- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: eBay Canada collecting Canadian Sales Tax as o...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

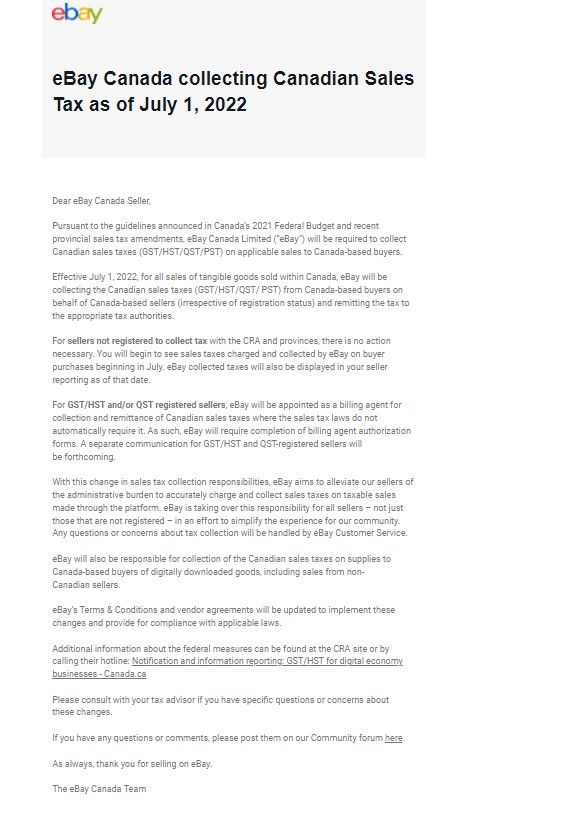

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 12:38 PM

@rickblenn wrote:

I sold some used items last week and this week and ebay is already collecting taxes. I don’t understand why because it’s mentioned that it will be start on July 1st.

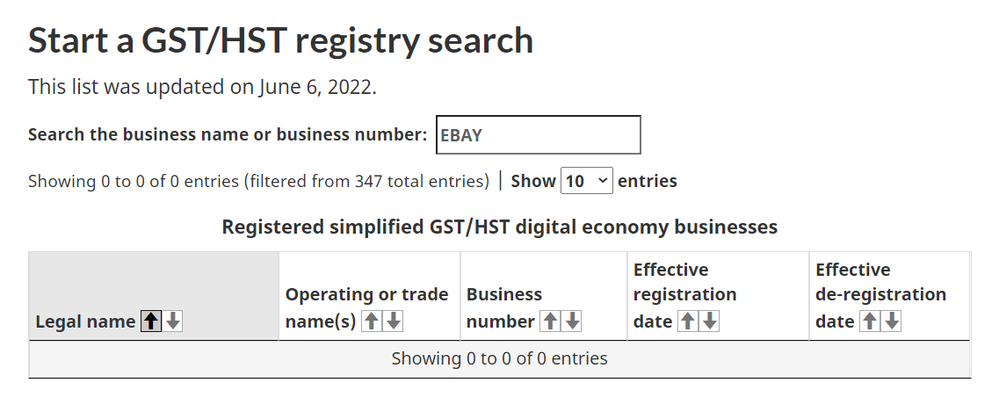

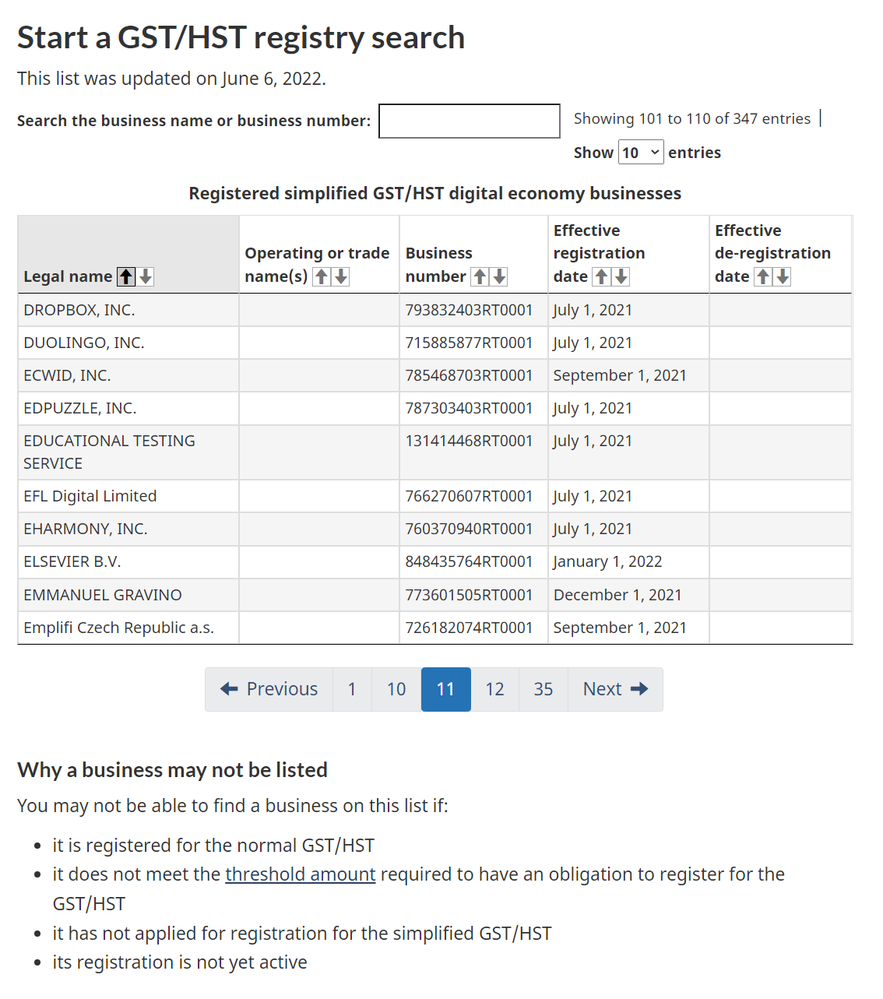

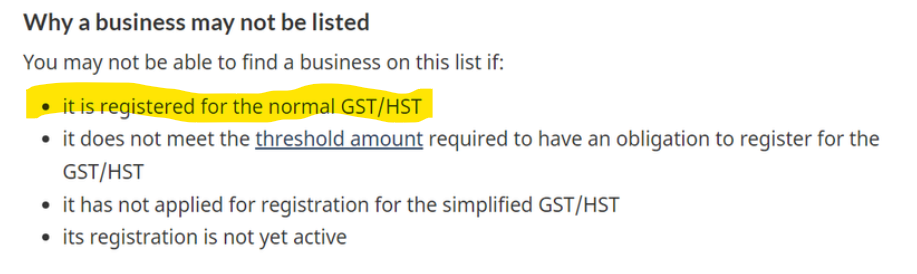

I don't understand how. Effective June 6, 2022, EBay (*.ca, *.com or any other domain) is still not showing up via CRA's Digital Economy Registry Search or alphabetical Listing.

See: Confirming a simplified GST/HST account number - Canada.ca

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 01:00 PM

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 01:10 PM

Yes, I saw that recped. But we now live here: Notification and information reporting: GST/HST for digital economy businesses - Canada.ca

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 01:19 PM

...and by these terms: Definitions for the digital economy - Canada.ca

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 01:34 PM

@doc_scribe wrote:Yes, I saw that recped. But we now live here: Notification and information reporting: GST/HST for digital economy businesses - Canada.ca

Not sure what your point is. eBay has been registered for GST for YEARS (at least 2016 and probably long before that), their registration number is on every invoice.

GST Registration Number :

87488 3325 RT0001

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 02:11 PM

Look, I'm merely trying to chart as sane, sensible, and simple a course as possible through these uncharted - and already choppy - waters.

Even if it means forfeiting my currently rather small amount of ITCs to avoid getting swept up in a lot of time consuming, unclear to the point of confusion, and ultimately unproductive reg-mgmt paperwork, I will gladly do so if it avoids more mind-numbing drudge.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 03:56 PM - edited 06-09-2022 03:56 PM

If you are currently registered for GST then it's REALLY very simple......

You report the GST YOU collected (any sales not via a "platform/eBay"), enter the amount of ITCs and await your refund payment to arrive.

If you were previously having to remit GST you might have been waiting until the last day possible. Since you will now be getting credits most or all of the time you might want to switch to filing on the very first day after the reporting period.

You seem to be concerned that your switch will somehow cause alarm bells to go off with CRA but there will be literally MILLIONS of registrants that will be in the same situation so CRA will be well aware of what is going on.

It is a different situation for those that are not currently registered, they have been able to go their merry way getting a 5 - 15% price advantage over registered sellers. Now they will no longer have that advantage and should be motivated to register to recoup whatever ITCs they have no matter how small.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 07:55 PM

@recped wrote:If you are currently registered for GST then it's REALLY very simple......

You report the GST YOU collected (any sales not via a "platform/eBay"), enter the amount of ITCs and await your refund payment to arrive.

Which will, for my Q3 '22 sales, suddenly zero-out and pretty much remain that way going forward.

@recped wrote:If you were previously having to remit GST you might have been waiting until the last day possible. Since you will now be getting credits most or all of the time you might want to switch to filing on the very first day after the reporting period.

It's not "having" to... over the past 20 years of selling on eBay I've never collected a dime of tax from my customers, yet did elect early on to reconcile the 5% GST that would have otherwise been incurred via direct sale.

FTR, I'm whistle clean with CRA, with no outstanding tax returns. And yes, I already NetFile on the first day each quarter. So no issue there either.

@recped wrote:You seem to be concerned that your switch will somehow cause alarm bells to go off with CRA but there will be literally MILLIONS of registrants that will be in the same situation so CRA will be well aware of what is going on.

In part, yes. As implied by my first point, I cannot imagine any self-respecting CRA autobot not raising a red flag over a couple of thou in sales with $0.00 CAD GST/HST due. At very least that will mean some phone calls, extra paperwork, and maybe even a drop-everything-else CRA interview at the closest office nearly 70km away. Although I am confident that the result will be as clean as it was back in '06, I still recall how the CRA investigation process itself eventually wearies you.

@recped wrote:It is a different situation for those that are not currently registered, they have been able to go their merry way getting a 5 - 15% price advantage over registered sellers. Now they will no longer have that advantage and should be motivated to register to recoup whatever ITCs they have no matter how small.

As others have already noted, is it not more of a competitive disadvantage for incentivization of Canadian buyers to shop stateside, not only avoiding automatic GST/HST at point-of-sale, but also maybe getting lucky with Customs in terms of border valuation.

But mainly I have a housekeeping issue with the whole thing. Recently I stumbled across a GST/HST page - maybe a form - with some wording to the effect that once you provide an agent with your CRA Business Number, both the platform and supplier become accountable for the accuracy and completeness of all tax amounts and info submitted to CRA...which also seemed to suggest that in case of a dispute the buck stops at the seller.

Anyone who has those policy details handy, please jump in...

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 08:13 PM - edited 06-09-2022 08:15 PM

The form is the billing agent authorization form and it has the perhaps worrisome wording in it.

The actual text from the form we're signing says in the obligations section (this is only one of the obligations and I've put in brackets the common person version of what's in the document):

"reporting and remitting the net tax, as well as any amount that the agent (ebay) might neglect to remit and that is reasonably attributable to a supply (sale) covered by the election. (billing agent authorization)"

There is more dialogue/thoughts in my post (it is currently #3 of 26) in this thread:

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-09-2022 08:50 PM

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-10-2022 04:12 PM

This message is from jt-libra. When I was in Preview Mode, it showed up as Anonymous ... I don't know why.

This notification was addressed to eBay Canada Buyers which I guess includes sellers as well. I didn't get a separate e-mail as a seller. I'm thinking about both eBay buyers who have not received or read this e-mail, or new buyers ... in short, people who may be surprised to see a tax added and want to cancel their transaction. When this happens, I hope it's a streamlined process for both the seller and the buyer.

eBay states that they will be collecting the Canadian sales taxes (GST/HST/QST/PST) on behalf of Canada-based sellers and remitting the tax to the appropriate tax authorities. If the delivery address is the US, the tax will be included in the order total at checkout. So I was a bit thrown when listing an item just now (it's been a while) to see a Sales Tax section where a province needed to be chosen, as well as the appropriate sales tax, and what looked to be an optional box: "Also apply to shipping and handling costs". I just ignored this section and completed my listing. If eBay is going to be collecting the appropriate tax, why is that section included in the listing form for us to complete. As well how will they know if I want the optional box about shipping and handling costs checked off. I know I risk sounding dumb but I don't understand this sales tax section on the seller's listing.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-10-2022 04:26 PM

@jt-libra wrote:This message is from jt-libra. When I was in Preview Mode, it showed up as Anonymous ... I don't know why.

This notification was addressed to eBay Canada Buyers which I guess includes sellers as well. I didn't get a separate e-mail as a seller. I'm thinking about both eBay buyers who have not received or read this e-mail, or new buyers ... in short, people who may be surprised to see a tax added and want to cancel their transaction. When this happens, I hope it's a streamlined process for both the seller and the buyer.

eBay states that they will be collecting the Canadian sales taxes (GST/HST/QST/PST) on behalf of Canada-based sellers and remitting the tax to the appropriate tax authorities. If the delivery address is the US, the tax will be included in the order total at checkout. So I was a bit thrown when listing an item just now (it's been a while) to see a Sales Tax section where a province needed to be chosen, as well as the appropriate sales tax, and what looked to be an optional box: "Also apply to shipping and handling costs". I just ignored this section and completed my listing. If eBay is going to be collecting the appropriate tax, why is that section included in the listing form for us to complete. As well how will they know if I want the optional box about shipping and handling costs checked off. I know I risk sounding dumb but I don't understand this sales tax section on the seller's listing.

eBay collection of Canadian taxes doesn't start until July so in the meantime registered sellers are collecting taxes.

Regarding notifications, I have received several emails from eBay about these changes, the initial ones plus the follow up for GST Registered sellers.

Sales by Canadian sellers to US buyers (or EU, UK, AU & NO) are subject to US Sales Tax or VAT not GST/HST/PST, nothing new there and not really relevant to Canadian sellers other than the amount is included in the fee base.

I'm confused about your post and what you are concerned about, maybe you could redo one at a time as you are jumping from one thing to another and this is causing my confusion.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-10-2022 09:43 PM

I had not received any notifications from eBay until this recent one addressed to all buyers. I have paid tax occasionally when buying from a U.S. seller but I have not collected taxes as a seller.

I'm sorry about my confusing post. My concern is that tonight was the first time I have ever seen a Sales Tax section on the listing page even though I have been selling for 15 years. Because I did not know why it was there all of a sudden, I ignored it because the only thing I know about sales tax right now is that it needs to be collected beginning July 1st.

Thank you for your reply, but please don't trouble yourself providing any more information. I am not overly concerned because I will learn when the time comes I'm sure.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2022 09:15 AM

Pirates both Gov & EBay.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2022 10:56 PM

Next they'll be driving around on Sundays to collect sales tax from yard sales.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-05-2022 04:21 PM

over the past 20 years of selling on eBay I've never collected a dime of tax from my customers, yet did elect early on to reconcile the 5% GST that would have otherwise been incurred via direct sale.

You've been paying the taxes your customers owe?

Good way to get high customer satisfaction.

Because if you were registered to collect taxes, sold taxable items, and did not remit the applicable tax, I don't think you should be saying so in public.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-05-2022 09:32 PM

@reallynicestamps wrote:over the past 20 years of selling on eBay I've never collected a dime of tax from my customers, yet did elect early on to reconcile the 5% GST that would have otherwise been incurred via direct sale.

You've been paying the taxes your customers owe?

Good way to get high customer satisfaction.

Because if you were registered to collect taxes, sold taxable items, and did not remit the applicable tax, I don't think you should be saying so in public.

Sorry if I wasn't clear enough @reallynicestamps, but my eBay sales have always been hobby/niche, under $30k, and I live in a no-PST/no-HST province with no other brick and mortar presence.

However, since the early 90s I have had a Business Number for my contracting services (in an unrelated field), and simply wanted to keep my sidebar sales here above reproach by CRA. In that spirit, I chose early on to voluntarily report my eBay sales as if the total for my Canadian customers included 5% GST. Back then (circa '02), the overwhelming majority of my eBay sales were to the U.S. and Eurozone anyway, thus zero-rated. So other than reducing my ITCs slightly, reporting the 5% GST tax-in on my Canadian sales had minimal impact, and all of it out of my own pocket.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-06-2022 12:01 AM

The GST/HST rate you collect and remit (included in the selling price or not) is based on the delivery address, 13% would be the correct rate for sales delivered in Ontario.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-06-2022 03:10 PM

@recped wrote:The GST/HST rate you collect and remit (included in the selling price or not) is based on the delivery address, 13% would be the correct rate for sales delivered in Ontario.

True, if your sales are over $30k annually, and you're registered to collect/remit provincially. Moot point though; since July 1, 2022, that activity is handled by the Platform/Agent (in our case, eBay).

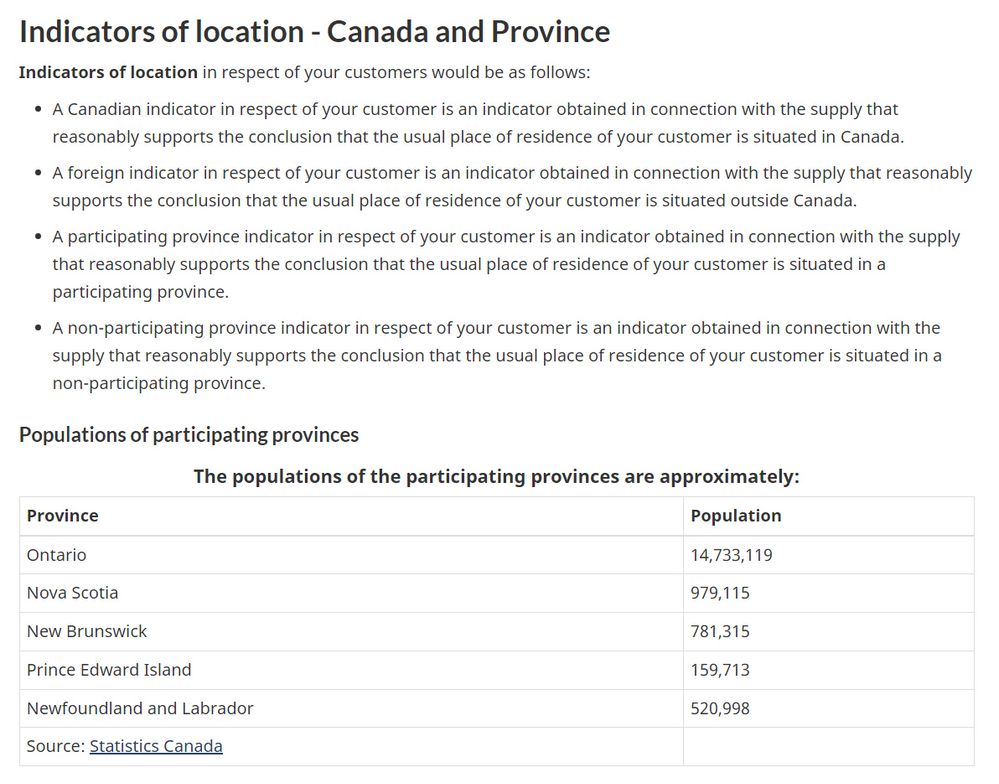

However, there now *appears* to be an asymetric implementation of participation in provincial collection/remittance across Canada (Note: "Populations of Participating Provinces" in chart below):

From: Definitions for the digital economy - Canada.ca

Currently M.I.A.: British Columbia, Alberta, Saskatchewan, Manitoba, Quebec, Northwest Territories, and Nunavut??? That is a big schwack of this country either not participating, or possibly working on provincial collection/remittance policies of their own.

Beats me. Even the definition of "Location" seems to be changing...

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-06-2022 07:44 PM

What about GST that the final value sellers' fees that I am as a seller pay to ebay. Can I get those back at the end of the year from CRA? How?