- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-08-2024 07:07 PM

A question about using ebay's PURCHASE A SHIPPING LABEL which allows one to purchase a Canada Post label.

And when you hover over the TAX DETAILS on the ORDER DETAILS page. It says

"Please ensure that you share eBay’s IOSS number electronically with your carrier for your shipment to the

EU."

Where would one include the IOSS information? There is no place to enter that information. Futhermore, that information is not printed on the label.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2024 01:00 PM - edited 02-09-2024 01:06 PM

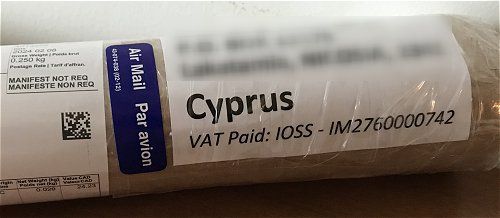

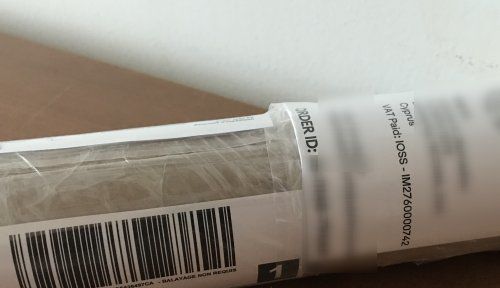

It depends on the country. Sometimes it's added to the address, sometimes not. You can always find it in the order details. Here's what I do (today's shipment to the EU):

Add also the packing slip outside, with all transaction details:

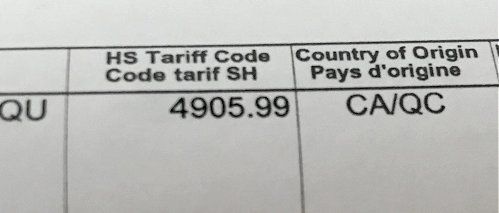

And do not forget about the HS code (very important!)

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2024 01:09 PM

The HS code for coins is 7118.90

https://www.canadapost-postescanada.ca/information/app/wtz/business/findHsCode?execution=e1s5

EBay often buries the IOSS code in the middle of the buyer's address.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 09:55 AM

When you hover over the TAX DETAILS on the ORDER DETAILS page. It says

"Please ensure that you share eBay’s IOSS number electronically with your carrier for your shipment to the

EU."

Why does it say this?

Does eBay not share this IOSS number with my carrier for me?

I use eBay labels to purchase a Canada Post labels when shipping to EU.

Why doesn't eBay share their specifc IOSS number with Canada Post, as part of the label purchasing process?

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 12:09 PM

As an FYI, the other day I had a low value shipment to the UK. Value was under 10.00 CAD. The IOSS info did not display due to no VAT being collected. Just added that info to the notes field at bottom of label page. The minimum order amounts "may" vary country to country.

-Lotz

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 01:06 PM - edited 02-14-2024 01:07 PM

I suspect that message was somehow intended as a boilerplate advisory that would come up for sellers who were shipping to countries where an electronic IOSS was required, no matter how the seller was purchasing shipping. I wouldn’t worry about it.

Here’s an older thread from the .com discussion boards if you need more reassurance:

https://community.ebay.com/t5/Shipping/IOSS-Numbers/m-p/32389384

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 02:19 PM

This is a good link as jasmen@ebay directly answers a similar question, she says

"On any shipments where an IOSS is required our label system will automatically provide the proper number to the relevant customs authority without the need for a member to populate the number. If a shipment meets the requirements, an IOSS number will not be printed on the label."

This answer is for ebay.com and US shipping services. So I still wonder if the same holds for ebay.ca and Canadian shipping services.

The point is, I don't want a customer to be have to pay or even be asked to pay VAT twice. It would be a problem getting that kind of customer to ever buy from me or ebay again.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 04:58 PM - edited 02-14-2024 04:58 PM

@ight.coin wrote:

The point is, I don't want a customer to be have to pay or even be asked to pay VAT twice. It would be a problem getting that kind of customer to ever buy from me or ebay again.

The way I see it, the alternative is not to ship the item, cancel the sale, and also take the risk that your buyer will never buy from you or eBay again.

My understanding from threads like this one from 2022 is that double VAT charges are due to issues with how the receiving country's customs bureau handles the item, not necessarily due to any absence of electronically-transmitted data. In what country is your buyer?

That thread I linked to in this post also has a link to a very useful page from the Canada Post website. I suggest you review that page. If you're following those instructions as closely as possible, you will have done everything you can to prepare the shipment for customs in the receiving country.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 10:08 PM - edited 02-14-2024 10:21 PM

@marnotom! wrote:

@ight.coin wrote:

The point is, I don't want a customer to be have to pay or even be asked to pay VAT twice. It would be a problem getting that kind of customer to ever buy from me or ebay again.

The way I see it, the alternative is not to ship the item, cancel the sale, and also take the risk that your buyer will never buy from you or eBay again.

My understanding from threads like this one from 2022 is that double VAT charges are due to issues with how the receiving country's customs bureau handles the item, not necessarily due to any absence of electronically-transmitted data. In what country is your buyer?

That thread I linked to in this post also has a link to a very useful page from the Canada Post website. I suggest you review that page. If you're following those instructions as closely as possible, you will have done everything you can to prepare the shipment for customs in the receiving country.

Because of the lack of transparency....How do we truly know that the VAT funds were collected for each individual international order? How do they get cross referenced? And what happens when a seller uses something besides eBay Labels. Would have been so much better if this had been left in the hands of sellers to send and customs to collect. When/if necessary. Correctly. Then no worries of funds being charged twice.

Put another way, just saying so (writing it on the box) when we ship doesn't prove anything from an international customs perspective.

-Lotz

Probably also good idea from a buyers perspective. A physical invoice of those funds collected. For THEIR records.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 10:29 PM

st saying so (writing it on the box) when we ship doesn't prove anything

Nor does saying that the box includes a copyof Harry Potter and the Philosopher'sStone sa copy of Harry Potter and the Philosopher's Stone.

The number can be checked against the records.The box can be opened.

But most people and organizationsare honest.

Re: IOSS to EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2024 11:16 PM

@reallynicestamps wrote:st saying so (writing it on the box) when we ship doesn't prove anything

Nor does saying that the box includes a copyof Harry Potter and the Philosopher'sStone sa copy of Harry Potter and the Philosopher's Stone.

The number can be checked against the records.The box can be opened.

But most people and organizationsare honest.

Only speaking of IOSS note. The declaration of what is in the box should match the contents. Any package can be inspected...Basically held for questioning. That is why customs xrays and inspects when they feel the need or the trained dog says so.

-Lotz