- The eBay Canada Community

- Discussion Boards

- Buying and Selling on eBay

- Seller Central

- Re: Australia buyers getting GST added.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 03:38 AM - edited 07-09-2018 03:40 AM

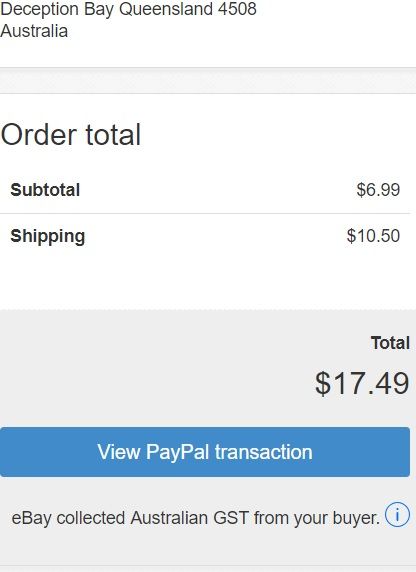

Ebay told us it was coming and this is my first Australian sale since July 1/18. This is how it shows. This buyer has bought from me before in May. I get about 2-3 buyers a month from Australia, so I hope this won't stop them from buying. Does anyone know the 10% rate of GST are they paying it on the item or on the item plus shipping.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 04:08 AM

The way I look at it is that if an overseas buyer could find it nearer home, he would buy it there.

So if he is willing to shop overseas, he is willing to pay for the 'privilege'.

GST means Goods and Services. Shipping is a service.

So your Aussie customer 'probably' paid $1.75 Cdn (~$1.78AUD) in GST, which was collected by eBay and has nothing to do with your accounts. (Thank heavens!)

If he is being billed when he orders, the total cost is presented to him before he pays, just as the GSP is presented to us when we order from US or UK sellers using it.

At a guess, we should be watching for requests for cancellations and/or unpaid items from Oz if there is going to be a backlash.

But this is the same GST Aussies pay at the mall right?

And they have a $1000 AUD duty free allowance I gather.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 12:17 PM

I just had a pang of concern, if the Canadian government ever made the .COM side cover the HST/GST for Canadians buying stuff off .COM, it would cause me a paperwork nightmare.

I would actually have to try to rewrite part of my customer applications to cover the customers who paid HST through eBay so it didn't get paid again by me.

Us born worriers never go without here on eBay!!!!

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 12:19 PM

This subject (GST on imports, effective July 2018) has been discussed on the eBay.au board:

https://community.ebay.com.au/t5/Buying/GST-on-all-imports-July-2018/td-p/2141509

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 07:49 PM

Interesting read. Thanks for sharing that.

My question now is, if ebay is charging GST on all purchases by Australians and Amazon charging the buyers, or another on line shopping list isn't, how does the government know which package had GST collected on the purchase and which didn't. I don't want my buyers to be double charged.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 07:55 PM

On that same thread, it seems that other buyers are concerned too.

"Hi guys, a UK seller here.

I have had my first GST sales this weekend. Ebay have taken the GST correctly (taking money is always the part they get right).

However, they appear to have no process in place for the seller (me) to show Aussie customs that the GST has been paid. I understand other platforms have given sellers an account number to quote on the customs label. I called ebay customer service and their reply was what's GST!

So my question is does anyone know what is going to happen when my parcels arrive at Australia Customs? Are my customers going to be charged again?

Thanks in advance for any insights"

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-09-2018 07:59 PM

I got my answer further down.

"

As you can imagine, most people are still working out the ramifications and speculating on some of the details of how this low-value imported item GST works. The best guess re Customs to date is that Customs won't be collecting GST on low-value items because our government has passed on the administration and collection of this GST to the seller. For the purposes of the relevant legislation, even though you're the actual seller, eBay is treatedas the seller, and Australian Customs should (I say with some trepidation) simply let all goods under the $1,000 threshold through without charge. That way, Customs isn't burdened with holding up the many many many low-value items that come into the country to check whether or not GST has already been paid on them, and whether it should have been paid (because sellers whose annual turnover within Australia - that is, selling to Australian customers - is less than $75,000 aren't required to collect GST at all), and so on and so forth.

The ATO states that the reforms “treat the operator of an electronic distribution platform (EDP) as the supplier of low value goods if the goods are purchased through the platform by consumers and brought into Australia with the assistance of either the supplier or the operator”.

eBay is treated by the ATO as the supplier under this description, and collects the GST on behalf of the ATO. Because of this, it is irrelevant whether or not a seller on eBay is under the $75,000 annual threshold in respect of sales to Australia.

However, if the seller sells on their own platform / website, and is under that $75,000 threshold, Australian buyers can still purchase from them without GST needing to be collected by the seller on behalf of the ATO."

So that means if they buy from another website that doesn't collect the GST once it comes into the country, they don't get charged the GST unless it is over $1,000 AU$.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-10-2018 06:25 AM

(although I am not sure if this is the number we over here are supposed to put on):

I understand that if the GST was collected from the buyer, the seller should add the following lines on the parcel :

eBay's ABN # 64 652 016 681

Code: PAID

================================

I will worry about this if I ever have an Australian sale over $1,000..... I expect I will have a lot fewer sales of any kind to Australia now....I expect the Australians in my world will migrate to the sites that are smaller and aren't charging the taxes....

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2018 05:30 PM

I just sold an item to Australia earlier today. Regarding GST here is some of the info ebay provided. It appears we are required to add the following -

eBay's ABN Number: 64 652 016 681

Code: PAID

Do we just print the info out and tape it to the package? The full ebay info is below, but is somewhat vague on the proper parcel preparation.

Australia

Goods and Services Tax (GST) applies to goods imported by consumers into Australia.

Orders up to AU $1,000

From July 1, 2018, if an item is located outside Australia and the buyer selects a shipping address in Australia, eBay will add GST to the order total at checkout. You'll receive payment for the order value (item price + shipping costs) as usual, and eBay remits the GST portion to the Australian Taxation Office (ATO).

You'll need to ensure that you include eBay's ABN number and the customs code on the package:

eBay's ABN Number: 64 652 016 681

Code: PAID

Later in 2018, this information will be included with the buyer's shipping address.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2018 05:33 PM

The last one I processed, I just added those details to the customs form that is included with your mailing label. (I use Shippo). The form will open up to add more specifics if required.

-CM

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2018 05:38 PM

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2018 09:39 PM

I am just going to print out the eBay APN info on a page of small address labels. Then I can just stick one on the pkg or bubble mailer when I have to mail to Australia.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2018 11:40 PM

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 09:25 AM - edited 09-03-2018 09:25 AM

I may have missed something or it may have changed whilst I was on holiday, are we supposed to be putting this on all packages to Australia now?

My earlier understanding was that it was only necessary if the item was worth more than $1,000

It looks like from the above that it needs to go on all items now, even those below $1,000?

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 10:09 AM

I think that this is so that Customs don’t have to bother checking parcels under $1000. If they can see that the taxes have already been assessed then the parcel will not be held up in Customs and will hopefully move faster. I actually had to stop shipping to AU for a while as pkgs. were taking too long to move through Customs and were causing some INRs. Things do seem to have recovered lately.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 10:55 AM - edited 09-03-2018 10:59 AM

@ricarmic wrote:I may have missed something or it may have changed whilst I was on holiday, are we supposed to be putting this on all packages to Australia now?

My earlier understanding was that it was only necessary if the item was worth more than $1,000

It looks like from the above that it needs to go on all items now, even those below $1,000?

Original announcement: https://community.ebay.ca/t5/Announcements/Australia-GST-on-low-value-goods/ba-p/403128

The eBay VAT number ONLY goes on items valued under $1000AU -- since (in theory) eBay will only be collecting sales tax from the Aussie buyer on items under $1000AU.

Over $1000AU is collected by Australian customs and does not involve eBay.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 03:48 PM

Unless I'm missing it, I don't see anything on the .ca site about adding that info to the label. I see it now on the .au site but has anyone seen it here? Also, there isn't even an announcement about the Australian gst on the .com site so if we are supposed to add that info to our labels, shouldn't ebay be a little more upfront about it?

I mailed something a couple of weeks ago to Australia and although I was aware that they were adding tax on sales to buyers there, I didn't realize we were supposed to add anything to the label. It will be interesting to see if that causes a problem. The buyer hasn't contacted me or left feedback yet so I have no idea if they've received it yet.

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 03:57 PM - edited 09-03-2018 03:58 PM

Like everything else around here it seems of late, we have to try to figure it out for ourselves.

Thank goodness for these boards, spending time here drastically reduces the risk of missing problems or changes and knowing options of dealing with the same!

Anyway for safety sake, because I'm a stamps on the box kinda guy, I'm putting it manually in the customs forms, same as I do for the HS code.

(PS I mailed a bunch of stuff in July with no mention of this stuff and it all got there ok. Store was closed for August)

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 04:35 PM

Re: Australia buyers getting GST added.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-03-2018 05:10 PM

That link doesn't say anything about adding info to the label. That's what I was referring to and what ric was commenting on.