- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Australia buyers getting GST added.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 03:38 AM - edited 07-09-2018 03:40 AM

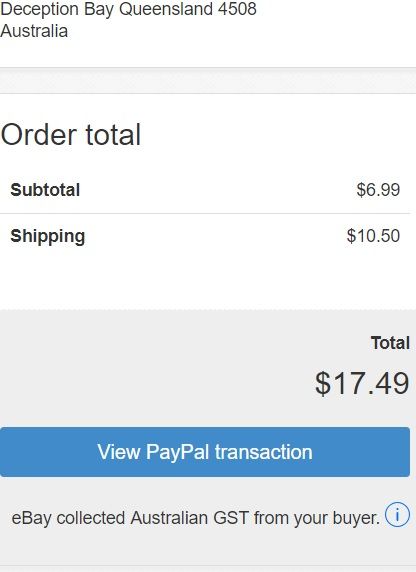

Ebay told us it was coming and this is my first Australian sale since July 1/18. This is how it shows. This buyer has bought from me before in May. I get about 2-3 buyers a month from Australia, so I hope this won't stop them from buying. Does anyone know the 10% rate of GST are they paying it on the item or on the item plus shipping.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 06:49 PM

Thanks, I was responding to the question ric posed before his post was edited to remove that question. That question was about the GST being applied to low-value items as opposed to the $1000 limit that used to exist for it. Hence the link to the announcement.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 06:54 PM

Maybe ebay can settle this for us.

@happy_pigeon: what does an ebay seller need to do with their Australia-bound postage label or Customs form to indicate that GST has been prepaid at the ebay checkout level so that their buyer doesn't need to pay again?

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 07:40 PM

"eBay note: This total includes tax that eBay is required to collect from your buyer. You can view the amount paid to you in the sales record. Learn more"

Be aware the learn more link goes to a page with no useful info. I then looked at the tax info page on ebay. Here is the link - www.ebay.ca/pages/help/account/tax-ov.html

Scroll down the page until you see the section on Australia, it has the info there. Hope this is helpful.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 07:55 PM

Thank you for that link. I wonder how many people will actually click on that Learn More link. I know I didn't click on it when I had the Australian sale because I thought it would just tell me that ebay had collected tax and I already knew that they were doing that.

Perhaps they could include the ADN # etc. in the note...rather than just direct us to a link.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-04-2018 10:54 AM

@momcqueen wrote:

Maybe ebay can settle this for us.

@happy_pigeon: what does an ebay seller need to do with their Australia-bound postage label or Customs form to indicate that GST has been prepaid at the ebay checkout level so that their buyer doesn't need to pay again?

Canadian sellers don't need to take any action at all. If a buyer in Australia views your item, eBay automatically increases the sale price to accommodate the addition of GST, which eBay collects on the seller's behalf and remits to the Australian tax office.

Here's a Seller News Article we released that contains more information:

https://community.ebay.ca/t5/Announcements/Australia-GST-on-low-value-goods/ba-p/403128

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-04-2018 11:09 AM

Like, if I ordered through Global

Shipping Program, there would be special paperwork attached to my clearance to show my fees were paid on purchase.

How does Customs know this is the case for buyers in this example?

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2018 01:51 AM

At the following link it states that we should be adding ebays ABN number to the label but that isn’t mentioned in your announcement, Do we have to add that info to our labels? If so, that info should be added to the note we receive from eBay when we have a sale to Australia. Very few people are ever going to see it on the tax page.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2018 08:44 AM

@pjcdn2005 wrote:

At the following link it states that we should be adding ebays ABN number to the label but that isn’t mentioned in your announcement, Do we have to add that info to our labels? If so, that info should be added to the note we receive from eBay when we have a sale to Australia. Very few people are ever going to see it on the tax page.

https://www.ebay.ca/pages/help/account/tax-ov.html

That information should now be included with the seller's shipping information (see the last bullet), so it shouldn't require any extra steps for the seller.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2018 09:23 AM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2018 09:36 AM - edited 09-05-2018 09:44 AM

@happy_pigeon wrote:

@pjcdn2005 wrote:

At the following link it states that we should be adding ebays ABN number to the label but that isn’t mentioned in your announcement, Do we have to add that info to our labels? If so, that info should be added to the note we receive from eBay when we have a sale to Australia. Very few people are ever going to see it on the tax page.

https://www.ebay.ca/pages/help/account/tax-ov.html

That information should now be included with the seller's shipping information (see the last bullet), so it shouldn't require any extra steps for the seller.

@happy_pigeon Do you mean when the label is printed? Not everyone prints labels on Shippo or PayPal and a lot of sellers mail using stamps. Please explain further. Thanks!

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2018 04:48 PM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-06-2018 08:54 AM

@vintagenorth wrote:

@happy_pigeon wrote:

@pjcdn2005 wrote:

At the following link it states that we should be adding ebays ABN number to the label but that isn’t mentioned in your announcement, Do we have to add that info to our labels? If so, that info should be added to the note we receive from eBay when we have a sale to Australia. Very few people are ever going to see it on the tax page.

https://www.ebay.ca/pages/help/account/tax-ov.html

That information should now be included with the seller's shipping information (see the last bullet), so it shouldn't require any extra steps for the seller.

@happy_pigeon Do you mean when the label is printed? Not everyone prints labels on Shippo or PayPal and a lot of sellers mail using stamps. Please explain further. Thanks!

It's only there for business sellers, in case they need it. From the Australian Seller Centre:

I have a Business but I only use eBay to buy or sell privately, do I need to fill in the number?

You should only fill out the number if you are using your eBay account for your business. If you only use your eBay account to buy or sell personally, you should not register your ABN with us. You will need to pay the GST on your fees.

If you are a private seller, you do not need to take any action at all when selling to Australian buyers. If you are a business seller, you should consult with a tax professional.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-06-2018 10:19 AM - edited 09-06-2018 10:20 AM

I may be wrong but I do not think this applies to us at all. This looks to be from the perspective of an Australian buyer/seller.

We're Canadian (international) sellers exporting to Australia, we need to know if we need to put eBay's info on our customs forms to Australia noting that their taxes have been paid so the Australian buyers don't get dinged for taxes 2 times.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-06-2018 06:12 PM

I agree. That page is for Australian sellers and it is about paying gst on their fees. It has nothing to do with the question that is being asked.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-06-2018 06:12 PM

@happy_pigeon wrote:

@pjcdn2005 wrote:@

At the following link it states that we should be adding ebays ABN number to the label but that isn’t mentioned in your announcement, Do we have to add that info to our labels? If so, that info should be added to the note we receive from eBay when we have a sale to Australia. Very few people are ever going to see it on the tax page.

https://www.ebay.ca/pages/help/account/tax-ov.html

That information should now be included with the seller's shipping information (see the last bullet), so it shouldn't require any extra steps for the seller.

I'm not sure what you mean by that and not sure what last bullet you are referring to. Are you saying that ebay's ABN is now included and if so where is it included? On Shippo labels? On the little blurb that explains that you charged gst to an Australian buyer? or?

Sorry not trying to be difficult here but I'm confused. 🙂

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2018 08:06 AM

I'm not sure what else I can say, my friends...

If you're a non-business seller, you don't need to take any action. Treat an Australian buyer as you would a Canadian buyer.

If you're a business seller who frequently sells to Australia and/or keeps inventory there, eBay recommends that you speak to a tax professional.

That's the long and short of it.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2018 08:23 AM

I think you may have misunderstood our comments.

Whilst that information that was posted was intended for Australian readers, it still doesn't answer the question for us.

Generally those of us reading here are in business.

Contacting a tax professional here (Canada) or there (Australia) isn't going to identify for us if we have to put the ABN etc on the customs forms when we are a Canadian seller sending a package to Australia.

That's all we need to know.....

Personally for safety sake, until I know for sure, I'm manually putting the ABN etc on the customs form. It can't hurt.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2018 08:29 AM

Hmm I read back through the items and I've answered my own question.

We do have to include the ABN and Code:Paid on the package somewhere, on the customs form or elsewhere.

Here's the text with the answer:

Australia

Goods and Services Tax (GST) applies to goods imported by consumers into Australia.

Orders up to AU $1,000

From July 1, 2018, if an item is located outside Australia and the buyer selects a shipping address in Australia, eBay will add GST to the order total at checkout. You'll receive payment for the order value (item price + shipping costs) as usual, and eBay remits the GST portion to the Australian Taxation Office (ATO).

You'll need to ensure that you include eBay's ABN number and the customs code on the package:

eBay's ABN Number: 64 652 016 681

Code: PAID

Later in 2018, this information will be included with the buyer's shipping address.

Orders over AU $1,000

We don't collect GST on orders over AU $1,000, as this is generally collected at the Australian border.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2018 07:01 PM

I do all my online labels through paypal and don't think there is any way to add this info to the customs form.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2018 07:29 PM

I did see that info earlier but my concern was that if we were supposed to post the ABN on the label, ebay should have included that in the original announcement and also include it with the note they send stating that they charged the Australian buyer gst. Few sellers are going to go to that help/tax page so they won’t realize they should be adding that ABN to the label.

Anyway.....I did receive happy feedback from my recent Aus. buyer and I don’t think there were any problems with her parcel even though I didn’t add any gst info to the label.