- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- eBay Canada collecting Canadian Sales Tax as of Ju...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

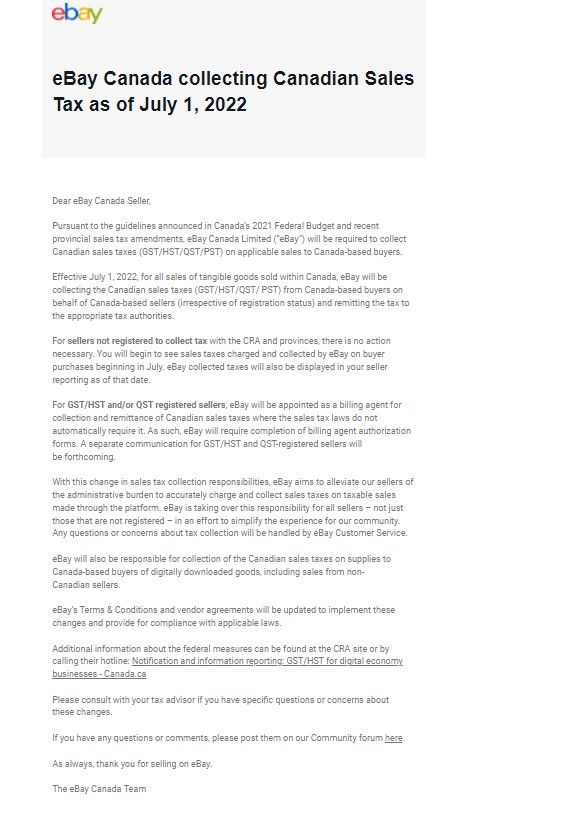

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 02:57 PM

I'd like to know how EBAY will deal with Canadian goods that are not subject to either HST or GST. For example any collectible gold and silver coins with a purity of .999 or bullion with the same level of purity.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 04:07 PM

@tch_ca wrote:I'd like to know how EBAY will deal with Canadian goods that are not subject to either HST or GST. For example any collectible gold and silver coins with a purity of .999 or bullion with the same level of purity.

It's been noted elsewhere that the eBay "tax team" is taking the line that the tax(es) aren't on the goods but on the transaction, but it remains to be seen whether transaction taxes equate with goods taxes.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-07-2022 04:23 PM

It will be interesting to see.

I have noticed for the European countries and Australia that sometimes folks are charged the VAT sometimes they aren't.

I have not noticed any consistency as to why/not.

I have regular buyers, sometimes they pay, sometimes they don't.

The items could be new ones could be old ones (I wondered for a while if my grandfathered ones were being missed but sometimes they are sometimes not, same as newly listed ones.). They could be exensive ones, or not expensive ones.

This lead me to believe something in BOTland was using the item title wordings to decide whether the item was taxable or not. It appears that's not the case from what I'm hearing here.

I have noticed that the UK folks seem to very rarely pay.

Anyway I'm making the assumption its not going to be my job to police how successful the taxing is, I'm assuming the "billing agent authorization" absolves me of that.

Like everything, time will tell, July 1 is not going to be a fun time this year......

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-08-2022 11:07 AM

Well, Not sure that that can be done. Good is a good. Calling a transaction a service is quationable behaviour. If it was me, everytime I purchased something that is exempt in Canada, I would request a refund from the CBSA. Enough people do that, the CRA may want to rething their straategy.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-08-2022 12:21 PM - edited 05-08-2022 12:29 PM

@tch_ca wrote:Well, Not sure that that can be done. Good is a good. Calling a transaction a service is quationable behaviour. If it was me, everytime I purchased something that is exempt in Canada, I would request a refund from the CBSA. Enough people do that, the CRA may want to rething their straategy.

The Canadian branch of The World's Largest Online Retailer is already doing this for their Marketplace sellers. I'm not sure if they're taxing the transaction or the goods, though. In eBay's case, I guess somebody's interpreted Canadian taxation laws to suggest that marketplace facilitators are providing a service to the buyer or user in a manner that, say, a telecommunications company does.

Don't forget that buyers in the US, the EU, the UK, Australia and others are already experiencing something along these lines but it applies to anything they purchase online, not just from their home country or region. If transactions involving "exempt" or "zero rated" goods are going to be charged transaction taxes, I suspect that CRA is anticipating a learning curve on the part of consumers for this development and will be hiring or reallocating staff to kick back these refund claims for "exempt" purchases as ineligible.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-09-2022 12:29 PM - edited 05-09-2022 12:33 PM

It sounds like if you are registered, and file the appropriate paperwork with eBay, they remit the tax on behalf of your business.

My assumption is that you will have a credit with the CRA equivalent to the amount eBay remits on your behalf. Which means, instead of recovering your GST tax credits from the GST you hold in trust for the government, you will recover them via a refund from the CRA.

Let's look at someone who collected $1000 in GST but accumulated $500 in tax credits through money they spent on inventory and supplies.

Under the old system, the seller would be responsible for collecting the GST and holding it in trust for the government. The difference between what they collected and their tax credits is $500. Meaning, they are responsible for sending the government $500 in taxes, and they can then release the additional $500 they were holding to themselves to refund their tax credits.

Under the new system, eBay holds the taxes in trust, not the seller. eBay has the entire $1000 they collected on your behalf throughout the tax year. They send it to the CRA, which puts a $1000 credit on your CRA account. When you file your return that shows $1000 collected and $500 in credits, that will reduce your credit that the CRA has on file to $500. Which means shortly after filing, you will receive a $500 refund from the CRA.

You still technically gave the CRA $500, but it is reversed. Instead of you sending in the $500 you owe them, they already have the $500 but they also have your input tax credits which they must return to you.

I am not an accountant, so this shouldn't be a substitute for speaking to one, but I assume it will work that way. While your GST records should be comprehensive with receipts for all your purchases you claim input tax credits on, the actual filing aspect is pretty simple and straight forward for a small eBay business.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-12-2022 08:49 AM

recped wrote: "For the sky is falling folks, keep in mind that now anything purchased from outside Canada will include GST/HST, this removes the imbalance for Canadian sellers when competing with US sellers. In the past I could buy a $20 trinket from a foreign seller and not pay any gst/hst, going forward that will no longer be the case and for me the 13% I could save by buying cross border vanishes and local to me sellers are no longer disadvantaged."

That's not correct. Ebay is only collecting tax on Canadian buyers who BUY FROM CANADIAN SELLERS. It's not like what the US States and the EU is doing, ie no matter what country you buy from Ebay taxes the buyer. So a Canadian buyer who buys from a US seller will not be charged GST/HST, that buyer will only pay taxes if he purchases from a Canadian seller.

At least that is the way it was a few days ago....has something very recently changed?

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-12-2022 10:47 AM

@fergua3 wrote:

That's not correct. Ebay is only collecting tax on Canadian buyers who BUY FROM CANADIAN SELLERS. It's not like what the US States and the EU is doing, ie no matter what country you buy from Ebay taxes the buyer. So a Canadian buyer who buys from a US seller will not be charged GST/HST, that buyer will only pay taxes if he purchases from a Canadian seller.

At least that is the way it was a few days ago....has something very recently changed?

Pitney Bowes pays the taxes (as well as the duties) owing on an item forwarded through the GSP and the buyer repays them as part of the "import charges" on a GSP shipment.

Most other carriers will also advance the taxes owing on items sent through them with the importer repaying them as a separate line item or as part of the shipping charge. Do a search for "UPS brokerage charges" on these boards to get a sense of how extreme this practice can get.

Items sent by mail are a bit oddball as they rely on CBSA assessing them and getting Canada Post to collect the taxes owing, and we all know they haven't been all that diligent about doing this, despite the C$20 tax-free limit for mailed items. Perhaps they'll be ramping up enforcement of the C$20 tax-free limit for mailed imports, at least temporarily, as of July 1.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-12-2022 11:17 AM - edited 05-12-2022 11:27 AM

right, but that's how it's always been. My point was Ebay is not collecting tax on Canadian buyers who purchase an item from a non-Canadian seller, which is different than what the US States, Austrailia, UK, New Zealand and EU are doing, which is to charge tax to their resident buyers regardless of where the seller lives.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-12-2022 12:13 PM - edited 05-12-2022 12:14 PM

@fergua3 wrote:right, but that's how it's always been. My point was Ebay is not collecting tax on Canadian buyers who purchase an item from a non-Canadian seller, which is different than what the US States, Austrailia, UK, New Zealand and EU are doing, which is to charge tax to their resident buyers regardless of where the seller lives.

I must have misunderstood the point you made at the end of your previous post, then. It sounded to me as though you meant that a purchase from a US eBay seller will always be tax exempt.

@fergua3 wrote:

So a Canadian buyer who buys from a US seller will not be charged GST/HST, that buyer will only pay taxes if he purchases from a Canadian seller.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-12-2022 01:42 PM

ah, i meant have taxes collected by ebay. i was responding to recped's post, which i quoted, that seemed to be saying that Canadian buyers will be having taxes collected by Ebay no matter where the seller they purchase from lives. But it's different, not the same treatment for Canadians as for citizens of other countries (us, nz, aus, eu etc)

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 01:53 AM

You are correct, on my first skim of the minimal information eBay provided I mistaken assumed it would apply similar to US Sales Tax / EU VAT

Since it doesn't I think this is a matter that should be revisited by both CRA and eBay. For the CRA it's a ton of revenue lost and for eBay buyers it would eliminate the Canada Post charges when do do collect GST/HST (+maybe duty). It doesn't do anything to help Canadian eBay sellers either especially the small unregistered one whose buyers will pay GST/HST on domestic orders and nothing on low value imported orders.

It's a real insult to get dinged for $10 - $15 in GST/HST and then have to hand over 10 bucks to Canada Post for collecting the payment.

Must really annoy people in Alberta, import a $300 item, pay $15 in GST and $9.95 to Canada Post for basically doing nothing.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 04:40 AM

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 08:18 AM

@rickblenn wrote:

I sold some used items last week and this week and ebay is already collecting taxes. I don’t understand why because it’s mentioned that it will be start on July 1st.

Did you sell those items to buyers in Canada or to buyers in the US? EBay already collects taxes on items bought and mailed to the US, Australia, NZ, and the EU.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 09:10 AM

I'm thinking that there will be a slight increase in our fees because Ebay may charge a transaction fee on the amount of the taxes the way it is charged on shipping fee?

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 09:16 AM

Yes you are correct, it will increase our fees slightly just like the fees on shipping.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 11:39 AM

@recped wrote:

Since it doesn't I think this is a matter that should be revisited by both CRA and eBay. For the CRA it's a ton of revenue lost and for eBay buyers it would eliminate the Canada Post charges when do do collect GST/HST (+maybe duty). It doesn't do anything to help Canadian eBay sellers either especially the small unregistered one whose buyers will pay GST/HST on domestic orders and nothing on low value imported orders.

It's a real insult to get dinged for $10 - $15 in GST/HST and then have to hand over 10 bucks to Canada Post for collecting the payment.

Must really annoy people in Alberta, import a $300 item, pay $15 in GST and $9.95 to Canada Post for basically doing nothing.

A $300 item might incur duty charges as well, though, although I'll grant you that there's a lot of stuff flowing through the system that's not subject to duty. 😁

Would a change to the collection system also mean a few tweaks would have to be made to CUSMA, as there'd no longer be a de minimis for GST/HST/etc?

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 03:59 PM

As a buyer I like the de minimis exemption.

As a seller I don't as it is a competitive disadvantage since I do charge GST/HST to Canadian buyers.

Currently it's an equal footing for Canadian sellers who are not GST registered but that will end July 1st.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 05:16 PM - edited 05-13-2022 05:31 PM

It will be interesting how the CRA will look at this with repect to ITCs. As a business, other than paperwork, this doesn't change anything for me (other than the potential beef I have with respect to exempt items in Canada, which should be interesting). I already collect and remit tax on ebay sales by province. However it will be interesting to see what the CRA does with individual "self employed" ebay sellers that start claiming input tax credits (assuming they registrered for a tax number) on taxes paid to coduct their "buisness" activities.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-13-2022 08:51 PM

@tch_ca wrote:It will be interesting how the CRA will look at this with repect to ITCs. As a business, other than paperwork, this doesn't change anything for me (other than the potential beef I have with respect to exempt items in Canada, which should be interesting). I already collect and remit tax on ebay sales by province. However it will be interesting to see what the CRA does with individual "self employed" ebay sellers that start claiming input tax credits (assuming they registrered for a tax number) on taxes paid to coduct their "buisness" activities.

What makes you think there would be any change in how ITC's are handled?

I don't understand what you mean by "claiming ITC credits on taxes paid".

We don't know the finer points of this change for sellers who are registered. The notice said that those sellers will be contacted later to provide authorization for eBay to be the "billing agent". I'm GUESSING this will mean eBay will report the amounts they collected on behalf of registered seller so if there ever is an audit the seller will be able to show CRA that GST/HST was collected on their behalf if an auditor wonders why you are claiming ITC's but not reporting ANY GST/HST collected.

That said, on one of my GST accounts I must have gone 15 years or more claiming ITC's with almost zero GST collected. This was back in the days when 98% of my sales were exported.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.