tax should not show up on my record on Paypal.

If a seller is not registered to collect a specific State Tax, then that tax should not appear on the Transaction record on Paypal.

Hi @cumos55 - thanks for sharing your input on this. The process change was announced in October and emails were sent notifying you of the change, but I agree that there could have been clearer communication on what that would look like for you in your PayPal account. I've made sure to share this with the right teams involved.

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:27 PM

@lotzofuniquegoodies wrote:

Hello Tyler,

Should Canadian buyers be receiving offers from US sellers that DO NOT make available shipping to Canada? Possibly that setting was not considered when the program was designed? Have noted some of those sellers with settings that won't even let you message them to even make a request.

-Lotz

Hi @lotzofuniquegoodies - I don't have any information on that, I'm afraid. I'll see if I can get more detail and will reply to this thread when I get updates!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:27 PM

it is the LEGALITY or lack thereof that is the PROBLEM. Third party sellers CANNOT collect tax unless THEY register in the tax jurisdiction for which they are collecting tax (and they have no need to do so unless they have volume sales there). It is EBAY that is the registered tax collector. It is ILLEGAL for me to be the tax collector.

I may gripe about a few pennies here and there in fees, but that is NOT the BIG PICTURE problem here!! Running afoul of US law IS!!

Re: November 13 2019 Weekly Session

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 02:31 PM

Thanks for joining the chat this week. It's now closed, but I'll be on the boards for the rest of the week. 🙂