- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- eBay Canada collecting Canadian Sales Tax as of Ju...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

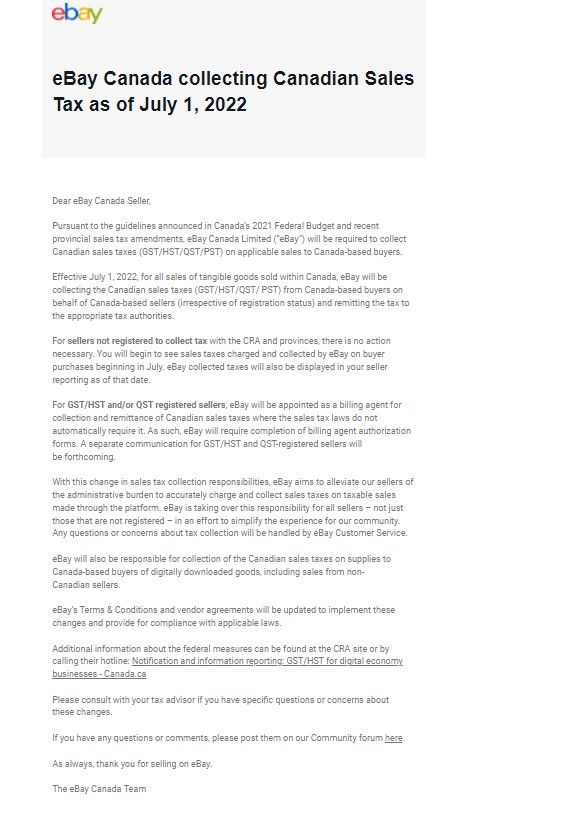

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:36 PM

The sky isn't falling for you, because nothing is changing for you. In fact, you'll be benefiting from the change because now you'll be on a level playing field with all the small time sellers, price-wise.

The sky actually IS falling for the small time sellers, I think. Many of us barely make a profit and ebay has become more onerous and expensive, as of late. It was really getting hard to justify the fees, with so many free selling options that have become so popular in recent years. This is simply another nail in the coffin...

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:39 PM - edited 05-03-2022 04:41 PM

The only way taxes will drive away buyers is if they don't realize taxes are charged, and they get sticker shock at checkout when their $100 item is now $113.

Buyers don't care about the cost of shipping, the cost of taxes, etc. They care about the total cost and the overall value.

Based on everything included in your listing, if a buyer decides it is worth $100, they don't care if it is $100+0 tax+0 shipping, or 80+20 shipping+0 tax, or 70+20 shipping+10 tax. All of those cost the same, which is $100.

Sales tax are actually a tax on the seller, not the buyer. Look at it this way, if your item is worth $100 and not a penny more, you cannot sell it for $100 + 13 percent HST. You can sell it for $88.50, because $88.50 + 13 percent HST is $100, which is what the item is worth.

This means that the sales tax is essentially an input cost for the seller. No different than the cost of bubble mailers, the original cost of the item, the cost of gas to drive to the post office, etc.

Depending on the elasticity of a seller's prices, what is going to happen is that sellers will have to lower their prices or otherwise find ways to offer more value to their customers.

You won't see an exodus of customers. You will see sellers having to lower their prices to compete.

The argument about Facebook marketplace, the problem I see with it is that eBay already is a lot more expensive to sell on and people still sell on it. If I sell something for $300 on eBay, eBay fees and shipping amount to an input cost of about $55-65. Shipping is the same as taxes. It doesn't matter if the buyer or seller pays for it, at the end of the day the cost of shipping comes out of the amount of money that goes into the seller's pocket. In that respect, just like sales taxes, it is an input cost. People are already giving up anywhere from 15-25 percent extra to sell on eBay. Could taxes be the breaking point for some people? Maybe. But I don't think it is logical to assume sellers or buyers will leave. The price won't change for buyers, so the only reason they will leave eBay is if all the good sellers leave and the platform offers the buyers no value.

Also, there just isn't enough stuff on Facebook Marketplace. I look at my most recent purchases, there is nowhere other than eBay or Amazon that I am going to reasonably be able to find those specific things. Nobody locally is going to have it. Even if I search Canada wide on Kijiji or Facebook marketplace, not everybody ships, and those who do usually expect payment via a risky service like Interac E-Transfer. Kijiji and Facebook marketplace are only better substitutions to buy or sell incredibly popular and in demand items.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:40 PM

I've looked at FB Marketplace, but the problem with it is that it is local.

I don't see how to sell there with a worldwide audience.

I've bought there, but only a few pieces of furniture which I would not ever buy by mail

There may be a lot of listings and sales, but my market is small here on Vancouver Island, while of my last 15 sales, seven were to the US, six to other provinces, and one to the Netherlands.

EBay is worldwide mail order.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:45 PM

Hmm well things might be even more complicated from an ITC perspective.

Today, when someone in BC buys something I'm only able to collect/count the 5% GST because the buyer doesn't have to pay me the 7% provincial tax because BCs not an HST province and I'm in ON.

I'm presuming now the BC buyer will pay eBay the full 12%.

I'm presuming I can't count the full 12% against my ITCs or can I?

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:51 PM

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:58 PM

I'm presuming I can't count the full 12% against my ITCs or can I?

I doubt that you will be able to count it as you are not submitting it.

I am guessing that the tax will not be associated with your gst/business number at all but I

could be wrong.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:59 PM

@ricarmic wrote:Hmm well things might be even more complicated from an ITC perspective.

Today, when someone in BC buys something I'm only able to collect/count the 5% GST because the buyer doesn't have to pay me the 7% provincial tax because BCs not an HST province and I'm in ON.

I'm presuming now the BC buyer will pay eBay the full 12%.

I'm presuming I can't count the full 12% against my ITCs or can I?

This is what happens when a 3rd party...ie (eBay or similar to the perils of PB etc) gets involved. The train inevitibably goes of the track with many many many casualities!!!

-Lotz

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 04:59 PM

@reallynicestamps wrote:

There may be a lot of listings and sales, but my market is small here on Vancouver Island, while of my last 15 sales, seven were to the US, six to other provinces, and one to the Netherlands.

And most of those US sales probably had taxes applied to them and the Netherlands has a VAT of 21%. Just sayin'.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:02 PM

@ricarmic wrote:Hmm well things might be even more complicated from an ITC perspective.

Today, when someone in BC buys something I'm only able to collect/count the 5% GST because the buyer doesn't have to pay me the 7% provincial tax because BCs not an HST province and I'm in ON.

I'm presuming now the BC buyer will pay eBay the full 12%.

I'm presuming I can't count the full 12% against my ITCs or can I?

I don't think your presuming is correct. While it's possible the remaining provinces with their own Sales Tax will pass laws forcing eBay to collect on their behalf I don't think it has happened yet.

For sure the notification that eBay sent which specifically refers to FEDERAL measures.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:02 PM

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:05 PM

My feeling on this is it will effect some catagories more than others. Ebay is the largest marketplace where you can find rare collectable items domestically and internationally. My hunch is a buyer won't mind too much if the thing they've been looking for everywhere is slightly more expensive. I do see this effecting sellers who sell newer goods that can be found at places like amazon or walmart.

My take on local marketplaces like fbm or kijiji is, sure theres no tax, but as a seller, its a lot more work. You deal with shadier situations, constant replies to messages, logistical issues and the simple fact that its a smaller market share. Its the price we have to pay to get this amount of eyes on our listings here.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:06 PM

@reallynicestamps wrote:I've looked at FB Marketplace, but the problem with it is that it is local.

I don't see how to sell there with a worldwide audience.

I've bought there, but only a few pieces of furniture which I would not ever buy by mail

There may be a lot of listings and sales, but my market is small here on Vancouver Island, while of my last 15 sales, seven were to the US, six to other provinces, and one to the Netherlands.

EBay is worldwide mail order.

I don't know about FB Marketplace in Canada but in the US you can have a shipping option, FB processes the payments and currently charges 5% (up from free and it probably won't stay at 5% for long). FB adds US Sales Tax to those sales just like eBay does.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:16 PM

@ricarmic wrote:

I'm presuming I can't count the full 12% against my ITCs or can I?

Against your ITC?

Why would you want that? starting in July you will no longer collect GST/HST but your ITC's are all valid and will be fully refundable.

The only problem would be if you have an "issue" with your GST account and they are not refunding your credits.

I had this issue some years ago when I have multiple GST accounts and one of them (no longer in use) had an outstanding final return. While that final return was outstanding the fesd put a hold on refunds for any other GST accounts I had.

My refunds were quite small to begin with so I wasn't motivated to file that final return, until I did the credits just keep piling up. When I finally provided the last return for that accoiunt the credits to my other account were released.

CRA were probably disappointed because that final return was like all the previous ones......a CREDIT balance! They demaned the final return and as a result had to pay out just over $1000 to me for ITC's.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:21 PM

highly unlikely...as this is not unique to eBay...and it's not sellers paying it...buyers pay the taxes ...this is the Canadian version of what the USA implemented about 3 years ago...

Online Marketplace facilitators must collect the taxes and remit to the proper taxation authorities.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:23 PM - edited 05-03-2022 05:39 PM

You can sell on Facebook if you create a group and attract others who are interested in your same hobby or collectibles. I did it for years, selling to American and Canadian buyers who I attracted to my group page. You can decide if you want to sell it in a auction or buy it now format. You have 100% control over who you allow to sell to, and 100% control of your account. You can sell in American or Canadian dollars. There are no rules, just trust, and zero fees. Absolutely none. I had 375 people in my group I created before I closed it, just buying off me for 2 years straight. I sold every item I ever listed. There are 19 Million Facebook users, so there are options to Ebay if you can think outside the box.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:44 PM - edited 05-03-2022 05:47 PM

@recped Good point, correction that's a "brain fart" on my part as my (older than me ;-)) card playing pals like to say.

My perspective is screwed up because I've always sold "taxes in" as stamp buyers like to have things. This will be a big change for me and them that way.

My corrected thinking now is that now Canadian sales on eBay will be the same as the US sales, no taxes collected by me from a reporting/ITC perspective, wow I might even be getting ITC refunds now that would be an interesting change. Would also likely mean another "how come you aren't collecting more GST/HST" enquiry from the CRA, just had one of those earlier this year.

I guess I'll have to have a means of identifying how much tax eBay collected from my buyers on my behalf incase they do ask. Presumably eBay is working on building the reporting for that for us.

Whew, looks like that will be less traumatic than I feared, although it will be interesting to see what I/we have to do around the "billing agent authorization form" stuff. I've in my medium oldness stayed non-online for all the reporting, I may have to end up setting up one of the "My Business Account" accounts after all.

I'm still looking at 1,285 items of manual description editing as it looks, I did some investigation and don't see any automagic ways to zap a distinct set of wording out of descriptions.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 05:44 PM

Sellers nightmare….. No ending…

eBay increased fees,

New implemented post regulations. No letter Post.

Canadian sales tax from July 1, 2022

International VAT taxes. Like Canada, many countries have and will implement VAT.

My international sale has dropped due to the VAT.

eBay has informed German recycling tax/fee will be implemented on sale to Germany from July 1 2022.

As seller, it would be nice to know when we can expect to receive further information from eBay, if and when we are forced to sign up to +_ 25 European countries that have or will add recycling fees, for sales to the European Union.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 06:00 PM

I have been away and just saw this now. Wow, what a steaming bucket of mess this is.

So much for the old "eBay is just a venue". eBay is basically taking on the role as the seller to collect the tax, and violating my right to limit sales to under $30k and to not have to charge it. Legally there is no reason to collect HST on sales under $30k. And for those who are registered for HST, do they now lose their ability to claim Input Tax Credits on goods and supplies they purchased?

As eBay is taking the postion that the sale is THERE sale and tax must be collected are they on the hook for items not received, etc...... heck no.

The only seller benefit I see is for registered users who don't like that small sellers do no thave to charge HST, even though this new setup is contrary to the tax law. If you lose your ITCs, it won't be worth it for many I would think.

A wise old accounting prof preached that to understand why something is done, look at the motivation and incentive. Ebay now gets to collect fees on the Canadian sales tax, and puleeze let's not have anyone insult our intelligence with the argument that the FVF fees charged on the tax amount are just to cover the costs of collecting and remitting the taxes. The FVF is way to high for that, this is a nice profit center and back door fee increase.

Welcome to another back door fee increase.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 06:37 PM

The way I read it is that eBay will collect the all the taxes.

-They will remit taxes that you are registered for on your behalf.

-They will remit taxes that you aren't registered for on eBay's behalf.

If you are only registered for GST/HST and not for any specific PST, you aren't involved the PST collections eBay makes on your transactions. They will collect the GST/HST on your behalf, and the PST (when applicable) on their behalf.

The same way that someone who is not registered to collect GST/HST won't be involved in eBay collecting GST/HST on their listings.

That would be my assumption. Again, I am not an accountant so any of my posts in this thread shouldn't be seen as a substitute for speaking to someone who knows what they are talking about.

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 07:35 PM

My thought about your specific situation.........

You currently bury the GST/HST in your selling price (how you do it actuately is beyond me since the rate varies from 5% - 15% depending on buyer location).

Don't change anything, let eBay collect the taxes and you keep your prices the same. I'd bet that the bulk of your buyers never realized they were paying GST/HST previously.

It should be noted that while I'm not a big eBay shopper I do buy stuff from time to time and because of what I buy I am almost always dealing with sellers that have always charged GST/HST. Most of my oline shopping is not through eBay, I can't remember the last time I bought something online where GST/HST was not charged.

For the sky is falling folks, keep in mind that now anything purchased from outside Canada will include GST/HST, this removes the imbalance for Canadian sellers when competing with US sellers. In the past I could buy a $20 trinket from a foreign seller and not pay any gst/hst, going forward that will no longer be the case and for me the 13% I could save by buying cross border vanishes and local to me sellers are no longer disadvantaged.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.