- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: How to find total sales for taxes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 08:22 AM

It used to be easy to find this, I am sure there is somewhere to find this. Any help will be greatly appreciated.

Solved! Go to Solution.

Accepted Solutions

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 04:40 PM

Try under sellers Hub to go to "Sales", while there use drop down menu and chose "Last Year" as option.

Make sure you click the blue "Generate Report" button or it won't calculate the custom info (last year).

I just tried and mine shows that way. Should show Sales/Tax Collected by eBay/Selling Costs (if you use eBay labels or other eBay fees) and then Net. Try that way see if it works.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 01:08 PM

In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 02:27 PM

@flipistics wrote:In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

If a sale is either partially or fully refunded does any applicable tax paid also get refunded? The refund email details do not clearly express this anywhere. There is no way to correct the packingslip or the customs form accurately. From a buyers perspective if they were charged tax....provincial/state/VAT type they would need to know they were charged correctly. Same thing goes for when fees and taxes are charged to the seller. Again, actual proof of what happens is nowhere to be found in help.

-Lotz

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 03:28 PM

I can't make that work. I put is "custom' and the dated Jan 1st to Dec 31st but I just get $65, I know that is not correct. I am hoping that there is an easier way to find a total for 2023.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 04:24 PM

@lotzofuniquegoodies wrote:

@flipistics wrote:In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

If a sale is either partially or fully refunded does any applicable tax paid also get refunded? The refund email details do not clearly express this anywhere. There is no way to correct the packingslip or the customs form accurately. From a buyers perspective if they were charged tax....provincial/state/VAT type they would need to know they were charged correctly. Same thing goes for when fees and taxes are charged to the seller. Again, actual proof of what happens is nowhere to be found in help.

-Lotz

If you issue a partial refund the buyer will also receive a refund of the appropriate amount of tax be it GST, HST, PST, VAT or US State Sales Tax.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 04:40 PM

Try under sellers Hub to go to "Sales", while there use drop down menu and chose "Last Year" as option.

Make sure you click the blue "Generate Report" button or it won't calculate the custom info (last year).

I just tried and mine shows that way. Should show Sales/Tax Collected by eBay/Selling Costs (if you use eBay labels or other eBay fees) and then Net. Try that way see if it works.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-01-2024 06:10 PM

@lotzofuniquegoodies wrote:

@flipistics wrote:In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

If a sale is either partially or fully refunded does any applicable tax paid also get refunded? The refund email details do not clearly express this anywhere. There is no way to correct the packingslip or the customs form accurately. From a buyers perspective if they were charged tax....provincial/state/VAT type they would need to know they were charged correctly. Same thing goes for when fees and taxes are charged to the seller. Again, actual proof of what happens is nowhere to be found in help.

-Lotz

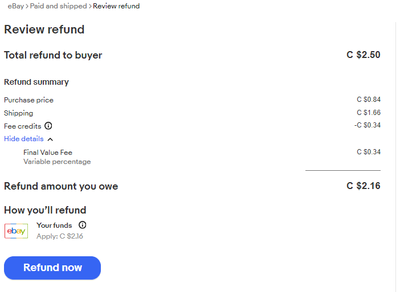

I always send any partial refund before printing the packing slip or label. Yes, the buyer is refunded the tax they paid on the portion of the refund. I think the refund confirmation screen breaks it down, but I don't think the buyer sees the full breakdown.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2024 09:57 AM

Thank you so much, that is just what I needed. I am older and although I am doing well with eBay generally (no mistakes), learning new things is getting harder. So glad I can find help here.

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2024 04:24 PM

Glad to have helped!

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2024 05:18 PM

@flipistics wrote:

@lotzofuniquegoodies wrote:

@flipistics wrote:In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

If a sale is either partially or fully refunded does any applicable tax paid also get refunded? The refund email details do not clearly express this anywhere. There is no way to correct the packingslip or the customs form accurately. From a buyers perspective if they were charged tax....provincial/state/VAT type they would need to know they were charged correctly. Same thing goes for when fees and taxes are charged to the seller. Again, actual proof of what happens is nowhere to be found in help.

-Lotz

I always send any partial refund before printing the packing slip or label. Yes, the buyer is refunded the tax they paid on the portion of the refund. I think the refund confirmation screen breaks it down, but I don't think the buyer sees the full breakdown.

I think for the majority of sellers...they send a refund after they process the label. Or often it comes up after the fact. Special agreements. This is what displayed for a recent 1 I sent. No mention of tax. Same if you check the your payments details. For transparency it should be included with payments AND refunds. If it was a large amount it would directly affect VAT paid and collected for international shipments. This would make customs documents inaccurate. (Again if it is done after creating label but before posting.)

-Lotz

Re: How to find total sales for taxes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2024 11:11 AM

@lotzofuniquegoodies wrote:

@flipistics wrote:

In the Seller Hub go to Payments -> Reports. You can generate the transaction reports, financial statements, and tax invoices there.

If a sale is either partially or fully refunded does any applicable tax paid also get refunded? The refund email details do not clearly express this anywhere. There is no way to correct the packingslip or the customs form accurately. From a buyers perspective if they were charged tax....provincial/state/VAT type they would need to know they were charged correctly. Same thing goes for when fees and taxes are charged to the seller. Again, actual proof of what happens is nowhere to be found in help.

-Lotz

Hi @lotzofuniquegoodies! When a seller issues a partial refund on eBay, the buyer receives the partial refud and a partial sales tax refund in the same portion. For example, if a seller issues a refund for one third the value of the item, the buyer will also be refunded one third the sales tax.