- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Australia buyers getting GST added.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 03:38 AM - edited 07-09-2018 03:40 AM

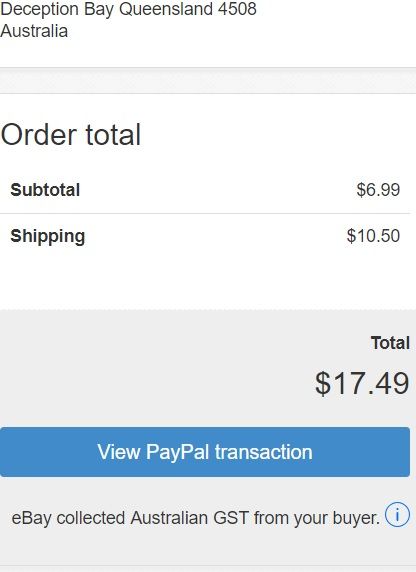

Ebay told us it was coming and this is my first Australian sale since July 1/18. This is how it shows. This buyer has bought from me before in May. I get about 2-3 buyers a month from Australia, so I hope this won't stop them from buying. Does anyone know the 10% rate of GST are they paying it on the item or on the item plus shipping.

- « Previous

- Next »

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 07:35 PM

I thought I read somewhere in my earlier perusing of the background info that the whole purpose of having the ebay etc vendors collecting the tax was that the Australian customs only had to worry about the big over $1,000 stuff, everything else was assumed to have been collected when it came through customs.

That's why I was surprised when it came out that we're supposed to be putting it on the under $1,000 packages.

I can't re-find that information so perhaps I'm misremembering......

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 07:52 PM

Yes, I recall reading something like that too but couldn't find it when I looked the other day so didn't want to tell people that unless I could confirm it. If I find it again, I'll post it.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 08:05 PM

@ricarmic wrote:I thought I read somewhere in my earlier perusing of the background info that the whole purpose of having the ebay etc vendors collecting the tax was that the Australian customs only had to worry about the big over $1,000 stuff, everything else was assumed to have been collected when it came through customs.

That's why I was surprised when it came out that we're supposed to be putting it on the under $1,000 packages.

I can't re-find that information so perhaps I'm misremembering......

For goods under $1000, GST is charged at the time of supply, not importation. The responsibility to collect is based on the threshold the government there have set (I think It was $75k into AU). As the supplier Ebay has to collect and remit GST at the time of the purchase, but otherwise that product will just move into Australia unhindered if it declared as under $1000.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 09:04 PM

@hlmacdon wrote:For goods under $1000, GST is charged at the time of supply, not importation. The responsibility to collect is based on the threshold the government there have set (I think It was $75k into AU). As the supplier Ebay has to collect and remit GST at the time of the purchase, but otherwise that product will just move into Australia unhindered if it declared as under $1000.

Therefore, there is no need to write ebay's ABN on the label...right? They are not going to assess package's that are declared under $1000 so people aren't going to be charged twice if there is no 'proof' that gst was already charged.. Does that sum it up correctly?

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 09:39 PM

@pjcdn2005 wrote:

Therefore, there is no need to write ebay's ABN on the label...right? They are not going to assess package's that are declared under $1000 so people aren't going to be charged twice if there is no 'proof' that gst was already charged.. Does that sum it up correctly?

If by some stroke of good fortune it was over AUD 1000 I would include that information on the label along with a copy of the invoice if it shows the GST paid (I haven't had an AU order since the change so I'm not sure how it appears on our side versus the buyers order detail/invoice). Otherwise I would not see it as necessary as long as you declare the goods with the appropriate description, HS code, and value. They are not assessing goods under AUD 1000 so there is no potential for a double taxation issue unless for whatever reason the agent decided to reassess the value of an item that was close to that limit and they though the declaration to be inaccurate.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 10:24 PM

If you use Shippo its a straightforward process. The tax showed up on the packing slip as a separate line. Technically a copy of that should be attached with the customs form where you filled out with the HS number and country of manufacture for the item along with the paid value. I marked the required information in an open field on that form. Shipment arrived no issues. If you use the Canadapost mailing tools you would have those options also. When dealing with customs always best to fill in all the blanks. That way you are covered and less chance for a delay. Paypal is basically bypassing this step if they are using an all in one shipping label/customs form.

-CM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-10-2018 11:30 PM

Actually, if it was over $1000 then eBay is not supposed to charge gst. Australian customs would process the parcel. I’m fairly sure though that I will never have to worry about that.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-12-2018 10:36 PM

Question: I am sending a CD to Australia though Chit Chat. Do I need to do anything differently?

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-12-2018 11:30 PM

I don’t really know for sure. When you do the label check to see if ebay is already adding their ABN to the label. If not, you could write it in yourself or just not worry about it and do nothing. My buyer last month didn’t have a problem with her parcel and I didn’t do anything extra. But it’s up to you...imo either way would be fine.

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2019 06:27 PM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2019 06:38 PM

Not sure of the easiest way with Paypal but with Shippo I just open up the customs invoice and add in the details...the required #, the amount paid. I believe it was shown on the last packing slip when I went to send an order to Australia. I always include 3 copies of the shipment label, the customs invoice and packing slip in the pouch. You can highlight that info if you want it to stick out better. And it never hurts to include a packing slip inside the box and mark Customers Copy so customs will leave for customer if they do choose to inspect. Not all Aussie customers may actually be aware of the charge or for that matter even notice it.

-Lotz

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2019 10:50 PM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2019 02:44 AM

As I understand it every item purchased by Aussies from foreign sellers IS taxed since last Summer. Anyway I printed the number from the ebay page and taped it onto the package next to the customs form.

As I said in my last post - WOULDN'T IT BE GREAT IF SOMEONE THAT WORKS FOR EBAY ACTUALLY TOLD US WHAT WE SHOULD ACTUALLY ATTACH TO AUSTRALIAN PACKAGES. IS ANYONE FROM EBAY OUT THERE???

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2019 02:49 AM

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2019 08:54 AM - edited 03-02-2019 08:55 AM

I understand things the same as PJ customs doesn't "care" about the taxes aspect of anything under $1k anymore, so doing nothing is probably aok.

Because I sell on multiple sites and this one is the only one I know of so far collecting the taxes, for safety sake, I put the eBay ABN and Code: PAID on the customs form (remember I am a stamps on the box kinda guy).

For certain my postmaster tells me I'm the only one doing that here... (but remember I live in a wee village, there are only 5 or 6 of us eBay sellers here)

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2019 03:50 PM

@forester_studios wrote:

The tax was collected and paid by ebay and there was a tax number in the orders detail page as I stated in my post above. Please read it again.

As I understand it every item purchased by Aussies from foreign sellers IS taxed since last Summer. Anyway I printed the number from the ebay page and taped it onto the package next to the customs form.

As I said in my last post - WOULDN'T IT BE GREAT IF SOMEONE THAT WORKS FOR EBAY ACTUALLY TOLD US WHAT WE SHOULD ACTUALLY ATTACH TO AUSTRALIAN PACKAGES. IS ANYONE FROM EBAY OUT THERE???

I realize that there was a mention of adding ebays tax number to the label but I think that would be necessary only if Australian customs needed to know whether tax had been paid so that they knew whether or not to collect it on their end. Before the law changed there was no tax due on international parcels valued at under A$1000. The change in the law requires businesses/sites who sell large amounts(A$75,000+) to Australia to collect gst for purchases under $1000. They didn’t want to start having to collect gst on smaller purchases at the border so if the purchase hasn’t already had gst paid on it, there is no gst collected at the border so I can’t see them checking each parcel for a tax number. Customers aren’t going to be charged gst twice if we don’t put it on.

GST on low value imported goods

As of 1 July 2018, GST will apply to retail sales of low value goods (A$1,000 or less) to Australia, when purchased by consumers. For low value goods, GST is collected through the sale, instead of at the border.

- « Previous

- Next »

- « Previous

- Next »