- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: US State Tax Paid by Foreign Buyers is a “Wind...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-08-2020 09:59 AM

"Please note the applicable tax will continue to be paid by the US buyer

- « Previous

-

- 1

- 2

- Next »

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-10-2020 03:28 PM

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 11:22 AM - edited 02-14-2020 11:23 AM

tyler@ebay wrote:Hi @gwrocen - not sure if you saw the reply to this question that you asked in last week's chat, but I addressed it here if you'd like to review. Thanks!

Just a couple of comments...................................

Thank you for your response but I don’t think you answered the question. If you don’t have the answer, who at eBay does?

Hi @gwrocen - as a designated marketplace facilitator, we're required to charge US sales tax to buyers in the states that mandated it.

No one ever said that eBay should not charge and collect the tax. What has been said is that eBay should not use sellers’ personal, private PayPal accounts to do it and force sellers worldwide to pay fees on the tax amounts collected for American States funneled through sellers’ PayPal accounts.

While PayPal charges a fee to process the total amount you receive, we do not charge you fees to collect or remit the taxes on your buyer's behalf.

I do not like the intimation in that statement. Is eBay planning to levy another fee on worldwide sellers because of eBay’s requirement to collect the state taxes?

So why should any seller such as myself, be charged a fee on a tax which by LAW, I, as a Canadian, am not required to collect or remit on behalf of any buyer to an American state? There is no sales tax obligation for me since I have not established nexus in any state. I do not sell enough into any state to exceed their threshold. I do not have a registered tax number for any state.

The taxes are not being collected or remitted for me on my buyer’s behalf. You have explicitly stated the reason in the first line above in your response to my question: “..as a designated marketplace facilitator, we're (i.e. eBay) required to charge US sales tax to buyers in the states that mandated it”.

eBay is the one required to collect that tax – not someone in Canada or any other country.

Thanks.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 02:09 PM

@gwrocen wrote:No one ever said that eBay should not charge and collect the tax. What has been said is that eBay should not use sellers’ personal, private PayPal accounts to do it and force sellers worldwide to pay fees on the tax amounts collected for American States funneled through sellers’ PayPal accounts.

Which begs the question: If PayPal accounts are personal and private, why is PayPal allowing eBay to do this?

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 03:00 PM

[1.] If you don’t have the answer, who at eBay does?

"While PayPal charges a fee to process the total amount you receive, we do not charge you fees to collect or remit the taxes on your buyer's behalf."

I do not like the intimation in that statement. [2.] Is eBay planning to levy another fee on worldwide sellers because of eBay’s requirement to collect the state taxes?

[3.] So why should any seller such as myself, be charged a fee on a tax which by LAW, I, as a Canadian, am not required to collect or remit on behalf of any buyer to an American state? There is no sales tax obligation for me since I have not established nexus in any state. I do not sell enough into any state to exceed their threshold. I do not have a registered tax number for any state.

-Quote edited for brevity, bracketed numbers added for ease of reference-

Hi @gwrocen - I'm not certain how much more clarity I can provide on this subject, but I'll give it a go.

[1.] The justification for this change was to reduce buyer confusion in avoiding splitting their PayPal transaction into two, regardless of the seller's location. If you use the eBay Marketplace (nexus) to facilitate a sale to a buyer in a marketplace facilitator (nexus) state, you will see US sales tax applied to the buyer's purchase and sent through your PayPal account.

[2.] No

[3.] By using the eBay Marketplace to make a sale you are participating in a financial nexus. While you may not have a physical presence within the state, and may not have sales that meet the threshold requirements as set by that state, eBay does. That's actually the whole reason these states made the law focused on Marketplace Facilitators as opposed to individual sellers. Your utilization of our platform means your buyers will have tax assessed where applicable.

As to why you should pay a fee? I can only direct you to PayPal for assistance with that justification, since eBay is not charging you the fee to process that amount. Again, I realize that for you this is splitting hairs, and that your larger argument is that this is not something that you should see at all. I do not have a response to that other than the ones I have provided previously.

Ultimately, it seems like we're at an impasse, because the information I have available to provide hasn't been sufficient for you. While I am happy to answer questions and be a reference point for anyone on the boards, I may no longer reply to further questions along these lines.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 03:18 PM

Can I simplify that?

Paypal is not eBay.

EBay is not Paypal.

I object to eBay setting up the collection of American taxes in such a way that the seller who never touches that money is liable for Paypal fees on them.

EBay, ethically, should be writing a program that will subtract the amount of Paypal fees paid by sellers on the fees that are included in the buyer's payment as part of our monthly billing.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 03:44 PM - edited 02-14-2020 03:46 PM

@marnotom! wrote:

@gwrocen wrote:No one ever said that eBay should not charge and collect the tax. What has been said is that eBay should not use sellers’ personal, private PayPal accounts to do it and force sellers worldwide to pay fees on the tax amounts collected for American States funneled through sellers’ PayPal accounts.

Which begs the question: If PayPal accounts are personal and private, why is PayPal allowing eBay to do this?

PayPal is allowing to eBay to do this because PayPal has no clue what is going on.

I tried to get PayPal to tell me why PayPal was allowing eBay access to my private personal account to collect those state tax payments.

I sent more than a dozen messages to PayPal on their website and got more than a dozen different explanations from PayPal customer service. These were not explanations but excuses saying everything from "that is not a tax but an eBay fee for allowing us to use eBay's platform`` to “it’s all eBay’s fault. Get in touch with eBay”.

I even phoned PayPal Customer Service and asked them about this.

The gist of their verbal response was “we can’t stop letting eBay use your account

because of the way eBay has set this up. You will have to contact eBay”.

I asked them to block eBay from using my account and they said that they could not do that.

https://en.wikipedia.org/wiki/PayPal

“Although PayPal is not classified as a bank, the company is subject to some of the rules

and regulations governing the financial industry including Regulation E consumer protections

and the USA PATRIOT Act”.

PayPal therefore is somewhat the the equivalent of a “financial institution”.

I wonder if RBC or Scotia Bank or Bank of Montreal would allow someone to walk in off the street and help themselves to using MY ACCOUNT.

Check out another post I made about PayPal`s response.

See message 30.........

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 06:39 PM

Hello Tyler,

Most of the frustration was caused by the original announcement dated Oct 1,2019

https://community.ebay.ca/t5/Announcements/US-Internet-Sales-Tax/ba-p/428022

Please note the applicable tax will continue to be paid by the buyer and as a Canadian seller, you will not need to take any action.

Nowhere did it state there was going to be a fee attached to this at the backend. Possibly thinking sellers would not notice? Hmmm!!! if this was addressed properly from the get go it may have reduced all this ongoing back and forth.

As far as I know a Brick & Mortar store does not charge a fee to collect Provincial or State taxes. Maybe mute. Maybe not. Usually those are the costs of doing business.

The next concern is how its displayed in Sellers Hub and on the various forms. In Hub Sales Tax & Shipping should be separate totals. They are not revenue for eBay sellers. Only for eBay. Shipping in the past was a separate column. Suddenly it changed. Seller's Hub is supposed to be a tool for the use of sellers.

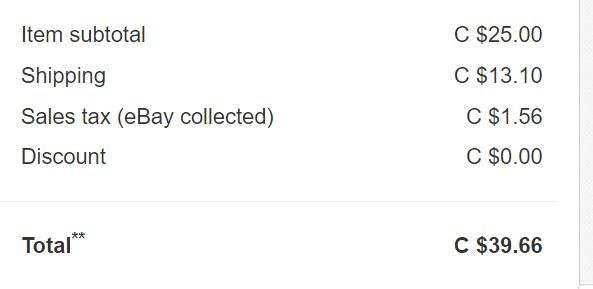

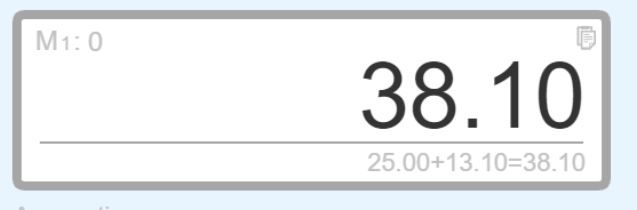

When it comes to each area displays the numbers in different formats. View Record shows Tax as part of the total. When you check packing slip suddenly the tax line is missing . As per my example the total is incorrect as per eBay math. Refer to the Shippo packslip and the tax is included as part of the final but omitted as a line item. In the normal scheme of things(Real World Environments) Sales Tax should show with the State it is being applied to along with the % being used. Important information for both the seller and buyer. As others have mentioned there are products that are exempt or have lower rates. Information available on State websites which eBay should have access to. Are those rates even being applied?

Regarding the suggestion, please call PayPal, as others have noted you will receive a variety of answers depending on who and when you call or that doesn't sound right. May vary depending on when you originally called. Quite often, "You should check with eBay on that." Another fine example of passing the buck. eBay & PayPal knew the whole story from the beginning. That was never the explanation we were given.

See recent transaction screenshots attached.

A = B or C(D for PayPal) We need to be able to depend on the numbers presented by eBay and not need an accountant at the ready. There also should be no need to download a special report.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 06:49 PM

Add on to previous.

The other reason it's important that the math is correct and consistent, for certain countries for customs a Packing slip is required. All totals should match or processing could be delayed. A seller shouldn't need to manually update and customs could question if you did.

-Lotz

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 07:03 PM

Thanks for sharing this input @lotzofuniquegoodies - the Seller Hub 'download report' link on the Orders page is the best place for a single read out of your orders. I recommend downloading it quarterly, just to keep for your records.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 07:40 PM

Nowhere did it state there was going to be a fee attached to this at the backend.

And from eBay's end there are no fees.

EBay is not Paypal

Paypal is not eBay.

This is a question of business ethics. Technically neither eBay nor Paypal has done anything illegal.

Paypal charges fees for processing any payments.

EBay is not charging us those fees.

Shoulda, coulda, woulda-> didn't.

Ethically, eBay should be paying us back for the Paypal fee, since it is to their benefit that our Paypal invoice shows that tax payment, however briefly.

It would be interesting to know if eBay's own Managed Payments service is charging those sellers enrolled in it a fee on the Internet Sales Taxes.

And since Paypal will be some part of the MP service, I believe, how will MP handle the PP charges on payments through eBay's service.

Personally I blame Carl Icahn.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 07:47 PM

Hi @reallynicestamps - the process change announced in October did not impact managed payment sellers, and have not changed even when PayPal was added as a payment method for buyers last year.

Thanks!

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 07:50 PM

So sellers using Managed Payments are not charged -- by MP or PP-- a fee for processing the Internet Sales Taxes?

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 07:56 PM

I rely on the packing slip form being correct. Those are the 2 methods available for me.That is what I include with my orders to customers because I ship to businesses in many situations. Downloading a report does not solve that problem. That was only 1 example. How many more are "wrong"for myself and others?

-Lotz

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2020 08:04 PM

@reallynicestamps wrote:

So sellers using Managed Payments are not charged -- by MP or PP-- a fee for processing the Internet Sales Taxes?

Hi @reallynicestamps - Sellers participating in managed payments receive funds a single way (via managed payments). That's regardless of how their buyers choose to pay (credit card, paypal, Apple Pay, etc). There is no processing fee for US sales tax in managed payments.

Re: US State Tax Paid by Foreign Buyers is a “Windfall” for American States and eBay!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2020 12:58 AM

@gwrocen wrote:PayPal is allowing to eBay to do this because PayPal has no clue what is going on.

I tried to get PayPal to tell me why PayPal was allowing eBay access to my private personal account to collect those state tax payments.

I sent more than a dozen messages to PayPal on their website and got more than a dozen different explanations from PayPal customer service. These were not explanations but excuses saying everything from "that is not a tax but an eBay fee for allowing us to use eBay's platform`` to “it’s all eBay’s fault. Get in touch with eBay”.

I even phoned PayPal Customer Service and asked them about this.

The gist of their verbal response was “we can’t stop letting eBay use your account

because of the way eBay has set this up. You will have to contact eBay”.

Although they are important, customer service reps do not a company make. From your experiences, I would conclude that the higher-ups at PayPal are providing their CSRs slight and highly filtered information about eBay's handling of Internet Sales Tax. PayPal is not a conscious entity. It is a company of over 10K employees in North America, and the reason you've been getting so many different responses to your questions is because people communicate differently and take information on board differently. These poor CSRs are probably extrapolating as best they can some very vague information they've received from on high and trying to make it jive with what they already know about both companies' operations.

@gwrocen wrote:https://en.wikipedia.org/wiki/PayPal

“Although PayPal is not classified as a bank, the company is subject to some of the rules and regulations governing the financial industry including Regulation E consumer protections and the USA PATRIOT Act”.

PayPal therefore is somewhat the the equivalent of a “financial institution”.

I wonder if RBC or Scotia Bank or Bank of Montreal would allow someone to walk in off the street and help themselves to using MY ACCOUNT.

Note my emphasis.

I find it interesting that you note--correctly--that PayPal is not a bank, yet in your example you cite three different banks.

PayPal is a payment facilitator, not a bank, not a credit union, not a caisse populaire, not a trust company. One reason it is not a bank is because it does not offer deposit accounts. A PayPal account is simply a holding pen or waiting room for funds that one party has transferred to another.

I'm going to hypothesize here that because PayPal accounts are "waiting rooms," eBay or PayPal may be considering it part of PayPal's job to facilitate payments of Internet Sales Tax and ensure that those monies get directed properly. The fact that those monies are first sent to an individual may mean little to PayPal as they're just going to a "waiting room" anyway, not a bona fide bank account.

Just spitballin' as usual.

- « Previous

-

- 1

- 2

- Next »

- « Previous

-

- 1

- 2

- Next »