- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: eBay Canada collecting Canadian Sales Tax as o...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

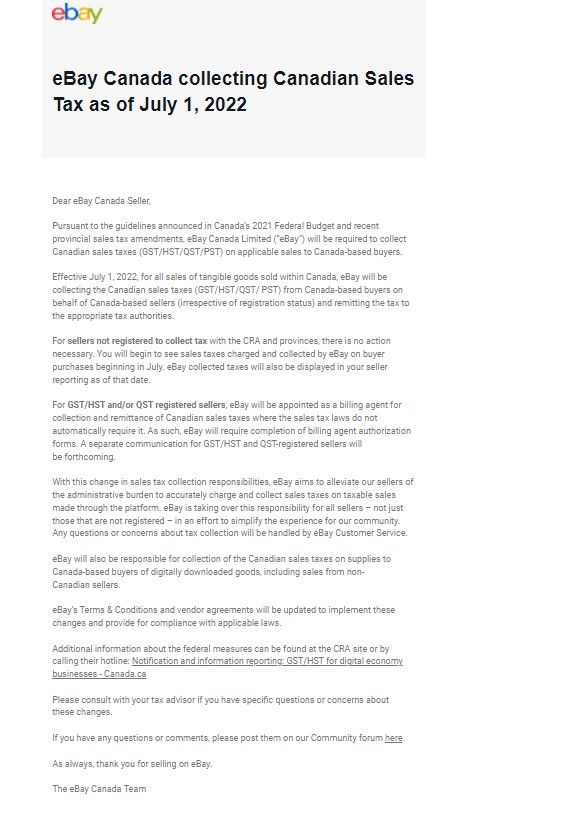

eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2022 03:12 PM

For anyone that doesn't regularly get eBay emails and this applies to:

Associated link below:

-Lotz

- « Previous

- Next »

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-06-2022 07:52 PM

Are the GST we pay to ebay on the final value fees for each transaction considered ITC and can be fully claimed from CRA at the end of the year?

thanks

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-07-2022 03:20 AM

Yes any GST/HST you pay for eligible expenses is a refundable Input Tax Credit if you are Registered.

"What else could I do? I had no trade so I became a peddler" - Lazarus Greenberg 1915

- answering Trolls is voluntary, my policy is not to participate.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2022 02:41 PM - edited 07-09-2022 02:59 PM

Apologies if this has been mentioned before, but for Canadian sellers who sell out of the US for USPS cost savings this announcement seeminly screws us over royally as there is now no way to manually charge sales tax for Canadian Buyers and eBay's resolution to this was to create a seperate listing for each item for the US and Canada. Why would eBay and the government not mandate ALL sales to Canadian buyers be charged the tax? This is a huge leg up for anyone selling internationally into Canada. Australia and the US for instance charge the tax regardless of where the seller is from and eBay collects it. What a pain.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2022 08:31 PM

When a Canadian imports goods, she pays duty (if any) and sales taxes (usually) to CBSA. These are collected by Canada Post or the private carrier which also charges a service (customs brokerage ) fee.

For the record, imports from the US* have a duty-free allowance of $150 and a tax-free allowance of $40 while imports from overseas have only $20 as their duty and tax free allowance.

CBSA has for many years been very forgiving about collecting because it actually would cost more to collect the import charges than could be collected.

This may change with the $150 duty-free. Not enough complaints have come here to know-- in two years.

US and UK sellers further confuse the issue by using the GSP. There's an example of "eBay" (actually Pitney Bowes acting for eBay and CBSA) charging taxes for you. Import fees are made up of applicable duty, applicable sales taxes and a ~$5 service fee.

BTW, GSP/Pitney Bowes cannot slough off these fees like CBSA/Canada Post, but like UPS/FedEx/DHL, or any other private carrier, is required to collect and remit them. There are thousands of posts about this both for GSP and earlier for UPS.

*And probably Mexico, since this is part of the newish NAFTA agreement of 2020

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2022 11:04 PM

All true, but in the TCG market and others where lettermail is used letters are almost never stopped. Canadian sellers are forced to have eBay collect sales tax or a sale for any amount when their US counterpart can sell the same item, mailed via lettermail and not have eBay collect sales tax. Not to mention the USMCA exemptions. Its another nail in the coffin for Canadian sellers. Having a blanket collection for all goods bought by Canadians would be a much cleaner and fairer solution.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2022 11:28 PM

@reallynicestamps wrote:over the past 20 years of selling on eBay I've never collected a dime of tax from my customers, yet did elect early on to reconcile the 5% GST that would have otherwise been incurred via direct sale.

You've been paying the taxes your customers owe?

Good way to get high customer satisfaction.

Because if you were registered to collect taxes, sold taxable items, and did not remit the applicable tax, I don't think you should be saying so in public.

I've been doing this too (remitting tax that customers owe), because I think my Canadian customers would get ticked off if I started charging tax. I also sell on the USA site, so I'm not sure how I'd go about collecting Canadian taxes, but between all lines of business registered under my name, I have to by law collect HST/GST (or at least remit what should be collected). So what we do is run a spreadsheet to calculate tax based on location and remit it at month end, it runs from $100 to $400 in tax, less input tax credits, so I often get a tiny bit back instead.

I checked my sales records for Canadian sales for this week and none of them have paid tax. So I guess that means business as usual, the customer pays, I calculate the percentage of the sale that's tax, I declare it to CRA and send them their money (that only happens a few times a year... I've always got piles of receipts for shipping services, eBay invoices, and packing supplies to use against what's owed).

C.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2022 11:32 PM

@axecards wrote:Apologies if this has been mentioned before, but for Canadian sellers who sell out of the US for USPS cost savings this announcement seeminly screws us over royally as there is now no way to manually charge sales tax for Canadian Buyers and eBay's resolution to this was to create a seperate listing for each item for the US and Canada. Why would eBay and the government not mandate ALL sales to Canadian buyers be charged the tax? This is a huge leg up for anyone selling internationally into Canada. Australia and the US for instance charge the tax regardless of where the seller is from and eBay collects it. What a pain.

I'm in this boat, I just posted about it. I ship from Niagara NY (but am located in Ontario). There is no taxes being charged to my Canadian customers. I had to register for HST in 2013 (due to income on my bookkeeping business), and only 15-20% of my sales are within Canada. So I just calculate how much tax is owed and remit it. Due to ITCs though I often get a little bit back each month. (I opted to file monthly to avoid a bookkeeping nightmare once a year... that was my part time job for years, and everyone waits until year end to resolve their financial issues).

C.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-16-2022 08:44 PM

I was really torn on whether or not to buy a certain camera lens, really on the fence all day, but then I remembered I heard somewhere about sales tax. Found this post; it will add $130 to my purchase, so I won't be buying, I'll look elsewhere.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-16-2022 09:39 PM - edited 07-16-2022 09:42 PM

@wrench777777 wrote:I was really torn on whether or not to buy a certain camera lens, really on the fence all day, but then I remembered I heard somewhere about sales tax. Found this post; it will add $130 to my purchase, so I won't be buying, I'll look elsewhere.

You'll be back.

If you can afford a $1000 camera lens, another $130 isn't that big of a stretch, IMO. Since this change enacted by CRA affects other "digital distribution platforms" in addition to eBay, the only sites you're likely going to find a tax-free sale are classified ad type sites which don't offer nearly the same sorts of protections to buyers. But if you do find something suitable, more power to you.

I suppose you could buy the lens from outside of Canada and hope that the seller ships it by mail and hope that CBSA doesn't access it for taxes when it goes through customs, but I suspect that most sellers of camera lens of that sort of value are going to give the postal system a pass.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-17-2022 01:38 AM

Import fees on US purchases now have a duty-free allowance of $150 and a tax-free allowance of $40. but from any other country, the old $20 allowance for both still holds sway.

And I can't imagine any sane merchant sending a $1000 item without tracking and insurance, which would also imply (for imports)a customs declaration. It's just a basic Seller Protection.

So back to FB Marketplace, CL, Kijiji, and UsedYourCity.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-17-2022 10:28 AM - edited 07-17-2022 10:32 AM

@wrench777777 "...it will add $130 to my purchase, so I won't be buying, I'll look elsewhere."

Well, by all means, do but if you use a `Marketplace Facilitator` you will still be paying your TAXES

And, like my brother-in-law once said to me & he is a real expert in all things taxes and laws, and I will say to you for your situation...

`If you can afford to spend what appears to be about $1000 on a lens for a Camara and a hobby with your DISPOSABLE income, you can afford to pay your TAXES on your purchases`

I suppose you could try and do your transaction under the radar, good luck with that...or try Kijiji

Oh, and my BIL, he is a CRA investigator, for real.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2022 02:32 PM

Another question for you CDN sellers:

Since I setup my GST no., I've been required to send invoices out to all CDN buyers and the GST no. needs to be listed on said invoice. So, if eBay is collecting the GST, are these invoices even necessary to produce anymore?

Thx

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2022 03:21 PM - edited 07-19-2022 03:24 PM

This is how I understand things, so please keep in mind that I could be wrong.

After July 1 the buyers get the ebay invoice with the eBay GST/HST number (or they should, there might have been a problem in the first days where it wasn't on the receipt) because eBay is the one collecting and remitting the GST on the transaction. So the important invoice to the buyer is the eBay one.

So as far as I know, we do not have to generate our own "extra" special separate invoice any more. There is no reason to because we don't have to provide our business number because we did not collect the GST/HST.

Before July 1st I provided all NON Canadians a copy of the packing slip and Canadians got my own invoice because I had to show my business number and relevant taxes.

Now it is so much simpler, everyone gets packing slips and I don't have to create customer invoices of my own to satisfy the GST/HST requirements! Previously I had to create my own invoices for everyone, and all the NON-Canadian ones were really a waste of time but I couldn't construct my total sales record keeping any other way. Now I can do that directly from the eBay records for everyone.

Again, while I believe the above is correct, it is possible that I am wrong, I would of course like to hear from someone if that is the case.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2022 03:54 PM

@ricarmic wrote:This is how I understand things, so please keep in mind that I could be wrong.

After July 1 the buyers get the ebay invoice with the eBay GST/HST number (or they should, there might have been a problem in the first days where it wasn't on the receipt) because eBay is the one collecting and remitting the GST on the transaction. So the important invoice to the buyer is the eBay one.

So as far as I know, we do not have to generate our own "extra" special separate invoice any more. There is no reason to because we don't have to provide our business number because we did not collect the GST/HST.

Before July 1st I provided all NON Canadians a copy of the packing slip and Canadians got my own invoice because I had to show my business number and relevant taxes.

Now it is so much simpler, everyone gets packing slips and I don't have to create customer invoices of my own to satisfy the GST/HST requirements! Previously I had to create my own invoices for everyone, and all the NON-Canadian ones were really a waste of time but I couldn't construct my total sales record keeping any other way. Now I can do that directly from the eBay records for everyone.

Again, while I believe the above is correct, it is possible that I am wrong, I would of course like to hear from someone if that is the case.

From a receivers(business or person buying for their own use) perspective the paper included it is for recieving the goods into stock. In the past the packing slip got matched to in house copy confirming what they ordered is what they received etc and then got forwarded to accounting. That was back when buyers paid on receipt. Now because the form is combined....Packing Slip/Record of payment, its just a hard copy record for that buyer to use based on their requirements. As a seller I don't know if an item is going to a business or an individual but as habit I always include that hard copy.

As a side note for courier shipments a packing slip copy is recommended to be attached because it helps customs see exactly what the value of goods are and how much was paid. So never a bad thing to include. (A matches B...Check. Good to go.)

-Lotz

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2022 04:35 PM

@hold.your.own.media wrote:Another question for you CDN sellers:

Since I setup my GST no., I've been required to send invoices out to all CDN buyers and the GST no. needs to be listed on said invoice. So, if eBay is collecting the GST, are these invoices even necessary to produce anymore?

Thx

My understanding is that you no longer have to. I print off the packing slip and include it because I think it's nicer for the buyer, but it shouldn't be necessary.

Buyers can get the proper tax invoice from their orders. It's under More Actions -> Order Details and there's a link at the bottom to View Tax Invoice. It's kind of hidden.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-31-2022 08:07 PM

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-31-2022 09:39 PM

You will have to stop buying online almost entirely then.

Online venues had only until July first to set up a mechanism for collecting and remitting provincial and federal sales taxes.

Any online venue selling over $30K annually-- and eBay likely does that every hour. Amazon every minute.

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-31-2022 09:47 PM - edited 07-31-2022 09:53 PM

I don't understand how a $300 purchase would attract 16.67% in taxes. Was the item from a Canadian seller or a US seller using the Global Shipping Program?

Re: eBay Canada collecting Canadian Sales Tax as of July 1, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-01-2022 02:06 AM

Four provinces have 15% sales tax rates.

But if the purchaser were importing there might be duty on an item priced over $150 from the USA or over $20 if purchased overseas.

Many people (including me) don't make a difference between taxes and duties.

I found this-- http://www.sice.oas.org/trade/cancr/english/canada_schedule_e.pdf

which is sort of a rabbit hole.

Do you know that if you exceed your access commitment on spent fowl the tariff is 238%? Do you know what spent fowl are?

Upright pianos are duty free but grand pianos are 7%.

But a brief look at the 235 page document showed the vast majority of imports have no duty or less than 5% duty.

- « Previous

- Next »

- « Previous

- Next »