- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- eBay Canada collecting Canadian Sales Tax as of Ju...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 07:47 PM

@ilikehockeyjerseys yep I realized when recped pointed it out that my thinking was flawed.

These sales will now look from a GST perspective like an international buyer, "no GST/HST collected" from my perspective, all I have to worry about now is that the ebay reporting works out that it properly explains why and how much we're not submitting the GST for the eBay sales theoretically their reporting will handle that. Time will tell.

Technically I'll be better off because now if I sell something to an Ontarian for example, I'm not "eating" the 13% that I've chosen to in the past. I'll have to reflect on whether I reduce my prices a wee bit to offest the average savings. At the moment "no" will be the answer with the ever increasing postal rates it will just stave off price increases necessary for that!

I'm also feeling a wee bit more relaxed about my massive 1,241 item description manual adjustments, I just timed myself doing some and it looks like I can accomplish it in just a bit over 10 hours. Fortunately the problem is only in my .CA items and most of them aren't gradfathered like the old .COM stuff is so I can get in and out fairly quickly within each listing. It will be mind numbing work though, not looking forward to it.

2022 sure seems to be shaping up to be a very difficult/frustrating/expensive time to be a small business owner....

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 07:55 PM - edited 05-03-2022 07:56 PM

I'm interested to see how this is going to work with inbound international purchases that would normally go through (Canadian) customs and potentially be assessed GST at that point...

I wonder if there will be some sort of reference number that needs to be included for international shipments to Canada so that CBSA knows the taxes have already been collected. Similar to how it works with the IOSS numbers for the EU.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 08:11 PM

@ricarmic wrote:I don't think there is an automagic way to mass apply a change to item descriptions is there???

The good news is that the wording is exactly the same in all the descriptions.

If there is a mass way to zap that it will be a godsend, anybody know???

(given I'm the master of grandfathered items, I've almost never gone in to adjust items information, some stuff has been running for 10 years)

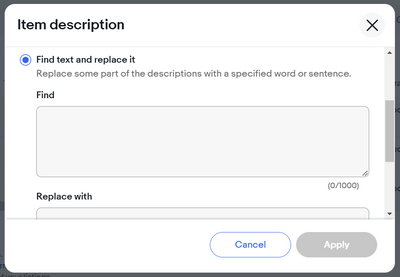

@ricarmic - actually you can 'automagically' do it. Go to your active listings and select Edit --> Edit all listings in the dropdown. This will bring up the bulk editor. Select all your listings, click the "Bulk Edit" dropdown, select "Item Description" and you'll get a pop-up box where one of the options is "Find Text and Replace it" (see image). Enter the text you want it to find, and then just leave the "replace it with" box blank and it will remove the text.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 11:29 PM

Yes to @dinomitesales that is the way to do it.

Looks like you use this statement "GST/HST are included for Canadian Customers." if it's the same on all listings then.......

You should be able to bulk edit that out with no trouble. Given the number of listings I would try it in batches of perhaps 100 or 200 as I hear the bulk edit gags if there are too many listings selected at once.

No personal experience since I use SixBit, with that I could remove them super erasy, 10 seconds to set up the find and replace, one click and it will take care of the rest no matter how many items and one click (I have heard some users say that even SixBit will gag if you try it on more than 10,000 listings at a time.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-04-2022 01:03 AM

Bulk Edit for description sucks!!! Definitley try it with a lower amount of listings if trying to bulk edit the description (I can never get find/replace to work if its more then like 3 words lol)

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-04-2022 06:54 AM

@dinomitesales AWESOME! I've never used bulk edit before and "description" wasn't one of the options showing, now I've discovered how to add other columns and voila just changed 3 with no problems. Fortunately I used the exact same phrase in them all because I'm a "sell similar" kinda guy!

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-04-2022 10:13 AM

Are you a peer-to-peer seller? Here’s what you need to know

April 30, 2021

Ottawa, Ontario

Canada Revenue Agency

What is a peer-to-peer sale?

A peer-to-peer (P2P) sale is the selling of goods or services from one person or party directly to another. You may be involved in P2P selling if you are connecting with buyers through online platforms like websites, online marketplaces or mobile applications (such as Etsy, eBay, Amazon or Kijiji).

Income tax implications

As a resident of Canada, you have to report your income from all sources inside and outside of the country, including P2P transactions, on your tax return. If you paid tax on foreign income, you could be eligible for a tax credit.

It is important to maintain proper financial records of all your sales and expenses. This applies to the sales you make to buyers in Canada and other countries. Keep records of all your purchases to claim eligible expenses on your return.

GST/HST implications

You may have a reasonable expectation of profit from your online activities, and your total taxable supply may be valued at more than $30,000 over four calendar quarters. If so, you will need to register for, collect and pay to the Canada Revenue Agency the goods and services tax / harmonized sales tax (GST/HST) for taxable supplies of goods and services that you made inside and outside Canada. You can get more details on GST/HST registration requirements at: Find out if you must register for a GST/HST account.

How to correct your tax affairs

If you did not report your income from P2P selling, you may have to pay tax, penalties and interest on that income. You can avoid or reduce penalties and interest by voluntarily correcting your tax affairs. To correct your tax affairs (including corrections to GST/HST returns) and to report income that you did not report in previous years, you may:

- Ask for a change to your income tax and benefit return

- Adjust a GST/HST return

- Apply for a correction through the Voluntary Disclosures Program

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-04-2022 11:30 AM

@dinomitesales wrote:I'm interested to see how this is going to work with inbound international purchases that would normally go through (Canadian) customs and potentially be assessed GST at that point...

I wonder if there will be some sort of reference number that needs to be included for international shipments to Canada so that CBSA knows the taxes have already been collected. Similar to how it works with the IOSS numbers for the EU.

@fergua3 posted something elsewhere that suggested that this isn't happening. I would probably add "at least not yet." I don't think there's enough turnaround time to get an initiative like that going by the beginning of July, but it could happen somewhere down the line.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-04-2022 10:35 PM

I was wondering - exactly how many times can you charge sales tax on collectables?

Old enough to know better. Young enough to do it again. Crazy enough to try

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 02:57 AM

@rosscd57 wrote:I was wondering - exactly how many times can you charge sales tax on collectables?

Every time it's sold, there is no limit!

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 06:22 AM

Good day everyone.

As a Canadian ebay seller, do I have to charge GST/HST to buyers from the US, EU, and the rest of the world? or just Canada buyers?

My sales are higher than 30K/year.

Thanks

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 06:47 AM

You don't actually charge the taxes yourself, it is going to be done automatically by eBay but the Canadian taxes GST/HST is only for Canada (and based on province), US has had their sale tax added by eBay for a few years now (well most states anyways, a couple are still exempt) and Europe has been charged the VAT tax (by eBay directly) since I believe last July. The changes are not something we have to do as sellers (since eBay is collecting and submitting it), for us it is just the extra cost the Canadian buyers will see/have after that time.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 10:36 AM

An item being used doesn't matter.

Let's say a collectible changes hands 3 times because both the first two sellers underprice it, and everybody involved is buying it to re-sell. If all 3 sellers are registered to collect GST/HST, all 3 sellers have to charge it.

With that said, they can all claim the HST they paid on it originally, since it was a business transaction. They were buying inventory to resell. So if seller 2 buys it for $100 and pays $13 HST, then sells it for $200 to someone in Ontario and has to charge them $26 in HST, at the end of the tax year they only have to send the CRA $13 (26 collect minus 13 spent = 13).

This is why everybody should consider registering for GST once eBay begins collecting. The downside of raising your prices is going to happen whether you want it to or not, so it would be smart to set yourself up to take advantage of the input tax credits that come with being registered.

Again, I'm not an accountant, so this isn't professional advice. Do your research/seek the advice of a pro.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 10:39 AM

You have to register with the government before you charge anybody.

You only charge HST or GST to Canadian orders based on each provincial rate, which can be found online.

Sales outside of Canada are considered "zero-rated". Which means, you do not collect GST or HST on those sales. You still need to keep track of the amount of zero-rated sales you make for when you file.

It would be advisable for you to speak with an accountant to get set up if you are already doing over 30k in sales. Especially if you've done so for a considerable time without being registered.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:09 PM

totally agree. ebays current method now of collecting gst for those of us who are incorporated is just to default collect whatever amount we set and send it to us in our general revenues, forcing us to tabulate how much to set aside. it is annoying af and a massive make work project. Doing it right off the top like this is the way it should be done. Canada has been totally behind the eight ball compared to every other bloody country in the world when it comes to collecting its sales tax revenue and its about time they did what everyone else is already doing.

What this does for me though is generate questions for my accountant, because for those of us who do this know we can decrease the amount of GST we need to remit based on how much GST we pay acquiring items for the purposes of our companies. Its a cent for cent credit, this way I cut the amount of GST I needed to remit last year by a significant amount. How this is going to work with ebay remitting it immediately off the top before I can tabulate my yearly ITC's is not addressed here. Maybe I wont need to file gst at all, I have no idea how this is going to affect the process as it stands right now.

I hear what other sellers are saying but I dont see the sky falling. Personally I dont think this is going to affect sales as much as some think, but I'd like to see the numbers after a few months as we all know the numbers here are dropping. Everyone has to pay tax, and we all pay it wherever we go, and furthermore I didnt notice a drop in business when my first four quarters were done and I had to start collecting GST.

The people who are going to be the most affected are sellers on here who are running this out of their back pocket for extra cash and who arent reporting any of the income at tax time. Doing this is a way of ebay telling these sellers that the wild west days of yore of not reporting your ebay income on your tax return are over. By collecting GST on the sale, ebay are making every seller on here a legitimate business by proxy. It looks like these sellers will have to choose by July 1 between going the formal route and getting a business license or closing shop here and finding some other informal place to hawk stuff on the sly where CRA wont be able to find them. Personally I find kijiji a bad / unreliable place for doing this, theres so much complete garbage to sift thru (theres this fellow in town here who mass posts used vhs tapes he recorded over with various movies for sale, he has about a hundred of these things and a different listing for each one and none of these things ever sell, yet he's been listing these ridiculous things continuously for literally years) and you can tell alot of these guys who do the mass ads on there are former ebay folk trying to keep the taxman at bay. My reaction is, you arent going to be able to run forever, and for these people, the options are getting fewer and fewer. Govts now know how much money is in ecommerce, the cat long since escaped the bag.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:18 PM

its a question for accountants honestly, and certainly one i'll be asking mine as I noted in my post above, there are advantages to running a business and collecting GST as you can write down the amount of GST you need to remit every year based on the amount of gst you pay for items in a given tax year for your business, whether thats inventory, shipping supplies or various administrative stuff, its a cent for cent credit, and can decrease the amount of GST you need to remit by a significant amount. This part I dont know how it is going to work now with them collecting it right at point of sale.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:22 PM

ebay will tack it on, collect it and Im assuming remit it at point of sale so it will be on top of your price like anything thats bought in a brick an mortar store.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:27 PM

Canada Day. Nice timing.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:37 PM - edited 05-07-2022 01:44 PM

@darak10 wrote:ebay will tack it on, collect it and Im assuming remit it at point of sale so it will be on top of your price like anything thats bought in a brick an mortar store.

So is this going to turn into an end buyer final location tax or a tax based on the province a seller is located. Similar to situation when a Canadian sellers sells something to the various US states and the buyer gets charged the tax based on that state.

If Fred from Alberta walks into a B & M store in Alberta he pays 5% GST.

If Bob from Saskatchewan walks into an Alberta store he pays 5% GST.

If Hector from Texas walks into an Alberta store he pays 5%. (He can claim when he leaves the province)

If you mail something to another province, what tax rate gets applied?

(Just like when Roger (From the other provinces goes to Ontario) he gets charged local tax.

-Lotz

PS. I understand this is all mute when you buy a car in another province(registering) but majority of eBay sellers do not sell cars on eBay. My kingdom for a papertrail with eBay!!!

PS2: I guess in theory Bob could buy for Fred (pay 5%) and then ship to Fred. Similar to when you need to buy something from the US but want to avoid the GSP system and you have it sent to a US address for forwarding.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 01:48 PM

GST/HST as it applies to items shipped to buyers is always based on the destination.

For sellers like me who have always charged buyers GST this change to collection by eBay changes NOTHING (for me or for my buyers).

My buyers will pay the same amount, I will still file GST/HST returns on the same schedule (I'm on quarterly reporting but could if I wish change that to annual).

For sellers not currently registered for GST nothing changes except the incentive to register increases given that buyers will be paying GST/HST regardless and since that is the case some simple reporting once a year will get them a refund of all Input Tax Credits they may have.

Under the existing system sellers had to decide if the amount of ITC credits available outweighed the advantage of being 5 - 15% cheaper than sellers who are registered.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.