- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: Sales Tax Table not applying, any ideas?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-27-2021 04:33 PM

First off before anyone asks. YES! I am required to collect Sales Tax, thank you!

So let me just say I have contacted customer support multiple times, they have "opened tickets", but the issue is still not resolved. I am getting no where with them.

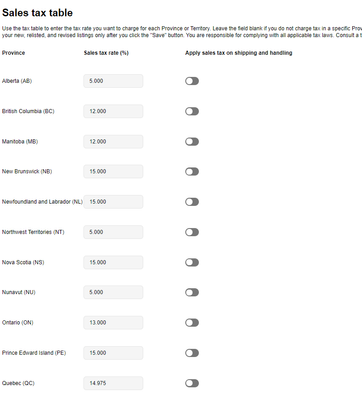

So I set up my Sales Tax table over a month ago, Ebay customer support has verified it is set up. I have added my "VAT" Gst number.

All my listings have been closed down for a vacation and reopened since. I have added many new items. No sales tax. Yes I have verified with sold listings, no sales tax for Canadian sales.

Before recently I was only selling small items on ebay and I was paying the tax out of pocket, but recently I have been selling $1k cards on the weekends, and the taxes are a big chunk of change, so I wanted to collect it from the buyer. (yes I know this will effect my sales).

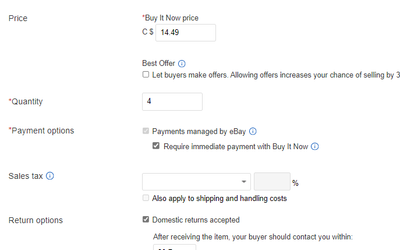

I have attached what I see on my listings. I do not have the option of applying the sales table, only making individual province percentages. I have tried different browsers, changed out the options on the listing page, redid my sales tax table, everything I can possibly think of.

I honestly have given up on Ebay fixing it. After the first ticket to "fix" it, I talked to them and they said the ticket was never created. After multiple contacts, I now have a ticket in the system, but they haven't fixed the problem. Each weekend they delay is costing me hundreds in sales tax out of pocket.

Does anyone see something simple I am missing to fix this problem?

Solved! Go to Solution.

Accepted Solutions

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-15-2021 03:36 PM

@beavosorus - I got told yesterday that this should be resolved now. Would you mind having a look and letting me know?

Thanks,

Tyler

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-27-2021 04:33 PM

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-27-2021 09:50 PM - edited 08-27-2021 09:52 PM

My listing page looks different then yours, might be the problem? My tax works fine. I think ebay has an advanced and a basic listing form if I recall correctly but this is the form I have used for years

I attached a photo (its called 1 below the "add tags" on my post kinda hard to see)

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-28-2021 09:59 AM - edited 08-28-2021 10:01 AM

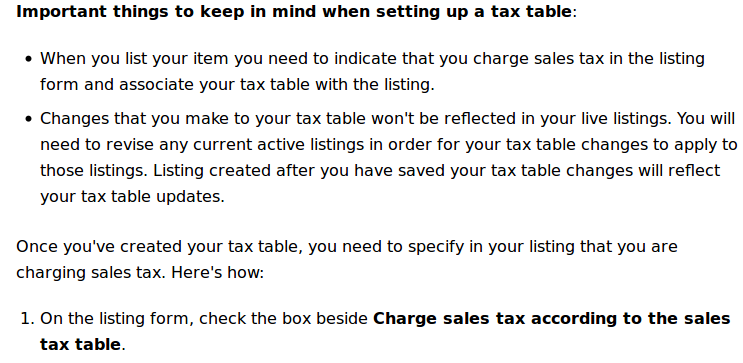

You are saying you have no option to apply your sales tax table when editing/creating a listing?

From: https://www.ebay.ca/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-28-2021 02:23 PM

I have been using the "Advanced Listing" page. Yours definately is different from mine. That pull down just lists the individual provinces and requires me to pick "ONE" and apply the rate that I enter.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-28-2021 02:26 PM

You are correct, I don't even have the option. My sales table has been set up this whole time.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-28-2021 04:03 PM

I'm not sure what the problem is but I did notice on your tax rates that you shouldn't be charging pst unless you have registered with each of those provinces to collect and submit tax for them. You're in Ontario so you would collect hst and gst in all provinces but shouldn't be collecting pst in Sask., Man., BC etc unless you have a physical presence there.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-28-2021 06:49 PM

I am registered in all 4 PST provinces. From my research, even if you are not in the province if you are selling to people located in the province (and you meet certain thresholds) you need to collect and remit it.

Businesses Located Outside B.C. but Within Canada

You must register to collect and remit PST if you are located outside B.C. (see Location of Your

Business below) but within Canada and do all of the following in the ordinary course of your

business:

Sell taxable goods to customers in B.C.

Accept orders from customers located in B.C. (including by telephone, mail, email or

Internet) to purchase goods

Deliver the goods you sell to your B.C. customers to locations in B.C. (this includes goods

you deliver through a third party, such as a courier)

Solicit persons in B.C. (through advertising or other means, including mail, email, fax,

newspaper or the Internet) for orders to purchase goods

Registering to Collect PST (gov.bc.ca)

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2021 02:41 AM

https://www.thebalancesmb.com/does-your-business-need-to-register-for-bc-pst-2948446

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2021 02:52 AM

I doubt that most sellers here 'solicit' as described in the last criteria and the provincial tax needs to be collected only if the seller does all 4. It's my understanding that by listing here we aren't directly soliciting buyers in those provinces although I'm not a tax accountant or an expert so I could be wrong. If you meet all the requirements and have registered to collect then of course you are in a different situation than many others.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2021 09:20 AM - edited 08-29-2021 09:31 AM

Your link is from 2019, BC changed the sales tax rules for sellers outside BC as of April 2021. Threshold is $10000 in taxable sales to BC.

https://home.kpmg/ca/en/home/insights/2021/03/businesses-face-new-bc-pst-rules-on-april-1-2021.html

https://www2.gov.bc.ca/gov/content/taxes/tax-changes/whats-new/sales-taxes

Now back to the OP's ebay sales tax collection problem...

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2021 01:30 PM - edited 08-29-2021 01:35 PM

@ypdc_dennis wrote:Your link is from 2019, BC changed the sales tax rules for sellers outside BC as of April 2021. Threshold is $10000 in taxable sales to BC.

Yes, but my point was about how "soliciting business" from British Columbia is defined, as @pjcdn2005 elaborated on in the following post. I don't believe that definition has changed.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-29-2021 09:39 PM

Have you inputted your "VAT Number"?

Selling Preferences page

Your Buyers>Buyers Can See Your VAT number

you should have your Canada Revenue Agency Business number there.

A shot in the dark but if your # is not there that maybe why eBay doesn't register you as a tax collector.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-30-2021 11:01 AM - edited 08-30-2021 11:02 AM

Yes I gave it a shot a few days ago no luck.

But I think I "may" have found a "possible" problem. When I created my account 20 years ago I was in the US. Of course when I moved up here 10 years ago I updated all my addresses etc, and I have been selling with no problems on .ca since then.

On a whim, I decided to ask Ebay where my account is registered. Even though all my addresses are Canadian and I have my Canadian SIN in the system, their system still lists me as in US. I see nothing of this on my end that says this. I am having them fix this for me in hopes that it corrects the problem.

Of course, Ebay still hasn't fixed it my Sales Tax problem, or even contacted me as asked, updating me on the ticket status.

I am crossing my fingers *:D*

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-30-2021 02:06 PM

Hi @beavosorus - CS cannot change your site registration, and shouldn't (it could break your connection with eBay-managed payments and leave your account unable to receive payouts. It's been a nightmare).

Your sales tax table shouldn't follow your site registration, but rather the site you are currently logged into - so when you're logged into eBay.ca, your Canadian sales tax table should be what's listed in your preferences.

I'm looking into this further, but there are a few things that will help me:

Will you get me an example item number? You have a lot listed already but specifically I'm looking for an item that is Fixed Price and not near its renewal date.

When was the last time you edited or changed the tax table? Will you try re-saving them once more?

Thanks,

Tyler

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-30-2021 05:08 PM

Hello Tyler,

So here is a newer listing. Hitmonlee Series 1 Pokemon Marble Bag Set Collector Pouch *NEW SEALED* | eBay

I have "resaved" the tax table a few times already, but I gave it another save today. I did look at editing this item prior to this post and I still do not have the option to apply the tax table.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-30-2021 06:27 PM

Thanks so much @beavosorus - I'm heading home for the day soon, but one last thing to try tonight if you don't mind.

Would you go through and process a revision on the Collector pouch you shared? Just trying to check all the boxes before I send this to the tech team.

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-30-2021 06:39 PM

I gave it one more shot, no luck 😞

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-31-2021 11:36 AM

Thanks again @beavosorus - the good news is that all our base-checking paid off!

The (semi)bad news is that the product team reviewed and confirmed this is a tech issue, and are working on a fix. They haven't given me an estimated time of resolution, but it seems like it's a large enough issue that it's getting a lot of attention. I hope that we'll see it corrected quickly.

Thanks!

Re: Sales Tax Table not applying, any ideas?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-31-2021 12:00 PM

Thank you for working on this for me 🙂

I feel a lot more confident that it will be corrected now.

Thanks again!