- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- eBay Canada collecting Canadian Sales Tax as of Ju...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

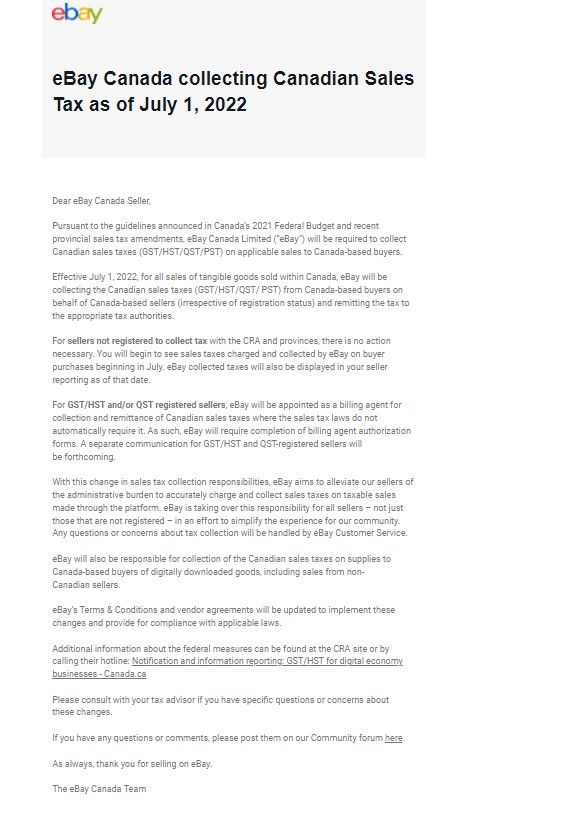

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:27 PM

This will be very helpful to drive down sales a little more. No wonder Marketplace is so popular now. Thanks government of Canada!

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:34 PM

I think this is just going to drive more people to buy and sell privately on Marketplace, Craigslist and Kijiji.

I'm not sure if this means I'm finally going to call it quits on ebay. I feel like the foundation of my Canadian sales was my buyers' ability to save 5-15% in the taxes they'd normally pay.

Uggggghhhh

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:41 PM

Exactly. Marketplace is taking over the World now. Everyone I know uses it! It may be time to take advantage of that platform now, I am afraid we are doomed here on Ebay. The excessive fees drive away sellers, and the taxes will drive away buyers. A perfect recipe for failure.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:55 PM

If you already charge sales tax, this is a good thing. It means the playing field is even. Now everybody is losing 5-15 percent of their margins to sales tax, even those not registered.

If you aren't registered for sales tax, it's a bad thing. It means that you may have to lower your prices to realize the same sales.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:59 PM

That was the benefit of staying under 30k. Now that benefit is gone and the smaller sellers are left competing with much large operations. It's a shame

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:05 PM - edited 05-03-2022 04:07 PM

How will this change impact filing tax returns each year (for both small time sellers who normally don't file, and high volume sellers that file regularly every year)? Does that mean ebay will require you to provide your SIN and remit a tax form to you every tax year (like they're doing in the US)? It seems to me they can't just blindly collect taxes without a paper trail of whose sales it came from. I don't get how all of that will work...

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:05 PM

Uggghh July is going to be so bad this year, the Germany and possibly France/Spain recycling stuff which in the worst case to me is just shutting off sales to them but now, at least for me this Canadian Taxes change is MUCH worse.......

My problem is that I have manual wording in my item description that says:

"GST/HST are included for Canadian Customers."

My spider senses tingled when I put that in, but I was tired of Canadians asking me, should have listened to the spider senses!!!

I don't think there is an automagic way to mass apply a change to item descriptions is there???

The good news is that the wording is exactly the same in all the descriptions.

If there is a mass way to zap that it will be a godsend, anybody know???

(given I'm the master of grandfathered items, I've almost never gone in to adjust items information, some stuff has been running for 10 years)

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:05 PM - edited 05-03-2022 04:12 PM

If you sell solely on eBay, and you aren't registered to collect GST/HST, you should voluntarily register when eBay begins collecting the tax.

The way GST/HST works is that with some exceptions, any GST/HST you pay towards supplies or inventory counts as a tax credit. So if you collect $1000 in HST from your customers, and you spend $900 in HST on supplies/inventory, you only pay the government $100. Or, if you collect $1000 and spend $1100, the government will send you a rebate for $100.

Since eBay is enforcing taxes to be collected on your listings, you might as well register and lower your input costs by 5-13 percent by collecting the tax credit.

I have to do research on this or speak to an accountant. But my assumption would be that this new system works the same way, except that with eBay holding and remitting the HST on your behalf (if you are registered), whatever HST you spend during the year is going to be a refund by proxy.

So in the scenario where you collect $1000 and spend $900, you technically owe the government $100, but because they already have the entire $1000 via eBay sending it to them directly, they will have to cut you a check for $900. Normally, you would hold the $1000 in trust for the government during the business year, so the $900 would already be in your account.

Does anybody with any accounting knowledge know if I am understanding this correctly? Or, is there a chance that this change will make sellers unable to collect their input tax credits? (which makes no sense, and would be a death blow to many businesses with margins that are already slim)

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:06 PM

@joels-retrocade wrote:That was the benefit of staying under 30k. Now that benefit is gone and the smaller sellers are left competing with much large operations. It's a shame

I don't know how typical my online buying habits are, but my decision to buy from a particular vendor or website is not influenced by whether or not I'm going to be charged taxes on the sale.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:07 PM

Regarding the taxes moving people away, this was also said when the US states began applying the internet sales tax.

Personally I did see regular buyers starting to buy from other sites that I'm listed on instead, however that lasted for maybe a few months and they're all "back" here again, despite the fact that on at least some of the other sites they do not have to pay the taxes even yet.

So I don't think it will make a long term change that way, based on what I've seen for the IST....

Time will tell.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:11 PM

Will the tax be collected from the buyer or will it be taken from your sale price?

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:12 PM

It is a bad thing for everyone, whether you have been charging tax or not. It will drive away buyers to Marketplace or other online venues that do not charge tax, plain and simple.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:15 PM

Who I buy from is VERY heavily influenced by the lowest price. All things being equal, if you're currently charging 12% taxes on a $30 item, and someone else isn't, I'll save the 12%, thank you very much.

This change just killed the last bit of leverage the small-time domestic seller had...

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:15 PM

The buyer pays it.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:20 PM

True, but Canadians are already taxed up the A$$... outrageously... for literally EVERYTHING. This was like the one area where we could enjoy some tax free purchases. It felt good to just buy for the list price online.

I think it's going to kill Canadian sales. And I don't think I'm going to stick around long enough to see if "time will tell".

I knew the train would arrive at the station at some point. The ride was great, but I think it's over...

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:23 PM

Assuming it works like every transaction on eBay, the tax will automatically be calculated at checkout and charged to the buyer.

Meaning, I am in Ontario. I add a $9.99 w/free shipping item to my cart. The price I will see at checkout will be $11.30 (9.99+1.30 HST) not $9.99.

That is regardless of whether the seller is registered for taxes.

The only difference between people who are registered for taxes and who aren't won't affect anything on the end of the buyer. If a seller isn't registered, eBay is collecting and remitting the tax on behalf of eBay. If the seller is registered to collect taxes, eBay is collecting and remitting the tax on the behalf of the seller's business.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:24 PM

@teenytrinkets wrote:

.... Is it going to happen on all online fee-based sales platforms (like Poshmark, Etsy, etc) or is it just Ebay?

I'm not sure if this means I'm finally going to call it quits on ebay. I feel like the foundation of my Canadian sales was my buyers' ability to save 5-15% in the taxes they'd normally pay.

Already in place on Amazon.ca for sellers -- they got switched over July 1, 2021.

It will certainly dampen sales in some categories when it comes into effect.

As a buyer, I plan to do some buying before the tax changeover.

As a small seller, I will have to rethink my listing practices with perhaps having a "tax free" sale in June.

-;-

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:28 PM

@mapleleaf-collectibles wrote:It is a bad thing for everyone, whether you have been charging tax or not. It will drive away buyers to Marketplace or other online venues that do not charge tax, plain and simple.

Other than private sales through someplace like Kijjiji where can you buy stuff without paying GST/HST?

I would veture a guess that when this LAW (not an eBay policy) comes into effect well over 90% of all online transactions will be subject to GST/HST. That is not going to leave many options for those that are tax adverse.

FYI - I have always charged buyers GST/HST since day one on eBay in 1999 and elsewhere since 1991 when GST/HST began......the sky is NOT falling.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:31 PM - edited 05-03-2022 04:34 PM

Sellers who are not registered to collect sales taxes will not see those taxes as income.

And will not be taxed on them.

We will be paying fees on the collected taxes just as we do now on US Internet (state) sales taxes and European and Australian VAT.

EBay will collect the taxes from the buyer, not from the seller.

If a seller has not been declaring eBay income, well.... you were supposed to.